KSwr7UDHyn

-

Posts

38 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by KSwr7UDHyn

-

-

34 minutes ago, Sheryl said:

I am surprised as April Global (France) in m,y experience usually comes back asking for more information, copies of test results etc.

Also what you describe does not sound like their Health Questionnaire. It does sound very much like the Health Questionnaire of April Thailand (which is underwritten by LMG, a Thai company and so reads like a typical Thai insurance questionnaire).

Can you post a pix (identifying info removed) of this questionnaire?

If it was in both Thai and English it is not April Global, it is April Thailand. Ditto if you were told it meets the Thai Immigration requirement for OA visa extension. April Global does not (other than for initial issuance of the visa).

If it really was April France and you went through a broker could ask the broker to pursue it and see if you can submit more information to clarify things. (In case it was the colonoscopy, then that report as well as records of your various negative cardiac tests).

If however it was April Thailand then what you are getting is from the Thai underwriter and everything I said re them applies. You could try asking broker to interceded, but with Thai underwriters (who do not usually have a medical person look at the forms, and have limited comprehension of English medical terms) it may be hopeless.

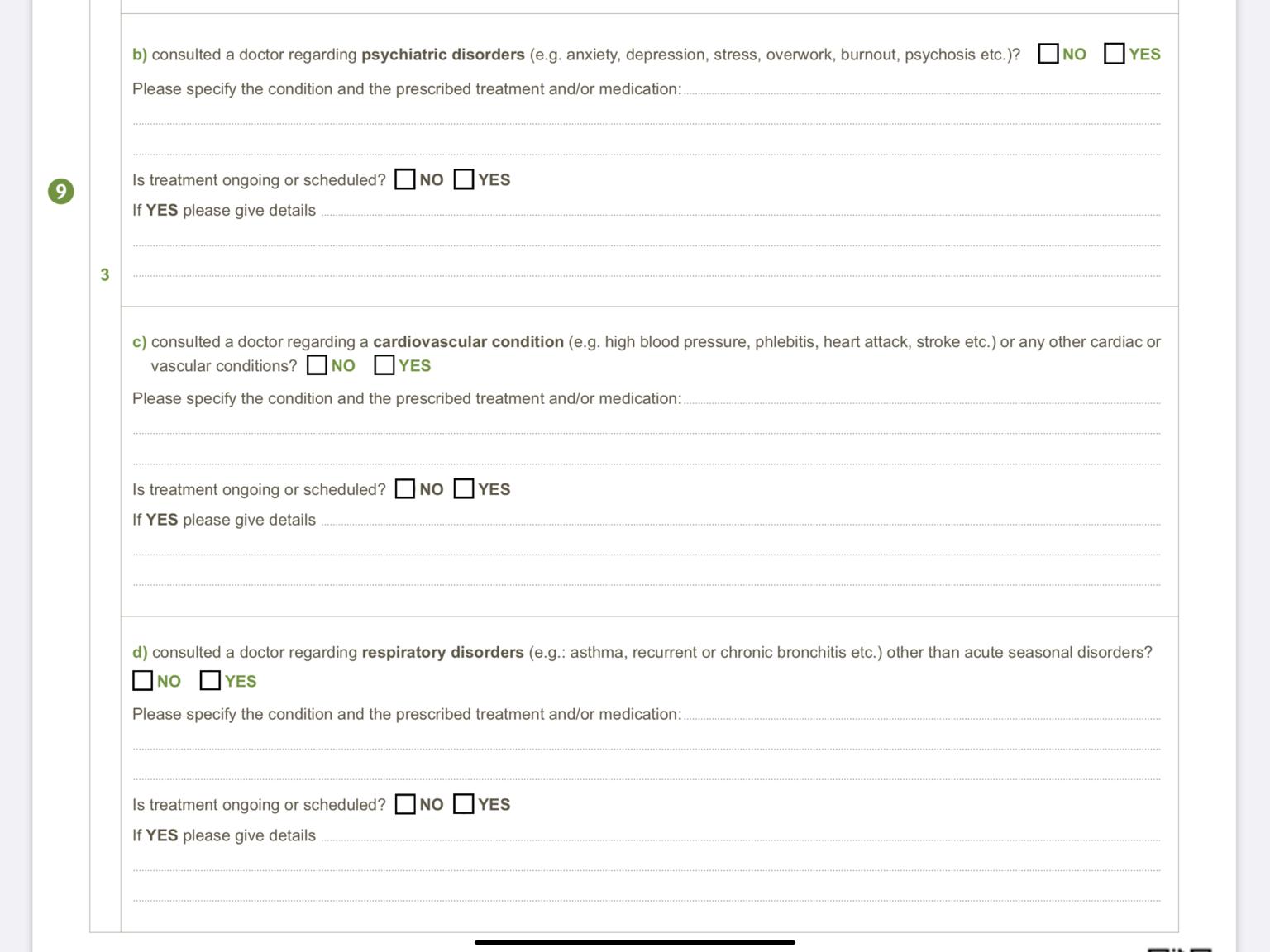

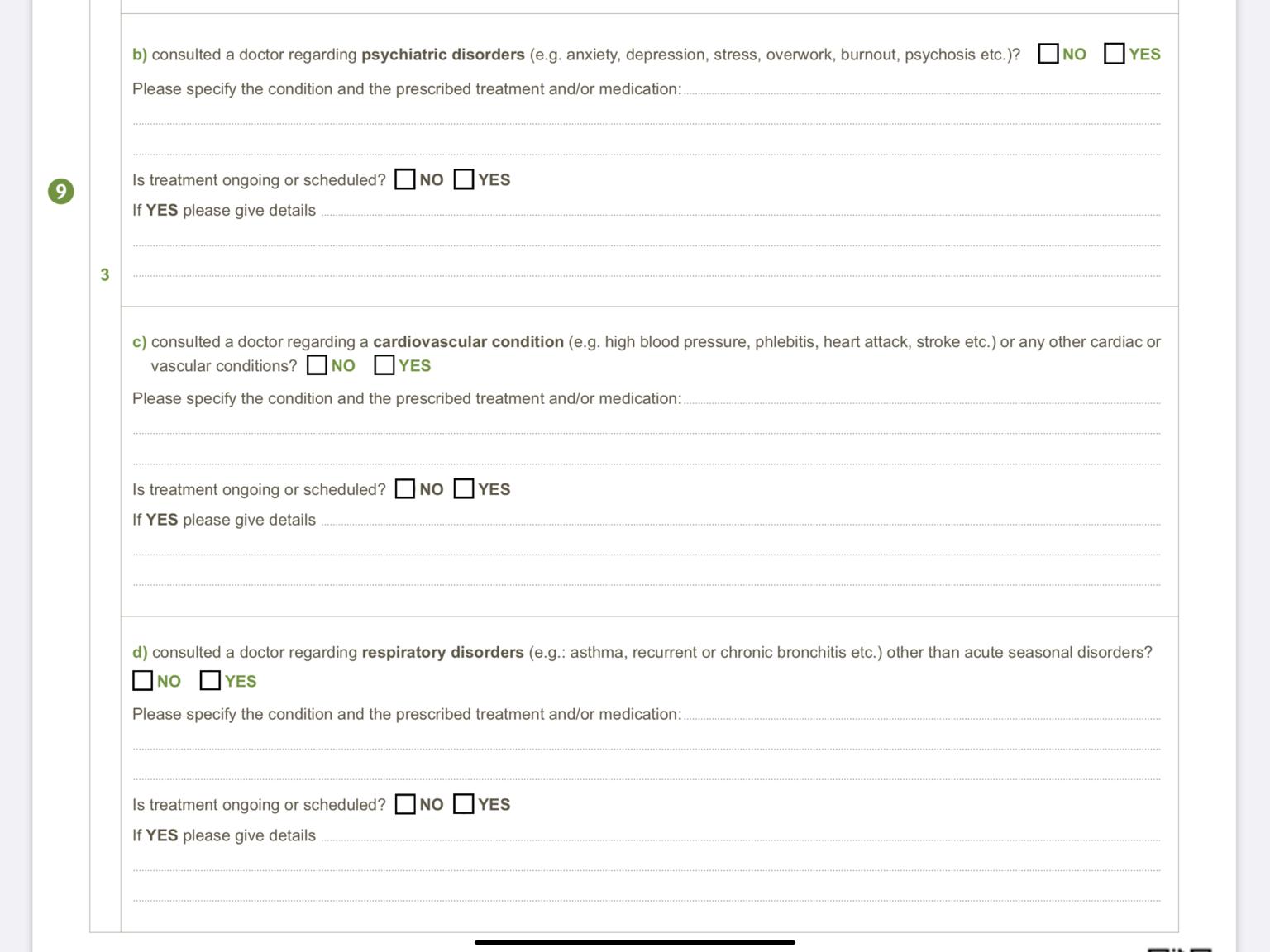

I re-read the application and it was for within the last 5 years (not ever - must have missed it or been confused). But this is the language used is attached.

The cover doc says April International, updated April 2018

-

2 hours ago, Sheryl said:

From what you describe you did not and do not have heart disease.

You had episodes benign arrythmia (premature atrial contractions, which occurs to many people if they take too much caffeine).

