Nemises

Advanced Member-

Posts

2340 -

Joined

-

Last visited

Nemises's Achievements

-

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

If you can’t wipe the phone remotely because let’s say it’s taken to an area outside of cell network, how do the thieves unlock the phone if you they need your Face ID and/or passcode? -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

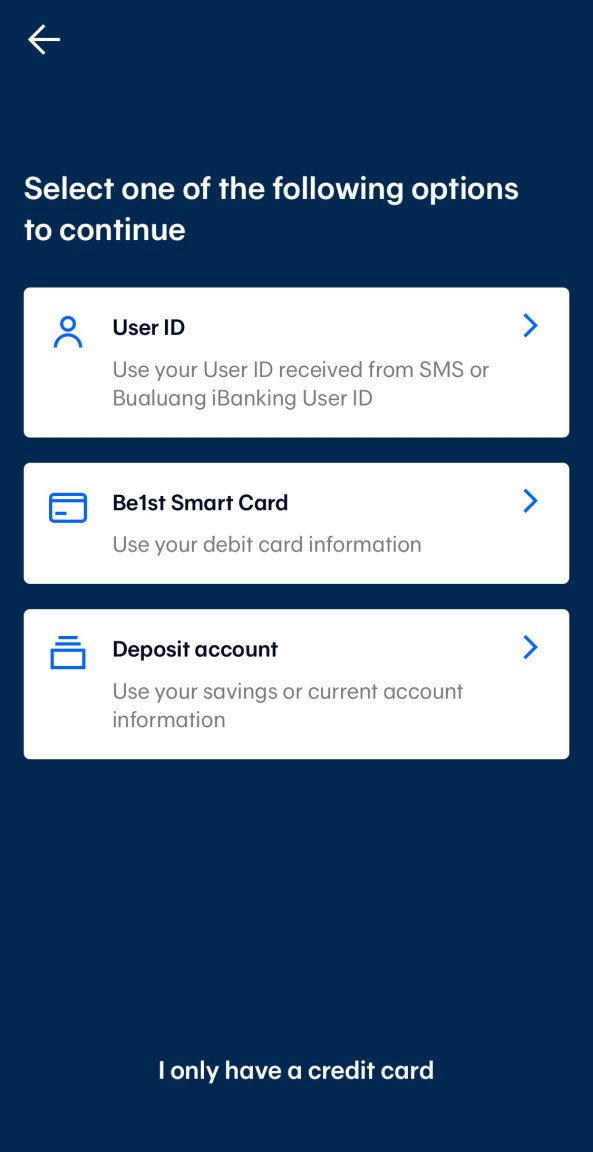

Wasn’t much of a hassle for me. I recently got a new phone. There were two Banking apps on my old phone (KTB & BKK). KTB reinstalled perfectly from my Cloud backup without any authentication whatsoever (I was amazed!), whilst BKK gave three different ID authentication options (per screenshot) needed before the app started working again. Can’t speak for other Banking Apps. Wouldn’t be surprised if hassles occur. -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

No thanks. -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

How wrong you are. You must have missed the bit where I said “Lots of people on here live in remote villages …” Do try and read what’s said before making false statements. -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

Rather than hijack this thread, please create a new thread about “cloud electricity consumption” and share your knowledge about it. Looking forward to it! -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

Correct! Lots of people on here live in remote villages so cash works best for them, but for a lot of city folk these days the days of carrying around cards, cash and wallets are long gone. Need cash? No problems. Use your phone for contactless ATM withdrawals. Loss of electricity or connectivity at the shop or ATM? No biggie as it rarely happens, but if so, go to another power grid area within your city where supply is unaffected. Lose or have your phone stolen? No problems, automated daily Cloud backups ensure everything is effortlessly downloaded onto your new phone. Technology…life is good 👍 -

How do you deal with soi dogs ?

Nemises replied to TheFatOne's topic in Plants, Pets & Vets in Thailand

Simply change your rental accommodation location. Another reason not to buy in Thailand. -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

So, you live in a village in Nakon nowhere where technology doesn’t exist. Now go to the local market where they still accept your cash. 🤣 -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

