Kevin1908

-

Posts

571 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Kevin1908

-

-

I only come here rarely so I knew nothing about it. I will pay more attention in future. Given that the Thais can't implement a compulsory travel insurance scheme then I don't see this going anywhere soon.

-

1

1

-

1

1

-

-

"That thai person speaks good english." That aside, is this story <deleted> or not. And that would be English not english and Thai not thai. I hope you aren't one of those foreign teachers working in Thailand.

-

1

1

-

-

- Popular Post

- Popular Post

Is there any truth in the following story I was told by a Thai person. Any money by way of savings or pension will be taxed if you stay more than 180 days in any fiscal year. "Have you Read about the proposed tax changes in Thailand. If living here for more than 180 days in a fiscal year, money you bring into Thailand will be taxed. Even moving savings into Thailand is counted as income and taxable. That’s absurd. WOW! " Tell me the Thai authorities aren't that insane.

-

4

4

-

16 hours ago, Gottfrid said:

Most probably, she is not working for Amway, but sell their products. That makes her something they name distributor. In reality, same as selling on commission.

Yes I gather that is what they are doing. So they pester their friends and family to buy Amway stuff then they get commission on sales. Is that right? I can't see how they can make enough sales to get a living income.

My soon to be ex sells Protein Bota B. She buys it for 3500 baht or there abouts and only makes 200 baht per sale. Less of course her costs in sendiing it to her customer. I assume also this is a pyramid that she had to buy into. For the amount she sells it seems a hell of a lot of effort and outlay for very little return.

-

1

1

-

1

1

-

-

The reason I asked is that a Thai woman I chat with on line said the she is working for Amway. I hope she hasn't been conned into joining a pyramid scheme.

-

1

1

-

-

Compared to the UK where I come from is insurance typically less then the UK or more expensive. I would expect it to be lot less as labour rates for repairs to be a lot less than the UK and not encounter 20% sales tax. I think my BMW 320 was in the £450 mark fully comprehensive so 19,800 baht.

-

Can somebody tell me what this online business Amway is? The web site is in Thai, I am hoping it isn't a pyramid seller.

-

How much is insurance typically?

-

I am planning a 3 month stay in Thailand next year as a precursor retiring there. I want a car but if I am not on a retirement or marriage visa can I own a car. As a last resort resort I could register it under my ex's name. At the end of my 3 month stay I would then lay the car up for when I stay permanently later in the year. Any pit falls to avoid if buying a used car?

-

16 hours ago, Delight said:

The most important feature of any Will is the name of the administer.

You can have have as many 'originals' as you like.

The administrator has to hold an original..

Q When you die -presumably in the UK-who will contact the Thailand based administrator?

Also the administrator will organise probate.

Does the administrator have the money at hand to finance this?

I will be changing the Administrator of the will. Does that mean I should inform the Administrator of the old will that the will is no loner valid?

-

I have emailed the will to the Thai lawyer who drew it up in the first place. I was going to change anyway. I drew it up when we got married and I think I was overly generous to my wife over my own sons. Now I can cut her out completely. It is reassuring that I don't have to make a trip to Thailand to sign it.

-

I need to change my Thai will as I hold assets in Thailand. I have a Thai wife but we are now separated pending a divorce. I am in the UK. Do I have to go to Thailand to complete the will or can it be sent to me for signing then returned to Thailand for completion.