What to put on an insurance form will depend on what exactly is asked.

You can truthfully put "no" to heart disease. Also "no" to taking any medications for a heart condition.

If asked to give details of any condition for which you saw a doctor (not hospitalized) within the time period that this occurred you should put down that you saw a cardiologist for what at the time felt like palpitations, but tests excluded any abnormal heart condition. And offer to attach full medical report, which you might do well to get a copy of.

It would be unusual for a an insurance form to ask about doctor visits more than 2 years ago, but be guided by what exactly is asked. Answer truthfully but do not volunteer more than is asked for.

Was this a Thai or international policy that you had applied for? Unfortunately most Thai underwriters do not use medically trained people to scrutinize forms and staff tend to work robotically off of simplified charts. I have known many cases where people were given exclusions for pre-existing conditions that they never had. Some of the forms are so constructed that if answered literally, everyone would have to say yes to questions that would then lead them to be branded as having a chronic respiratory disease, for example (e.g. along the lines of "Have you ever had a sore throat or runny nose?").

No reasonable insurer would consider what you describe as a pre-existing condition, assuming you gave the full information in your post. But Thai insurance company staff in my experience would often miss the key elements and take away only "saw a doctor for a heart condition".

It was with April Global and the question was along the lines of “Have you ever . . .” All the questions were of that format. Have you ever seen a doctor for a heart related condition?

So, I did answer that truthfully and given that the only other issue in my records was getting my 50+ colonoscopy which I had to list as a surgery (they put you under for the procedure), I have to assume the heart question was the disqualifier.

That’s why I said, I’m not trying to cheat the system. I just want some advice on where the line is, because, as you say, some of the questions are presented in a fashion where you have to answer yes.

I haven’t applied with another insurer yet and am a little concerned that this cautionary visit to the doctor to get something checked out is suddenly going to set off red flags with a trigger happy reviewer that is looking for a reason to say “no.”. I guess I’ll have to shop around based on their pre-screen questionnaire. LOL.

BTW, the doctor said exactly what you did, cut down on the caffeine. I was drinking 4 or 5 cups a day and after I stopped the PACs stopped.

-

18 hours ago, OneMoreFarang said:

You had a heart problem.

That’s sort of the point I’m making. According to the doctor, I didn’t have a heart problem. In fact, because of all of the testing that he did to confirm that there was no problem, I’m probably a lower risk than someone that has never had the tests done. The doctor said that the pre-arterial contraction is actually normal but some people are more sensitive to feeling it than others. In other words, you probably have the same thing happening and you may not even know it. And the doctor doesn’t consider that a problem as there is no correlation to any sort of other heart condition.

Now, an insurance company can say that because I was cautious, that this is now a pre-existing condition.

Doesn’t this just incentivize people to not check out problems until they get to the point of being serious or life threatening?

That’s why I was asking, what defines a pre-existing condition? If you notice a lump and get freaked out that you have cancer and the doctor performs some tests and determines it’s just some sort of cyst, because you originally sought treatment for cancer is cancer now a pre-existing condition?

-

A few years ago, back in the US, I began to experience a feeling like my heart was thumping out of beat. I looked up a bunch of stuff online and most of it said that this was quite common and, to a degree, normal. Saw a cardiologist and he ran me through the paces, stress testing on a treadmill, ECG, sonicgram of the heat, etc. Said everything appeared to be normal. He called it a pre-arteirial contraction and said it was nothing to be concerned about. Asked if I wanted to try some meds that might make the thumping less annoying by decreasing blood pressure, but mostly, cut caffeine, get more exercise, etc. I took the meds for a couple of months and then quit taking them (doctor said I could quit if I wanted). The thumping went away on it’s own and it’s been a year or so now since I last took the meds.

When I applied for a health insurance policy, that was the only other thing I mentioned on my application and it was turned down. No reason given.

First, is a condition that was temporary and the doctor did not deem serious, a pre-existing condition?

Second, I know I could be denied coverage if the insurance company were to find out, but would an insurance company be able to get my US medical records? Is that common?

Mind you, I’m not trying to cross the line. I just want to know where the line is. Too many folks like to say, “report everything” but sometimes we see a doctor because it’s better safe than sorry, especially with something heart related. If even seeing a doctor to rule out a serious condition could disqualify you from ever receiving health coverage, that seems pretty crazy.

-

1

1

-

-

- Popular Post

- Popular Post

On 11/28/2019 at 3:48 PM, beautifulthailand99 said:Whilst a lot of the opinions , observations are true for many posts one would do well to bear in mind that farang expats are a relatively small subset of the market which is of course dominated by Thais , Chinese, other Asians and to a lesser extent at the low market end Russians and of course the more bomb-proof, well pensioned nordic snow bird couples. If the location is good and the price is right it will sell. Farang houses in Nakon Nowhere or isolated in a rural idyll may be ultimately unsalable at a price that the owner would have thought it might have been worth.