Here’s a few reasons why cash is no longer king. Now you are up to speed with the times 🤣 “After oversleeping one morning, you stop at a cafe for some coffee and a muffin on the way to work. You take your food up to the counter and hand over a $10 bill, but instead of opening the register to get your change, the clerk says, “Sorry, we don’t accept cash.” There are places all over the country in which this scenario could happen. There have always been some retailers, such as discount grocery stores, that don’t accept credit cards. Now, at the other end of the spectrum, an increasing number of stores and restaurants are accepting cards and digital payments while refusing to take cash. For many retailers, it’s a precaution to limit the spread of germs during the coronavirus pandemic. But considering all the advantages going cashless can have for businesses, there’s a good chance the trend could stick around. That won’t affect most consumers since most people pay with their cards anyway. But it’s bad news for the minority who prefer cash — and even worse news for the smaller minority who don’t have a card. Why Some Stores Refuse Cash Even before COVID-19, some specialty stores and upscale eateries had tried going completely cashless. For instance, when Amazon first opened its experimental Amazon Go stores in Seattle, Chicago, and San Francisco, there were no checkouts at all. Instead, anything you carried out of the store was automatically scanned and charged to your Amazon account. In 2018, Slate reported that the cashless trend also attracted several fast-casual restaurants — places that offer fancier food than Burger King or Subway but with equally quick service. When the coronavirus outbreak hit, this trend accelerated. A study by payment processing company Square found that between March 1 and April 23 of 2020, the number of its users in the United States that were “essentially cashless” rose from 8% to 31%. In Canada, Australia, and Great Britain, cashless payments rose even more sharply. For businesses, going cash-free offers several significant advantages: Fewer Germs. When businesses reopened after the first wave of COVID-19 closures, many chose to limit the use of germ-laden bills and coins. Takumi Hirose, a Tokyo stationery shop owner interviewed by Square, explains he’s moving toward a cashless model because so many customers now see cash as “unclean and unwelcome.” Reduced Risk of Robbery. Any business that handles lots of cash every day is at risk of being robbed. David Friedman, proprietor of the Chicago-based Epic Burger chain, told the Los Angeles Times he decided to go cash-free after his restaurants suffered a total of six armed robberies and burglaries over eight years. No Counterfeit Bills. In addition to thefts, stores and restaurants often lose money when customers pay with counterfeit bills. Friedman said his restaurants handled “dozens and dozens” of fake bills in the years before going cashless. Eliminating cash closes off that avenue of fraud. Less Employee Theft. After a cash purchase, it’s easy for an unscrupulous worker to keep the cash and not ring up the sale, a practice known as “skimming.” Employees can also ring up a smaller purchase — say, $5 for a $10 sale — and pocket the difference. Skimming is a tough crime for employers to detect, but getting rid of cash eliminates it. Faster Service. Cash is a relatively cumbersome method of payment. The total sale is seldom a round dollar amount, so either the customer or the clerk has to spend time fumbling with bills and coins to hand over the right change. Card-based transactions are much quicker. According to The New York Times, when the salad chain Sweetgreen made six of its locations cash-free, employees at those locations could process 5% to 15% more transactions per hour than their colleagues at stores that took cash. Simpler Equipment. If a business doesn’t take cash, it doesn’t need a bulky cash register with separate slots for bills and coins. Machines that only process credit cards are smaller, sleeker, and less expensive. Less Expense. Handling cash costs businesses money because many banks charge fees for cash deposits, especially if coins are involved. If a business handles enough cash to require armored cars to pick it up, that’s an even bigger expense. Fewer Banking Hassles. Making cash deposits is also time-consuming. A manager has to spend time counting the money, preparing the deposit, and taking it to the bank — time they could be spending with customers or helping workers.” https://www.moneycrashers.com/stores-not-accepting-cash/ -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

On the rare occasion that the internet is down or electric is out you simply go to an ATM or bank and get out cash. Get with the times. Cash is no longer “king”. In many places it’s no longer accepted 🤣 -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

No one is saying cash is obsolete. It’s just no longer “king”. -

Google Wallet

Nemises replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

"Cash is King..." Not any more... https://www.euronews.com/business/2024/03/11/cash-no-longer-king-how-britain-makes-a-mint-from-cards https://www.smartcompany.com.au/finance/cashless-society-australia-digital-payments/ https://www.bbc.com/storyworks/where-the-world-is-moving/cashless-australia plus about another million links... -

5 Tips for dating a Thai - understanding culture

Nemises replied to CharlieH's topic in ASEAN NOW Community Pub

The 5th tip sounds great!! Just gotta hope the Mrs approves… -

Least Money in Bank.

Nemises replied to NoshowJones's topic in Jobs, Economy, Banking, Business, Investments

2,000 baht with at least one transaction per year. -

SIM card with an Australian phone number

Nemises replied to StraightTalk's topic in Australia & Oceania Topics and Events

.