tomkenet

-

Posts

94 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by tomkenet

-

-

On 2/10/2024 at 4:29 PM, ChasingTheSun said:

Is this the bottom line for those who already had significant capital/assets overseas already at December 31 2023?….

This new tax grab only applies to expats residing in Thailand who live off of their overseas pension/biz/investment income and cap gains which is generated after December 31 2023 and brought into Thailand?

If you simply bring in capital that was existing pre-2024 into Thailand you will be tax exempt on that pre-2024 capital.

Income/cap gains generated after December 31 2023 is never taxed in Thailand unless it is brought into Thailand at a future date.I believe many of us will remit and live on pre24 savings, perhaps combined with a small portion of post24 income, dividends , gains (low enough to keep the tax reasonable).

In a few years the pre24 savings will run out and will have to be replaced with generated post24 income.

This funds will be taxable when remitted to Thailand.

If relocating out of Thailand at that time these funds will be tax-free and will create a huge incentive to move .

This is a situation Thailand must avoid and probably there will be new regulations in place.

I guess we will see a world wide income taxation (remitted or not) in a few years with amnesty for the generated post24 income.

-

2

2

-

1

1

-

-

Gift tax.

There is an essential difference between a gift beeing given within Thailand and a gift given from abroad.

Given from Thailand the income the giver once had to fund the gift was subject to taxation in Thailand . (If assessable )

Given from abroad it might be untaxed funds.

If it is not assessable It can be transferred to Thailand tax-free anyway.

-

1

1

-

-

If I'm a resident in Thailand for a year and I earn foreign sourced income in that year,

next year I reside outside of Thailand, remit that income to Thailand, then move back to Thailand the year after.

Any tax to be paid in Thailand?

-

20 hours ago, Mike Lister said:

Hypothetically, the total value of your asset as of 31 December 2023 should be free of Thai tax, according to what has been said thus far, this whole business is alleged to start again new on 1 January 2024.

Surprising, but of course positive if latent, unrealized capital gains by 31.12.23 are tax exempt when realized later, and only the gains from 1.1.24 are assessable.

I believe this is to good to be true

-

40 minutes ago, ChrisParis75 said:

Thailand... a real "tax paradise" (for us earning money abroad !).

And still is. Remittance of savings taxfree, earning money abroad taxfree if kept abroad or spent abroad.

-

9 hours ago, stat said:

You explicitly stated that nothing would change in 2024, I am glad that you now understand that this is not true.

Sorry, i still think this will not change in 2024.

Earnings from previous years are remitted taxfree, just like 2023 and before.

Earnings from same year are taxable when remitted , just like 2023 and before.

What is new in 2024

-

1

1

-

-

13 hours ago, stat said:

Dead wrong in the case of earnings in 2024 and remitted in 2024. In addition no one knows how and if to prove that their earnings have been from before 2024. In addition no one is 100% sure that earnings pre 2024 are not taxed when remitted.

Funny post, I did not state anything about earning and remittance the same year, which always is taxable.

A ringfenced account pre. 24 would prove that the earnings have been from before 2024