Yes, what do they estimate, 2 million foreigners living in Thailand, out of 70 million Thais? I'm not sure on that number but I've heard it thrown around.

Out of that 2 million, how many are even in a financial situation where they can afford to buy a condo or house for cash? Let's say 500,000??? And if that seems too low, how about we throw in the fact that many of the foreigners that live in Thailand and could afford to buy, don't plan on living here long enough to want to buy. I think that would get us down to 500,000 or so, right?

I mean, we haven't even dug into farangs buying homes in their wife's name so that land is not even his to resell.

So, farangs would represent less than 1% of Thailand's potential buyers (about 0.7%).

But, let's be fair, not all 70 million Thais are over 18, and most will be married when buying, so, let's bring that down to 25 million potential buyers.

We're 2% of the overall market?

I don't think you can define what Thai real estate market is like based on 2% of the market. That's not even a good representative sample since we skew much older (and die much sooner, thus forcing sales) and can't own the land.

-

3

3

-

- Popular Post

- Popular Post

On 11/27/2019 at 2:24 PM, baansgr said:But it's a true indicator of the market...Tens of thousands of sellers and very few genuine buyers.

No, it's an indicator of an imperfect market with imperfect information.

The reason Joe Farang thinks his condo is worth 5 million baht is because he doesn't know jack about real estate and he's using what other people have listed their property for and what the new condos are selling for as his guide. He figured that if condos across the street are selling for 20% more than he paid for his, that his condo must be worth 20% more than what he paid for it.

But he's WRONG! That's not how the market works.

The only price that matters is what price condos are actually transacting at. If you have your condo on the market for 5 years at 5 million baht, that is not any sort of indication of where the market is at.

What is an indication of where the market is at is when Fritz Farang sold his condo two floors above you for 3.5 million baht.

That's why in the US, you don't go by the price that the property is listed on the MLS. You use "comps" or "comparable sales" in the area.

But if the market had better data, you would see Joe Farang's condo sitting there for 5 years at 5 million and still unsold. That would guide the next person to aim lower. And people would keep aiming lower until they hit a price that their condo sold for, and then that becomes the new market price.

The problem is there is no good source for pricing information or sales data.

-

4

4

-

- Popular Post

- Popular Post

On 11/27/2019 at 10:54 AM, baansgr said:If anyone wants to see the true state of expat real estate in Thailand. Join the 100 or so groups of RE on Facebook targeting over a million people. Post a condo, land, house for sale will be lucky to get one reply... Post you are looking to buy and will receive hundreds if not thousands of replies

As a buyer, the last place I would look for real estate deals either in Thailand or the US is on Facebook.

I would use the local real estate sites to get a rough idea or pricing and such and then I go out and walk the neighborhood, talk to people, go into buildings and ask if they have any properties available, etc. [Disclaimer: Wife does most of the talking, often asking me to wait outside so they don't get farang-fever and start driving up prices]

The prices being advertised online and what one can actually purchase (or rent) something for are two entirely different things.

I haven't bought in Thailand (yet) but I have rented several times and I know I can always pound the pavement and get better deals. I've (or we've) done it.

And when I did real estate deals back in the US, I seldom bought anything that was on the MLS. I always used wholesalers that got the deals before they made it onto the MLS. Or, I did the grunt work myself identified properties, went to the city website and found the owner, reached out to the owner and told them I wanted to buy the property, etc.

The number one rule in real estate INVESTING is you make your money when you buy, not when you sell. If you're not buying the property at the right price, it's going to be very hard to make a good return on your investment.

-

3

3

-

15 minutes ago, Why Me said:

I have $40k in my CU doing nothing. And $1.4mil in the market working their butts off for my well-being. 40k is less than 3% of my capital as a hedge for the 7% annual return.

Incidentally, that $1.4mil came from 250k I had saved before moving here in 2005. If I had a rush of blood say in 2007 to buy a condo for $150,000 (5 mil b. then) which I almost did I would be worth less than half I am now, not that it's a lot but at this time I can afford to buy a 10mil b. place which gives me a nice uppity buzz. But I won't:-)

Congrats and I don't mean this to sound insulting but you would have been an idiot to spend $150K of your $250K net worth on a condo back in 2005. That would have been 60% of your net worth tied up in one asset which is just bad investing to begin with.

But, I don't think that's necessarily what people are suggesting either. I don't see people talking about sinking half their net worth into a condo.

