thecottonmill

-

Posts

100 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by thecottonmill

-

-

Hi, just wondered if anyone knows of a good moo kata (grill buffet) place near the silom area of town? Thanks in advance!

-

Hi all, my friend is a big Leicester City fan and he asked me if I could pick up a match programme for him. Unfortunately I'm not in Thailand at the moment. If you have a match programme or anything from the match (used ticket stub or whatever) I'd be happy to buy it off you. Please PM me if you do!

Many thanks

John

-

Hi I was hoping someone could do me a favour.

I really want to get a hold of a couple of match programmes for Saturday's game. My friend is a big Leicester City fan and I was hoping to surprise him. I'll pay for them and the postage to the UK!

Please PM me if you can help out.

Many thanks

John

-

Have people here seen this ?

-

I'm getting paid 6500 Baht per day as someone claimed above, making 195,000 Baht per month, like every other red shirt demonstrator on the streets.

Didn't someone say it was 6500 baht per week? as opposed to per day?

Am I right? Is Che wrong?

-

-I guess it will come down to a fight, not army, not police, but between protestors, pro and anti government.

It will be nasty, bloody and dirty, but my money is on the pro-government side...they're boiling over...

you should be ashamed of yourself to bet on others "nasty, bloody and dirty" grieves.

I don't think he's actually putting down a wager. I think it's just a turn of phrase Zaza.

What a ridiculous situation this all is.

People want democracy? Well then wait till the election and vote. That's democracy. Go home, raise awareness in your local community, peacefully, use intellect rather than physical means and you garner the respect and support of so many more people. Do not spit your dummy out, impose yourself on others and threaten your fellow citizens.

They should have left so much earlier. It would have been a much more powerful political statement in my opinion.

-

Hi all,

A genuine questions because I really don't know too much about all this...but you guys are mentioning the yellow shirts...well if that's not the police and not the army...who is that exactly and what kind of power/numbers do they have?

Thanks

-

was your old camera a DV camera? And if so do you still need to be able to watch and edit the old tapes?

If so I'd go for any of the old canon DV range - they're still great.

If you're going for something more modern - hard disk based I'd go for the Canon or Sony camcorders. Both small, compact, great quality. My mum bought a panasonic - top of the line one a couple of years ago and it's fidgety and doesn't always get the best results in dim lighting. Stick with the Canon or Sony and you're on to a winner I'd say

-

I've booked a flight to visit Chiang Rai this weekend!!!

Aghhhhhhhh Is it really that bad ??

-

If you are going to Canada soon,then I would advise you to wait and buy there. All OS's are genuine and the laptops are less expensive than here in Thailand.

I Agree...for some reason technology seems to be quite a bit more expensive here. Silly really seeing as so much stuff is manufactured here or in surrounding countries.

-

Hi,

17 inch laptops are heavy!

15 inch is probably your limit if you want something portable and not too heavy. If you're looking at a core2duo 2.66 or higher then you'd be hard pushed to find anything less than 30000 in the shops.

However you might be able to get a new i5 notebook (i5 is replacing core2duo). i5 laptops are coming in at around 27000+vat at the moment.

I am selling my DELL VOSTRO (shameless plug!...you can see it in the Thai Visa classifieds). The other reason I bring it up though is that it's a 14 inch, core2duo 2.4 cpu, 300gb hard disk, 4GB ram system. I was looking at comparable notebooks in the shops (hence the reason why i know the prices right now)...and couldn't find anything for less than about 28000 baht.

So I guess the question is does she really need such a powerful machine? If not then those asus lightweight notebooks might be enough - the ones with the core solo cpus. They run nicely and look and feel good too. It's all a matter of necessity really. If she isn't going to do anything too intensive then a cheaper, lighter notebook might be the answer!

Hope that helps

-

these sites should get you started

I've used Tisco for the last 18 months and been perfectly happy with them. I heard kimeng is a little cheaper tho - could be wrong so double check. Personally I'm sticking with Tisco. I was assigned a customer service representative when I first arrived and she's been superb - prompt, courteous and knowledgeable.

-

package tours to So. Korea during winter months are relatively low due to the cold winter there, you'll see a spike in travel during

the chinese new Years period as So. Korea observes this holiday period.

why don't you search on the airline website; KAL (Korean airline) or Asiana for some insight, perhaps you can search KNTO, Korean National tourist organization site.

I have been there during winter and the mercury dropped to -20'C... had to drink a ton of Jinro sohju & eat kimchee..to keep warm.

Many thanks all, I'll check out the suggestions.

-

I was largely out of the market during the meltdown of 2008/9 and also during the bull rally that followed (unfortunately)..ive just decided to jump into the Thailand stock exchange...some of the highest dividends in the world, but alot of volatility - from what i can see the local investors tend to buy and sell quite frequently. My current MO is to sell whenever a stock increases by 5%..if it increases to 7% i then buy in again..if it falls i move to the next stock on my watch list..

