tomyamg00ng

-

Posts

22 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by tomyamg00ng

-

-

I wish you good luck than...you need it.

BTW: medium to long term isn't really end March 2009, is it ?

LaoPo

Of course it isn't but I didn't say I was basing my investment decisions on the price of oil merely exceeding $50 a barrel. I genuinely believe that oil will be at well over $150 within the next couple of years and that is based on unimpaired fundamentals.

The $50 call is based on nothing more than the expectation that speculators are the ones driving the price down and that they'll be looking for somewhere to put all those repatriated dollars once the bond bubble pops.

I m with you on this. I do quite a bit of research into this, and oil is going to go much higher in the future. Over the last 10 years, oil has made two 50% corrections and one 40% correction, but the quarterly average is up. Large fluctuations are there anyway. People who dispel peak oil, dont even seem to know what it is.

Do you know Matt Simmons by the way...? HAs anyone read any recent EIA research? Has anyone actually seen the depletion rates in the top 100 biggest oil fields in the world...

Why are the Saudis pumping water into the wells to keep up the flow rate...alternative energy is not an alternative for the liquid fuel market. In the next 10-15 years, oil will spike up massively...in fiat currency terms...in gold terms it will be quite stable.

-

Dissolution, I'm so sorry for your loss. I've contacted my friend so she will not have to bring it to the news, though she was willing to help and I appreciate her for that - she offers her most sincere condolences to you and your family and your friends' families. I wish I could have been of more help for you.

Try not to beat yourself up over what happened or what you could have done, your friends will smile at you from above if they know you can move on, as they will always be in your thoughts and watching over you.

RIP to all others who died in this terrible tragedy, and I hope for speedy recoveries for the injured.

Many are placing blame on this party or that party, but on the flipside there were some real heros that night, and they should be commended for trying their best to save human life. I do not doubt for a second that the rescue workers on the scene would have done anything to save more lives if they could.

Again Dissolution, I'm so sorry for your loss. I hope you can someday remember the happy memories you've had with those who died, and cherish them as you live on. You do not have to go through this alone...

I want to add a similar sentiment as this and it i good to see people offering genuine helpo...It is very humbling and great that there are many good humans about, that are always willing to help someone when it is needed. I m not in Thailand at this time, but I wanted to do something, anything...but it is frustrating following these threads and feeling helpless...

I m very sorry Dissolution, each evening I ve come home, I ve logged straight on to find out if you had any news...and I offer you my best wishes...and I hope that you can find some strength from the people around you, and the genuine words of condolences and wishes, offered on here by strangers...

I feel really emotional...and I bet most people reading this have been tearful, and have felt compassion for you even if they dont know you...but I m sure everyone can relate, even if the pain will only be a microcosm of what you feel...

Take care friend...

-

Update:

The girl has been positively identified through DNA testing as one of the previously unidentified bodies. Please, if anyone has seen or has info about any of the other missing 3 guys, please let me know.

Thanks, and much appreciated.

Dissolution,

I have been following this thread since yesterday morning. I didnt sleep well lastnight. I know people that go but they posted on facebook, they were not there., which was good...but there is no getting away that good news for some will be tragic news for another. I really feel for your situation. I have been thinking all day about this. I wish you all the best man. I am a stranger to you, and you to me, and most others on here also...however I m sure we can only imagine what you are going through as we all have families and friends, and in that way, we can imagine how it is for everyone if we experience the same with our friends and family...and only imagine, so I dont really knwo how it is...but the very act of imagining this and sensing what people are going through is very saddening. Dont know what to say. I just hope you can find some strength to get through the next few days, and all will be alright. Our hearts go out to you man,rest easy friend...

Chris.

-

Because of the budget deficit, because of the credit binge... USA need foreign money. And for that matter, it will be more and more difficult to fool foreigners with a falling dollar...

some foreigners might not be fooled but some foreign countries with emphasis and a high dependancy on exports to the U.S. have no other choice than to finance a good part of the U.S. deficit.

as flaming is forbidden by forum rules i refrain to comment on "USD will be worth next to zero" by tomyamg00ng

Thats ok

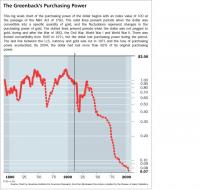

Its almost there now anyway. The black line I marked on the chart is when the FED was created in 1913...Most people don't realise how near the USD is to a cliff. It is no coincidence that since the FED cut interest rates in half,from 5% in August 2007 to 2% in March 2008 that oil has doubled in price. The "King Dollar" is undergoing serious debasement.