Like, someone buying a 3 or 4 million baht condo out in Issan or Pattaya or Chiang Mai or ?? that has $1.4 million in the market, isn't crazy. I mean, you could lose more than $100,000 (3 million baht) in a market correction.

If that gives them comfort, and they feel like they can live on $1,500 a month, rather than $2,200 a month with rent, and they can just live off that SS money and let their portfolio keep rolling, well, great for them.

It seems like this thread has a lot of straw men being set up. People seem to construct these arguments trying to win arguments against situations nobody is actually proposing.

Like, even this, conversation is really just the extension of me trying to remind someone that you can't just assume that because the market has historically returned 7%, that your returns are going to be 7% every year, and how to look at sequencing of returns as a better way of thinking about market returns.

-

1

1

-

-

1 minute ago, Number 6 said:

But what's the gain upside and the risk on the downside? Really at the end of the cycle.

I guess I could rephrase that in terms of, how much money have they lost since 2010 or 2011 when we came out of the last recession?

Let's just say that, your budget is $3K USD a month, or $36K a year. No need for anybody to start crying about the fact that they live on $1,500, the general math works out the same.

So, $36K x 2 years = $72K sitting in cash (or cash equivalents like money market)

In the time between Jan 1, 2011 until today, they gave up an average annual rate of return of 10.5% and your investment would have increased in value 141% over that time period.

So, they've given up $101,520 waiting for a recession.

And that's not even including dividends. With dividend reinvestment, they lost $133,200.

Like I said, doesn't matter if it's $3K a month or $1K a month, the important part is the 141% return over that period.

Back in the US, people have been talking about the housing market being too frothy and set for a major crash since, oh, 2014 or so. I bought a house in 2014, sold it in 2019 and it increased in value over 30%.

So, is it really the end of a cycle? It seemed like the end of a cycle in 2014 too. If I had waited to buy a house, I would have lost six-figures in appreciation.

That doesn't mean that I'm some eternal optimist. I think we're near the end of a cycle too. I'm just not willing to try to time the market.

-

- Popular Post

- Popular Post

2 hours ago, Why Me said:Anyway, back to Thailand I can't see the advantage of owning unless you really know what you are doing like some earlier posters claim. My rent hasn't gone up in 15 years, my investments back home are fully liquid unlike a house/condo here, I have no worries about being stuck in a poorly maintained place or with lousy neighbors, if I choose I can leave and move to the other end of the country in a week, a nice freedom.

For you, the freedom to move is important. For someone else, knowing they always have a place to live no matter what happens to their investments, might be perceived as freedom (freedom from worry).

That's ultimately what a lot of this comes down to; different strokes for different folks. Everyone is arguing as if they're right and everyone else is wrong. But there's no right or wrong.

Even back in the US, people have these rent vs buy debates and people will often draw up these very elaborate, but completely flawed, mathematical models to show that their point of view is right, but, not surprisingly, they never convince the people taking the other side of the argument.

Mostly because the difference is typically negligible and it really comes down to personal choice, and personal choice can't be expressed in a mathematical model.

Personally, I would probably never INVEST in Thai real estate, even though I've done lots of real estate investing in the US.

But I can understand why people want to own a condo or go out somewhere rural and buy a house (in their spouse's name). I'm looking to buy something, not sure where or when, but I like owning my house.

That said, while I think I could come up to speed very quickly on Thai real estate, the fact that people talk about properties taking years to sell, gives me way too much pause. I don't want to have to worry about selling to get my money.

But, that doesn't mean people that do it are wrong. They just have a different risk tolerance or investment criteria than I do. Good on them.

-

3

3

-

1 hour ago, Why Me said:

Again look at the data. An average recession lasts 11 months. Even the 2007-2008 Great recession lasted only 18. So, have the cash to tide over max 2 years till the markets back even and then you're riding the upswing again (and don't forget to replenish the cash bucket in the bull years). No need to drop expenses as you suggest.

That's my strategy at any rate. I have cash in my credit union to see me through 2 years. People screw up when then bail out from fear at a market bottom or starting raiding their principal.

So, you have two year's worth of cash sitting in a money market account or CD earning next to nothing?

I think you're simply presenting another side if the same coin. You're forgoing stock market returns as a hedge against a recession. So, you are paying (via lost returns) for peace of mind.

-

15 minutes ago, GarryP said:

Rather disingenuous. I would say that the vast majority of foreigners do not live in houses like those posted on that website. Even if they were back in their home countries they would not be living in the European/US equivalent. Many are living in 2 or 3 bedroom 2-storey houses or bungalows. Normal houses that middle class Thai would be living in. These are real houses.