Had a quick look at your blog - nice work there expatJ!

I'm holding off from investing for another week. I think there may be a small nosedive but I'm excited about future prospects. KBANK, ADVANC, HMPRO, LH, LPN and the excellently run CPN are all on my watchlist.

We live in interesting times!

-

Hi all, what a great thread - really informative. Was wondering if anyone knew any way around this problem:

My mother was born in Udon Thani in 1946 but her mother never kept any paperwork. As a result she has no proof of being born there. She then moved to the UK and became a British citizen but now she would like to have her Thai citizenship too so that I too can also acquire it.

Not sure if there's any solution to this but thought I'd ask. Is there a register we can look up or research into or something like that?

Thanks

-

Hi, I'm thinking of taking a short break with my mum - maybe four or five days. She suggested Korea. Has anyone been on a package holiday there? Has anyone got any recommendations?

Any help or suggestions would be much appreciated. Cheers

-

This is like tennis. haha.

So, anyone else wanna share their own top stock tips for the next few weeks?

HMPRO is an excellent stock by the way - even at the price today. Well undervalued in my opinion.

HOMEPRO is a good growth stock..i prefer buying growth stocks i.e. those with the highest growth increases in profit, income, sales and EPS and whose stock price is already rising. The highest growth stocks in SET - HOMEPRO SENA, BANPU, LANNA, TTW, CMR, DSGT KCAR.

I guess I'm too emotional for stocks.

I lost money in the US trading and am thinking about Thai stocks.

But, HMPRO? Sorry but when I went in one of the huge new stores yesterday, they had about 20 employees standing around and I was one of 4 customers. (I bought a 200 baht item) I can't buy a company that is losing money like that.

Now KBANK is one I've been watching. But, I see people on here buying it for it's dividend (which is listed at 2.5%)

However, the stock has dropped 10% in the past 30 days. (wouldn't it take 4 years to get that money back?)

I am guessing that perhaps the market hasn't hit bottom and may not until after (or closer to) the Taksin decision near the end of this month.

HMPRO's net profit increased 96% from 2008-2009- as you say its easy to fall the trap of buying stocks by emotion and gut feelings rather than cold hard analysis of facts e.g. visiting an empty store and using that to base your analysis on companies profitability.

I think KBANK paid 6 baht per share last year?? ( i wasnt in the market then).

Yes, Kbank is down 10% last 3 weeks, but i bought into it for dividends not quick trading..

I think you are right, we havent reached the bottom yet..

KBANK is a great stock. I bought it last year at 40 baht. Sold it at 74 baht. I'll rebuy it if it drops below 70 in a couple of weeks.

HMPRO really is an excellent stock - well run company. There's a chance it'll fall below 4 baht and if it does I'd buy it up.

So far on this forum I've been surprised by some suggestions - MBK? Not too bad actually. KCE - not too sure about this one. Perhaps, if it falls enough in the next 2 weeks.

It'll be an interesting 2 weeks in the SET. Hope everyone here does well out of it. I'm still trying to sell my remaining holdings in the next day or two.

-

Amongst others I like....

KCE - should make Bt145m in 4Q well ahead of its forecast of Bt100m. Should make Bt600m this year against consensus of Bt450m. Current trading at BV and slightly less than 4x PE. Target Bt9.

STA - usually makes a seasonal loss in 4Q but will report a profit of Bt200m+. Trading 30% below BV and on less than 4x 2009 earnings. Probably worth Bt40+.

Interesting. I'll check those out!

My other two pics are DTAC and CPN. Both excellently run companies whose share price should reflect this in a year from now. At their current prices they are super cheap (give it a week though and they may be 10% cheaper)

-

This is like tennis. haha.

So, anyone else wanna share their own top stock tips for the next few weeks?

HMPRO is an excellent stock by the way - even at the price today. Well undervalued in my opinion.

-

SET down 8.94 points today. Expect another 10 points to come off in the next few days.

My stocks to watch are

LPN - Buy when it hits 6.1 (may fall further but 6.1 is good)

AP - A great Buy if this hits 4 baht

SF - Another great buy if it goes below 2.9

MAJOR - Anywhere close to 8.00 and you should snap it up.

I'd predict all these should give you 20-25% gains by July.

-

You could look at the market today (I'm writing at 2pm) - having fallen 6% and buy now and sell in 4-5 weeks.I do know the benefits of trading, as well as the pit falls. If one tries to time the market, they can get chopped, head faked and rack up commissions. You dont see Buffet or Faber trading in and out on a regular basis for a reason. They decide what they are bullish on, in what time frame, and they hold their position.Our main point for holding Thai stocks and not trying to time the market is the fact that we are bullish on Thailand for the longer term, like I said, 5-10 years. So, we will continue to hold, collect the juicy dividend, and average down if and when there is a significant correction. This is our plan, and we feel confident in it, and sleep well at night. Mainly because we dont have it all in the SET, but are invested in other markets, and other assets, like real-estate, cash and precious metals.

