-

Government coming for "...foreign nationals using Thai nominees to acquire land unlawfully."

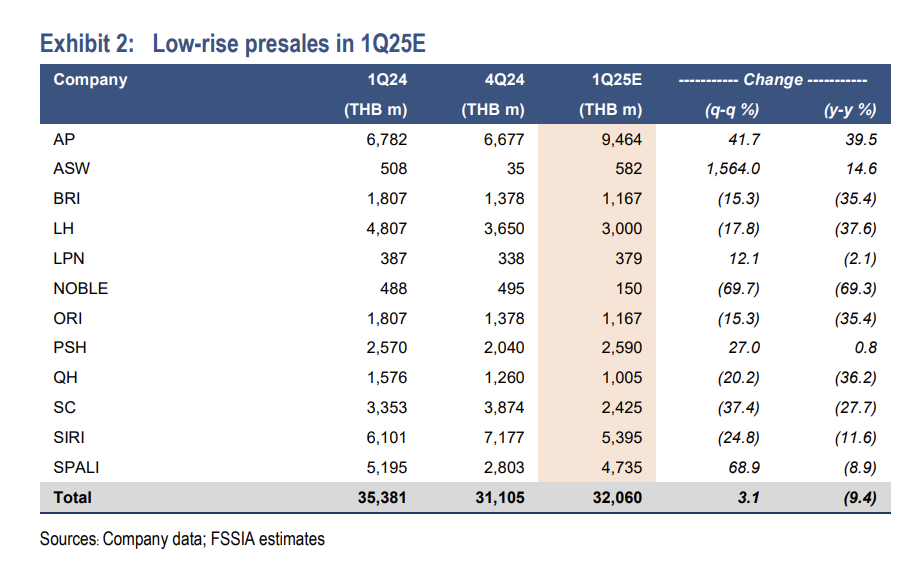

Well, at least I support my confidence in actual, objective, facts. If your of opposite view, which your condescending tone suggest, I'd appreciate if you could return the favor. On the topic of facts, here's a Q1 (First Quarter) summary up low-rise sales. To your benefit, I completely left out Condos which are in very much worse shape. Uptake is down double digits across the board, and if you read what the developers are saying in their communication to investors they are saying the demand is low from domestic as well foreign investors. Coming back to my first point: if foreign capital left it will not only hit condos, but also "housing" that only Thais can own. It all sticks together. I'm out, but you can continue swinging if you like.

-

Government coming for "...foreign nationals using Thai nominees to acquire land unlawfully."

I'm fairly confident the property market will take a hit if foreigners completely left. "We" represent 1/3 of every condo acquired. There are no similar stats available for land, as "we" can't own it. But, as you very well know, the amount of wife-owned properties, legit-leased properties and the company-owned properties are in the hundred thousands. Not really sure why we're debating if foreigners can sway the market or not - it's considered a fact by the developers and analysts themselves.

-

Government coming for "...foreign nationals using Thai nominees to acquire land unlawfully."

Well, you said that there were hardly any foreign buyers and I just pointed out the actual fact that foreigners represent 30% of the market, and perhaps closer to 40% or above accounting for all the shady nominee companies and the wife being on the contract.

-

Government coming for "...foreign nationals using Thai nominees to acquire land unlawfully."

In the first quarter of 2025 of all condos transacted in Thailand, 29.3% were foreign buyers. Approximately one third of demand came from foreigners. What other market, globally, does foreigners represent such a big part of the overall demand? Mind you, the numbers are even higher when we account for the nominee company transactions and the "bought via the wife"-transactions. I don't subscribe to the idea that if ~30% of demand would disappear, market prices would remain flat. Furthermore, almost all the major developers are listed and they all were unable to meet their sales target in Q1 2025 - not to mention 2024.

-

Government coming for "...foreign nationals using Thai nominees to acquire land unlawfully."

The Ministry of Commerce and the Ministry of Interior have signed a Memorandum of Understanding (MoU) to tackle the long-standing issue of foreign nationals using Thai nominees to acquire land unlawfully. https://www.bangkokpost.com/thailand/general/3033167/ministries-tackle-nominees

-

Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

Good news - let's hope it get passed! On a different note, doesn't this mean that some filings that were done recently - for income year 2024 - should be corrected/edited? I.e. if someone transferred money in 2024 - that was earned in 2024, and paid income tax on that. Or is this proposal only for 2025 and onwards? (point 2 in your table).

-

Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

Is this proposal, if one could call it that just yet, supposed to be enacted retroactively, i.e. for 2024, or is it for 2025 and onwards only?

-

Thai Restaurant Industry Faces Crisis as Purchases Plummet by 40%

What are these Chinese restaurants mentioned in the article?