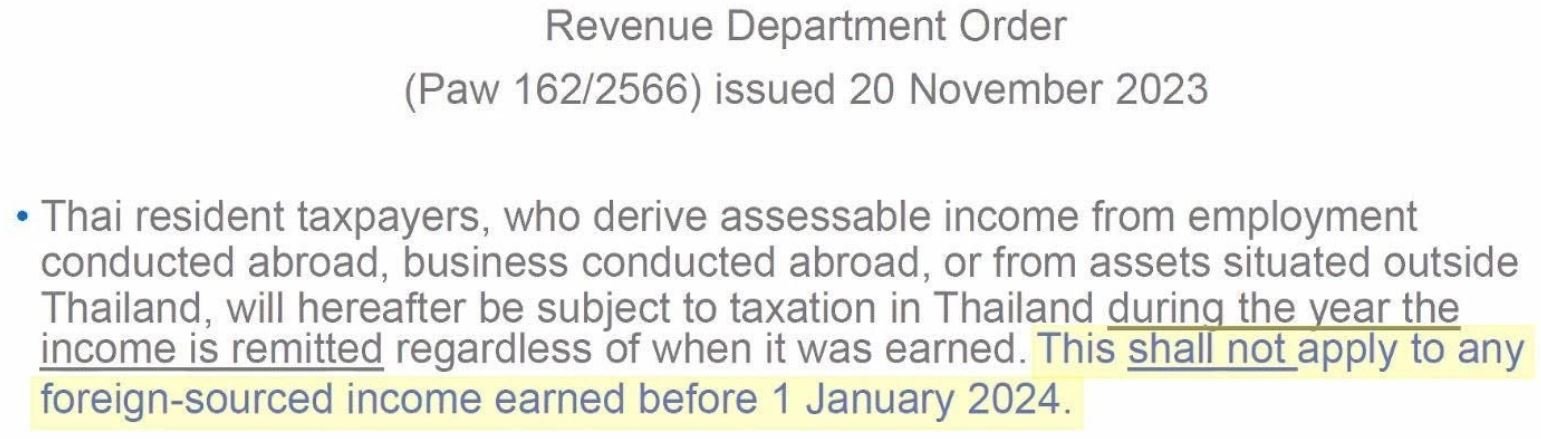

So you question the interpretation of Paw.162 made by all the major tax- consulting firms?

-

7 minutes ago, Mike Lister said:

Actually no, it has not always been the rule, the new rule specifically sets out to change that aspect. Previously, income earned and remitted in the year it was earned, was taxable, if earned in a an earlier year it was not.

So you think money earned and remitted in 2023 is taxfree?

It's not

-

15 minutes ago, Mike Lister said:

Incorrect, income earned prior to 2024 is specifically excluded

Not if earned and remitted in 2023 which is the case here.

This has always been the rule

-

1

1

-

1

1

-

-

30 minutes ago, whiteman said:

Got my big lump sum in on the 23rd Dec Happy Days

Hope you earned this before 2023.

If earned in 2023 it is taxable.

If earned in 2023 and remitted in 2024 it would be tax-free, just like it has always been when remitted the year after earned.

This however changes for money earned in 2024.

-

1

1

-

2

2

-

1

1

-

-

8 hours ago, stat said:

Nonsense, sorry mate. That is just the deadline for the tax calendar year. Starting 1 Jan 2024 you are liable to pay tax on your remittance without any substantial guidance on how profit of this remitance will be calculated (Lifo or Fifo for example etc). I know TiT but this time there are 6-7 digit USD taxes on the horizon for some people.

2024 will be just like previous years.

Last years earnings will not be taxable when remitted.

2025 will be the first year with the new rules. Last year earnings will be taxable when remitted.

-

1

1

-

1

1

-

-

37 minutes ago, Eudaimonia said:

To be honest, I think the big money is either moving soon or being taken care of by lawyers and bankers who know how to prove these things later.

Grandfathering pre-2024 income was not part of the original Order or plan. It was announced later when they understood how complicated everything would otherwise become. Perhaps some influential people also mentioned that they will need at least one more year to repatriate their funds.

If you have the money and want to buy a condo, I would not wait until 2028.

paw 162 is logical, it is just previous loophole continued for the rest of current year.

Not applying Paw 162 would be for Paw 161 to be retroactive from 1 January 2023.

-

1

1

-

1

1

-

-

57 minutes ago, jerrymahoney said:

I wonder if this deduction also can be used for foreign sourced dividends or capital gains remitted to Thailand

-

1 hour ago, Dogmatix said:

I have been busy created transactions by selling shares and funds prior to the year end. Hopefully that will create a pool of funds generated from pre-2024 transactions that can be remitted tax free in future. But it is anyone's guess how they will implement this..

I am in the same prosess.

My guess, you'll have to show documentation if they ask, which they probably will not.

