jamie2009

-

Posts

698 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by jamie2009

-

-

6 minutes ago, lopburi3 said:

You can apply on the last day of permitted entry (nothing to do with visa expiration date - which may have gone bye).

Apologies I will have a 90 Day Non Immigrant Single Entry Visa based on being in receipt of my U.K. State Pension obtained from Hull. I was under the impression there had to be a minimum numbers days left on it to allow me too apply for an Extension of Stay

-

On 10/16/2018 at 9:04 AM, ubonjoe said:

Not problem then to get the single entry non-o visa at Hull.

Then apply for the one year extension of stay and then a multiple re-entry permit to keep it valid when you make your trips out of the country.

What is the minimum number of days I need have left on my Non Immigrant O Visa too apply for an Extension of Stay ?

-

Can the 800000 baht be in a joint account or has it to be in a sole account ?

-

5 minutes ago, ubonjoe said:

Are you 65 or over and drawing a state pension? If not you will not get one in the UK. If yes you could also get a multiple entry non-o visa at the embassy in London.

Forgot to mention over 65 and in receipt of the U.K. State Pension.

-

I intend to get a Single Entry Non Immigrant O Visa from Hull, my intention was too then get an Extension of Stay (Retirement Visa) 30 Days before it expired.

As I travel 3/4 times a year too the U.K. I am sure I read on the Forum there is another Extension, Multi Entry I can apply for ?

-

-

On 10/10/2018 at 11:41 AM, ubonjoe said:

You cannot directly apply for an extension of stay with a tourist visa entry.

The first step is to apply a change of visa status to get a 90 day non immigrant visa (category O) entry. That requires 15 days remaining on your 60 day entry or the 30 day extension of it. The 800k baht only has to be in the bank on the date you apply (60 days not required) and you also need proof it was transferred into the country from abroad. See: https://www.immigration.go.th/content/service_80

Then during the last 30 days of the 90 day entry from the visa you would apply for the extension of stay based upon retirement. The 800k baht would need to be in the bank for 60 days on the date you apply.

Can I change this Visa to an Extension of Stay,

Non-Immigrant Category "O" Visa on the basis of being a UK State Pensioner

-

14 minutes ago, ubonjoe said:

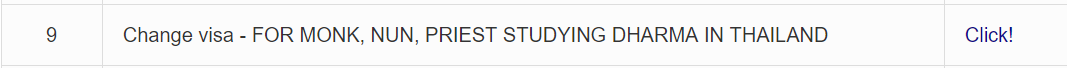

The change visa page in English is one big batch of translation errors. ( https://www.immigration.go.th/content/change_visa ).

The real one is number 9 on that page that shows this.

When you use Google translate on the page in Thai it shows this.

After over a year of dealing with it I know most of the correct ones from memory.

Thanks again for all your assistance Joe

-

10 minutes ago, ubonjoe said:

You cannot directly apply for an extension of stay with a tourist visa entry.

The first step is to apply a change of visa status to get a 90 day non immigrant visa (category O) entry. That requires 15 days remaining on your 60 day entry or the 30 day extension of it. The 800k baht only has to be in the bank on the date you apply (60 days not required) and you also need proof it was transferred into the country from abroad. See: https://www.immigration.go.th/content/service_80

Then during the last 30 days of the 90 day entry from the visa you would apply for the extension of stay based upon retirement. The 800k baht would need to be in the bank for 60 days on the date you apply.

Thanks Joe, the link is in Thai, how do you apply for a Change in Visa status

-

With all the publicity surrounding the clamp down on Agents etc, what is the correct/legal way to obtain an Extension of Stay/Retirement Visa providing you are 555 plus ?

if one gets a 60 Day Visa from Hull extends it by another 30 at Immigration can it then be ‘converted to an Extension of Stay/Retirement Visa providing they still have 15 Days left on the 30 day Extension ?

Does the 800000 baht have to be in a Thai Bank for 2 or 3 months if it is the first application ?

-

1 hour ago, Jip99 said:

Given the grammatical shortcomings in your posts, I seriously doubt your ability to ask the right question - or understand the answer.

Your ignorance of the rules is no defence.

To clarify...

You need a new embassy income letter each year. That is based on the request form that you submit showing your various pension incomes, evidenced by bank statements/pension letters (the embassy are not too fussed and will not require new pension letters each year).

You appear to be receiving state pension increases that you are not entitled to. YOU ARE NOT ENTITLED. You are deemed to be a UK resident by virtue of your property ownership - that does not entitle you to state pension increases when you live, for most of the year, in Thailand.

You have failed to correctly advise your change of circumstances (I.e. living in Thailand) to the DWP. You think that your conversation with IPC covers you - it doesn’t.

Based on what you have been told (on here), by people who know, means that you are now knowingly receiving an incorrect state pension. Not a hanging offence but your are the one who said that, at your age, you didn’t want to operate on the wrong side of the law.

I have not been receiving State Pension which I am not entitled too, last year was my first full year of receiving my State Pension. I was resident in the UK for 6 months.

The reason I contacted the IPC recently was too determine what was classed as residency for the State Pension increases for 2018/19.

-

14 minutes ago, Esso49 said:

So you are admitting you are going to fiddle the system irrespective of the UK guideline link I attached stating that you will not qualify as you intend to not be in the UK for at least 6 months per year ? amassing. Another quality retiree coming to Thailand whilst abusing the UK system

Not fiddling the system just following advice given too me by the IPC. BTW I was resident in the UK for 6 months last year.

