fuehrio

-

Posts

98 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by fuehrio

-

-

1 hour ago, Sydebolle said:

Read very carefully:

1) I referred to 40% write-off - that is over the time span of TWO years; one year allows 20% usually. So, the remaining value of the car is 60% of the purchase price.

2) well, the 50% - or even less - could be the case, if you had a major water damage due to the present heavy monsoon while you parked the car wrong. Put this as "water damaged" onto the sales contract between the company and your friend and all is OK. There will be thousands if not more such cars on the market within weeks - given the present weather pattern. I am sure that your friend would not offer more than 30% - 40% of the value as he might have to rip out all the carpets, upholstery and many other components of the car, don't you think so?

When transferring the car, you will have to have the car inspected. This is done either at the Department of Land Transport or external, officially authorized, inspection agencies (see logo photo enclosed here symbolizing a cog wheel - visible at the road side):

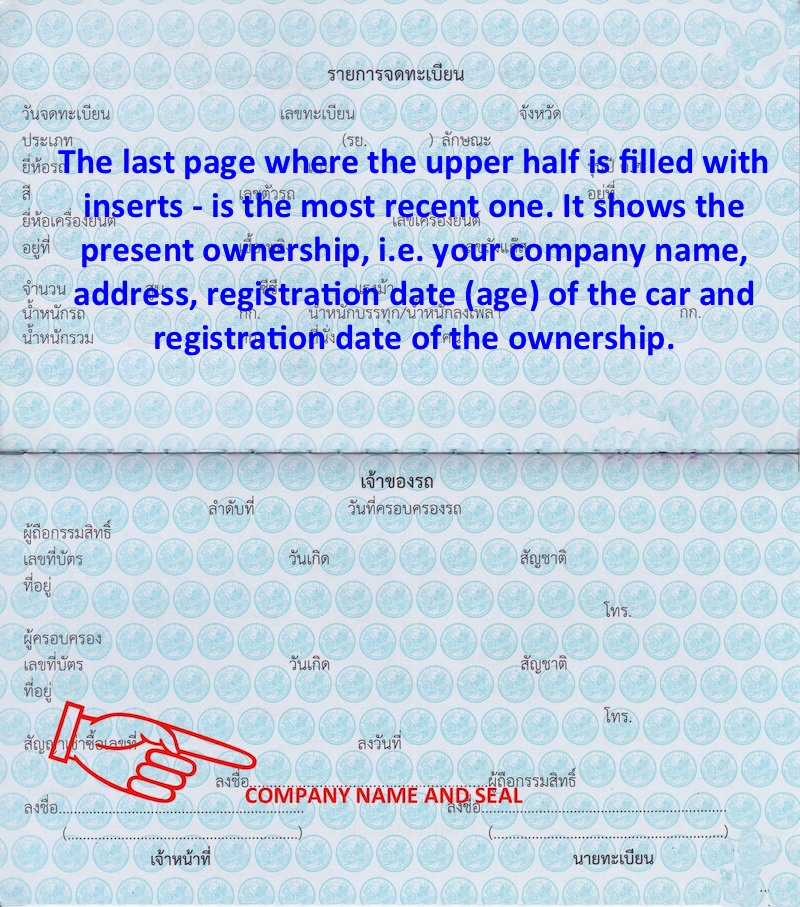

Go to an external one, they just check the engine's fumes and the brakes and give you a paper confirming, that your road is roadworthy. There is a nominal fee of a few hundert Baht for this. And, while you are at it, get a new insurance coverage (the government insurance for THB 650+ or something like that). Then take this certification, the insurance confirmation, the blue car registration book with the sales contract, duly signed by the company's authorized signatory/ies and the company seal (see sample) to the DLT for transferring ownership:

Make sure your friend's paperwork is in order and you'll finish this in one go.1) OK, understood now about the depreciation.

2) This seems a very good way. But as I wrote in the original post, I have 2 cars, not sure this will be looked at with such a story (water damage). Also, a Thai friend told me that I should sell the car first before closing the company, instead of closing and transfer without actually paying into the company account. This way I should be able to sell the car at any price (e.g. 100,000 Baht) and there should be no additional tax when closing the company as the asset is gone. I guess I also would need to sell to a friend first and not directly to me as a shareholder. What is your opinion on this approach?

-

3 hours ago, john donson said:

no accountant??? ah fake company

I don't use this company since 3 years, just paid the annual tax report in case I would use it again. But I am sure now I don't, so I am closing....

-

19 minutes ago, sometimewoodworker said:

Since the transactions will be looked at by the TRD that would be an extremely risky course of action.

However the report of an “independent” mechanic detailing all the requirements to bring the car to a saleable condition could easily drop the market value by a very significant amount. Nudge nudge wink wink

I did read when looking up on the internet, if selling below market value, there needs to be reason why it has been sold that cheap, e.g. hurry to close the company. I will also talk to a mechanic as you suggested - Thanks!

-

1 hour ago, Sydebolle said:

The VAT amount mentioned by you would represent a today's car value of THB 715,000.