Many of the homes on that website would be $1 million+ almost anywhere in the US.

-

1

1

-

-

3 minutes ago, Airalee said:

Everybody has their own tolerance for risk. However, it’s a bit disingenuous of the owners on this board to go on and on and on about their paper profits on a condo purchased 15 years ago. Currently, the P/E ratio for condos here is absolutely in favor of renting. It’s always about the P/E ratio.

I also say this as someone who is currently in the market to buy. I don’t consider hypotheticals (rising rents, rising purchase prices). It’s purely an emotional decision. From an investment standpoint, it would be completely irrational to buy.

If that is the case, then it seems like you're throwing arguments at me, which I did not make, nor was I even responding to.

I was responding to someone that said that if they had a choice of paying 20,000 baht a month rent or paying 6 million for a condo, they could invest the 6 million and basically just pay their rent with the investment returns.

Without advocating for or against owning, I simply pointed out that this was flawed logic and that if the market tanked early into this person's experiment, they may not even live long enough to get back to 7% annualized ROI, if it's possible at all.

That shouldn't even be controversial. It's a fact and can easily be proved with simple math.

It doesn't mean that it will happen, but it does mean that you can't treat stock market returns like a 7% yielding savings account. It doesn't work like that.

So, I haven't a clue why you're talking to me about disingenuous owners and paper profits. I never said anything about that.

-

1

1

-

-

16 minutes ago, Airalee said:

Then perhaps this article should be about the plight of renters instead of listening to owner sob stories.

Why? This forum is about real estate. If you want to have a thread about renters, start one. The OP seems to be, quite obviously, talking to and about owners.

21 minutes ago, Airalee said:The rent for the original unit I leased is lower now than it was 8 years ago. The condo I’m in now rents for less too.

Good for you. There are a lot of factors that might cause that to be true.

But, I think a lot of farangs that rent or buy in Thailand, do so hoping to retire or live here for an extended period of time. So, getting priced out of the rental market or having to downgrade their lifestyle because rents went up might be something that they want to hedge against.

And hedges, in general, tend to cost you something. So, people that want to hedge, hedge. People that don't want to hedge, don't hedge. That's up to you.

BTW, if you purchased AT&T stock when it first spiked to around 22'ish on your chart, which seems to be around the late 1990's, it appears that that it would have taken you nearly two decades for the stock to simply get back to the price you paid for it. And for a good part of that time, it was worth half of what you paid for it.

And don't try to play both sides where you say, "Well, at least you got part of that back in dividends." In theory, you're living off (or paying your rent from) the dividends so your brokerage balance isn't holding all of those dividend payments, it's simply 50% less than what you had before.

It's not a bond where you're going to get your money back in 10 or 20 years. AT&T could sink into the toilet and get bought out by some other telecom who slashes the dividend. Maybe you buy in at 30 and drops to 10 over the next 5 years, but you're getting your dividend, so who cares, right?

But then they get a buy-out offer at 15 a share from AZ&Z, which they are forced to accept, and post buy-out AZ&Z slashes the dividend to $0 in order to turn the company around.

Now, you're down 50% on your investment and you have to try to put that into another dividend stock but with half of your original money so . . . bye, bye income.

I don't want to debate a specific stock but it's apparent that it's unrealistic to think that you can just post a screen grab from some dividend stock and declare, "Ta-da! Case closed."

I'm happy for you if that's the path you've chosen and you're happy with your decision. I actually don't think it's a bad move, but I don't think what you've presented works for everyone, and their are all sorts of risks that you haven't explored, so it's not some magic investment formula.

Remember the old saying, "There's no such thing as a free lunch." Dividend stocks have their own risks and trade offs.

-

1

1

-

-

5 hours ago, Destiny1990 said:

I don’t understand ur calculations Because very seldom properties in Thailand go up in value after being sold to the first buyer in-fact they loose value similar to a used car. Only new properties at launch go up in asking prices. So Capital gains aren’t there for consumers. Market can grow but not for your existing property because its second hand . Developers only can increase asking prices of New real estate!!!

Fyi some clowns here will now post how much profit they made on their last wonderful property deals here but as long as they dont proof that with documents then simply ignore their fairytales!!

I'm really not sure what you're trying to say either because I didn't talk about the price of the property increasing.

What I said is that if you do the math and figure out that rent is 4% of the purchase price and thinking that because the market returns 7%, you're automatically golden, you misunderstand how investing works because your stock portfolio is not going to go up 7% every year. It will go up 7% ON AVERAGE given a long enough time frame but one year it could be up 30% and the next year down 40%. In what order those up and down years happen can make it difficult (or impossible) to get that 7% return.

