garzhe

-

Posts

296 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by garzhe

-

-

- Popular Post

4 hours ago, webfact said:Picture courtesy of Yorkshire Live

In a dramatic court appearance in Georgia, British teenager Bella Culley revealed a snake-like scar, claiming it was proof of torture in Thailand. The 19-year-old from Billingham faces life imprisonment if convicted of smuggling cannabis worth 11.2 million baht into the country.

During the pre-trial in Tbilisi, Culley tearfully explained she was coerced into the crime, highlighting her ambition to become a nurse and her clean drug tests.

Her defence states she was unaware of the drugs, thinking she was on a trip to assist someone after receiving a passport and ticket.

Culley's lawyer argued she had no knowledge of her location, confusing Tbilisi for a country. Shortly after her arrest, she disclosed her pregnancy and recounted a failed attempt to alert authorities, claiming a police officer was part of the smuggling operation.

The hearing saw her display the scar, with her father and aunt visibly supporting her from the gallery. Despite her lawyer's plea for bail, citing no risk of flight, the request was denied, as reported by The Mirror.

Set to return to court on Friday, July 10, Culley's case hinges on proving her claims of coercion and innocence in a highly tense legal battle.

Adapted by ASEAN Now from [source] 2025-07-03

Adapted by ASEAN Now from [source] 2025-07-03

" thinking she was on a trip to assist someone after receiving a passport and ticket" Travelling on a false passport? Something strange here or bad reporting.

-

2

2

-

1

1

-

2

2

-

1

1

-

1

1

-

2

2

-

Its a risk flying back in to Thailand if youve had too many entries. You can get Fast track through an agent if you fly in to Svarnabhumi but now costs 7000 baht. Cambodia borders closed so no visa runs.

-

On 6/18/2025 at 7:28 PM, Unown said:

Hi everyone, thank you so much for all your replies and advice so far — we really appreciate it! 🙏

Just to clarify our situation a bit more:

- We were in Thailand on a one-year ED visa, which expired recently.

- We left Thailand on time to avoid overstaying and we had the brilliant idea to fly to Vietnam without any agent or similar, planning to re-enter on a visa exemption, as we are from EU and have done that before without any issues (we did that before we had a one-year ED visa track record in our passport, so that’s probably one reason we got investigated).

- Unfortunately, when we landed at Bangkok Suvarnabhumi a few days ago, immigration denied us entry and sent us back to Vietnam. They told us we must apply for a Tourist E-Visa instead of using the exemption.

Now we’re in Vietnam and want to return because we still have personal belongings there.

After being denied once, we really can’t risk being refused again — it’s stressful and expensive.We contacted several agents for help.

One agent (not FTV) told us that we have been flagged in the immigration system under sections 2, 3, and 9 — but they didn’t explain what those mean, saying it’s “only for immigration use,” so we honestly have no idea what that implies.Friendly Thai Visa (FTV) offered us their “Safe Entry” airport service for 8K THB per person. They said someone will wait for us at BKK airport, escort us directly to an immigration officer, and we’ll get a new 60-day Tourist Visa stamp with no questions asked, all done in about 5 minutes.

We have seen many different prices posted online for the same service, so we asked about that too. FTV explained to us:“Price depends on customer case — we have some 4500, 5000, 7000, 8000, 13,000. Variety price that ask from team so your case officer mentioned too seriously than normal so need to pay many parties. We cannot tell much more details.”

So far, we haven’t found any clear, recent feedback about this exact service, so we are hoping to hear from real people who used it at BKK airport:

-

Did it work exactly as described?

-

Were you asked anything by immigration or needed to show cash, bank statements, or an exit ticket?

-

Did you have any problems traveling domestically or internationally afterwards?

We are trying to be very careful because we can’t afford to be bounced again.

Any genuine feedback, tips, or warnings would mean a lot to us — thank you so much for helping us decide what to do next! 🙏

My Philippine GF came back on this service after a 1 year ED visa. Got tourist visa no problem and then applied again for further 1 year ED visa.

