4myr

Member-

Posts

61 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by 4myr

-

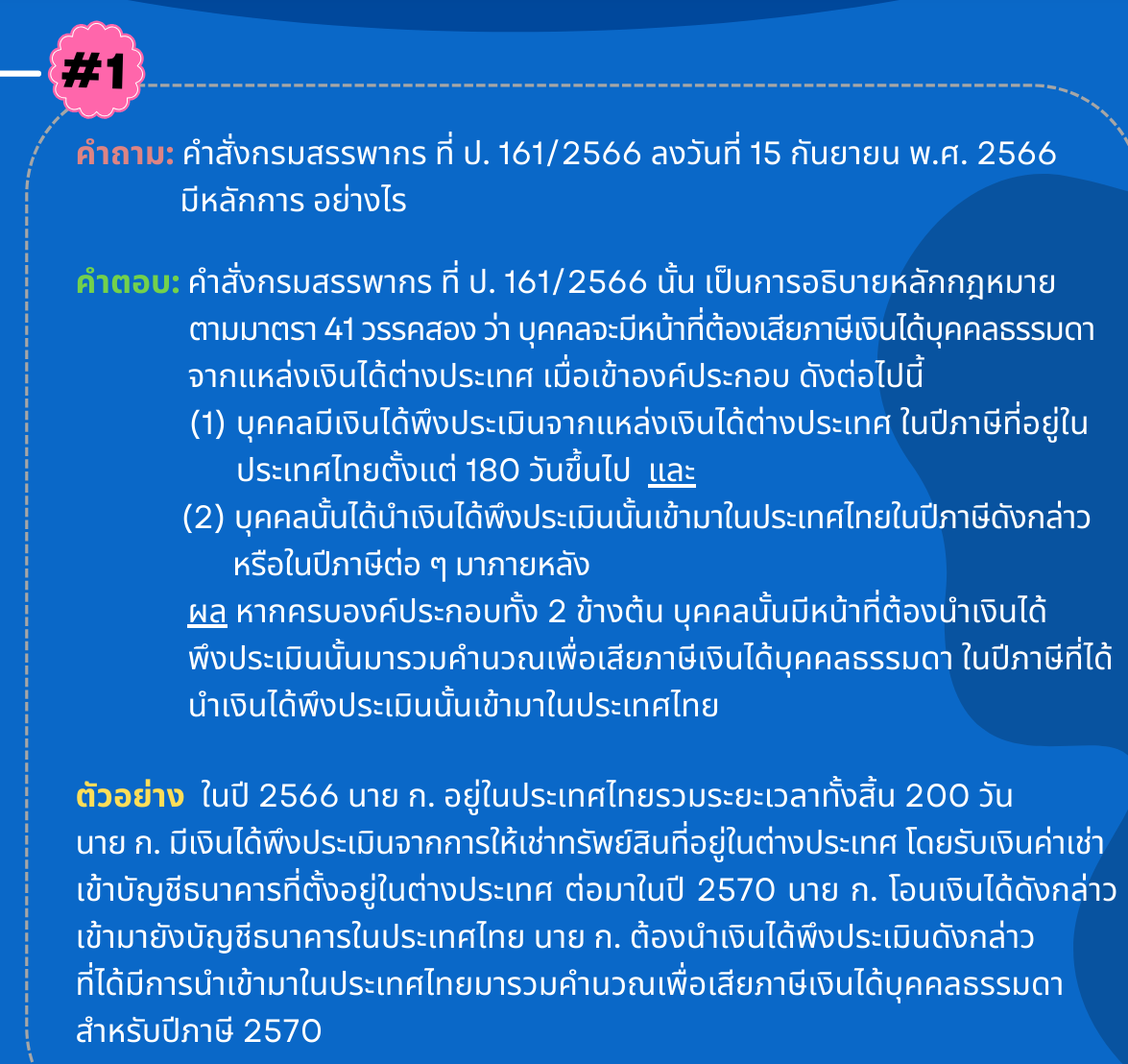

Avoidance is I'm afraid not possible if you're a tax resident. However you can bring in money which are exempted in the P161/2566 ruling, e.g. earnings before 2024, or for which you have a tax credit evidence available. I was watching back a TRD legal expert called Khun Nathanan Junprateepchai talking to the Swiss ambassador that the Swiss pensioners should not worry, as he referred to the Swiss DTA that Swiss pensions will not be taxed in Thailand. Compare that to the position of his colleagues in my local office.

