Mike Teavee

Advanced Member-

Posts

3559 -

Joined

-

Last visited

Recent Profile Visitors

3886 profile views

Mike Teavee's Achievements

-

Humorous Signs, Pics, Vids etc (2024)

Mike Teavee replied to CharlieH's topic in ASEAN NOW Community Pub

-

What Movies or TV shows are you watching (2024)

Mike Teavee replied to Rimmer's topic in Entertainment

Alcatraz (https://www.imdb.com/title/tt1728102/) popped up in the "Recently added TV Shows" on my TV Box & I remember watching some of it but couldn't remember how it ended so set about re-watching from the start. Got to the end & found out why I couldn't remember the story ending, Season 2 got canned so you're left with a lot of unanswered questions... Quite an enjoyable show if you're happy to never find out the full story behind how the convicts disappeared/re-appeared 50 years later 😞 Do Not Watch if you need your TV Shows to have a satisfactory ending -

Move from Laos to Philippines for retirement?

Mike Teavee replied to simon43's topic in Philippines Visa and Immigration

I prefer South Philippines (Visayas) & always thought that Cebu (excluding Cebu City & Mactan as too busy ) would be a good place to stay a while…. Maybe CarCar or Moalboal or even Bohol Island. Spent quite a bit of time visiting Davao/Kapalong with my Ex & thought Tagum or Carmen would be good places to live if you don’t mind not being near a beach. -

Pretty sure that no Thai's will need to sign up for a TIN as their National ID is their TIN so they're given a Tax ID from birth (as it is in most countries). FWIW, a) I have a TIN (Needed to get one for one of my UK Bank accounts though ended up not giving it to them) b) I will be "Self-Assessing" myself as No-Tax owed (I'll only be remitting 235K which is the limit at which I'd start to pay Tax) so not filing a return for 2024. I'll be ignoring the >3,000B withholding tax on my FD accounts so technically they'd owe me money if they want me to file a return.

-

Not nitpicking, just checking to see if I missed something... Did you mean 280K under 65 (60K PA +150K nil tax band + 70K from your government pension) & so 470K over 65? For me the "Tax Free" number is 235K made up of:- - 60,000 Personal Allowance - 150,000 nil tax band - 25K for Health Insurance ... which is exactly the amount I'll be xferring (to myself) this year 🙂

-

Thailand house of representatives approves same-sex marriage bill

Mike Teavee replied to webfact's topic in Thailand News

I don't see how "Legally" there is any difference in a foreigner marrying a ladyboy & one marrying a Thai male as they're both "Legally" (i.e. what their official gender is on their Passport/ID etc...) Males. -

Foreigners and their overseas income: what next?