When you bought it, your company used the VAT paid to the dealership as input VAT; i.e. this amount could be used for your company's VAT liabilities against company sales by the company. Obviously you cannot have your cake and eat it; if the car was properly booked as assets into your company with VAT credit, then you have to live with the VAT debit upon selling the asset.

Given the fact, that your company owned the car two years already, the company could benefit of a write-off 40% (20%/annum) of the car's initial value. Back in the day, the highest purchase price of car accepted by the Revenue Department was THB 1,000,000. Given that, your company's car would have a present-day value of THB 600,000 upon which of 0HB 42,000 VAT would apply.

Your company could also sell the car below the book or market value - but it would require a paper trail prove it.

Say, you sell the car to a third party and co-incidentally a friend of your confidence decides to buy your company's car in his name due to a very low attractive value, then he would have to pay the company through a bank transfer. On that amount VAT of 7% applies and the car changing ownership from the company to your friend.

At a later stage your friend might want to sell this car to you - at the same price he bought it or slightly more. You would have to pay your friend with a bank transfer for the paper trail and once done, the car gets transferred from him to you - again against a nominal transfer fee. No VAT would apply on this fictitious transaction anymore as both your friend and yourself have no VAT registration.

If you'r e lucky, this scenario could happen and Bob's your uncle!Many thanks for your vast advice, really appreciated! I see that in the assets file, the depreciation has been set at 20% for everything (furniture, car, equipment, etc). If I can change that to 40% for my cars that would be great. Do you know whether it's 40% or was this an assumption?

Selling it below market value to a friend: Do you think I could do that by like 50% of what is the market value?

-

Hello,

I need to close my company that I don't use anymore but now I should pay VAT 50,000 to transfer my old 2 cars to my ownership. Does anyone know a solution to avoid or reduce the tax significantly? From my research:

- I could sell it at a discount but if the discount is huge, it requires justification. I could maybe argue that we had to sell in a hurry?

- Transfer as Dividend or Shareholder Benefit. But would I need to pay any taxes on that?

- Donate as a gift. What are the rules in Thailand?

I would be super grateful for any advice.

-

-

- Popular Post

- Popular Post

There are many Russians working in the same building as I do so I guess they have work permit like everyone else. Anyway, why don't you just ask them instead asking here?

-

3

3

-

6 minutes ago, stoner said:

do you light the tail too ?

Only if you need the afterburner

-

1

1

-

-

- Popular Post

- Popular Post

-

16 hours ago, roietfortress said:

i think there's many levels of narcotic. aspirin is a narcotic in Thailand. they just want to regulate/control the weed. they will never schedule 5 it again. impossible. i think the free for all will end by the end of the year. i said that last year tho lol

as far as using those grower lists, over a million people registered. do you think any govt official in Thailand wants to knock on a million doors for something they don't even care about? the police are busy fighting meth.

i think everybody agrees there needs to be some regulation and control. i doubt they'll allow recreation, so make sure you are friends with a doctor. my glaucomas are killing me ????

#

I think it may take 2 years until any change will take place. The opposition is large on both sides.

-

1

1

-

-

- Popular Post

- Popular Post

2 hours ago, BritManToo said:Don't understand a lot of posts about cannabis.

You grind it and you roll it, nothing falls out.

Although I always use cones, so more like pinching and ramming.

The flowers won't fit in the cones, you have to break the flower up first.

Another thing I don't understand.

All the people that take a hit and are immediately effected ........ wtf?

I don't feel anything until about 10 mins after smoking, reaching full effect 30-60 minutes after smoking.

I can actually overdose before feeling anything, so normally I smoke 0.5gm then stop and wait.

How do you guys get instant highs?

For me, the art of making a joint is rolling backwards, i.e. the glue part is on the outside and all the redundant paper is peeled off. Cones a good alternative but I am faster by rolling and not getting nervous with the filling up.

1 hour ago, SamuiGrower said:Is there any science behind grinding weed? Funny you should ask?

Yes.

All the yummy organoleptic properties (taste, aroma, smells and flavors) are in the trichomes. The rest, vegetal matter, carbs, lignin and cellulose.

Weed is more than THC. Flavones, terpenes, polyphenols and other cannabinoids will be delivered more uniformly in every hit with grinding and deliver a fuller ‘experience’.

Uniform combustion and delivery assures a faster onset through the blood-brain barrier.

To grind or not to grind? That is the question. The answer: grind. (IMHO, of course! ????)

I never used a grinder for 30 years and I even had one for a long time but never used until a friend invited for a smoke insisted on it. Since then, always grinding. It burns much better and yes I think it has a stronger effect.

-

2

2

-

1

1

-

21 hours ago, MarcelV said:

Phrae, Phayao, Bueng Kan, Nakhon Phanom, Chanthaburi, Samut Songkhram, Prachuap Khiri Khan, Ranong, Phatthalung, Narathiwat, Betong, to name a few all over the country.

