spaceman79

-

Posts

16 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by spaceman79

-

-

2% devaluation of THB against the USD means in dollar terms, someone who is availing THB savings, has a zero rate of return. This can also cause liquidiation of bank deposits, accelerate external flight of capital. a cheaper THB is supposed to spur exports, however so far the data suggest contraction in manufacturing too. Intra regional trade is down, China is down, Thailand's biggest trading partner. Highest casualty from Erawan blast was from China and Hongkong and Chinese are the biggest tourist group by nationality and purchase power in Thailand. Sometimes it helps to look under the rug. Ensures better sleep in the long run!! Cheers!!

-

Rubbish created a big candle gap down in the SET of -3% the day after the bombing

... SET looks vulnerable to 1230 and even downwards after that. Charts follow patterns and chart readers dont look for reasons as to what may prompt events to go there. But it so happens Thai economy is showing classic bearishness. THB is down, Thai SET is down, Thai household debt is up. BOT rate cuts take place when previous stimuli fail to vigorate growth. I respect your views, but i hope just being longer here you dont ostracise newer voices. What i am saying is holding true. One month on since my post THB is still more than 2% down against the USD.

... SET looks vulnerable to 1230 and even downwards after that. Charts follow patterns and chart readers dont look for reasons as to what may prompt events to go there. But it so happens Thai economy is showing classic bearishness. THB is down, Thai SET is down, Thai household debt is up. BOT rate cuts take place when previous stimuli fail to vigorate growth. I respect your views, but i hope just being longer here you dont ostracise newer voices. What i am saying is holding true. One month on since my post THB is still more than 2% down against the USD.- Yday THB bid/ask was at 35.32/35.37 EOD. Today its 35.47. The bombing has shaken the THB. Yday FIIs were net buyers but today SET fell over 2% touching near 1370 on large volumes. Airport Authority of Thailand is one of the biggest losers. CNY has also been gaining against the THB which should be comforting for Thailand. However this fresh lows by SET could result in further setting THB down. Seems the breaking of 36 will be a self fulfilling prophecy.

"The bombing has shaken the THB",

Rubbish, the bombing had zero effect on THB value,

-

Next month the thai baht may be expected to cross 36 and onto 41 against the usd?

-

Perhaps you should be reading from the beginning of the thread. Btw when was the last rate cut by BOT?

-

- Yday THB bid/ask was at 35.32/35.37 EOD. Today its 35.47. The bombing has shaken the THB. Yday FIIs were net buyers but today SET fell over 2% touching near 1370 on large volumes. Airport Authority of Thailand is one of the biggest losers. CNY has also been gaining against the THB which should be comforting for Thailand. However this fresh lows by SET could result in further setting THB down. Seems the breaking of 36 will be a self fulfilling prophecy.

"The bombing has shaken the THB...?" Where do you guys come up with these ridiculous explanations? The THB has been weakening against the USD for months now, which probably has more to do with the USD strengthening against pretty much all currencies. And Thailand has just cut interest rates. I hope you're not investing other peoples' money.

-

35.50/35.53 bid ask USD THB.

-

- Yday THB bid/ask was at 35.32/35.37 EOD. Today its 35.47. The bombing has shaken the THB. Yday FIIs were net buyers but today SET fell over 2% touching near 1370 on large volumes. Airport Authority of Thailand is one of the biggest losers. CNY has also been gaining against the THB which should be comforting for Thailand. However this fresh lows by SET could result in further setting THB down. Seems the breaking of 36 will be a self fulfilling prophecy.

-

China's currency devaluation: Thailand's economic nightmare?

