Naam

-

Posts

36,715 -

Joined

-

Last visited

Content Type

Forums

Downloads

Quizzes

Posts posted by Naam

-

-

16 minutes ago, khunPer said:

Not really, it works for my home country, so not only theory, I talk from (positive) experience with advanced approval from the tax authorities, and as specified in the double taxation agreement. The 15% works for dividend from my US-stocks...????

good for you. i don't invest in any asset where tax at source is levied.

-

2 hours ago, david555 said:

This...in yellow marked

and who's following this regulation?

-

40 minutes ago, gamb00ler said:

The US does allow a generous foreign earned income exclusion of $105,900 for 2019. You will only pay tax on earned income exceeding that exclusion. But if self-employed you would still pay FICA on your income. See IRS Pub 54 for details.

does not apply to investment income!

-

15 hours ago, david555 said:

More.....take attention even that the foreign value on no need to declared cash normally must exchanged in that 365 day frame …… so normally may not keep it in foreign currency longer than 365 days

I wonder how many of us do that anyway as a safe heaven ...

says who?

-

8 hours ago, ukrules said:

This is the first I'm hearing about it.

sorry misunderstanding. US and Eritrea are of course the only taxes which tax a citizen living abroad.

-

15 hours ago, khunPer said:

Thanks for clarifying.

However, the 10% dividend tax was mentioned here, as some countries would tax dividend with the 10% Thai taxation due to double taxation agreement, if one proves that the dividend is transferred to Thailand the same year as earned; for example my Scandinavian home country instead of 27% dividend tax...????

If dividend is transferred into Thailand the following year, or later, it would be tax exempt in Thailand, and therefore could be taxed with the home country percentage or 15% for residents living abroad, depending on local tax rules.nice theory but i'm afraid to implement in practice would be rather difficult.

-

- Popular Post

4 minutes ago, vinniekintana said:Maybe you had a work permit.

Out here in the provinces ,it's work permit or marriage to a thai that can do the trick

Ditto for driver's license

Obviously in some farang-heavy places officials might bend the rules a little...or more than a little

no need for bending as such rules don't exist!

-

4

4

-

5 minutes ago, ballpoint said:

One rarely sees such a bundle of hearsay, misleading information and downright ignorance outside the visa discussions. Shouldn't this thread be in the jokes, laughs, and other fantasies forum?

-

11 hours ago, ukrules said:On 4/7/2019 at 5:01 PM, SCOTT FITZGERSLD said:

has to DECLARE ALL HIS ASSETS ALL OVER THE WORLD !!

That's an American thing.

there are many countries with that kind of tax laws besides the U.S.

-

1

1

-

-

19 hours ago, DogNo1 said:

I don't know Thai tax law but certainly there must be a foreign earned income exclusion. I wonder if it would be equal to or higher than 800,000. Does anyone know?

there is none as Thai tax practice is basically "no tax on foreign income".

-

1

1

-

-

- Popular Post

- Popular Post

21 hours ago, SCOTT FITZGERSLD said:that is interesting. now all the counried in the world are changing their tax and declaration laws,

following the new CSR changes.

all this started following the FATCA which the obama administration imposed in a desperate

attempt to recover the 2009 crisis losses.

now the rest of the world is following, and the whole world is becoming one big mafia, with

the help of the global bank system.

i heard horror storied about bank account frozen in one country, until the owner of the

bank account will produce tax papers from his tax residency country.

another story i heard from a german citizen who live in thailand for many years, is that they told him

in germany to show where he worked and paid taxes for the past 12 years. he could not do it because

his business is registered on his thai wife name, and so all the taxes paid there. so the

german authorities told him that they will cancell his passport. means

that he will have to go back to germany and stay there !!

so what he did is he found the one country that germany does not have diplomatic relationships

with, and there he produced fake documents proving that he works there as a "coltiral advisor"...

i don't know if this story is true but so i heard.

bar stool information from A-Z.

-

2

2

-

1

1

-

On 4/8/2019 at 2:21 PM, khunPer said:

Thai dividend tax is 10%, so paying Thai dividend tax might be better than one's home country tax

Thai dividend tax is levied only on dividends of stocks bought at SET and held in a Thai account.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

22 hours ago, DogNo1 said:It looks as though Thailand may be planning to enforce the worldwide asset reporting to collect tax from wealthy Thais who keep their money overseas, especially in tax haven countries.

nonsense!

-

3

3

-

- Popular Post

3 minutes ago, transam said:I don't do that on the Roll's....????

because it's your driver's job.

-

1

1

-

3

3

-

- Popular Post

17 hours ago, samsensam said:it is fairly common for thais to take pretty much anything told to them by family, friends, work colleagues, etc., however absurd, as gospel truth.

annoyingly, after stopping driving but before switching off her car engine my gf turns the aircon fans on full for 20-30 seconds. why do you do that? i asked, because my friend told me i should, was the reply. but why? i asked, i dont know she replied. but she still does it.

your girlfriend is doing the right thing but 20-30 seconds is not long enough to dry out the evaporator which prevents a built-up of potentially dangerous fungus. not everything in Thailand is absurd!