-

1

1

-

-

17 hours ago, snoop1130 said:

Picture courtesy of BreizhAtao

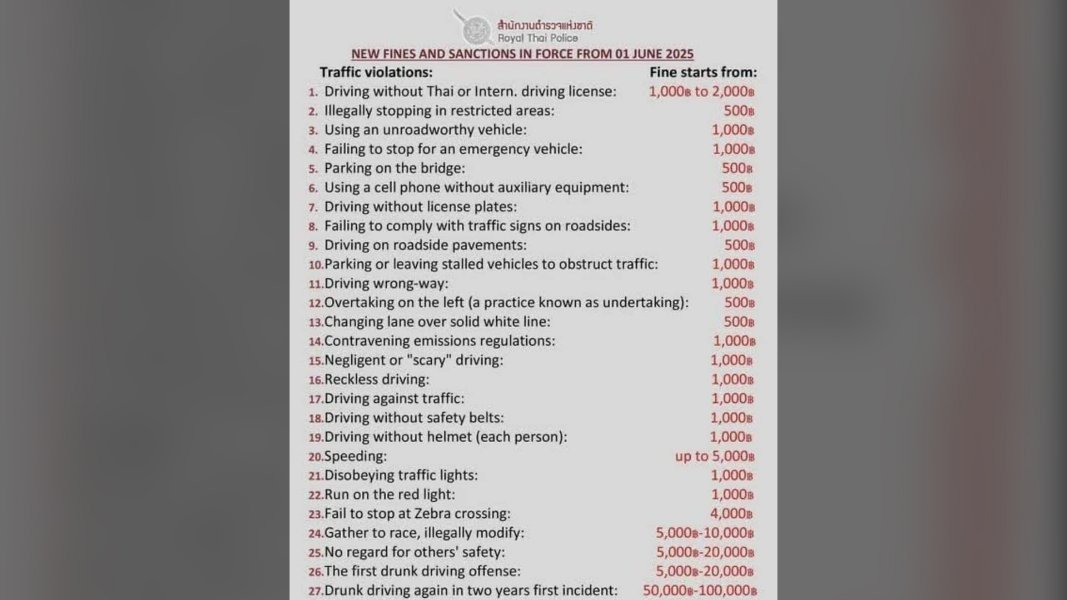

Since the Royal Thai Police (RTP) implemented their overhauled traffic fines and sanctions on June 1, 2025, skepticism remains widespread among the Thai public. The revised system, aimed primarily at improving road safety, has yet to fully convince citizens despite its focus on critical areas such as helmet laws and unlicensed driving.

Key among the changes is the stringency concerning motorcycle helmet use. Under Section 122 of the Land Traffic Act, both riders and passengers are mandated to wear helmets, with fines beginning at 1,000 baht. Notably, if both are caught without helmets, penalties can double. Police Lieutenant General Nithithorn Chintakanon, commander of the Traffic Police Bureau, points out that these requirements are central to the "Safe Roads Project," which seeks to curb road accidents and fatalities—a pressing issue nationwide.

Motorcycle accidents remain one of the leading causes of injuries and deaths in Thailand, largely attributed to insufficient helmet use. Many opt out of wearing helmets due to comfort concerns, despite the added danger. The RTP's firm stance on helmet laws is part of broader efforts to change this mindset and enhance road safety.

Further reinforcing this, the RTP has set sanctions for other risky driving behaviors such as driving on pavements, against traffic flow, or ignoring traffic signals, each incurring fines starting at 1,000 baht. Meanwhile, less severe infractions like undertaking or using mobile phones without hands-free devices while driving attract fines from 500 baht upwards, subject to the offence’s seriousness.

New traffic fines and sanctions, effective since June 1, 2025 | Photo via Royal Thai Police

Public skepticism towards these measures stems partly from historical grievances against traffic law enforcement. Unclear regulations, inconsistent enforcement, and perceptions of being unfairly targeted by officers compound distrust. This sentiment is compounded by the Supreme Administrative Court's ruling on February 5, which declared RTP's traffic fines issued post-July 2020 as unlawful. The court highlighted that these fines unduly restricted motorists' rights to contest tickets—fixing fine rates without due regard—thus breaching constitutional rights.