Just saying the math is not as simple as saying, "Oh, the market returns 7% a year, on average, so if I invest this money and use the proceeds to pay rent, I come out way ahead." There are other variables that can dramatically lower your chances of earning a 7% return. -

5 hours ago, Airalee said:

$200k (฿6,000,000) invested with a 5% dividend in a boring blue chip stock would bring in ฿300k (฿240k after taxes). Plenty to pay rent without touching the capital.

As a renter, one doesn’t have to pay any monthly/quarterly/annual common fees. No special assessments for ongoing maintenance which the low common fees never cover. Don’t have to pay for the new fridge, tv, washer, furniture as it wears out. No purchase or selling fees/commissions. Freedom to move at any time.

And many of those dividend paying stocks could cut their dividend during a recession or other economic hard times. Which would both drive down the price of the stock and lower your income.

I'm not saying that you should buy real estate rather than own equities, I'm just pointing out that due to the sequence of returns issue, you can't just make some projection of earning 7% like it's interest on your savings account.

It fluctuates and there will be up years and down years and some years you could be dipping into your principle which is going to kill your chances of hitting 7%.

BTW, the other thing here is that the original proposal here was rent was 4% of the 6 million (i.e. 240,000 baht) which is EXACTLY your after tax amount on your blue chips paying a 5% dividend. Even if you avoid rent hikes for 20 years, eventually you're going to pay more than you pay today and then the 240,000 and now you're dipping into principle again.

-

1

1

-

-

2 hours ago, Why Me said:

Equivalent condos in the neighborhood start at 6 mil. Now, 20k x 12 / 6 mil = 4%. So essentially I am borrowing 6 mil in the form of real estate at 4% per annum. I can and do make a lot more than that in the US stock market where I am fully invested. No, I am not some brilliant/lucky trader. The opposite in fact so I have everything in staid boring index funds. The market historically grows at an average of 7%/annum recessions included.

The market grows at a 7%/annul rate, but it does not grow in a straight line. That 7% is a historical average over many years.

It also assumes that all of your money remains invested.

So, let's say that you decide to set aside 6 million baht ($200K USD) and invest that in the market and use the proceeds to pay your rent at a rate of 4% of your principle balance.

If the market goes up 7% every year, that's wonderful. You will surely come out ahead and have made an excellent financial decision.

But what happens if the market tanks 20% the first year and instead of pulling out capital gains you have to pull it out of principle?

Your 6 million declined in value by 1.2 million baht. Plus you're paying 20,000 baht a month (x12 months) which is another 240,000 baht gone. So, now you're down to $4.56 million.

Basic retirement theory says you should drop your expenses to match the new value of your portfolio value. So, unless you're willing to give up your lease and get a place for 15,200 baht a month, you're going to have a hard time catching up to that 7% per annum rate of return because every monthly payment is eating into your principle.

Even if the market immediately bounces back 30% the next year, you're still short of 6 million (you would be at 5,928 million). But, that's rarely how the market works. You are far more likely to see 15% the next year, and maybe 15% the year after. But, since you started from a deficit, you're not just taking the rent money out of your capital gains, at least for awhile, you're pulling the returns out of principle so you're going to fall behind even further.

Look up "sequence of returns" for more information on how what the market does in the first few years impacts your overall returns.

-

2

2

-

-

51 minutes ago, DaRoadrunner said:

When China sneezes, the whole world could catch a cold.

I prefer to think of it as, When China farts, the whole world smells their <deleted>.

-

1

1

-

-

- Popular Post

- Popular Post

1 hour ago, tabarin said:Same in Phnom Penh, 1 BR apartments for 100K USD, some Chinese own entire floors and don't bother to rent it cheap.

Would not be surprised if they also have a fair amount in BKK, however, that China house buying boom also seems to be ending (soon).

But yet also unique that in Kuala Lumpur the rent of 2 and even 3 bedroom condo's is really cheap.The Chinese are doing this all over the world. They're desperately trying to get money out of the country.

In Hawaii, people are constantly complaining about the Chinese buying up the luxury condos and homes and letting them site vacant.

Vancouver's real estate market was going insane because Chinese were buying up places and letting them sit vacant. The city put a vacancy tax on any home kept vacant just to try to force them to at least rent the properties.

Up and down the west coats of the US, Chinese are buying like crazy.

Thailand is just one of many places where the Chinese are parking money.

-

3

3

-

On 11/12/2019 at 1:09 PM, findlay13 said:

I doubt it.The first time I saw the "thai way"was about 20 years ago in Pattaya.they was a big slowdown of tourists,so what happened? All the bar prices went up, to screw the fewer customers more.The logic defied me .I always thought more bums on seats lower the prices and sell more but that's not the "Thai way"

I have heard this story a gazillion times and I've yet to reconcile the fact that a large number of bars are owned by foreigners. So, "the Thai way" isn't just the Thai way. It seems to be the farang way too.