Pornpimol KanchanalakSpecial to The Nation August 13, 2015 1:00 am

Yesterday, the People's Bank of China cut the value of its currency for the second day in a row. Analysts now estimate that the yuan has depreciated more than 3 per cent against the US dollar, having already dropped 1.8 per cent when China "threw a curveball" the day before. Most media called it a surprise move, but observant economists had seen it coming for quite some time.Markets around the world are reacting with increasing anxiety. Yesterday, the Dow Jones Index dropped 212 points, NYEX was down 4 per cent, the S&P 500 tumbled 20 points, European stocks fell 1.6 per cent, while the price of oil and copper dropped 4 and 3 per cent respectivelyBasically, what China is doing is exporting deflation. That means shrinking demand and diminishing purchasing power across the globe. In recent years, China's GDP has grown at an anaemic rate of less than 7 per cent after years of double-digit boom. Beijing has responded with all the traditional antidotes against deflation, including monetary and fiscal stimulus policies and interest rate cuts. When those measures failed to stop the slump, the devaluation of its currency was the unavoidable remedy of last resort.

Investors are now concerned that China's economy is even weaker than anyone could have guessed. As such China may start pulling back on purchases of goods and services from other countries. In the US, whose currency is strengthening in reverse proportion to the weakening yuan, manufacturers fear for their already weakening export prospects, and the stronger dollar will make the competition even tougher.

Bank of America's preliminary analysis pointed out another significant ramification of the yuan depreciation besides the worldwide deflationary pressure - a foreign exchange currency war. Traders are betting heavily that the yuan will continue to fall, and the risk premium is being built into the yuan spot market. Central banks in several countries might follow China's lead and devalue their currency too. Already, anger is being expressed in Washington, where lawmakers are accusing China of playing currency-manipulation tricks on them.

With China's growing stature as a world economic powerhouse, the yuan is now part of the global economy's fabric. In the global village in which we all live, when China sneezes, the rest of the world catches a cold. For a small developing economy like Thailand, the cold could turn into pneumonia and cause havoc.

Two years after China devalued its currency in 1994-5, Thailand suffered its nightmarish Tom Yum Kung financial crisis. In the last days of the 1997 crisis, our exports experienced zero growth despite signs to the contrary which were the result of VAT fraud. Our current account deficit at that time brought down the exchange rate regime that had been rendered unsustainable.

Are we about to suffer a repeat of the economic meltdown in 1997? Not quite, but the outlook is gloomy.

Our exports are in the red, and the colour is turning crimson. With the world experiencing deflation that China is exporting, we will see further shrinkage of demand and purchasing power from the markets for Thai products. The recovering EU markets will turn to our Asean neighbour, Vietnam, which has just concluded a free trade agreement with the Europeans. We have no new markets and no niche products to give our exports a boost.

Tourism, our No 1 foreign exchange earner, will likely suffer due to shrinking purchasing power and disposable income among the Chinese, who constitute the largest portion of our visitors.

The baht will likely fall more steeply than expected, for several reasons.

The Bank of Thailand (BOT), in its attempt to keep the baht low without lowering the interest rate, has erroneously embarked on further financial liberalisation. Today, a Thai can send out US$5 million per day as opposed to $500,000. Well-to-do Thais are now allowed to remit $50 million per year to purchase property overseas, as opposed to $5 million. With the uncertainties around the baht's future value amid the yuan's devaluation, money will flow more freely out of Thailand, bringing added pressure to devalue the Thai currency even further.

The BOT has also allowed a higher quota for short-selling the baht - up from Bt300 million to Bt600 million. This will add to the volatility and helps neither the baht nor our financial health, especially at a time when we need more stability.

Thai exports will become increasingly less competitive in the world markets under our current exchange rate regime. Further contraction in export revenues will hit our balance sheet and hence our foreign exchange rate.

And for a double (or triple) jeopardy, Thailand will find that ignoring the Trans-Pacific Partnership (TPP) trade deal negotiations will come back to haunt us. Mexico has called for a TPP "rule of origins" that would prohibit TPP members from sourcing products from non-TPP countries. Japan, a major player in the TPP, buys lots of automobile parts from Thailand. If the TPP's rule of origins kicks in, Japan will have to look elsewhere for automobile parts suppliers and shift its investments in this sector away from Thailand.