Its almost there now anyway. The black line I marked on the chart is when the FED was created in 1913...Most people don't realise how near the USD is to a cliff. It is no coincidence that since the FED cut interest rates in half,from 5% in August 2007 to 2% in March 2008 that oil has doubled in price. The "King Dollar" is undergoing serious debasement.All these bailouts is causing rampant inflation. The FED will monetize the debt, which will cause the USD to collapse...We are at stage 2/3 of this inflation...

The ASean countries and China do have a choice. They have already dropped the peg and the RMB will increase 5 fold against the USD. Domestic demand is growing all the time in China. Once the YUan begins to appreciate the per capita income will increase and domestic demand will increase also, meaning a increasing demand for commodities, like oil...

-

For any of you guys who have money in dollars, get it out as soon as possible. The FED are going down the inflation route. Your USD will be worth next to zero by the time they have finished. I have read most of Bernankes papers. The man is crazy. He has spent his whole intellectual career learning about how to prevent deflation...by using inflationary practises...ie, printing money The consequences of what he has planned are to be honest frightening...I ll leave you with one quote from that a paper and a link to that paper that Bernanke wrote in 2002.

The FED have been the cause of these asset bubbles. The price of commodities are going through the roof...too much money chasing too few items.

Beranke said...

As I have mentioned, some observers have concluded that when the central bank's policy rate falls to zero--its practical minimum--monetary policy loses its ability to further stimulate aggregate demand and the economy. At a broad conceptual level, and in my view in practice as well, this conclusion is clearly mistaken. Indeed, under a fiat (that is, paper) money system, a government (in practice, the central bank in cooperation with other agencies) should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero.

The conclusion that deflation is always reversible under a fiat money system follows from basic economic reasoning. A little parable may prove useful: Today an ounce of gold sells for $300, more or less. Now suppose that a modern alchemist solves his subject's oldest problem by finding a way to produce unlimited amounts of new gold at essentially no cost. Moreover, his invention is widely publicized and scientifically verified, and he announces his intention to begin massive production of gold within days. What would happen to the price of gold? Presumably, the potentially unlimited supply of cheap gold would cause the market price of gold to plummet. Indeed, if the market for gold is to any degree efficient, the price of gold would collapse immediately after the announcement of the invention, before the alchemist had produced and marketed a single ounce of yellow metal.

What has this got to do with monetary policy? Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

-

I don't really see a problem with the laws. The youth should not drink, so they made a law that will directly affect this. Its not like Thailand is the only place that does this. There are a lot more Draconian laws in the US concerning alcohol. For one example, Texas is full of 'dry' counties. Dallas is almost completely 'dry' except for I believe district 1 (maybe wrong on the district). In Indiana alcohol sales in stores are prohibited on Sundays.

I don't think that these new Thai laws are that severe. If enforced, they may help.

What about Deep Ellum, Greenville, the West End, great places to drink in Dallas!

u can drink. a 'dry' county means u can't purchase at a store. it may be changed now, but when i lived there it was a 'dry' city. there are still plenty of bars.

And there are still more than plenty of bars in Bangkok despite whatever law they bring in...

-

While I agree with alot of what you say Wintermute,its also worth remembering that Thailand is the 5th biggest food exporter and the number 1 rice exporter. A fair achievement for a country the size of France.

The other major point is that tourism is massive in Thailand. This does a tremendous amount to support the economy. I think thailand isnt too far away from having a good economy. There is great potential. If they make the regulations abit more relaxed then we can see big improvements. Whether they will in the future is another matter.

-

Saw this all in May '97. That time the BOT were holding the floodgates in a desparate attemt to hold the baht from falling .

The exact same situation prevails now but in reverse with the BOT desparately holding the floodgates to prevent the baht from rising..

The 1997 intervention falied as market forces became too strong . Same will happen this time.

TIP : If you need or will be needing to buy baht , you should buy in Thailand NOW.