-

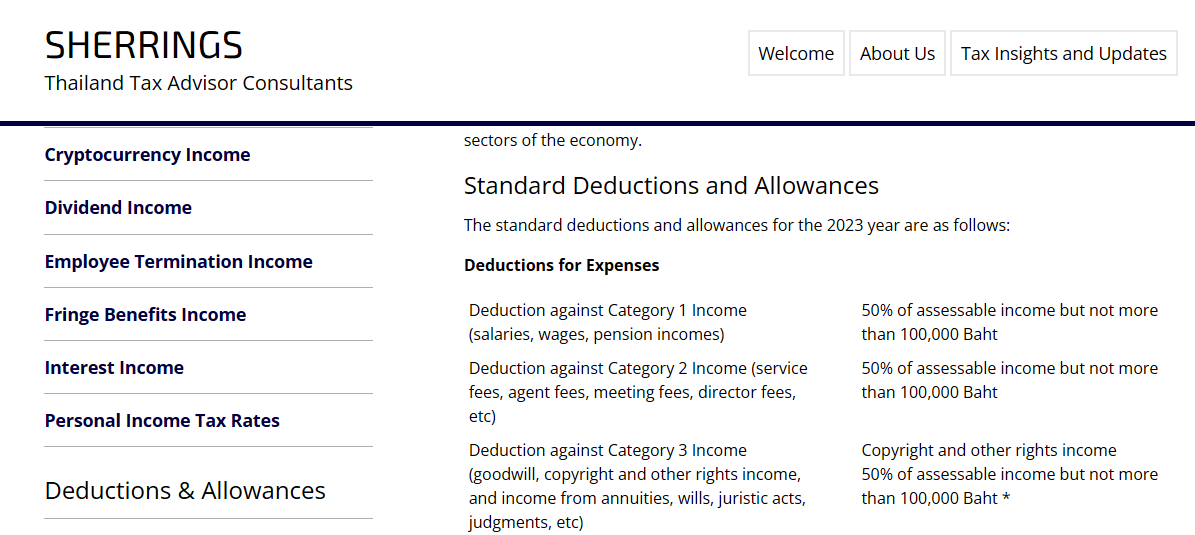

2024 will be just like previous years.

Last years earnings will not be taxable when remitted.

2025 will be the first year with the new rules. Last year earnings will be taxable when remitted.

-

1

1

-

-

3 hours ago, Steve2UK said:

That's near enough my* situation. Given that I received the sale proceeds into my UK bank account way earlier in 2023, I'm currently relying on the Paw 162 'clarification' (Mazar's version attached) that when remitting it to my Thai bank account even after January 1st 2024** it won't be taxable. Pure luck - if I sold in 2024, I'd be

. My fingers are crossed that Paw 162 stays in place and gets applied.

. My fingers are crossed that Paw 162 stays in place and gets applied.

* Retired and Thailand tax resident year after year.

** Which I see as basically an RD amnesty 'concession'...... and very necessary for many.

Is there any doubt Paw 162 will not be applied? It is actually quite logical, it is just previous loophole continued for the rest of current year.

Not applying Paw 162 would be for Paw 161 to be retroactive from 1 January 2023.

-

23 minutes ago, Ricardo said:

I didn't need to do that, last time I needed a certificate-of-residency, to apply for a 5-year Thai driving-license, FWIW.

Just a slow (IIRC 30-days wait) process at Immigration, which could be turned into next-day service, for a modest (B500 ?) administrative-fee.

What I need is a certificate of residency for tax purposes. R.O.22.

I think it is not the same thing

-

1

1

-

-

43 minutes ago, Ricardo said:

Erm, wouldn't the savings-account possibly generate interest on money-X, said interest arising after 1.1.2024, which would perhaps therefore be taxable here when transferred ?

Maybe see if you can get the saving-account to pass the interest to another (undeclared) account, to be safe ?

That is right and a good idea. I will try to do that, however, if it is not possible, with deductions it will end up in a very low tax bracket.

I have to file tax report anyway to get the certificate of residency.

-

My plan is prior to 2024 deposit in a savings account back home money to last for 3-4 years in Thailand.

Let's call this money X which can be remitted taxfree.

My other investments will after 2023 continue to generate income that is not taxed. Let's call this money Y. As far as i understand I will be developing a sort of tax debt on this money, generating tax when later remitted.

In 3-4 years, when X is depleted I will have a big incentive to move to another country where Y will be considered taxfree savings. I wonder how long I would have to stay away from Thailand for this taxdebt to go away.

Another outcome is by that time Thailand has changed to Worldwide taxation (not remittance) , what would then happen to Y.

-

- Popular Post

- Popular Post

I am very curious how Thai RD is going to make this system work

A tax resident foreigner holding a foreign account with income and savings from before 2024, proceeds with capital gains, dividends and pension etc. from after 2023, and proceeds with capital losses from after 2023.

All mixed together in 1 account.

Can the taxpayer choose which money he remits to Thailand or is it FiFo.

And how to sort out what money has already been remitted and what money is not yet remitted the following years.

This system might work for Thai citizens with limited economic activity outside Thailand, but for a foreigner with most of his economic activity outside Thailand this is very messy

-

3

3

-

1

1

-

1 hour ago, Eudaimonia said:

Here's my action plan. Maybe this is helpful to someone, or someone can point out mistakes. I am not in retirement age yet but live off investments abroad, so this change certainly affects me.

I have a portfolio of stocks from different countries. I now set up a new broker account and moved all my US stocks and ETFs there. Selling and buying back shares that have appreciated realised all capital gains so they will not be taxed later.