Analysts at HSBC estimate that there is about 1 trillion yuan waiting to be sent overseas by wealthy Chinese and Chinese corporations, and it's taking place every single day. The US will be an important destination for the drain. That enormous outflow of capital will add to the deflationary trend of the Chinese currency, and hence of the baht.

While our high-net-worth individuals and large corporations will always be able to weather the financial maelstrom, it is our farmers, small and medium-sized enterprises and middle class that will be hit in the pocket. They will find their purchasing power dissipating by the day. In direct proportion, the majority of the population will become more vulnerable and disenchanted.

And the worst part of it all? There is nothing we can do to avoid the suffering. The eleventh hour has passed and we have missed the rescue trains.

-

heres something interest... last night i bought something from a thai website using my home country credit card. today i got an update of the transaction via email from my home country bank. the exchange rate charged on my credit card in usd is exactly 36 thb!! i thought using credit cards was always more expensive. but i had a different experience.

interestingly right before my current trip to thailand i did a little tri currency arbitrage when buying foreign currency. i bought the saudi riyal( i am not from saudi arabia) physically and encashed to thb the following day. this was on 9th july and day after 10 th july usd. now the usd thb conversion rate is the same rate that i got on that day. off course had i held onto my saudi riyals longer, i would have got more purchase power in todays terms as in thb terms they would be worth more and seems like things are not yet going up in price in thb. on 10th july 15 super rich gave 8.95 baht for every saudi riyal. today its 9.2 thb. means a further devaluation of 2.5% of thb against saudiriyal since 10th july.

If someone is targeting a real estate purchase in thailand ( a condo in cash) in the near future, should one wait? thats also something i am interested to know. my normal sense tells me that with thai interest rates being low, condos will get cheaper once the interest rate is raised vis a vis mortgage lending rates. or the other way if the fed hikes interest rates sometime from now within dec 15, i think further outflow from thb is likely. so perhaps i am better off waiting.

i think 35 is good as 36.. my question is if and when it does break 36 what follows next? how long ago were you expecting 36? may i ask what financial steps you took to take advantage/protect your self from the thb devaluation?

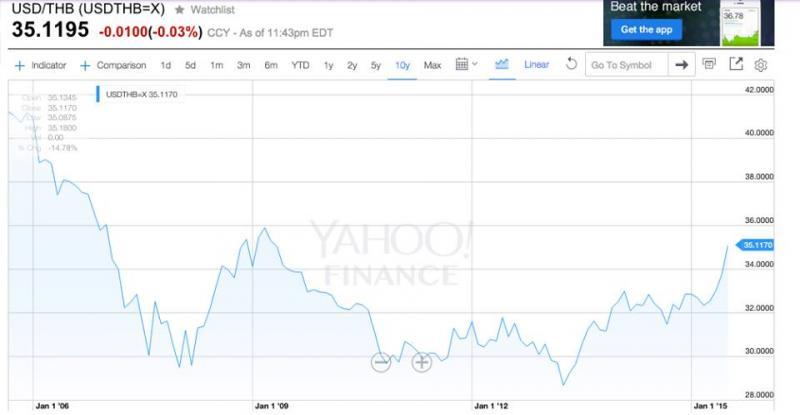

I don't pretend to know exactly where it will end up, but last time the US economy was firing all cylinders from 2002 - 2005 the dollar was stable around 41. From a macro perspective this is where things are headed.

Did some more digging and actually the only time the dollar has been below 35 is with the Fed funds rate at 0. So this can hardly be considered a normal equilibrium even though it's been like that for a while now.

That's where I came up with my conservative 36 price target a while back.

What happens after 36? Well

It's gone to 35 faster than I expected so it could overshoot on the upside before returning to the "stable at 35" level.

I just don't feel comfortable that the dollar is anywhere near stable with interest rates at zero.

I'm not in the thb so no steps needed other than not transferring large sums of cash.

If you're already in thb just spend the money in Thailand where you can still get the same amount of stuff for your baht.