Do you plan to buy stocks when they are expensive and sell them when they are cheap? Does Buffet buy the top of a market and sell the bottom?

If you buy stocks today and you believe they will be worth more in the future, isn't that the definition of timing the market? 5 days or 5 years, timing is timing.

haha exactly!

haha exactly what??

If I buy stocks today, and believe they will be worth more in the future, its called INVESTING. Buy and hold investing to be precise. Now, when I day-trade commodity futures a few times a night, THAT is timing the markets short term swings.

Or wait another week and buy when it's fallen another 10% and sell in 4-5 weeks.

Timing is not everything I guess...depends how much you want back on your initial investment.

I don't mean to offend. I just think the market is ripe for short term trading right now. In more stable times I invest more prudently and go for 'value' stocks but in these times I see a chance to make serious gains...IMHO I think the SET could drop to as low as 640 before recovering. I've sold the majority of my holdings and will start reinvesting in 10 days.

What is everyone keeping an eye on at the moment?

-

I do know the benefits of trading, as well as the pit falls. If one tries to time the market, they can get chopped, head faked and rack up commissions. You dont see Buffet or Faber trading in and out on a regular basis for a reason. They decide what they are bullish on, in what time frame, and they hold their position.

Our main point for holding Thai stocks and not trying to time the market is the fact that we are bullish on Thailand for the longer term, like I said, 5-10 years. So, we will continue to hold, collect the juicy dividend, and average down if and when there is a significant correction. This is our plan, and we feel confident in it, and sleep well at night. Mainly because we dont have it all in the SET, but are invested in other markets, and other assets, like real-estate, cash and precious metals.

Do you plan to buy stocks when they are expensive and sell them when they are cheap? Does Buffet buy the top of a market and sell the bottom?

If you buy stocks today and you believe they will be worth more in the future, isn't that the definition of timing the market? 5 days or 5 years, timing is timing.

haha exactly!

-

Absolutely...and nasty politics and leadership changes are ALWAYS ugly. I'd say don't be afraid to take a small loss - sell out, buy back cheaper and come back stronger. In the longer term it's better to be safe than sorry.

Orion - are you invested in the SET?

Right now I am completely flat and only day trade. I think we're at a critical point where the world markets *may* take another tumble.

From a risk perspective though, I don't see much reason to feel safer holding US or EU stocks over Thai stocks. As long as one uses stop loss orders and withdraws his money when the market goes south.

Yeah I couldn't agree more. I think last week's US employment news aftershocks showed just how shaky the markets still are - barely stabilised and certainly not recovered yet.

On another note, personally I'd say that Thai stocks are more risky a this present time...what with the political situation here. Stay clear this next 10-15 days. After that buy like crazy because there will be some big bargains.

-

Absolutely...and nasty politics and leadership changes are ALWAYS ugly. I'd say don't be afraid to take a small loss - sell out, buy back cheaper and come back stronger. In the longer term it's better to be safe than sorry.

Orion - are you invested in the SET?

The one thing that worries me deeply about investing in Thai stock is the age and health of HRH, when the inevitable happens the stock market will go into freefall, and who knows what else may happen politically to push the SET even lower.I can fully well see the benefits of having high dividends paid in the currency of the country you live, but at this moment the risks in the share price seem to outweigh any gains made from dividends.

I admit to know little about Thai stocks so maybe somewhat bias, but it does seem fraught with dangers.

I think your thinking is flawed, but it is the thinking of many people I know. They all cited reasons why investing in Thailand was more "risky", but I called their bluff when I told them what happened to my holdings in Canada during the summer of 2008. The fact that it happened in a first world country, to me, means that investing in Thailand is no more risky than investing in Canada. And, the fact that the worst thing that could hit a country, IE in the government overthrown and airport shutdowns, happened, and what happened? The currency held strong and the market is still there, so to me that denotes strength.

I have a nice holding of Thai stocks here, and receive dividends that can not compare to anywhere right now. We have a cash position as well, for when HM passes on, if the market drops, we will average down, as we are holding Thai stocks for the long term, 5-10 years. And are being paid to wait, paid quite well I might add.

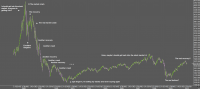

Posted this in another thread already but I think this 10 year chart of the Nasdaq gives a pretty clear picture of just how safe it is to buy & hold stocks in the US.

This chart should scare the heck out of anyone holding any stocks in any country.

The obvious message is: never be affraid to sell your stocks when things get ugly, nobody will stop you from buying them back later when things settle down.

I Just Bought A Fender Strat In Bangkok ! Questions...

in Bangkok

Posted

Hi, try posting this again in 'Bangkok Jungle'. Lots of musicians there which would be more than happy to help I'm sure.