coccigelus

-

Posts

34 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by coccigelus

-

-

1 hour ago, Pib said:

Transferwise (TW) is indeed not a bank; they are a payment service provided. See the quotes I cut and pasted from their Customer Agreement/Terms of Agreement. Even when you have a borderless acct with TW that is really an acct with TW and not its partner bank(s). Now TW does indeed have a "master" bank acct with its partner bank(s), but when you get issued a borderless acct your are really just being issued a TW acct linked to that master acct.

I expect IB is just taking the position that they know how TW operates with their borderless acct setup and what TW really is--a payment service vs a bank. And for whatever reasons IB does not want to do transfers to a payment service--surely just "their" policy.

Over the last few years I remember seeing a few (just a few) ThaiVisa posts here and there where a person's US bank deleted a person's ACH Transfer Link or Bill Pay the person had setup to push funds to TW...once again, it just seemed to be that particular bank's policy that they didn't consider TW meeting the requirements for a transfer/electronic billpay.

Below partial quotes from TW Terms of Agreement

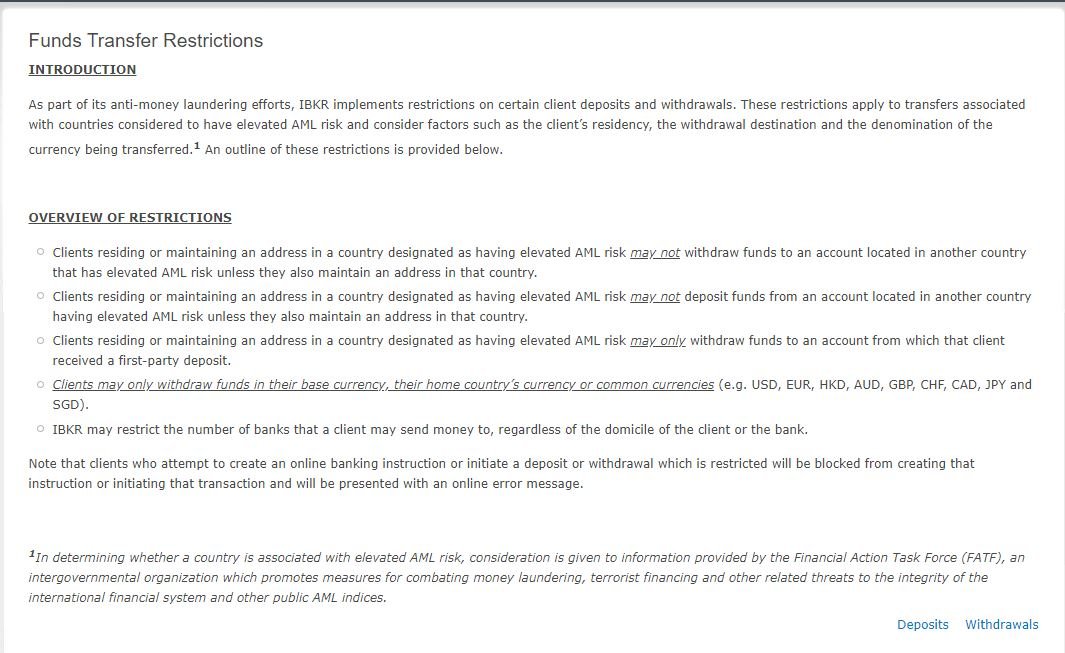

Remaining out the JP fiduciary bank venue banning. Are You incline to think this is a mistake worth opening a ticket?

-

Bank accounts are used to verify identity of a person which can’t be done with the same accuracy by a service like TW. Having said that I am very incline to think that there are some rules to prevent potential illegal activity that seems to affect especially usd transfers from US brokerage account right now. My guess is that is somewhat related to the policies issued after 9/11. As a US friend once said your business is our business...