-

Recalling back to the meeting I tend to agree with you. All tax officers in the meeting were only referring stuff from the Revenue Code, as if an international agreement like a DTA does not have any meaning, even to the lawyer in the room, while it should supersede national law. Unfortunately for any law abiding tax resident, it's easier, cheaper and less frustrating not to escalate to RD headoffice/court, but to use the legit escape routes available in their tax rules, to achieve the same result as applying the DTA.

-

From the FAQ of TRD case #1. As I understand it, income remitted is only assessable income, in case both conditions apply: [1] the income remitted was earned in a year that the person was tax resident [2] at the time the money is remitted, the person is also tax resident In case one of the 2 does not apply, that income remitted is not assessable income. The simplest case to check for any person from the tax office is when [2] does not apply. I can also stay less than 180 days when I sell my stocks with profit [1], however this situation gives me more headache. To file tax in the year that I transfer the money and be dependent on a tax officer who will apply this rule correctly

-

DIY solar system - how to sell electricity to PEA

4myr replied to 4myr's topic in Alternative/Renewable Energy Forum

Well, almost 5 months after signing the PEA contract end of Nov last year, still no change in the situation. Our neighbour who hired an installer got his first electricity sale within 5 weeks. So we called the guy we met in Petchaburi when we signed the contract in Nov. He checked our queue number. He said that it will take another 1 month and 1 week before the contract will come back to his desk, after the different departments has signed off on our contract. Then a few weeks will pass before we get a final inspection of our solar system. So we should expect end of May that the contract can start. He also said that PEA has 270 days after signing the contract to finish the backoffice procedures. It never happen that they cross past these 270 days. Also he said, fortunately the 10 year duration of the contract will commence after the backoffice procedures finished, and not after signing the contract. -

Here a short summary of the 2nd meeting at the tax office in Prachuap Khiri Khan. First I planned to go to the office in Hua Hin, however I found out, Hua Hin has a much smaller branch office. This time the topic is "exemptions" as specified in the Double Tax Agreement between NL and Thailand. Based on hardcopies in Thai and English. Both documents were retrieved from the Thai RD office. We made an appointment with a lawyer from the Legal dept of the tax office. He asked his colleagues to join, 2 colleagues from the operational department. His female boss and a junior colleague who were in the room also listened to the conversation. Focus of the meeting is the interpretation of Article 23.5 "exemptions" of the NL-Thai DTA from 1975: https://wetten-overheid-nl.translate.goog/BWBV0003872/1976-06-09?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=nl&_x_tr_pto=wapp "Where a resident of Thailand [i.e. tax resident] derives benefits and income or owns assets which are subject to the provisions of Articles 6, 7, 10(7), 11(5), 12(4), 14(1) and (2), 15(1) and (3) paragraphs, 16 , paragraphs 2, 17, 19 and 22, paragraphs 1 and 2, of this Agreement may be taxed in the Netherlands, Thailand shall exempt such benefits and income or those assets from tax, but may, in calculating the tax on the other income or capital of that resident, apply the tax rate that would have applied if the exempt income or capital had not been exempt." The wording "shall exempt" is very clear to me, and means no tax in Thailand, even if NL does not apply tax, for the following revenue items, which apply to me: 1) art 14.1 - in case I sell my house located in NL with profit and I remit this money. Capital gains are not taxed in NL. 2) art 16.2 - fees as a director of my company, which is based only in NL. Does not have a branch in Thailand 3) art 19 - when I retire in a couple of years, the state pension I will receive from government funds. Well in the meeting, the tax lawyer did not express his opinion. But his colleague from the operational dept was very clear and vocal. That in the history of tax filing cases, she did not come across exemptions being applied. Only tax credits are allowed. Well I told her politely that I disagree with her, as the English version of 23.5, which I downloaded from the TRD website is quite clear, and when a dispute arises, between NL and TH, the English language version will be leading. I also told her that the DTA is also clear about tax credits, which should be regarded differently than exemptions, in the subsequent article 23.6: "Thailand shall grant a reduction in the tax calculated in accordance ..." In case I do not agree with her answer, I can send the local tax office a written letter in Thai. Then they can open a case to request for advice to the head office in Bangkok. The officer said she will look into the matter again, if there were exemptions in the past, of tax not being applied in above mentioned cases. Unfortunately the lawyer in the room did not say anything different than repeat what his colleague has said. His female boss printed out a case of a Swedish guy who filed tax about capital gains on stocks, however this does not match my case. I understand that gains on stocks does not get exemptions, also according to NL Thai DTA, as it is not fixed to a country similar to a property or a company. At the end she had a simple advice, which will save time for me and the tax office. In the situation that I need to transfer sums of money, make sure I stay less than 180 days in that year in Thailand. I also had a question about record keeping, in case an audit will check my records as evidence. The officer said that the RD got a lot of questions on this matter. She said that the RD head office will come with a document which list all these record keeping requirements. She could not say when. For example, on the day that I transfer money to Thailand, I need to keep a record of the euro-baht exchange rate of that day. [PS. I assume to convert a tax credit in euro to thai baht]