The RTP's publication of detailed traffic offences and corresponding fines represents a positive, albeit necessary, step towards transparency. While this initiative may improve trust gradually, deep-seated issues, including enforcement consistency and legal clarity, continue to cloud public perceptions.

Despite the initiative's forward strides, addressing the underlying causes of distrust is vital. Enhancing the system's fairness and clarity, alongside reinforcing respectful enforcement practices, is essential for truly effective traffic law adherence. For now, the RTP’s focus remains on mitigating safety risks, but winning public confidence remains a significant challenge.

Adapted by ASEAN Now from The Thaiger 2025-06-13

Adapted by ASEAN Now from The Thaiger 2025-06-13

-

Unless you have skills that a company requires here, there's no chance to get employment with a work permit. Only way is constant border runs or maybe an Education Visa, which will cost you around 40,000 baht a year.

-

On 6/3/2025 at 9:15 AM, Yudie said:

Hi, I’m a 25-year-old girl from Sri Lanka. I’m planning to come to Thailand with a volunteer visa.

After that, I want to stay longer and do simple legal work like farming, gardening, or helping in hostels — just enough to survive peacefully.

Is there any legal way to stay and work after volunteering? Can a local person help me get a Non-B visa or work permit?

I’m not looking for big jobs or online work — just a quiet, honest life. Any advice would mean a lot. Thank you!

-

3

3

-

-

It is so simple to solve if they want to. As I've seen elsewhere, a notice on the dashboard saying "No Meter No Pay" and enforce it.

-

- Popular Post

" nine Vietnamese, four Tanzanians, one Kenyan, and one Thai national"

That says it all.

-

1

1

-

3

3

-

- Popular Post

Dual Pricing has got worse in recent years. I used to get into most places showing my Pink Thai ID card. Now not so easy. National Parks are the worst, most wont accept a driving Licence or ID card. It's considered a scam if Taxis or other private enterprises charge more to foreigners but where did they learn it from. Cant see it changing anytime soon.

-

3

3

-

7 hours ago, webfact said:

FILE photo for reference only

Thailand's Ministry of Tourism and Sports has committed to tackling notorious dual pricing practices following widespread complaints from foreign tourists. Minister Sorawong Thienthong vowed to eliminate unfair pricing schemes after a significant meeting with tourism industry leaders and assorted agencies on Wednesday.

The ministry's heightened response stemmed from a viral social media article entitled “Where Have Foreign Tourists Gone?” published last April, which showcased concerns from foreigners and expats. The article was sparked by a Bangkok Post piece on dipping tourist numbers and drew over 1,800 comments on Facebook.

Complaints pointed at various issues, including tourists' safety fears, widespread overcharging, and ongoing intimidation by transnational crime groups in popular tourist hotspots.

In a move to address these issues promptly, Minister Sorawong has set up direct case reporting from police to his desk for all tourist-related incidents. Tourists can also use the Thailand Tourist Police app or visit the designated tourist assistance centres now operational in each province for support.

Acknowledging the grievances, particularly about higher accommodation fees, Mr Sorawong cited seasonal price fluctuations and global airfare increases due to aircraft shortages as contributing factors.

The minister assured better regulation of tourism scams and pledged to ensure equitable pricing for both Thai citizens and international visitors by scrapping dual pricing altogether.

Despite a slight 0.2% dip in foreign tourist arrivals over the past four months, tourism revenue has risen by 5% year-on-year, as shown by ministry data.

The ministry has also responded to the Airlines Association of Thailand's call for more governmental support by requesting the Ministry of Transport to expand flight slots at major airports, including options for chartered flights.

In conclusion, while tourist arrival numbers have waned slightly, efforts are being made to boost fairness and safety in the tourist experience, promising a brighter outlook for Thailand's tourism industry.