-

2 hours ago, TallGuyJohninBKK said:

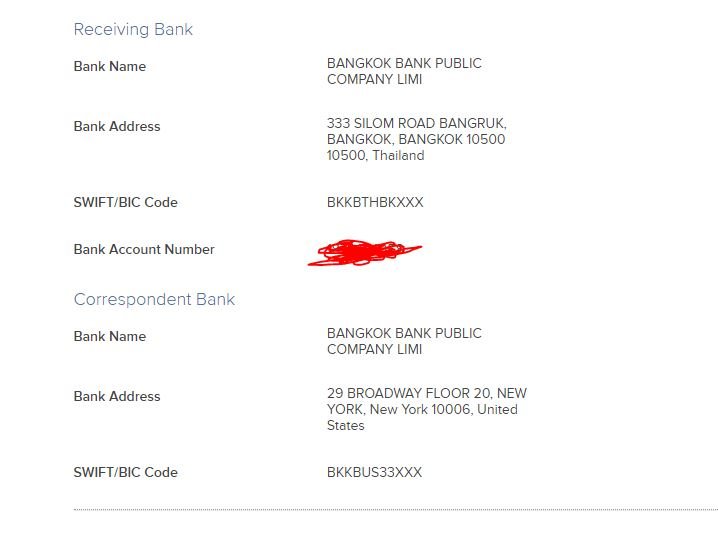

It sounds like switching to domestic wire transfers from your IB account to BKKB NY (and them forwarding the funds onward to your BKKB TH account) should be a perfectly fine alternative, and one that could save you money -- unless IB was giving you totally free intl wires and they won't do the same for domestic ones.

Well I was agreeing with You before to read the answer of another guy that was suggesting the JP venue was actually cheaper. It’s located somewhere in this thread. Pib can probably recall this as If I remember correctly was suggesting the same. Not big difference but cheaper via Jp rather than wire through bkkb Us via wire.

-

2 hours ago, Pib said:

it sure seems to me based on info your have provided and that IB KB3442 article that you should still be authorized to do the transfers you are doing...and I've read that article numerous times. But I guess there is something I don't understand....or the article doesn't address/discuss fine print that is the real cause....or IB is just shutting down transfers to Thailand based on policy not included in the article.

Pib i tried to find out the answer i’ve got from an Ib representative when i was still an European resident for IB when I asked clarifications about the banning of the borderless account. Basically the answer was that TW borderless account is not a bank and thus IB can’t wire (or get deposit)to a different entity than a bank. I will try to check out tomorrow when I will come back to my office and see if i am able to find out the answer I’ve got by IB but that was a different account so maybe It got deleted. (As I had to close the old account and reopen a new one with the residency in Thailand.) Regarding the banning of the JP venue I agree with You that doesn’t make sense and I am going to clarify further. I am actually a bit renitent to mess up because I believe following the same reasoning should be banned also some euro venues i have which are fintech not technically banks. Unless the issue is merely USD which is very possible as well. I am open to advices how to construct a possible question to submit to IB if You or TGJB have any .

-

2 hours ago, TallGuyJohninBKK said:

It would be helpful, if you could clarify just what exact kind of transactions IB is telling you you can no longer do...