-

Agree. I'm in the process of discovery right now. Double tax treaty and remittance rules seems to be clear now. Only scare is if my local tax officer is willing to spend time to learn the exemptions from my country's DTA stated in non plain Thai language. Also in discovery with my tax office is to find out the specific records that need to be kept for each income type and whether credit can be obtained. For example dividend income from a company where I am a significant UBO is called in Dutch tax law "box 2" income tax: "Tax on substantial interests (box 2) In box 2, you pay tax on any substantial interests. You have a substantial interest if you, or you and a tax partner together, own at least 5% of the shares, options or profit-sharing certificates in a company. You pay 25% tax on income from substantial interests." Try to explain to a tax officer such a type of income. Because there is also dividend income from stocks under box 3, which is called the wealth tax.

-

Please read the FAQ question 1 https://www.expattaxthailand.com/thailand-revenue-department-foreign-sourced-income/ The year that you remit the money, 1) you are obliged to file tax, and 2) the income you remit was earned when you were tax resident. When do you need to file a tax return: 1) as tax resident and your remitted income & Thai income > 120K as a single, or 2) as non tax resident your Thai income > 60K as a single. However filing tax return in the 2) case, you don't need to file remitted money as assessable income. Something I have not asked the tax office yet, but I saw a foreigner tax lawyer speaking about this situation. In an audit, they can ask you whether the income you earned in case 2 has been tax filed in the country that you were tax resident at that time. So they can ask you for a tax assessment from the RD of that country. I don't know if this is correct. For example in my country I don't need to file capital gains, as they are not taxed.

-

This is the case I prepared to ask them: Case 4: In 2024 I am tax resident and in 2025 I have filed tax for 2024. In 2025 I need to be 8 months in NL to sell my house. I also intend to transfer all the income of my sold house to Thailand in 2025. In 2025 I am not a tax resident. Am I obliged to file my taxes for 2025? Will RD office send me a reminder to file taxes on tax year 2025? If so, do I need to come to the RD office to show that I am not a tax resident in 2025.

-

My opinion: I think they will try to catch the big remitters [known thru the bank reporting system] first who are also tax resident [for Thai citizens - 100%, and for foreigners - I think RD is not connected to the Immigration 90-day reporting system, which is also not yet adapted to this new tax rule, so difficult at the moment]. EDIT: unless you as a foreigner already has filed before, as you are obliged to if you remit more than 150K baht in a year that you are tax resident.

-

Tourists don't have a Thai TIN, never did Thai filing, and rarely have a Thai bank account. If you are already in the loop having all 3, then in subsequent years you are possibly liable to pay tax and it is up to you to proof [file tax or show that you are not tax resident] that you don't need to pay.

-

You have to proof to RD that you were not tax resident in that year, to avoid not paying taxes. And my local tax officer said that sofar your passport would suffices. As we know with the automatic lanes at airports, this is not the case. So be prepared to collect items e.g. tickets, boarding passes and 90-day reports.

-

Thai banks need to report to the RD. Even money exchange brokers will report your passport id and the cash money you changed. Money transfered by the SWIFT network will convey the sender being you and your foreign bank. However suppose you transfer thru Wise, the transfer is domestic. But I'd bet Wise need to report to Kasikorn Bank for the omnibus account they're using. And that KBank reports these to the Revenue Dept.