-

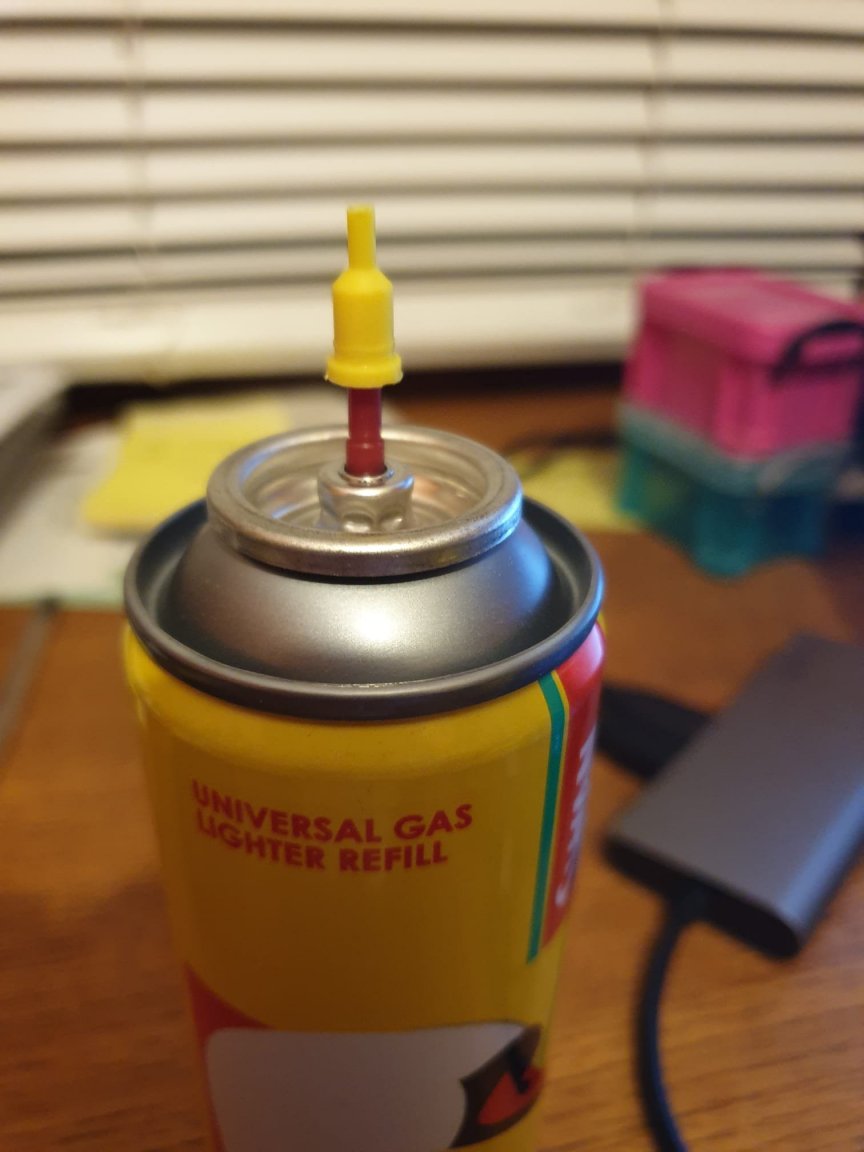

Great I can take the Proxxon mini blow torch and be able to re-charge it.

-

I am not a smoker so not a user or lighters but is the attached type of universal gas lighter refill available in Thailand. I want to take a Proxxon mini blow torch for diy work but if the universal gas lighter refills are not available there is no point. https://www.axminstertools.com/proxxon-mfb-e-microflame-burner-475091?queryID=a234b9bd7da6bf786bc104799153d9fa

-

"Well you need a few nails, a 2by4, a hammer and the sign. :)"

I should say I am not Thailand based otherwise I would consider doing it myself.

-

1

1

-

-

I installed Kanit onto the computer but how I get the spread sheet app to see Kanit in the list of available fonts? So I downloaded Kanit, extracted the compressed file and installed them. Seems I have missed something.

-

I am preparing a spread sheet that contains data and a person's name that is in Thai. I copy the name from another source but if I copy and paste is rubbish. This is with Calibri or Arial. Which spread sheet font will accept true Thai script?

-

Who normally puts these signs up? Who or where would I go to. A general handyman, real estate agent?

-

I have some land owned through a company with my ex wife. It is on the old type deeds with green logo. I did investigate 10 years ago or so and as the land in Ranong had not been digitised with satalite imagery it couldn't be done.

Assuming Ranong now has satalite images can I update the deeds to nor sor 4? How do I go about it, through a solitor I guess.?

-

1 hour ago, retarius said:

AS far as I know, you can spend any amount of time out of the country but you have to extend your visa each year on or before its anniversary and if you don't your visa is cancelled. Note that if you are not in Thailand for 180 days or more, you cannot claim residency, which may be an issue for taxes in your home state or country. You 90 day report clock restarts every time you enter Thailand, so you don't need to worry about that.

Well I may not re-register for tax in the UK anyway. Checking it out with my Financial Advisor half my savings are in a private pension and half in ISAs. Only the private pension would take a tax hit of about £1300 per year. For that I keep access to the NHS and annual increments in the state pension and avoid the very onerous rules for remaining UK tax exempt. I gather if I own a house in the UK and spend more that one night in it in any year then you can't claim tax exemption. Which for the first three years can't be more than 16 days in the UK anyway.

-

Is there any limit on the time spent out of Thailand if you are on a Retirement or Marriage Visa? I know you need an exit visa but what happens to the 90 day registration if you are out of the country, does it just re-start when you return. How long a period are you allowed out of the country without invalidating the visa?

-

56 minutes ago, transam said:

If you have a Thai wife that has never paid N.I. in her own name, you can forget any cash from pensions for her., it has all gone....

In need to check. She did pay some contributions over a period of about 10 years but I think most of the time she was below or just over the treshold to pay NICs. Did I see some where she has to have made 35 years worth of contributions so with ten years worth she wont get anything in her own name?

-

I have no idea if the concept of a marriage pension still exists but as I am 72 and my wife is 52, Thai obviously, am I entitled to claim a marriage pension when my wife reaches 60 or 65. She was born in 1970. I understand when a marriage pension existed the bit for a spouse was paid to the wife not to the husband. What is the situation now?

-

2

2

-

-

The location will be Surat Thani. It will be indoors 00/H0 scale.

Using a courier to Thailand

in General Topics

Posted

I have to do an annual tax return for a Thai company and have been using the same accountant for 12 years or so. Accountant sends me the documents, I sign and stamp and send back. This year I sent UPS. Clearly marked documents and zero value. Sent from the UK.

First of all UPS said they couldn't deliver as the address was wrong. I notified them that the address was correct but I did advise them that the phone number I had used was not correct as he had changed his number. I got the correct number and advised UPS. Another week gone by so called the accountant and documents have not been delivered.

Phone up UPS who now give me a different story, the documents are in Thai Customs and they want an export invoice. I pointed out these were zero value documents that had originated in Thailand.

Are Thai Customs really that awkward or is it UPS not up to the job? Do I really need and export invoice for valueless documents? What next a Customs declaration on a birthday card?