The main reason to have two accounts is that dividends from various countries have different withholding taxes. For example, the UK and Singapore are 0%. Those would be taxed when remitted to Thailand after 1.1.2024. That is why it is best to have separate accounts.

The US withholding tax for Thailand tax residents is 15%. I already have a Thai tax ID, which I have sent to my broker, so they apply the double tax agreement and withhold 15% tax from my US dividends.

Calculating Thai personal income rates using the progressive levels (5-35%), I see that the overall tax rate rises to roughly 15% at around 1.4 million baht. I plan to remit up to 1.4 million per year and use a withholding certificate from my broker to prove that I have already paid 15%. I expect to attach proof of the withholding tax paid and be able to claim it as a credit (The Revenue Department has promised they will amend the tax forms for this). That means there should be little or no Thai tax to pay.What if 1.4 million baht is not enough in the future? Maybe I need to buy something expensive. Luckily, according to the latest order No. 162/2566, the new rules will not apply to income earned before 1.1.2024.

Before the end of this year, I will transfer some funds to a new offshore bank account that is ring-fenced for remittance purposes. In January, I will send some of that money to my Thai bank account, and as pre-2024 earnings it will not be taxed. So, I have some savings as a buffer. It is possible to remit that pre-2024 money later as well, but if the offshore account accrues any interest, that interest part would be taxable in Thailand. We do not yet know how such mixed funds will be treated.

(If I sent more money to my Thai account now, in December, it would be assessable income because I have earned it this year. That has always been the case, according to the old law. So I have to wait until 2024.)

My other broker account, with non-US stocks, will never be used to send anything to Thailand. I can use those funds when staying abroad. At this point, they will not be assessable income in Thailand. However, even that might change in the future. Therefore, it is best to sell (and buy back) those shares now as well to realise the capital gains before 2024.

Does this sound like a feasible plan? Have I missed anything?

Sounds like a good plan. I will do something similar,but with a overweight of transferring money to a Ring fenced account before new year.

-

1

1

-

-

26 minutes ago, jerrymahoney said:

REDUX:

According to the Revenue Department, it will seek opinions from the stakeholders affected by the new rule and issue guidelines to provide more clarity. The plan includes an amendment of the personal income tax return form to facilitate the foreign tax credit claim.

Looks like this one is from before. Paw. 162/2566

They have also issued a report after, which is more useful.

-

On 12/2/2023 at 11:51 AM, Dogmatix said:

Some up dated advisories in the light of P 162/2566 from BM, EY and SCB for interest.

The BM document is just in slide form. One slide gives the idea of using an offshore company to remit a "genuine loan" to the company's 100% owner who is tax resident in Thailand. It says this is not assessable but doesn't define "genuine loan".

SCB reiterates the point from the Prachachart Thurakit article that a RD source said they want to amend the Revenue Code to tax all foreign source income in the year it arises, regardless of whether remitted to Thailand or not. I guess that is where we are headed eventually and a future MFP government with plans for enhanced welfare funded by an iniquitous wealth tax and other new taxes would probably make that more likely.

Baker McKenzie 24 Nov 2023.pdf 1.21 MB · 26 downloads EY 28_Nov_2023[1].pdf 248.91 kB · 24 downloads

It's from the Baker McKenzie report. It has been referred to several times on this thread, surprised you haven't seen it .

Mazars and Ernst & Young reports the same interpretation

-

24 minutes ago, TroubleandGrumpy said:

There are two clear ways to read this statement and what it means (that I can see):

1. Assesable income earned before January 1, 2024 will not be taxed in the future (I do not think it means that);

2. Assessable income earned and remitted into Thailand before January 1, 2024 will not be taxed.

The question is when is income tax on assessable income incurred - it is incurred when it is remitted into Thailand.

IMO it means - remit the money into Thailand before January 1, 2024 and it will not be taxed.

Clear as mud.

-

2

2

-

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Thai government to tax (remitted) income from abroad for tax residents starting 2024

in Jobs, Economy, Banking, Business, Investments

Posted

It is not only the heading of this thread, It is the initial news-article from Thai enquirer,

https://www.thaienquirer.com/50744/thai-government-to-tax-all-income-from-abroad-for-tax-residents-starting-2024/

"Thailand’s revenue departments has released new guidelines which will see all income from abroad taxed as personal income tax regardless of whether it was earned income or savings."

No wonder many panicked when they saw this. Luckily the truth is much less dramatic.