Related topic:

Rising Prices, Broken Systems Dim Thailand’s Tourist Charm

https://aseannow.com/topic/1359304-rising-prices-broken-systems-dim-thailand’s-tourist-charm/

Adapted by ASEAN Now from Bangkok Post 2025-05-01

Adapted by ASEAN Now from Bangkok Post 2025-05-01

-

- Popular Post

2 hours ago, riclag said:Yup ,America First , last November AF ,stopped the advancement of

cultural Marxist/ Socialist / Woke /open borders movement and most important it Stopped the dem appeasement of terrorist nations & proxy’s by defeating Harris!

We are proud that Trump assigned Musk to head up DOGE , which took on the task of investigating Government Waste, Fraud and abuse which was discovered during a GAO audit in 2024.

as a result saved billions upon billions.

We also appreciate that he has dramatically curtailed the illegal border crossing , which upset many on the left.

Deportation of terrorist ,foreign insurgents attending University’s, criminal illegal migrants are being dealt with more & more.

https://www.foxnews.com/video/6371951282112https://www.gao.gov/products/gao-24-107198

Besides those achievements stay tuned , there’s a whole lot of Far left

indoctrination still to transform!

While it's fair to acknowledge efforts like cutting government waste and tightening border security, albeit done in breach of the Constitution, there’s a far bigger issue that can’t be ignored. The U.S. dollar is steadily losing both its value and global dominance, with more countries actively moving away from using it. Meanwhile, trillions have been wiped from the American stock market, devastating pensions and retirement savings. The wannabe U.S. dictator seems to believe the country is somehow "making money" from tariffs on imports. Has no one given him a basic lesson in economics? From the outside, it's obvious that saving a few billion through audits is insignificant compared to the scale of economic damage unfolding. Without serious action on inflation, currency devaluation, and financial instability, political victories risk being nothing more than cosmetic fixes on a system that's starting to crack badly.

-

2

2

-

1

1

-

1

1

-

- Popular Post

As a European, what the past month has shown me is that the American Constitution needs some serious amendments, since it was never envisaged in the 18th century that an aspiring dictator could be elected president.

-

1

1

-

4

4

-

1

1

-

1

1

-

2

2

-

23 hours ago, Rolo89 said:

On the DTV and was planning on paying Thai tax, but since tightening the rules on banking it's impossible to get a bank account until you have a work permit.

My DTV allows working for my foreign company remotely in Thailand, but how can they expect me to pay Thai tax if I'm not even allowed to open a bank account?

If your resident and can get a certificate of residence from Immigration you should have no trouble opening a bank account.

-

1

1

-

-

- Popular Post

- Popular Post

22 hours ago, BritManToo said:More nonsense,

Everything is priced in USD, therefore the USD is required for international trade.

And probably the most stable currency in the world.

It was until Trumps presidency

-

1

1

-

1

1

-

1

1

-

1

1

-

1

1

-

1

1

-

Ive just switched to Yolla. Its slightly more expensive than skype but works well calling European landlines.

-

- Popular Post

3 hours ago, Mark Nothing said:Trump loves grandstanding. According to him this is liberation day. Trump's declaration of economic independence will make America wealthy again. The objective seems to be to bring large scale manufacturing back onto domestic soil bypassing the need to import products.

Sounds simplistic but whose going to invest in producing low tech products in the US at 5 times the cost that are produced in China, Asia and Africa.

-

1

1

-

1

1

-

1

1

-

- Popular Post

The U.S. trade tariffs have triggered significant stock market volatility, posing risks for both pension funds and consumer prices. These effects will be felt by retirees, investors, and everyday consumers.

Most US pension funds rely heavily on stock market investments. The S&P 500 dropped over 8% since February 2025 and continues to drop, pension portfolios have likely suffered considerable declines. If market instability continues, underfunded pensions could struggle, forcing adjustments such as increased contributions from employees, reduced cost-of-living adjustments, or delayed retirement eligibility. I wonder if the average Trump supporter realizes whats happening to his pension.

I think this Trump/Oligarch strategy is simplistic, what do we all do when hit with a price hike, look elsewhere and apart from tech there’s not too much that cant be sourced outside the US.