-

Today I visited my local tax office in Prachuap Khiri Khan. Here a short summary of things that might interest you as well. On tax credit documents: 1) they prefer the foreign sourced documents with stated paid taxes to be translated to Thai. Does not need to be a certified translator. Can also be machine translated. As long as the translation makes sense. 2) I showed them an Annual Salary Statement from NL with stated paid payroll tax, and a Final Tax Assessment report from the RD in NL. Both documents they accept and the tax credits mentioned can be deducted from the Thai tax amount. 3) However a tax credit cannot be used over multiple tax years. Suppose your payroll tax credit in 2023 is 500K baht. And in 2024 you transfered 1M baht. As a single you need to pay 83K baht tax wrt the 1M remittance. By using the tax credit of 500K you don't need to pay tax. However, the remainder tax credit amount of 500K - 83K = 417K cannot be used in future tax years. In years of not being tax resident: 1) In the tax year that a person is not tax resident, you can transfer as much money as you can. You will not pay taxes. This is in accordance with https://www.rd.go.th/english/6045.html. “A resident of Thailand is liable to pay tax on income from sources in Thailand as well as on the portion of income from foreign sources that is brought into Thailand. A non-resident is, however, subject to tax only on income from sources in Thailand.” 2) the Prachuap tax officer and her colleague next to her, gave the wrong interpretation of Question 9 from the Governments Q&A . According to the tax officer, she will only look if in the year that you remit the money, you are tax resident. If yes, then you need to pay taxes. Contrary to Q&A #9: https://www.expattaxthailand.com/thailand-revenue-department-foreign-sourced-income/ Question 9: If a person lived and worked or conducts business in a foreign country for a long time but later returned and brought to Thailand his accumulated incomes earned overseas, will such a person have to pay taxes on these earnings? Answer: No taxes need to be paid. This is because the said accumulated earnings came from assessable income that occurred in the tax year in which the person stayed in Thailand for less than 180 days. Fortunately we have the Q&A in Thai https://www.expattaxthailand.com/wp-content/uploads/2024/03/Thailand-Revenue-Department-QA-Revenue-Deaprtment-Order-DI-No.161-2023-15-Seotember-2023.pdf to convince that she is wrong. An example of how a tax officer can ignore exceptions in a DTA from Thai tax rules: I showed her Art 14.1 of the NL-Thai Double Tax Agreement: https://wetten-overheid-nl.translate.goog/BWBV0003872/1976-06-09?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=nl&_x_tr_pto=wapp " Article 14. Capital Gains. 1. Gains from the alienation of immovable property, as defined in Article 6, paragraph 2, may be taxed in the State in which such property is situated." I told her - I will sell my house in NL in 2025 with profit. And I will transfer principal + profit in 2026. In 2025 and 2026 I will be tax resident. Do I need to pay taxes in Thailand in 2026. She said YES.

-

DIY solar system - how to sell electricity to PEA

4myr replied to 4myr's topic in Alternative/Renewable Energy Forum

after 3 corrections of the document, we finally got a go to sign the contract with PEA. after each rejection we got an email with details how to correct it. it took a while (more than 3 months) because the engineer was not all the time available and we did not see the rejection email on time. Pea always gave a reply within 1-2 welds after submitting the (corrected) document. after signing and paying the 2140 baht fee, an appointment will be made for inspection. i’ll keep you updated. btw our neighbor who hired a installation company from bangkok got the contract within 6 weeks. what surprised me that they did not replace the analog meter. only that the analog meter is connected to the huawei 5kw inverter. -

I have been using a 1 year unlimited data sim for 3 years now in my LTE router at home. As the cost of fiber is 4,000 baht / year more expensive than 4G internet. I am using the internet for content streaming with/without VPN to Europe. In general 4-6 mbps is sufficient. Sofar satisfied with DTAC 15 mbps until they limited the speed from 15 mbps to 3 mbps. Found NT mobile Thunder Net Unlimited for 999B per year. NT is a merger of TOT with CAT. Compare this to DTAC which increased their price from 1,300 to 1,900B for 15 mbps, since they were taken over by True. TOT does not have a good name, so I bought a one month sim to check if it's worth it. Sofar so good. My router supports band 40. TOT even broadcasts band 40 in aggregation mode [2-3 band 40 channels together], so I can get 60 mbps during the day. I suspect TOT is leasing the network from True and DTAC. What are the cons? Have not discovered yet. The speed is not consistently high though. In the evenings I get around 12-15 mbps, and ping time can increase to 1s, but thats OK for me.