36 to the dollar / around 71 to the pound . Current rate outside Thailand 35 to the dollar 69 to the pound (approx)

tomyanggoong wrote : "And anyone who claims they can predict currency movements are liars."

Former Prime Minister Taksin was able to predict the devaluation of the baht and his was the only major Co not to suffer losses in the '97 crisis !!

Was he a liar ??

He didnt predict it, he went with what the market was telling him and positioned himself accordingly. Also this is an extreme example, anyone can be right in a one off. George Soros and Warren Buffett were asked how do they predict currency movements. They laughed and said if they tried to predict currency movements they would have been broke years ago. This is also the advice of many traders who have compounded 20% a year for 20 years, R Dennis. SEykota, Jones-check them out.

Alan Greenspan also said predicting currency movement is like predicting the outcome of a toin coss. Take a large enough sample size of predictions and you will find that people will be right half the time.

Anyway as I ve said before you dont need to be able to know the direction to make money as paradoxical as it seems. There is a method to make money which enables you to ask and answer this question. QUESTION: DO I CARE WHICH WAY THE MARKETS GOES?

ANSWER: NO.

-

Actually reverse will occur baht is going to tank, just a matter of time.

interesting, though what do you base this assumption on?

Well instability of govt for starters, knee jerk reactions, and no sound economic reason speculators are pooring heaps of dosh into bht.

Seems to me that this would then create optimal short selling for the major speculators.

define "sound economic reasons"

How do you know speculators are pouring heaps of dosh into baht?

How would this create optimal short selling for the major speculators?

And if you know the baht is going to tank why arent you positioned to make a gain.

Your assumption has no more than a coin toss of being right. Its a 50/50 what way it will go.

All we can say is that its in a downtrend now and has been insteep decline for that last 3 months. The last 3 weeks has seen high volatility, and a congestion around the 35 mark. No ones where it will go next...

-

LOL, no my surnames not Leeson. Leeson certainly brought a stigma to the word "short selling" However I dare say this has more to do with the media portrayal of Leeson. The media focus on the losers always. They never asked who were the winners in the Baring banks scandal. Where did that 2 billion go to...?Someone got it in this zero sum game. But the media never care to ask. A look at the CTA trading records for those few months during the barings bank scandal will show that there were a few CTA's with gains of 30% Dunn Capital Managment, JW Henry to name two. They were short and cleaned up.

Leeson was heavly over leveraged in the Nikei 225, he kept buying but when the market tanked he was screwed.

I use some techinques to profit in the fx market. I dont take risks, I risk only 3 percent of my account at one time, and I ve thoroughly backtested my system over many years of data.

The system tells me the exact entry,

how much to buy

where to exit

how much to risk.

risk/reward ratio.

While I ve no way of knowing the direction of the baht, and I dont know if a trade will be successful when I put it on, i know that in the long run the probabilties are tipped in my favour. Wins and losses are randomly distributed.

And anyone who claims they can predict currency movements are liars.

-

This is about a 6 month daily chart of the USD THB. For those of you worried about the strength of the baht, you can protect yourself.

Howevr you will have to choose a level of leverage which suits your spending profile.

Let me explain. If you look at the chart here (attachment). If you had choosen to sell baht at 36 and it then went down to 35. This represents 100 points. Thats means if you had sold at 36 at 1 dollar per point movement you would have made 100 dollars.

At 5 dollar per point movement you would have made 500 dollar. Now depending on how much usd you transfer into baht then you have to work out what your average spending is per month and how much in USD terms are you losing every month if the baht goes from say 37 to 36. This is only 100 baht in every 100USD

Lets say you spend 2000USD per month then you are losing 2000 baht per month. Now the drop which has been quick from 40 baht to 35 means that spending 2000 USD a month means you are now losing 10,000 baht per month. A fair chunk over a year.

If you had sold the USD/THB at 40 with a gearing of 1 dollar per point movement then you would have made £500 dollars which would have cancelled it out some way. If you had used 5 dollar per point then you would have made 2500 dollar.

Of course the trade could have went up and the dollar could have moved up from 36 where you sold,say, and went to 38 you would be -200 USD, but because your getting a better rate in your spending this offsets the loss.

Currency movements can be nasty but their are ways of protecting yourself, with some risk involved. But if you manage it right, and use small leverage then it can be ideal. You can actually make money in it as well.