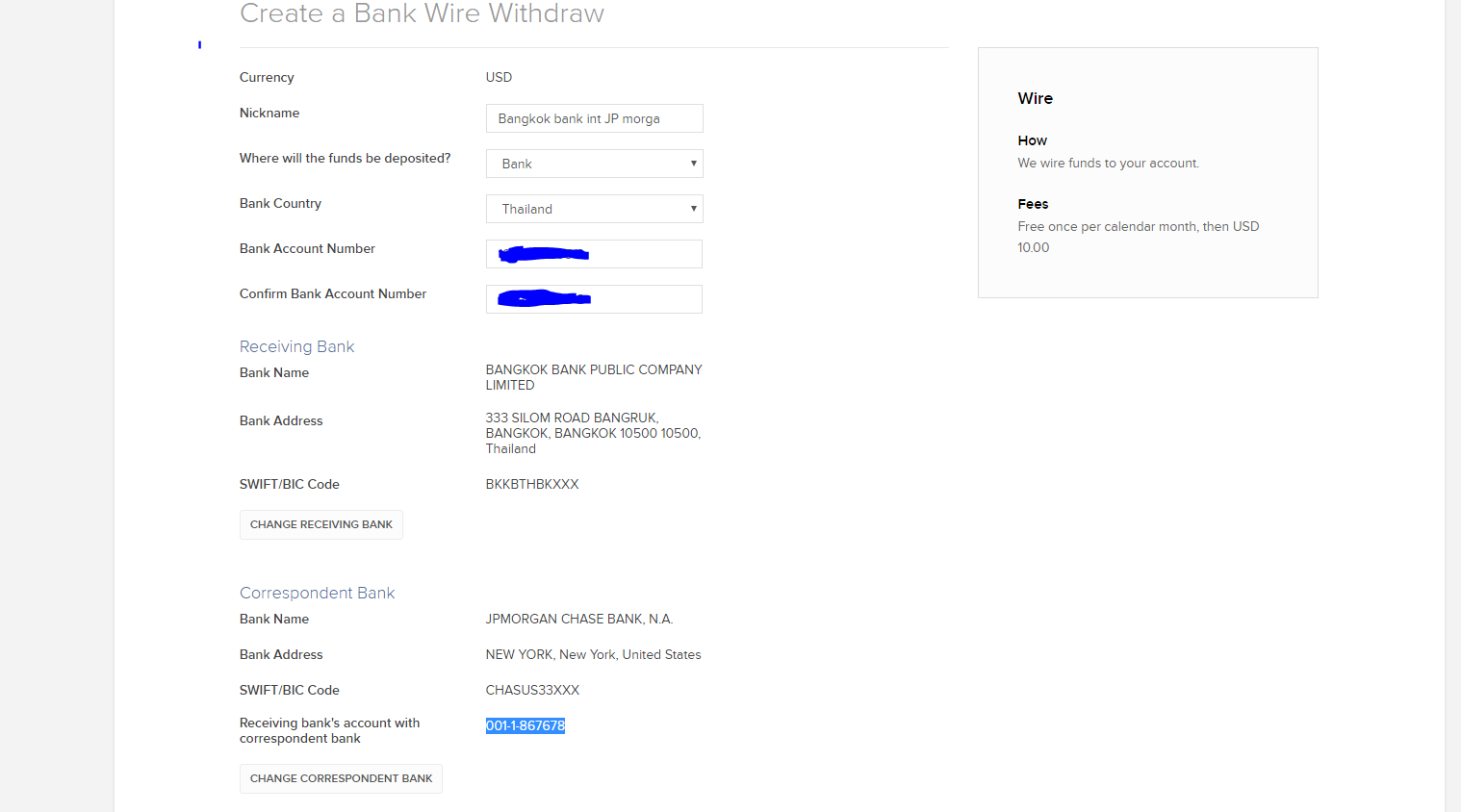

Are those entries referencing domestic wires from IB in the U.S. to BKKB NY and then onward to Thailand. Or are they referencing international wires from your IB account to BKKB Thailand via JP Morgan as an intermediary bank?

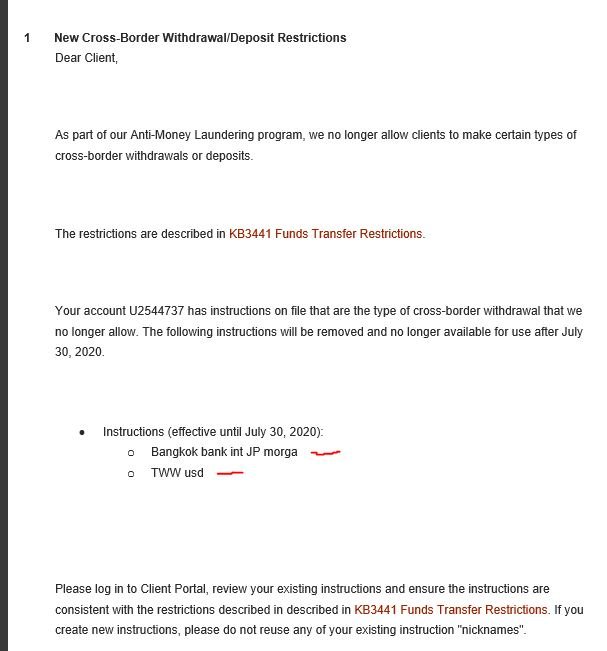

They are going to block after 31 july the international wire from my IB account to BKKB Thailand via JP Morgan. And the wire transfer to the TW borderless USD account which is held at the Community federal Bank. So i believe TW borderless account is useless right now because I read that TW B.A. can only accept USD incoming wires when a brokerage account is used. ( but not sure is really the case as I actually did at least one denominated in Euro a while ago)

Ban of the int wire Via JP does not make really sense as it was the recommended way to wire to BKKB by their portal.

-

Thank You Pib to have taken the time to answer. Indeed It's quite frustrating especially the Bangkok bank route through JP which was the option suggested by their terminal. But If You are confirming me that the wire protocol (not ach) through their US branch is still a viable option I would not be that concerned. Can You pls confirm this?

Regarding TW borderless account They flag only the USD option but de facto I believe, I would not be able anymore to transfer directly to TW borderless account as I read TW can accept funds only in USD from brokerage account. (although I think I have actually did in the past) To be honest I am not surprise at all by TW being flag as IB has cracked down hardly with TW before when I had my residency in Europe. JP route being red flag though is a mystery and somewhat something that I do not understand the reasons unless is a mistake from their end. (because I am resident in Thailand so I am supposed to being able doing an international wire..)