-

7 minutes ago, Esso49 said:

And as you seemed not able to do a thorough search I have done a quick one for you at the pensions advisory website which I am sure you are aware of

Read this link and it is now worse than I said, especially for you, because you have to live in the UK for a minimum of 6 months per year to qualify for your increases. Fiddling the system is now getting harder by the number of prosecutions also.

https://www.pensionsadvisoryservice.org.uk/about-pensions/when-things-change/moving-abroad

As you said you live permanently in Thailand so never return to the UK therefore not entitled to the annual increases so no need to phone.

If I get pulled I will refer them back to the phone call I made too the IPC, calls are recorded on the advise the DWP Rep gave to me.

-

1 minute ago, Jip99 said:

So, with all your homework you can explain the difference between domicile and residency.

Everyone pays tax on income generated in the UK whether it be rent, dividend or pension.

Like you I not going to spend the W.E. trawling the internet as there is no need too explain to you the difference between domicile and residency as you live permanently in Thailand I don’t.

-

Just now, Esso49 said:

I am not going to spend my weekend searching through the UK gov website, you can do that. If you spoke to the International Pension Centre ( did you ? ), just ask them the question "what is the time limit to stop me qualifying for annual pension increases). Note you need to speak to the International Pension centre. +44 (0) 191 218 7777 . Years ago I was advised by them that the limit is 8 weeks. Doesn't matter for me anyway as I spend 52 weeks in thailand

Believe me I trawled the UK Gov websites looking for info so there is no need for you to spend the W.E. doing so.

Obviously you haven’t bothered too read my posts, yes I did call the International Pension Centre so there was no need to put the phone number and put in brackets ‘did you’ making out I am a liar ?

I fully explained my circumstances to the representative at the IPC and he said I was entitled too the annual increments.

-

16 minutes ago, Esso49 said:

They will most certainly withhold a pension if they find out you are out of the UK for longer than 8 weeks continually and could quite possibly take further action against you. They will not withhold a pension if you advise them of your Thai retirement address. They will withhold your pension, irrespective of where you are living if you fail to return a Certificate of Life within 16 weeks. All pensions withheld will be remitted to the beneficiary once their conditions are satisfactorily met.

Could you forward a link about the 8 week rule, I explained to the DWP Advisor all my circumstances, he couldn’t understand why I called the DWP in the first place.

It can be very confusing/grey area, I am liable for UK Tax as I have a property in the UK, I am entitled to the Annual Pension Increments but possibly not free NHS healthcare ?

i am also entitled too the Winter Fuel Allowance as I am resident in the UK for the qualifying period which is in September.

Believe me I have gone too great lengths to check everything out as the last thing I want at my age is ending up in court.

-

8 minutes ago, Esso49 said:

My understanding is that you must inform DWP if you are out of the UK longer than 8 weeks. That being the case you could see your pension withheld if they find out, which they will, you are out of the UK for periods up to 3 months at a time. It has happened to others already.

I have already explained my circumstances fully, no lies, too the DWP, as far as they are concerned I am entitled too any annual increase.

-

11 minutes ago, wgdanson said:

You need to get a letter from the British Consulate every year. You email them details of ALL your incomes, they DO NOT care about money going out. Email bank statements, their forms and of course credit/debit card details. Costs 52 quid and takes about 10 days. The immigation man then looks at the monthly GBP total, multiplies that by that day's exchange rate. If it is over Bht 65,000 you do not need any savings. If not, you do to make it up to 800K per year.. Simple

Yes but I have the documentation stating when my State Pension starts, it will not stop till I die. Surely if the UK Embassy confirms this that’s enough ?

-

1 minute ago, wgdanson said:

So you've not told them you are living over here!

I don’t live permanently in Thailand, I still have a property in the UK and return every 3 months spending 3/4 weeks there. I am also liable for UK Income Tax, I have already confirmed my position with the DWP, I am classed as UK Resident.

-

1

1

-

-

Just now, Lacessit said:

Yes. You can use a combination of pension and savings ( seasoned for 3 months ).

Because the exchange rate varies, you do have to get the letter every year. Immigration converts from the GBP amount to baht.

Yes but as long as I keep more cash in the Bank that should cover any ups and downs of the exchange rate.

My original State Pension letter states when my UK Pension starts and will only cease when I die ?

-

As I am in receipt of my UK State Pension I can now use it as part of the 800000 baht towards my Extension of Stay Visa.

Do I need too get a letter every year from the UK Embassy too confirm I am receipt of this prior to applying for my Extension of Stay, my State Pension will never decrease only increase or stay the same ?

i have the original letter from the DWP informing of when I would start too receive it.

Similar my Private Pension although that will always stay the same although it could decrease depending on my Tax Code, I have the original documents outlining what my annual and monthly payment is.

-

1 minute ago, elviajero said:

No. If you return after the 14th the re-entry permit will have expired and you’ll be given a 30 day ‘tourist’ entry. You could only apply a few days late if you were in the country continuously from the 14th and paid the overstay fine.

Yes, you would need a new re-entry permit to protect the new (current) permit to stay.

Thanks for the info.

-

My current Extension of Stay expires on the 14th of December in line with my Multiple Re Entry Permit.

i will be leaving Thailand in November returning on the 11th of December, I know you can renew your Extension 45 Days before it expires. If I return a few days after the 14th can I still renew it or is there no period of grace after the expiry date ?

Secondly if I do renew it before I leave do I have to get another Re Entry Permit to cover my new Extension as the current one expires inline with my current Visa ?

-

I pay direct so pay government rates others I know had their water and electricity rates reduced but the owners put the rent up to compensate for their loss.

Denied entry to Thailand!

in Thai Visas, Residency, and Work Permits

Posted

I will coming to Thailand in December with a 90 Day Single Entry Non Immigrant O Visa based on being in receipt of my U.K. State Pension.

is there the any possibility Immigration at Bangkok Airport will ask me to show 20k Baht in cash ?