I helped a friend of mine a few weeks ago where he was transferring money back and forward, a fairly large sum, and he made nearly 3000USD in about a week.

PS I may have got some of the sums wrong but Im just highligting the theory.

There are other factors to consider in this regarding time, for instance the baht might not change too much now for months meaning your short tarde will stop off setting because you continue to spend each month. The secret is to get in on a trend.

-

Market intervention works in the very short term, but it doesnt in the long term. The market forces are stronger than one government. It takes years for the underlying fundamentals to accumulate and the current baht price is the result of these fundamentals. Intervention at the last hour can t change the market forces.

Thailands exports went up 16.9% last year, helping to support the baht. However these exporters dont want to change this into baht, for the reason it will make the baht stronger and make their exports more expensive.

Despite this thailand ended up with a trade surplus of nealry 3 billion USD. Meaning 3 billion more usd(in baht) came into the country than left it.

Also released today is that BankThai took aloss last year of nearly 4 billion baht due to non-performing loans. Tourism will continue to support the baht, unless people start leaving en masse, which isnt that likely unless more bombs.

Its hard to know what way the baht will go. It is unpredictable. The best thing is to be positioned for either possibilty.

-

The interest rate rising period for about 18 months by the FED caused a rise in the dollar. Now since the pause and other countries raising rates it has weakened again. The carry trade is no longer as favourable, apart from against the YEN where the dollar is at 120 circa.

As for a bubble in the Thai economy. Of course there will be a crash. I m 99% sure of this. No economy is immune to this. Just the reasons that bring them about change, but the dynamics are always similar. There have been crashes for 3 centuries in nations. The tulip bulb bubble in the 17th century, railways in 18th, and nearly a crash every 10 to 15/20 years now. We have had 10 years since 1997. Another crash will come with maybe the ealry warning sides and sub plots starting to play out now. I would say within the next 5 years we are looking, but maybe in 2 years. Who knows for sure...?

But with all crashes there is alot of money to be made, and the economies will slowly recover again. History shows this. Argentina has come along way since their default, Russia, Asia since 1997, Western econmies since 2001. Footsie 100 already near its all time highs, Dow made new highs, S&P coming along nicely. DAx has been very strong. Bubbles and crashes are a fact of life and we never learn from them.

There is no better investment in a country that hits rock bottom. A great book to read on this Market Panic or another is Popular Delusions and the Madness of Crowds.

-

Check out all the projects in Bangkok

I think there is a gluttony of condo supply in Bangkok. There are literally 2/3 massive projects announced each week. Certain ones have quite a low take up rate.

-

"Fabulous News for UK Expats" ... not!

Maybe good for you and other layabouts

but some of us work in Thailand, don't you know?

but some of us work in Thailand, don't you know?Its not our fault we get paid in £. I guess if you make the decision to get paid in baht and work in Thailand you gotta put up with the downside. In fx market there is always an upside and a downside.

Sterling holders werent so lucky in 1992. It all swings in roundabouts.

-

I think anyone putting money in SET should have their head examined. Everyone know how things are done here. Only those with the right connection have a chance, the rest will lose their shirt.

why is this so bad? Can anyone not get their head around short selling. The whole wllstrret mantra,bloomberg, cnbc, print media is buy and hold, buy and hold. Its as easy to go short a stock as go long yet no one understands this simple concept.

A technical trader would have made a killing today. For every buyer there must be a seller. This money has arrived in someones hands.

"I met an econmist and a fundamental analyst and he dropped a knife and it landed on his foot. I asked him why didnt you catch it and he said he thought it was going to rise up again"

"A trade looks better to a fundamental analysis the more the price goes against him"

Imagine applying that method to Enron, the Nasdaq, which many "experts" did do of course. They are still waiting. The problem is that the optmists of this type of investing have to be right everyday, where as the pessimists only have to be right once. Look at Longterm capital management collapsein 1997. Victor Niederhoffer RIP.

-

Convenient store cashier attacked for not selling beer

BANGKOK: -- A convenient store cashier was attacked and severely injured by a drunk man after refusing to sell him beer after the alcohol sale hours.

Watchara Adam, 18, the cashier of Family Mart in Bangkok's Min Buri district received a deep cut each on his right hand and left arm.