-

1

1

-

2

2

-

- Popular Post

- Popular Post

Here's a link to the go fund me page where his mother is making an appeal to recover his losses. A different story as to what is reported here. https://www.gofundme.com/f/lewis-green-ordeal-in-thailand

-

1

1

-

4

4

-

- Popular Post

- Popular Post

On 3/3/2025 at 8:19 AM, BKKKevin said:Zelensky is always seen in military attire to show solidarity with his troops, many of whom are crawling through cold, muddy trenches, risking their lives. He is respected by his military, far more than if he were prancing around dressed like some dandy as we see in the US. All respect to him. His February approval rating in Ukraine was 63%, far more than Trumps by the American people who must be disgusted and embarrassed after seeing this debacle with Putin's puppet in the white house.

-

1

1

-

1

1

-

1

1

-

1

1

-

- Popular Post

- Popular Post

2 hours ago, Social Media said:NATO Secretary-General Mark Rutte has urged Ukrainian President Volodymyr Zelensky to mend his strained relationship with former U.S. President Donald Trump following their heated exchange at the White House. Rutte, speaking on Saturday, described the confrontation as "unfortunate" and emphasized the need for Kyiv to maintain strong ties with its most significant military backer.

The dispute arose during a meeting on Friday, where Zelensky pushed for firm security assurances while Trump signaled a preference for diplomatic engagement with Russian President Vladimir Putin. The disagreement underscored a widening gap between the two leaders' approaches to ending Russia’s ongoing invasion of Ukraine, now in its third year.

"I said: I think you have to find a way, dear Volodymyr, to restore your relationship with Donald Trump and the American administration. That is important going forward," Rutte told the BBC, recounting his conversation with Zelensky. He reminded the Ukrainian leader that Trump had previously played a crucial role in supplying Javelin anti-tank weapons to Ukraine in 2019, a move that significantly bolstered the country’s defenses against Russian aggression.

"Without the Javelins in 2022, when the full-scale attack started, Ukraine would have been nowhere," Rutte stated. "I told him we really have to give Trump credit for what he did then, what America did since then and also what America is still doing."

While declining to comment directly on the accusations exchanged between Trump and Zelensky during their White House meeting, Rutte reaffirmed the U.S.'s deep investment in NATO, particularly its commitment to the alliance’s mutual defense principle under Article 5. He described Trump as a friend but refrained from addressing whether Trump was justified in accusing Zelensky of risking World War Three or in suggesting that Ukraine must either strike a deal with Russia or lose U.S. support.

"I am absolutely convinced that the U.S. wants to bring Ukraine to this durable peace… And obviously, what they need to get there is to make sure that we all work together on this," Rutte said.

When asked if NATO allies could compensate for a potential U.S. withdrawal of military aid, Rutte sidestepped the question, stressing the importance of unity. "Let's move beyond this question. It is crucial that we stay all in this together—the U.S., Ukraine, Europe—that we bring Ukraine to a peace. This is exactly what President Trump is fighting for, what we all are fighting for," he said.

As tensions between Kyiv and Washington escalate, Rutte’s remarks highlight NATO’s concern over maintaining a cohesive Western strategy to support Ukraine. His comments reflect broader fears that fractures within the alliance could weaken efforts to counter Russian aggression and secure a lasting peace.

Based on a report by Reuters 2025-03-03

Z

2 hours ago, Social Media said:NATO Secretary-General Mark Rutte has urged Ukrainian President Volodymyr Zelensky to mend his strained relationship with former U.S. President Donald Trump following their heated exchange at the White House. Rutte, speaking on Saturday, described the confrontation as "unfortunate" and emphasized the need for Kyiv to maintain strong ties with its most significant military backer.

The dispute arose during a meeting on Friday, where Zelensky pushed for firm security assurances while Trump signaled a preference for diplomatic engagement with Russian President Vladimir Putin. The disagreement underscored a widening gap between the two leaders' approaches to ending Russia’s ongoing invasion of Ukraine, now in its third year.