For me the reason to use TW was principally due to the fact that I do not have to incur in double currency exchange for services I am paying in the US. So from now I would have to wire from IB in euro and then pay my services in USD dollar. I can't open an US bank account so unless You have some ideas this is a bummer.

Again, Thank You so much

-

To those that have an IB brokerage account It seems are coming bad news having just received the following: See pics.

So what options are still available to send money in Thailand? Is US Bangkok Bank route a still viable option ?

So TW usd account & Bangkok bank via JP morgan routes closed. Note that My IB account address report correctly my residency which is Thailand. Look absurd this situation.

-

1

1

-

-

-

-

5 hours ago, Thailand J said:

If you transfer >$2000 it is $10, and >$50000 it is $20.

I am going to keep repeating this: From IB send international wire to BBL BK (SWIFT code BKKBTHBK) , with JPMorgan Chase as intermediary bank ( default on IB) which only charges $2 flat rate. The usual BBL BK receiving fee (500B max ) applies.

Transferring to BBL BK ,Schwab's intermediary bank is BBL NY, I have not find a way to change it on their website.

I didn't forget your previous recommendation (which was same as above). I will try the international wire next time .

EDIT: no concerning is clear.

Thank You.

-

13 minutes ago, treetops said:

Yes, Bangkok Bank will convert at their published rates which are usually about 0.5% below interbank.

So, ~ 1.1% total cost for a 2000$ wire transfer including other fix Bangkok fees and considering free US wire. Unimpressed.

-

6 minutes ago, Pib said:

Yeap...and please note at $2000 "plus one penny" the NY fee goes to $10 just in case you wanted to regularly send a little over 2,000 as that seems to be an approx amount a lot of people send monthly.

Heck, after the fee dust settles if you sent $2005 or $2,000 you would receive exactly the same amount posting to your acct because a $2005 amount incurs a NY branch fee of $10 leaving $1995 to continue on and a $2000 amount incurs a $5 fee also leaving $1995 to continue on.

And for an amount between 2,000.01 and 2.004.99 a person would receive less than a person sending 2,000 due to their sliding scale fee at that $2k trigger point.

mmmhh. It seems reasonable wire into Thailand every 3-4 months instead of each month as I was planning to do. I am upset about that 5 dollars which I was totally unaware. Never mind less wires then into Thailand.

I agree regarding Schwab being a superior option... Even though is a nice option ONLY for Us residents ..

-

Lopburi, You can open a borderless account with TW. I think Us nationals can open an account with them as well. If You do that, which is free, You will get a nice multi-currency account + a debit card which is connected to the app of your mobile.

https://transferwise.com/gb/borderless/

Pib thank You very much to provide further clarifications with the hidden cost. So in case of a transfer of let's say 2000$ We will incur in a 5$+6.63$(200THB) which mean a ~0.6% of fixed cost plus I guess other hidden fee from the currency conversion itself. Not bad, but not that good as well.

-

1

1

-

-

Thank You both for the details. I have recently planned to wire into Thailand once a month but I am not sure the idea make much sense on the light of the fee nicely listed by PIB. I was totally unaware of the 5$ applied by Bangkok Bank NY for instance. Once sent into Thailand I then use the Central Credit card which is in the name of my wife which bring a lot of points - promotions, especially If You do shopping at Central and Top. Perhaps would make more sense use directly the TW debit card whenever is possible instead to wire so often into Thailand?

Another concerning I have is this strong THAI baht. Dollar is by no meaning a weak currency right now but THB became way stronger (especially) in the last year. ( The peak was ~ 32 THB this year and ~36 THB in 2016 ) And right now dollar doesn't look so well posed in the future, actually I believe very closed to a peak due to inflation, QE and Trump. I wonder if It would be wise hedge a bit with precious metals as Thailand with all these public investments pumped no-stop into the economy, would be logical to think They are getting even a stronger currency.

-

Yesterday, I did a wire transfer of 1500$ from IB to Bangkok Bank US. Today I got 44664.95 THB. How You evaluate this conversion? Edit: IB wire was free.

-

Thank You for the explanation. If I remember correctly the correspondent bank must be entered with IB. But I think the proposed correspondent bank is Chase as shown before by Thailand J. Anyway, thank You again.