Police said the attack happened at 3 am Saturday.

He was rushed to the Navamin Hospital for wound treatment.

Watchara later told police that two men came into the shop to buy a pack of beer but he could not sell it as it was after the alcohol selling time.

He said the two men became dissatisfied and one of them bought cigarette.

Watchara said the

man, who bought cigarette left and the other man attacked him with a knife before the two fled on a motorcycle.

-- The Nation 2006-12-16

The Nation sells itself as a broadsheet - but always seems to have these tabloid articles.

With all due repect it is a bit of a non-event.

It wasnt that much of a non-event for the attacked. And even though it only was 2 people involved it still brings to light some wider issues, about alcohol laws, social violence, alcoholism etc. The very fact we are people are responding to the post shows it as having some ramifications.

My point would be that this sort of article would make a local newspaper - but certainly not national coverage.

I guess so. The nation is certainly easier to read than the Bangkok Post. Many times I bought both on a day, just for balance..or lack of it.

cheers chris

-

Convenient store cashier attacked for not selling beer

BANGKOK: -- A convenient store cashier was attacked and severely injured by a drunk man after refusing to sell him beer after the alcohol sale hours.

Watchara Adam, 18, the cashier of Family Mart in Bangkok's Min Buri district received a deep cut each on his right hand and left arm.

Police said the attack happened at 3 am Saturday.

He was rushed to the Navamin Hospital for wound treatment.

Watchara later told police that two men came into the shop to buy a pack of beer but he could not sell it as it was after the alcohol selling time.

He said the two men became dissatisfied and one of them bought cigarette.

Watchara said the man, who bought cigarette left and the other man attacked him with a knife before the two fled on a motorcycle.

-- The Nation 2006-12-16

The Nation sells itself as a broadsheet - but always seems to have these tabloid articles.

With all due repect it is a bit of a non-event.

It wasnt that much of a non-event for the attacked. And even though it only was 2 people involved it still brings to light some wider issues, about alcohol laws, social violence, alcoholism etc. The very fact we are people are responding to the post shows it as having some ramifications.

-

One can talk talk, speculate speculate on the value of the baht but over the last few months there has been a seachange in monetary policy which affects us all and which seems permanent.

Over the last six years it did not matter if we held dollars or baht . They were pretty well interchangeable and the rate varied little . Holding dollars, we knew we could always change to baht without incurring much loss. Why ? Because the BOT and even the Monetary Authority of Singapore managed the currency. If the baht got too strong the BOT would just buy up the baht so an to ensure Thailand remained competitive , increasing the reserves at the same time ( these have doubled from 30 to 60 billion dollars over the last five years.)

The seachange has been the apparent breaking of the dollar baht link. The BOT it seems WILL NO LONGER BUY UP DOLLARS TO STABILISE THE RATE.

We are now on our own and holding dollars has suddenly become an extremely risky business. No longer can we rely on the BOT 5th Cavalry to rescue us . The dollar no longer has a floor to protect us.

Views of others agreeing or disagreeing much appreciated .

My answer ? Change your dollars to UAE DIRHEMS ! This currency is rock solid, high yielding and above all STILL TIED TO THE US DOLLAR.......but be quick..this opportunity wont last long.

Why would anyone want to change their cash into UAE dirhams? It has a dollar peg and will follow the dollar rate slavishly. It will continue with its dollar peg until 2010, then GCC monetary union begins.

CHF is the way to go.

I wouldnt invest in any countries currency where the property market is running at 28% growth per year, ie, UAE. Remember what happend to a certain SE Asia country in '97 when that was the case.

I also wouldnt invest exclusively in the CHF. Its not a good idea to onvest in only one currency. The perception of the CHF as a save haven is slowly changing.

-

Hello,

If anyone is interested, I am trading the USD/THB. I am going to post charts and all trades on this board so anyone can see how I perform.

I m putting my reputation on the line doing this, but then I dont have a reputation so I have nothing to lose. I thought it would be a good idea as there is alot of people with dollar deposit accounts, and the dollar weakness means your money isnt stretching as far as it should.

I ve been trading other currencies with some success on GFT Deal Book 360 and Interbankfx accounts. I have a system. Its not based on prediction as it cant be done this way.