-

i think 35 is good as 36.. my question is if and when it does break 36 what follows next? how long ago were you expecting 36? may i ask what financial steps you took to take advantage/protect your self from the thb devaluation?

I don't pretend to know exactly where it will end up, but last time the US economy was firing all cylinders from 2002 - 2005 the dollar was stable around 41. From a macro perspective this is where things are headed.

Did some more digging and actually the only time the dollar has been below 35 is with the Fed funds rate at 0. So this can hardly be considered a normal equilibrium even though it's been like that for a while now.

That's where I came up with my conservative 36 price target a while back.

-

so if you hold for promotion period and dont continue you think the special rate wont apply for the period of the term deposit?

check this page... https://www.sc.com/th/en/promotion/save/fcd/ in fact i visited their sathorn branch and spoke to the manager about it.. the minimum deposit is 10000 usd or similar in value for the currencies offered.

After TD account reach its maturity and roll over, normal interest per bank announce will apply.

-

check this page... https://www.sc.com/th/en/promotion/save/fcd/ in fact i visited their sathorn branch and spoke to the manager about it.. the minimum deposit is 10000 usd or similar in value for the currencies offered.

attached is a foreign currency deposit rate chart offered in thailand by a foreign bank. pls note that for the nzd time deposits have a higher rate of return then the same deposit rates offered for thai baht. do this rates say anything abt banks' expectations about the fx movements?

this "chart" and the interest rates mentioned must be ages old. please let us know what "foreign bank".

this is very current. its from the standard chartered bank website. you can check it yourself.

i checked and i am disappointed:

https://www.sc.com/th/interest-fees/_documents/e_int_20150703_2.1.pdf

-

attached is a foreign currency deposit rate chart offered in thailand by a foreign bank. pls note that for the nzd time deposits have a higher rate of return then the same deposit rates offered for thai baht. do this rates say anything abt banks' expectations about the fx movements?

this "chart" and the interest rates mentioned must be ages old. please let us know what "foreign bank".

this is very current. its from the standard chartered bank website. you can check it yourself.

-

-

I was looking at the long term graph of the THB against USD. It is now dangerously near the last two lows against USD sometime btw 2008-2009. That was when the sub prime crisis was in full swing. Now interesting thing is this time no such crisis looms in the horizon but the THB like many other currencies is losing value. The MYR is at its 17 year low against the USD. So if USD THB breaches 35.9 then its headed for USD THB at 41 the 10 year low of THB against USD. Interestingly Thailand lowered its interest rate in the last 12 months and now in my view in USD terms the real deposit rate is negative, in THB terms its just about 2.5-2.75% for 1 year deposits, as the actual inflation is -1.05% as of June, 2015. However the rapidly depreciating THB against the USD is surely to take inflation higher in the coming months as the country is energy deficient and imports most of its fuel. Meanwhile i saw on tv the Malaysian finance minister assuring that the Malaysian economy is on a much stronger footing since 1997 as their foreign reserve is 3 times their foreign reserve in 1997. Sounds assuring but then why the MYR is at its 17 year low against USD?? What is the answer?? For now it seems to me THB will get some support at its current levels but 35.9 will be breached even though Thailand is a net creditor nation, its foreign debt is USD 50 billion less then foreign assets held by Thailand abroad. I think i can see now why dirty floats are not so bad. I think part of the THB losing value is speculative in nature and has not bearing on the real fundamentals of the THB. Why do you think THB is losing and where will it stabilize in the near/mid/long term?

Stock Market CRASH Thread....Are we all doomed?

in Jobs, Economy, Banking, Business, Investments

Posted

anyone here invested in SET?

I follow the markets both technically and fundamentally.

Technically SET in monthly looks to me quite weak. I am expecting a double bottom at 1230 in the coming days and lower. In 2008 SET halved and i have not even put data for 1997. While financial boom and bust cycles dont follow the same pattern always I would like to hear what others think abt the near term outlook for SET in the next 3-6 months.