-

I installed a small ongrid DIY system a few years ago. I extended it with extra panels, due to the heat wave last April/May, as I added extra AC's. And now I am in the process of selling excess electricity to PEA for 2.2 baht per kwh. My electricity demand is moderate. My future plans are 1) more electricity demand [hotter climate - more AC, extra integrated room/attic ventilation, EV charging], 2) more solar panel production needed to meet the demand, 3) UPS battery storage for an exceptional 4-12 hrs grid outage, 4) and extra battery capacity to earn some bucks, when the time is ripe that due to the succesful EV adoption in Thailand, we get demand based pricing. Given my future plans and looking back how I implemented my DIY solar, the following I would do differently: 1) Review your energy use and select where you can to cut down in energy, without sacrificing in comfort or even increase your comfort Examples. I bought 2 years ago my house. I did not like the noise of the water pump, each time I open the tap. So I made a bypass with valves, as the water pressure from the municipality is high enough to have a comfortable shower. Only in exceptional cases of low water pressure I turn off the bypass and use the pump. Use distributed solar panels, buck [=DC/DC] converters, DC pumps and light in your garden as much as possible. This will also save you in AC wiring outdoors. During this year's heatwave I added extra roof and attic floor insulation. Not yet satisfied with the passive air flow thru soffits. 2) Make use NOW of the PEA/MEA Power Purchase agreement process for small households You can export at 2.2 baht/kwh for a period of 10 years. The buying program is maxed at 5kw single phase and I believe 10kw for 3 phased. What does it mean: 1) max out your inverter 2) use a PEA certified inverter 3) do a neat/thorough implementation of your combiner box and earth bonding as this will be inspected 4) Collect all your specs and datasheets of panels and inverter, as you need them to submit them with the online request. You'll need to hire a certified PEA engineer to make the system electrical diagram. An installation company will charge you between 15-20k baht for this and to help you with the 3-4 month process. If you are more than a moderate PEA user, you are even dependent on this PPA contract to get a good ROI. My engineer who is helping me with the PPA contract is telling me that PEA Hua Hin is starting to use drones to detect solar panels on roof and will change analog to digital meters. 3) Prepare on day 1 for battery extension in the future. This means pay extra for a more expensive PEA certified hybrid inverter that also can work without batteries. For UPS purposes, the hybrid should be able to output to 2 load panels, the main load and a critical load panel [fridges, small appliances, etc]. Preferably the inverter should work in parallel for future expansion and have a mechanism to control the amount of export electricity to the grid. Add your batteries later, if they further decrease in price or that more affordable second hand EV or telecomm batteries appear in Thailand. As ambient temperature can get to 35C here in Thailand, and batteries deteriorate with temp above 25C, allocate an insulated "machine" room inside your house for your future batteries close to your hybrid inverter that can be kept below 30C. 4) plan your future demand and production on your roof and garden premises You can divide your demand and production in 3 areas: 1) grid connected and maxed out at 5kw/10kw production and export, if you want to have a PPA with PEA [item 2]. This entails your hybrid inverter(s) and your batteries for UPS and future demand pricing. This will be primarily for your house needs, with or without grid tied EV charging 2) off grid & distributed in attic and garden e.g. attic fan or pump for pond or rainwater catchment tank. Depending on your needs, this can entail simple buck converters, or solar charge controllers with used non lithium batteries, depending on the demand time for the appliances 3) [future extension] off/on grid EV charger This depends on your daily mileage and EV battery size. The charger is connected to a separate solar panel string dedicated for charging and also to the grid. You can charge solar for small journeys and when the sun is shining. There is no need to fully charge in one go, except at the time that you need to make a long journey. Having off grid means higher initial cost but also independent from the grid, if the grid has an outage. I wonder if they already start to sell these chargers in Thailand.

-

DIY solar system - how to sell electricity to PEA

4myr replied to 4myr's topic in Alternative/Renewable Energy Forum

Last week the engineer submitted the form. I sent him the specs of the panels as cropped from the Lazada shop's website, as I could not find the data sheet from the manufacturer. But these were heavily pixelated, although still very readable. The engineer was a bit concerned that PEA would reject these, so he spend some time in looking for better quality pdfs. As he was planning to drop by at PEA Phetchaburi later during the 45 day wait period, he was also not very concerned. The status of the form as Google translated is now a bit confusing: 1) waiting for payment [have to pay after approval of 1st step] and 2) waiting for processing of documents [by PEA] I' ll update you again after the visit to Phetchaburi or around 1st Sept -