"I said: I think you have to find a way, dear Volodymyr, to restore your relationship with Donald Trump and the American administration. That is important going forward," Rutte told the BBC, recounting his conversation with Zelensky. He reminded the Ukrainian leader that Trump had previously played a crucial role in supplying Javelin anti-tank weapons to Ukraine in 2019, a move that significantly bolstered the country’s defenses against Russian aggression.

"Without the Javelins in 2022, when the full-scale attack started, Ukraine would have been nowhere," Rutte stated. "I told him we really have to give Trump credit for what he did then, what America did since then and also what America is still doing."

While declining to comment directly on the accusations exchanged between Trump and Zelensky during their White House meeting, Rutte reaffirmed the U.S.'s deep investment in NATO, particularly its commitment to the alliance’s mutual defense principle under Article 5. He described Trump as a friend but refrained from addressing whether Trump was justified in accusing Zelensky of risking World War Three or in suggesting that Ukraine must either strike a deal with Russia or lose U.S. support.

"I am absolutely convinced that the U.S. wants to bring Ukraine to this durable peace… And obviously, what they need to get there is to make sure that we all work together on this," Rutte said.

When asked if NATO allies could compensate for a potential U.S. withdrawal of military aid, Rutte sidestepped the question, stressing the importance of unity. "Let's move beyond this question. It is crucial that we stay all in this together—the U.S., Ukraine, Europe—that we bring Ukraine to a peace. This is exactly what President Trump is fighting for, what we all are fighting for," he said.

As tensions between Kyiv and Washington escalate, Rutte’s remarks highlight NATO’s concern over maintaining a cohesive Western strategy to support Ukraine. His comments reflect broader fears that fractures within the alliance could weaken efforts to counter Russian aggression and secure a lasting peace.

Based on a report by Reuters 2025-03-03

Zelensky came to negotiate a deal. However, the offer he received was essentially, "Give us your resources for all eternity, and we'll discuss security later." It's good that he walked away from these two morons. He entered negotiations to stop the war with a degenerate president, who didn’t even know how or when the war started and has been parroting Kremlin propaganda since he came to office. Zelensky's only mistake was attending the meeting without an interpreter, making himself vulnerable and unable to respond effectively. These two must be an embarrassment to the American people.

-

1

1

-

2

2

-

1

1

-

2

2

-

- Popular Post

On 2/20/2025 at 3:00 AM, Pouatchee said:i wonder how it would be under harris had she won... certainly no better than what is going on now. i am curious to see how this will play out. no one has a crystal ball and personally i don't trust polls. the dems were trying to convince everyone in the world they were going to win... -- ... until they didn't.

I don't think she would be throwing Ukraine under the bus and making ridiculous claims.

-

1

1

-

2

2

-

1

1

-

- Popular Post

- Popular Post

2 hours ago, Thingamabob said:A lot of pre-negotiation posturing going on. Meantime, it would be helpful if Zelensky would explain where the money has gone. So far the USA has contributed USD 150 billion approx to the war effort, much of it un-accounted for.

There are many unfounded claims and conspiracy theories but official audits from different sources have not confirmed widespread misappropriation of any aid to Ukraine. The Ukrainian government, in collaboration with international partners, implements measures to enhance transparency and combat corruption.

-

1

1

-

2

2

-

1

1

-

1

1

-

- Popular Post

- Popular Post

6 hours ago, Social Media said:Ukraine’s President Volodymyr Zelensky has reportedly frustrated Donald Trump so much during ongoing peace negotiations with Russia that the former U.S. president nearly withdrew American military support for Ukraine, according to three U.S. officials familiar with the discussions.

The friction between Trump and Zelensky escalated into a heated exchange that alarmed European allies, who fear the consequences of emboldening Russian President Vladimir Putin. “President Trump is obviously very frustrated right now with President Zelensky,” National Security Advisor Mike Waltz stated during a White House press briefing.

The relationship between the two leaders has been uneasy since Trump’s first impeachment in 2019, which stemmed from his efforts to condition U.S. military aid on Zelensky’s willingness to investigate Joe Biden’s son and his connections to a Ukrainian gas company. Now, as Trump attempts to implement his promise of a swift resolution to the Russia-Ukraine war, he is finding it more difficult than expected.