If domestic wire will be banned then I will try to do a test between international wiring and TW. It's so confusing!!

-

56 minutes ago, Pib said:

If you send USD from your Sending bank it will not be any intermediary bank doing the exchange; it will be the receiving bank which is Bangkok Bank "in-Thailand" for your transfer....the Bangkok NY branch will not do the exchange. However, Bangkok Bank NY will apply the same sliding scale pass-thru fee as they do for ACH transfers to relay your funds to your in-Thailand Bangkok Bank branch.

Pib Thank You to have taken the time to clarify better the situation. If You do not mind I have a few questions:

Do You think then would be the same in term of fee the domestic wire transfer compared to the international wire transfer with correspondent bank? (*assuming brokerage fee are the same for both option, in my case IB)

In case of international wire transfer with correspondent bank would be the same in term of fee choose between any US bank compared to Bangkok bank chosen as correspondent bank as well? (* It is really not clear what would be the interest for a correspondent bank to getting involved if They do not get any fees)

Many thanks,

Paolo

-

Good point. But since the IAT requirements are needed only for ACH I do not think It will make any issue for domestic wire. Surely I can be wrong, time will tell . Anyway, as You pointed out we can use intermediary bank. But is my understanding that the intermediary bank would be in charge for currency exchange. So I think would be better use Bangkok bank as intermediary:

-

-

just my 2cents. I am using IB and It worked nicely till now ACH, domestic wire and international wires (using both GS and bangkok bank as intermediary bank).

Now that ACH will soon be unavailable without IAT, It seems the most logic conclusion will be to use domestic wire that according to my knowledge should continue to work because those further data required are included with domestic wire format.

IB offers one free transfer per month and after that I think* 2$ .

*need to be checked again this

-

21 minutes ago, cornishcarlos said:

What would be a decent machine for a small restaurant, serving maximum 50 coffees a day ?? I can get the fully auto Saeco Lirika in Singapore for 23000 baht, but would it hold up to that much use !!

Personally I would avoid at any cost. But If You are not crazy for coffee and Your average customers is the typical Thai would probably be a good choice from an economical pow.

If You want to get taste espresso You need to increase your budget. 50 coffee a day are not that much and You do not need a big machine. You need also (very important) a good grinder.

-

34 minutes ago, sammieuk1 said:

Fed up with budget machines not making it a year I bought a Heston Barista on eBay brand new £240 13kg put in a bag paid £60 for an extra bag 2 years ago same model here but badged Breville 30,000bt if anyone wants a recommendation of a perfect product this is it stunning coffee with Hillkoff Italian expresso ????

Hillkof is ok. But I would actually suggest (to try) Doi Tung. What I do is the following: I call once every 3 months and I order 5 kg directly in Chang Mai the top quality ARABICA They have and asking them to do dark roasted. At the beginning They weren't very happy to do the customization but luckily They started to do. That however is not the exactly blend of espresso which require robusta as well.

-

55 minutes ago, scorecard said:

By 'servicing' I assume you could mean 2 things:

- Actual repair because some mechanical part of the machine is broken or damaged, etc.

- Cleaning all of the tubes etc., inside of the machine. This is the problem with my small steam operated machine (Mex Mini) over perhaps 5 years of use (several times every day) my machine works appears to work properly properly but the coffee is coming out much slower / and much reduced in volume. Is there a simple product available to clean out the internal parts of such machines?

Allora, You have a couple of options:

You can use vinegar or citric acid (same as lemon) with the latter being the superior solution. Or better use specific products such as:

Not sure if those products are available at homepro.

Problem with citric acid is that could be a problem for rubber garnish etc..

-

for servicing If You are worried about assuming You can get spare parts just go to soft ice cream seller and deal with their technician. They may be not interested at first sight but they change fast idea with a couple of 1000THB. Servicing for a good quality machine is required not too often.

Major Change Eff 1 Apr 19 in Bangkok Bank ACH Transfers

in Jobs, Economy, Banking, Business, Investments

Posted · Edited by coccigelus

PIB, I would post it back as soon as I will get an answer by IB as I decided to ask clarifications on their decision. I appreciate your further thoughts and Yes what You wrote is a possibility.

Thailand J I am not a US citizen, I am European with an European passport, but anyway I do not think is fine having the international wires flagged into the country where I have my residency which is on file with IB. I do not think the US passport is the reason behind but well I can be wrong and somewhat I would not be surprise if that is the case.

I guess we need to wait in order to get further clarifications, if any is given.