Would like to share some info/experience on how to get hold of a Power Purchase Agreement [PPA] with PEA to sell electricity to them. The online system is called Power Producer Information System [PPIM] and one of the programs is to buy electricity from small households. Hope this helps. Will keep you posted on the progress. If you are familiar with this program, please share. ======== A few years ago I installed a small DIY on-grid system [ 3.3kw inverter, 2,000 Wp panels ]. As my production was equal to what I used, I did not bother to look into the details how to make a contract to sell electricity to PEA. This month I extended the system to the full capacity of the inverter. On a normal sunny day I can export/sell around 10kwh per day. With the current 2.2 baht / kwh price and a contract of 10 years I can earn max around 70,000 baht. After some searching I found on the PEA site the online process to submit a request to have a PEA selling contract. It is called PPIM for rooftop solar households, type 1 residential. Please check your PEA invoice, column Type, if you can apply. Fee to submit the request is 2,000 baht excl VAT. After scrolling thru the online form I learned that I cannot do it on my own. I need a certified engineer that will sign off the electrical diagram [Single Line Diagram] of the system. So I called a few installation companies in Prachuap, where I live. One gave a quote of 15,000 baht + 2,500 baht extra, because they did not install my system. After providing them some pictures of the combiner box I had a call with sales. Success rate of a PEA selling contract is 100%. No rejections sofar. However I would be their first DIY customer. Wait time PEA for the whole process is 3 to 6 months. A few weeks ago, a company from Ayuthaya installed a solar system at my neighbour's roof. I managed to ask the onsite engineer to check my combiner box. After 20 minutes checking he said: AC circuit breaker of inverter in main panel should be 32A instead of 16A. And the earth/ground cable should be black color instead of yellow/green. Hmm. I thought that yellow/green was the international standard for ground. Accidentally my Thai wife found an engineer thru her friend. He also happen to live in the same town in Prachuap. He came to see the system. He also explained the request process, as he also installs solar systems. Nothing wrong with my system! No changes needed. What a relief. After submitting the form with many attachments e.g. SLD diagram, PEA will take 45 days to come with an answer. For Prachuap customers the process is centralized at PEA Phetchaburi. Progress of status of the request can be checked online. If approved for the next step, print out the online documents and pay the fee of 2,000 baht at your PEA office. PEA will make an appointment for inspection of around 3 hours. They will check the combiner box, main house panel, inverter and the earth bonding stick into the soil. They will not go to the roof to check the grounding of the panels. After PEA inspection, it takes an additional 30 days before final approval can be expected and that the selling/export is registered by PEA systems. So a total of around 3-4 months. The engineer also told me that there is no waiting queue for export meters in Prachuap. The best part came at the end. He will not charge us anything, except for expenses. As long as we can do some marketing about his solar installation business.

-

Hi, I was wondering, have anyone done this experiment in Thailand before? Paint your roof with lime wash, a mixture of hydrated lime, water, linseed oil [for waterproofing] and table salt [for durability]. I have a corrugated fibre cement roof with a lot of heat mass, which keeps my attic space between 45-65C and my ceiling at 38-39C on a hot day [32-35C]. My roof rafts and truss is made from steel and conducts & radiates the roof heat and transfers it to the inner walls as well. I have been considering insulation options like spray PU foam [against roof in attic space] or mineral wool insulation [attic floor], however this painting method is more friendly to human, environment [where I live the soil is acidic] and my pocket. The temperature effect as shown in below YT video is dramatic [around 20C temp decrease in attic space]. Unfortunately in a moderate climate with lower ambient temp and where the sun does not shine as hot. I would be happy if the attic floor temp can be lowered to 30-35C and the inner walls 1-2C above ambient temperature. I estimate the paint price to be around 7B per m2 for 2 coatings. Normal roof paint costs around 35B / m2. I can't find a price for a ceramic based roof paint, which will reflect the sun much better than ordinary roof paint or lime wash, but assume it is much more expensive. I will need to hire someone to go on the roof to [re-]do the paint job and remove the dirt on the white paint on a regular basis. Any thoughts on how more often I need to repaint lime wash vs repainting using a synthetic roof paint, which I supposed is more waterproof and more durable. Here some links about this subject: Hydrated Lime as a Highly Reflective Roof Coating for Home Cooling How much can painting a roof white reduce its temperature?