Mike Teavee replied to webfact's topic in Thailand News

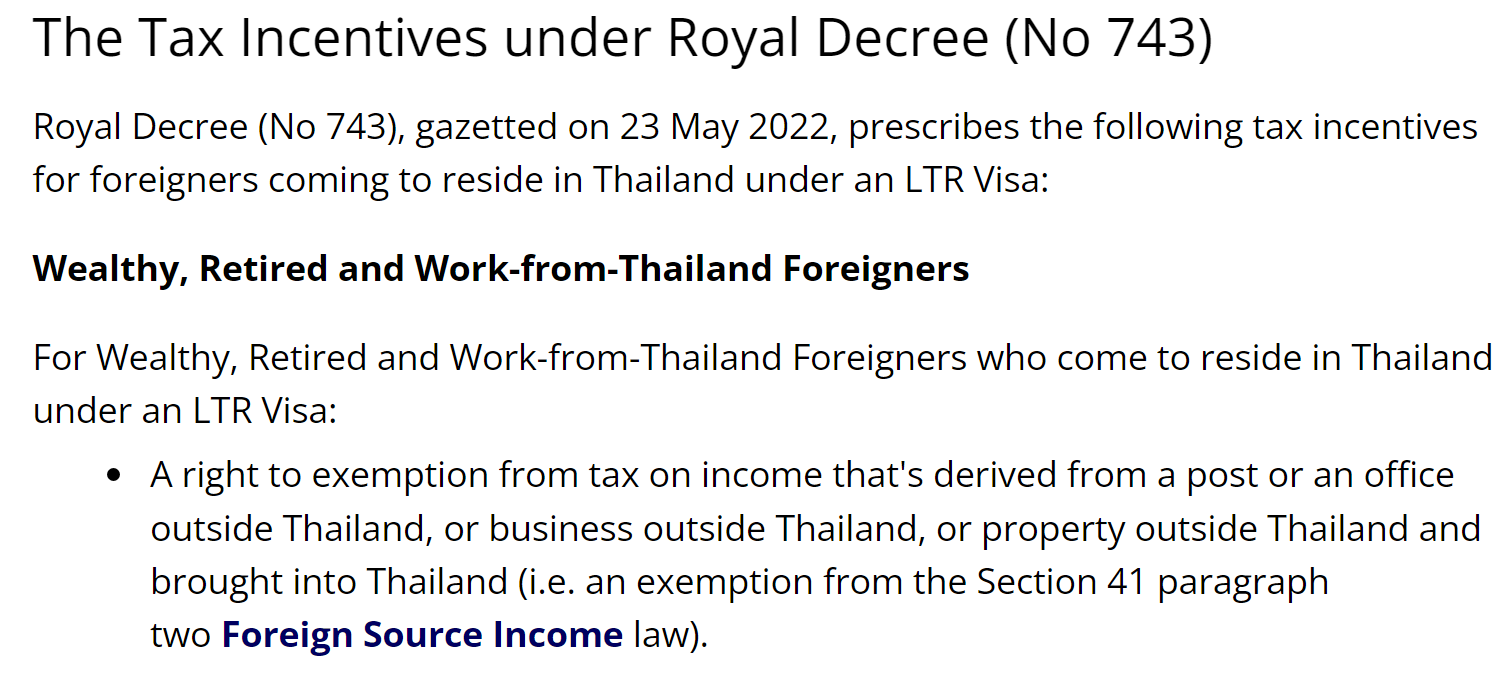

A lot of (if not most) countries offer incentives so "Wealthy" people will live there. E.g. UK (currently being discussed/reviewed after Sunak's wife was shamed into paying tax on her Indian income even though she didn't need to) & Singapore. -

Foreigners and their overseas income: what next?

Mike Teavee replied to webfact's topic in Thailand News

The fact that some LTR Holders do not pay Tax on the Overseas Income has been published by many sources, but Sheerings seems to be the most quoted when it comes to Thailand's Tax rules so here's their take... https://sherrings.com/long-term-resident-visa-tax-concessions-thailand.html -

What Movies or TV shows are you watching (2024)

Mike Teavee replied to Rimmer's topic in Entertainment

The Patient https://www.imdb.com/title/tt15574312/ A psychotherapist finds himself held prisoner by a serial killer who demands he help him curb his homicidal urges. A couple of years old now, for some reason I missed it when it 1st came out. -

Foreigners and their overseas income: what next?

Mike Teavee replied to webfact's topic in Thailand News

Do you have a link which says this only that would be a very large number of records & matching them to an individual would be a nightmare (e.g. my UK Bank doesn't know about my TIN or even my passport number & matching against Name/Date of Birth isn't accurate enough). I had a look at the CRS XML Schema (available here https://www.oecd.org/tax/automatic-exchange/common-reporting-standard/schema-and-user-guide/) & it seems to be about reporting "Closing Balances", the period for which isn't clear, but the minimum standard seems to call for reporting at least once per year so it could just be your Bank reports to Thailand what your closing account balance is at the end of the year (Again, this is only of any use if they can match this information to you as an individual). I believe they have no way of tracking ATM payments but could decide to look at an individual if they bring a lot of money into Thailand or have no visible means of supporting themselves (i.e. they don't bring any money into Thailand). FWIW until things become clearer, I've decided to:- Bring in 235K THB pa which matches my tax free allowances (60K personal allowance, 25K towards Health Insurance & 150K at 0 Tax rate). Give the GF 360K pa (30K pm) to provide "Support" for her so she can now start paying 1/2 towards rent, utilities, groceries etc... Use savings I already have in-country for the rest of my expenses. I'll also be bringing back £8,000 from my next UK Trip which will be used when I need to purchase foreign currency for trips outside of Thailand (all paid for on my UK Credit card)... I can't say this change has made me plan more international trips as I was going to do more anyway but it's certainly giving me a nudge to do so over domestic travel. -

What Movies or TV shows are you watching (2024)

Mike Teavee replied to Rimmer's topic in Entertainment

“Mr T” was in the A-Team & I believe they made a TV series called “Mr T” in the 80s. I quite like Professor T, easy watching.