-

Tax Filing Experience: Jomtien [March-2025]

I had the prepared withholding tax document from my Thai bank and the withholding tax from my Thai broker with me. And a copy of my bankbook, TM30, visa and passport. I don't know how to make this much clearer: they wouldn't even entertain giving me or anyone else a TIN without showing my banking statements first. It was literally posted on the wall at several places. The post said: "Foreigner that want a TIN need to supply the following documents: Banking Statements 2024, TM30, Visa, Passport"

-

Tax Filing Experience: Jomtien [March-2025]

First, I want to send my appreciation for any thoughtful feedback provided. Thanks! But, perhaps I was a bit unclear in my original post. When I visited the tax branch I initiated the conversation, and asked for repeatedly, that I wanted to acquire a TIN and file my own taxes online. The very first words from the tax lady was: - "have statements? make transfers?" The entire tax office was filled with papers stating "you foreigner? want TIN? need bank statements". It was very, very confrontative from the first contact. I'm simply not confident to show this lady a transfer of 10m thb and then, hopefully, receive a TIN. They wanted nothing else but to see my banking statements, northing else was of their interests. So, appreciate your feedback - but I'm stuck at the "acquire a TIN" row as of now. With that said, I stumbled upon the Expat Tax Thailand" website and they can acquire a TIN on my behalf for a fee. If I acquire a TIN, would I be able to file online immediately - or do that new TIN need to be activated or any way greenlit by the local tax office in advance?

-

Tax Filing Experience: Jomtien [March-2025]

@Yumthai @NoDisplayName@petermik @Ben Zioner All very helpful. Thanks! Somewhat disconcerting situation altogether. To the best of my understanding, neither my transfers nor my local dividends (that has been taxed, and I seek no refunds/deductions), are assessable. What has been somewhat unclear to me, and what I essentially tried to settle today, is if it is an obligation to file altogether if no taxes are owned. The coming two weeks I'll try to get a better understanding if I need to file at all. I appreciate that link. If we assume Sherrings is correct here, that pretty much settles it. https://sherrings.com/dividend-income-personal-income-tax-thailand.html

-

Tax Filing Experience: Jomtien [March-2025]

Hi, Tax Situation: - Became a Tax Resident according to the 180 day rule late 2023 - Transferred a 8 digit number to acquire a condo in early 2024 - Said sum existed, and had been taxed, in 'home country' bank account and brokerage account pre-2024 (2020, 2021, 2022, 2023 etc.) - The only income in 2024 is dividends from Thai companies, held in a Thai brokerage - and which withholding tax has already been deducted From my understanding, there's no assessable income here. (there seems to be contradicting info: if the transfers are sizable enough, they need to be disclosed regardless earned pre-2024?) Anyhow. Went to the Tax Office today, in Jomtien (Chonburi). I was immediately asked for my banking statements to even process my filing or getting a TIN. She kept hitting this subject, aggressively so, about my banking statements for 2024. Furthermore, she asked if I owned property that I rent out - and if I traded crypto. Hadn't mentioned any of it. Very uncomfortable setting. Essentially, my experience mirrored the most cynical and satirical approach created on this forum. As I didn't have the banking statements printed (nor wanted to show them), the meeting was over. I'm now left with two options: - Not file at all. - Produce end-of-year banking & brokerage statements from my home country and hope that would be sufficient. My hesitation is rather large right now, after the meeting today.

-

My Thai Tax Office Tax Filing Experience...

Correct, I wrote too quickly. 10% has been withheld.

-

My Thai Tax Office Tax Filing Experience...

I had a look at the filing template - link: https://www.rd.go.th/fileadmin/download/english_form/2023/220367PIT90.pdf Circumstances: - Became a Tax Resident mid-2024 - Transferred xxx-sum in 2024 that was earned pre-2024 from my home country. Can proof end-of-year balance over this sum for 2020, 2021, 2022 & 2023 if necessary - Own a local thai brokerage account and received 200k in dividends from a Thai company - of which 15% immediately was taxed as per withholding tax. I'll ask for a TIN. If asked why, I'll say I became a tax resident last year and that I had dividend income throughout the year. From my point of view, my international transfers are not assessable and thus I will not bring them up or declare them when I file. I'll file that dividend has been received and taxed already. Complete? My "issue" is that - my remittance is not assessable (in my POV) and I don't want to bring it up, and "fight" that issue. Secondly, from my reading of the filing template dividends should only be filed if I want to deduct the already paid withholding tax with an income (an income which I don't have). My rather large remittance last year was to a condo purchase, and even though I can proof it as taxed pre-2024 I can't let go of the notion that the guy at the RD that will handle my application - would tax me a silly sum just out of convenience.

-

My Thai Tax Office Tax Filing Experience...

Bless! And in regards to be able to file online, I first need to apply for a TIN at my local RD office (and have a local ID, as well?).?

aldriglikvid

Advanced Member

-

Joined

-

Last visited