-

2

2

-

1

1

-

19 hours ago, GroveHillWanderer said:

Did you hear about not crossing your bridges before you come to them? If and when the Thai tax code requires all tax-residents to declare all assets world-wide (if it ever does) I'll worry about it then. I'm not going to get myself all bent out of shape about it just yet.

According to the website globalcompliancenews.com, even after CRS comes in, it's still not clear that all worldwide assets will need to be declared. Their assessment of what it will mean in Thailand is as follows:

Quoteforeign-sourced personal income is only taxable if brought into Thailand within the same year it is earned, while corporate income tax is imposed on worldwide income regardless of whether the income is repatriated to Thailand.

corporate income tax on offshore proceeds applies only to Thai companies.

-

20 hours ago, SCOTT FITZGERSLD said:

where you are actually (physically) resident HAS ANYTHING to do with where you are (and remain) a tax resident. THIS IS THE THAI LAW NOW. if you stay in thailand - no mattar on which kind of visa - for more than 180 days a year, you have to pay tax in thailand.

absolutely **&^%$

Quote

QuoteTaxpayers are classified into "resident" and "non-resident". "Resident" means any person residing in Thailand for a period or periods aggregating more than 180 days in any tax (calendar) year. A resident of Thailand is liable to pay tax on income from sources in Thailand on a cash basis, regardless where the money is paid, as well as on the portion of income from foreign sources that is brought into Thailand.

Individuals residing for 180 days or more in Thailand for any calendar

year are also subject to income tax on income from foreign sources if that income is brought into Thailand during the same taxable year that they are a resident. -

-

14 hours ago, Loiner said:

Project Fear 2.0 notched it up a bit more today. Threats that we won’t be able to take pork pies, Cornish pasties or scotch eggs into Europe after Brexit.

Could it get any worse? Yes, also warnings that there will be a fish and chip shortage! You couldn’t make it up. Well... the Remainers just did.Chancelor[ette] Merkel issued yesterday an executive order which bans imports of Haggis after Brexit.

-

1

1

-

-

4 minutes ago, dick dasterdly said:

The 'claim' was nothing of the sort.

It was the youngsters' belief.....

tell me what part of

Quotethe E.u’s threat to make it difficult for Brits to travel for holidays on Europe by air or car

is it you don't understand? i will try to explain even though English is my third language.

-

1

1

-

1

1

-

-

Just now, dick dasterdly said:

So you agree that there are many examples of stupid remainers and leavers?

your sidestepping tactics don't work with a stubborn German. try harder.

-

1

1

-

1

1

-

-

- Popular Post

27 minutes ago, dick dasterdly said:Hang on a minute, are you denying that many young, leave voters were convinced that brexit would make it difficult for them to holiday in the eu?

the claim was:

Quotethe E.u’s threat to make it difficult for Brits to travel for holidays on Europe by air or car

-

1

1

-

2

2

-

- Popular Post

3 minutes ago, dick dasterdly said:So you think there were only stupid brexiters?

Let's be honest - there were more than a few stupid brexiters and remainers....

i don't think Brexiteers are stupid. i think they are misinfirmed and misguided. but i don't understand your question in context with the touristic mini-boom in U.K.

-

2

2

-

1

1

-

1

1

-

- Popular Post

19 minutes ago, dick dasterdly said:Hang on a minute, are you denying that many young, leave voters were convinced that brexit would make it difficult for them to holiday in the eu?

Of course more than a few brexit voters had no idea, in the same way as more than a few remain voters had no idea.....

hang on a minute. do you believe fairy tales such as

QuoteWhile holiday establishments in the U.K. are enjoying a mini boom at the expense of Southern European resorts.

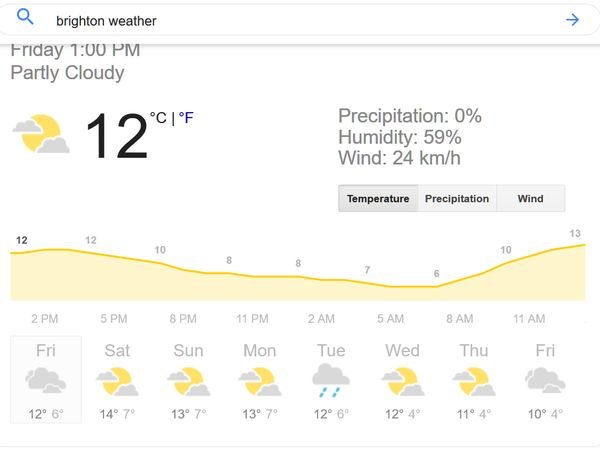

what's the weather nowadays in Brighton compared to Southern Europe?

more rubbish:

QuoteThe European commission confirmed last week that UK citizens would have to pay €7 for a travel permit, as part of the European Travel Information and Authorisation Scheme (Etias). It would be similar to the US Esta visa-waiver system: travellers will register their details and pay the fee in advance of travel (at least 72 hours prior to departure is advised), to obtain Etias authorisation, which is valid for three years.

-

1

1

-

1

1

-

1

1

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Do Residents Of Thailand Need To Declare All Their Assets?

in Jobs, Economy, Banking, Business, Investments

Posted

it goes without saying that tax laws can be changed. but one has to look at the background to evaluate the probability. and the background is that those with economical and political power are benefitting most of the prevailing practice "no tax on savings".