Lampang with its ponies and teak wood houses

-

2

2

-

-

- Popular Post

- Popular Post

1 hour ago, Jingthing said:Also I wonder if the move forward party position to recriminalize is more about opposition to the politicians that made it legal rather than rational policy.

That's my thought as well, I was told by my Thai friends that MFP is not really anti - weed. I also speculate (or kind of hoping) that it may become same as prostitution, not legal but tolerated, e.g. if get caught it may be moderate fine.

-

1

1

-

2

2

-

6 hours ago, Andycoops said:

In my experience mental health in Thailand is virtually unheard of.

All you get us a brief consultation and a bucket of pills to take.

There are no therapy sessions to attend and it's left to the family to try and help as best they can.

At least this is my experience here in Isaan with a close family member.

It's not that its unheard, its in my opinion more or less a mass processing. There are maybe 20 to 50 patients assigned to one doctor (mostly young) who has a time window of maybe 15 minutes for the "counseling" hence no talk therapy either. Totally agree more or less you just get pills and the rest is left to the family without having the knowledge and capacity. This is indeed a huge lack in Thailand and patients / families could be helped much better if more time and counseling could be given.

-

1

1

-

-

15 minutes ago, sotonfarang said:

Where is that please?

It's in BKK across the river (Thonburi area?) but I just read you are in Pattaya. However my wife was under treatment there for schizophrenia and as a Thai she preferred it over the private hospitals such as Bangkok Hospital. Can find on google maps

-

Bangkok Hospital but expensive. Thai mental hospital no 1 in my opinion is the Somdet Chao Phraya Hospital

-

1

1

-

-

On 5/1/2023 at 5:32 AM, rwill said:

Humans have this resistence to change thing.

We call it heritage

-

1

1

-

-

12 hours ago, stoner said:

ill throw in some free edibles. they are among the best around.

in fact anyone who thinks they are champ with edibles....pm me.

free cookie to anyone who thinks they tough enough.

I'm tough enough!

-

7 hours ago, 2baht said:

What was the subject again??? What were we talking about???

I had to scroll up again too, seems complicated....

-

This article sums up about everything what's wrong with Thai society - except the legalization of cannabis.

-

1

1

-

1

1

-

-

A Thai once told me a joke: "How to split an Atom? Just hand it carefully to a Thai and ask him not to break it."

-

1

1

-

-

14 hours ago, bkk6060 said:

This seems to be a noise pollution country. The cars and motorcycles are out of control. The worst is any kind of music or verbal advertising on speakers cannot stand how the volume is always turned up. For what?

Asians are noise addicted

-

- Popular Post

- Popular Post

3 hours ago, TheAppletons said:Beer contains alcohol and hops, both of which are preservative in nature.

Doubtful that additional preservatives would be added since that would increase cost and likely impact the flavor.

(Before someone chimes in with "but you don't know that, do you?", the answer is no I don't personally know that. No one outside of the brewing industry is going to be able to give the definitive answer but for the reasons listed above I think it's unlikely.)

This is true, a local supplier once confirmed that to me that beer has it's own preservatives and nothing else is added, its a myth. But he confirmed what makes beer many times taste bad (not getting bad) is because of these distributors that left the beer in the full sun for days.

-

2

2

-

2

2

-

13 minutes ago, mick220675 said:

You are a good person for caring so much.

I don't know where your ex wife lives. We are in South buriram our nearest specialist mental health ward is korat. They can help with assessment and prescribing drugs.

Two people in our village have been sent to korat, one thai and one german. The German man stayed two weeks and then came back to the village. He had a prescription he could pick up from our local hospital. He lived ok until he went to pattaya for a holiday died in the police cells after not taking his medication and drinking heavily.

The Thai man was brought back to the village and after repeatedly attacking people the police insisted he was put on a chain in his garden. The poor man lived for years like it.

Thank you! Really sad what happened to these 2 persons. We were living 15Y in Bangkok and she now lives with the family up in Lampang. Luckily they have a mental illness hospital there where she can be taken care if the psychosis is too strong (not eating and sleeping for several days etc), not as good as the BKK facilities though. She never drunk alcohol or took drugs but happened that she forgot medications if a new wave of psychosis approached. This has now improved as her family member observe very carefully that she don't misses the meds.

-

2

2

-

Transfer car from my company to me - Is there a way to avoid or reduce VAT?

in Jobs, Economy, Banking, Business, Investments

Posted

Having a story like the water damage (that I really liked) requires evidence such as a photograph, the tax officer wouldn't accept just a note in the sales contract. Given this I reluctantly accepted my fate and transferred the cars yesterday.

Soon after the transfer, I received an indication that the tax office or the TRD now thinks I should pay 50,000 per car and not for both as my external accountant advise me previously when I started this post. I don't know the details yet, but it seems I just made one of my worst mistakes here and I am deep trouble....I think I need professional help and happy to accept offers in my DM. Note: I accept to pay reasonable tax but the absolute minimum that is possible with any legal trick.