Now I will have losing periods, but I have a moneymanagement and risk control in place which should keep me a float awaiting the winners.

In another post I will explain the basic dynamics of the forex markets so you understand whats going on...

I will post whether I am long or short the USD/THB, and I will post my entry price and exit, and my profit/loss...

The trades will range from short term and some longer term trades.

-

The dollar decline or crisis is nothing new. Its only becoming more talked about as the issues surronding it become more acute.

Infact the wheels have been set in motion you could say since 1973 with the break down of Bretton Woods agreement. The gold standard was abandoned. Now there remains no mechanism to control imbalances in exchange rates. The responsibility was left to the free markt.

However, the problem is that America importants 70% of its goods. The reason for this is that with very low wages in countries in emerging markets goods are much cheaper to produce than in america. Wages averaging 4 dollars a day or less and cheap land prices, for new factories and HQ,s is the only reason the goods are made in these countries.

This means that america uses dollars to pay for these products and goods. However the emerging market countries don t dont exchange the dollars into their own currencies. Why? The reason they dont ,is that if they did this then their currencies would appreciate,meaning the exports would become expensive. These countries because they export led growth countries also have account surpluses. SO what to do with all this dollar surplus?

Instead of investing directly in their own economies and equity markets they invest in the US markets. They know the US has highly advanced, less risk adverse markets,or at least this is the perception. To cater to this notion The US have created all sorts of debt instruments. Issuing bonds,derivatives. This has been the cause of the current acount deficit. To stop the deficit growing anymore America has to attract investment of 1 million dollars a minute.

The american people and the rest of the world have never been so much in debt. Americans have taken huge amounts of capital out against the mortgages on their homes, and are living beyond there means.

The real fear is that when america stops spending and going into debt as it will have to,this will harm the export driven emerging market countries. The large amounts of credit allocation and loans by banks will non-perform and banks will start calling in the debt. Inturn these countries will no longer be able to finance the current account deficit. The global economy will be left without a definite growth engine as the emerging markets dont have near enough domestic demand. This in thoery would lead to a global recession, with deflationary pressures in the emerging market countries. The country that depends most on the Us for growth is china. When demand drops because the Us consumer is forced to stop spending the demand for imported goods will drop dramatically. This inturn will effect the other asian countries who rely on china for growth.

One way or another the only way that these massive disequilibriums can be solved is with a very big decline and devaluation of the dollar.

Investing, What Are My Options?

in Jobs, Economy, Banking, Business, Investments

Posted

I m buying silver bullion kilo bars at this time...I m looking for a large increase over the next decade or so. Even in the short to medium term, I will look to buy and sell silver and gold. Gold is coming into its true role as a true currency. Look at gold in terms of every other asset between 2007-2008. It ended up 6% this year, in USD terms, which had an artificial rally.

I deal with these guys...Guernsey Mint

Also www.goldmoney.com...

However, I like to have the physical in my house also, at least you know you 100% have the bullion. But goldmoney from all accounts seems a very good way of diversfying. I m not keeping money in sterling. The credit default swap on UK government debt is now showing that the UK has more chance of defaulting on its debt that Mcdonalds, or HSBC bank, which is scary. With several debt auctions this year in the UK, and all this Keynesian sillyness going on, I would not be in sterling. That goes for USD also, euro.

People say that in a period of forced liquidation, deflationary period, that cash is king...However, gold is a currency, its scarcity gives it value, its supply cannot be increased meaningfully like paper money. So even in this deflation, all assets have experienced deflation in terms of gold. Look at the price of all assets priced in gold in between 2007-2008, stocks, real estate, oil, sterling, euro...

Now thats a deflationary environment. In an inflationary environment, gold and silver will go to the moon. I expect inflation to kick in the next 18-36months. It is hard to know exactly when, but it will come...they are printing too much money.

Another idea is to short long term US treasuries this year...the last bubble.

Also investment in commodities. Look at the supply and demand, inventories are near historic lows, and the longterm demand is there. I have done a recent study of wheat, and I think it will spike up again at some point.

Also asian stocks, some are now paying double digit percentage dividends, and trading at low Pe's. The japanese market is at its 1981 levels. Taiwan is cheap, China is cheap.

As always do your own research...I also want to buy "call" options on