According to six administration officials, Zelensky made five key missteps over the past nine days that irritated Trump, Vice President J.D. Vance, Secretary of State Marco Rubio, and Waltz. One official remarked that Zelensky “showed how not to do the ‘Art of the Deal’” when seeking Trump’s support.

On February 12, Treasury Secretary Scott Bessent met with Zelensky in Kyiv to offer a proposal granting the U.S. access to Ukraine’s mineral rights in exchange for de facto American protection. Trump later described Zelensky as “rude” for delaying the meeting because he had slept in. Two days later, at the Munich Security Conference, Vance and Rubio pressed Zelensky to approve the deal, only for him to respond that he lacked the authority to do so unilaterally without parliamentary approval.

Then, on February 15, Zelensky publicly rejected the proposal at the conference, calling it “not in the interests of a sovereign Ukraine,” a stark contrast to his more optimistic remarks on social media the day before. The situation worsened on February 18 when Zelensky criticized peace talks held in Saudi Arabia between U.S. officials and Russian negotiators, saying Ukraine had been excluded. In response, an enraged Trump held a press conference at Mar-a-Lago, where he falsely claimed Zelensky had started the war with Russia and had an approval rating of only four percent.

The conflict escalated further on February 19 when Zelensky retaliated, accusing Trump of living in a “disinformation space.” Trump then fired back on Truth Social, mocking Zelensky as a “modestly successful comedian” turned “dictator without elections,” a pointed remark given Trump’s refusal to label Putin a dictator.

Vance later expressed his frustration with Zelensky’s actions. “He’s attacking the only reason [Ukraine] exists, publicly, right now. And it’s disgraceful. And it’s not something that is going to move the president of the United States. In fact, it’s going to have the opposite effect,” he told *The National Pulse.*

Three administration sources suggested that Vance’s comments were a veiled threat that Trump could withdraw support from Ukraine altogether. From the White House’s perspective, Zelensky had grown too accustomed to the unconditional backing of former President Biden, NATO allies, and positive media coverage. “Zelensky is an actor who committed a common mistake of theater kids: He started to think he’s the character he plays on TV,” said one White House official involved in the negotiations. “Yes, he has been brave and stood up to Russia. But he would be six feet under if it wasn’t for the millions we spent, and he needs to exit stage right with all the drama.”

Another official remarked, “We created a monster with Zelensky. And these Trump-deranged Europeans who won’t send troops are giving him terrible advice.” A third added, “In the course of a week, Zelensky rebuffed President Trump’s treasury secretary, his secretary of state, and his vice president, all before moving on to personally insulting President Trump in the press. What did Zelensky think was going to happen?”

Despite the animosity, Trump’s team is still negotiating with Zelensky, and a revised mineral-rights deal remains on the table as part of a potential peace agreement. However, the deal itself could prove highly controversial. Based on public and private statements, Trump’s administration appears poised to pressure Zelensky into conceding Crimea, parts of eastern Ukraine, and the Azov Coast in exchange for an end to hostilities.

Critics have likened the U.S. insistence on claiming a share of Ukraine’s mineral wealth to a “mafia shakedown,” arguing that Ukraine would be forced to surrender land and resources while gaining little in return. “It’s a sh*t sandwich,” admitted one Trump administration official. “But Ukraine is going to have to eat it because [Trump] has made clear this is no longer our problem.”

Based on a report by AXIOS 2025-02-22

Zelensky’s Actions That Provoked Trump. Wrong title. Should be Trumps actions that provoked Zelensky

-

1

1

-

3

3

-

1

1

-

3

3

-

2

2

-

Here we go again ! Next, bring back the TM-30, back to immigration every time you leave your house for 24 hours.

-

1

1

-

Chaos Erupts: Hotels Back Out of Thai Government Tourism Scheme

in Thailand News

Posted

I wonder whose kid fresh out of Uni was awarded this IT project.