And wouldn't the farang bar owner that did it "the right way" and lowered their prices totally crush all of their competition? Why aren't these farang bar owners taking over?

-

1

1

-

-

I was hoping some kind souls could help me work out some blind spots.

I have a multiple-entry, non-immigrant O visa for the purposes of visiting family (my wife - we both moved back to Thailand) that we obtained in the US.

My first entry was 90 days. My passport was stamped that I am admitted until Jan 6 2020.

So, here are my questions:

1. My wife and I intend to be up visiting some relatives for the new year and don't want to have to rush back so I can fly out of the country or take a bus trip somewhere across the border. Plan was to leave Thailand on a border run before new years but can I get an extension in BKK and do it after we get back from our trip?

2. Are there any sort of TM30 reporting requirements with this visa? If I leave Thailand and re-enter, do I have to notify my landlord (we're renting a house)? And if there is a TM30 reporting requirement, is it going to mess with me leaving or entering Thailand when this 90 day period is up? I'm taking a wild guess my landlord will probably not bother to report.

3. Similar to #2, are there any 90-day reporting requirements? I assume, based on the fact that I have to leave every 90 days, it's sort of pointless but who knows? Also, would I trigger a 90-day reporting requirement if I was able to extend my first entry as mentioned in #1?

4. Is there anything special I need to do when leaving or re-entering Thailand so as to not invalidate the visa? I see that on a retirement or marriage visa that you need to fill out a re-entry form but I haven't seen anything like that for the non-immigrant O ME.

5. How many entries can I do in and out of Thailand on this visa? Is it good until one year after issue regardless of how many times I enter or exit the country? I know this sounds like a stupid question but I was always under the impression (which could be wrong) that the ME tourist visas were a max of two entries. Just wanting to confirm.

6. I ultimately plan on converting to a marriage visa. I understand it's best to apply 30 days from expiration of the visa. Is that correct? Best to use this visa to the max and then apply to convert it to a marriage visa on the last 30 days?

Thanks in advance for the help. New to all of this longer-term visa stuff.

-

2 minutes ago, Arjen said:

I have some good experiences with Thai Air. The have flights to USA, I do not know if they have flights close to where you are. General it is much cheaper to be on the same flight a your dog is.

Arjen

I'll give them a try.

-

I've been pulling my hair out recently trying to figure out what I need to do to import our two dogs into Thailand. I'm leaving from the US west-coast (LA specifically) and I've spoken to two airlines, Singapore and United because we have miles we can use for the flights. We were initially planning on bringing the dogs as checked baggage but now we're looking at potentially shipping them as cargo.

Talking to anybody at Singapore Airlines makes me want to throw my phone across the room. As far as I can tell, nobody can tell you if you can bring your pets on the flight. They say that you need to email their reservations department that has been average about a 3 day turnaround on every email. And, of course, they always seem to ignore your most important questions and cut and paste something from the website so you have to email them back and start the 3 day clock all over again.

That makes booking a flight difficult if me + wife are supposed to be on the same flight as the dogs. I am literally on Day 10 of trying to find out if I can book a specific flight and will I be able to bring my dogs. Singapore Air claims they are still checking room on the flight.

And then they dropped a bomb on me randomly telling me that the dogs have to clear Singapore AVS (Animal and Veterinary Services) before being transferred onto the Bangkok leg of the flight as the dog is considered "transshipping." Just a quick look seems to indicate Singapore requires a rabies titer test which I may be running out of time to get.

I called United, they seemed downright brain damaged. The lady looked up a flight that was flying United to Japan and then ANA from Japan to Thailand. For whatever reason, she did not seem to understand that I did not want to bring the dog into the cabin. So, she kept looking up flights and telling me that we could fly with the dog from LAX to Japan but we could not fly with the dog in the cabin from Japan to Bangkok. What am I supposed to do with the dog in Japan? She has no idea.

So I asked her about shipping the dogs as accompanied baggage, checked baggage, or whatever they want to refer to it as, but she seemed not to grasp the concept of the dog not flying in the passenger cabin.

Now, the wife and I are considering just shipping the dogs as cargo just to avoid the hassle of trying to get the dogs on the same flight as us.

I've dealt with a lot of Byzantine government BS with my wife's visas and US citizenship but this is a whole new level.

Reservation agents can't tell you if you can bring the dogs, but the people that can tell you, don't really want to waste their time unless you've booked a flight. But if I book a flight and there's no room for the dogs, then what?

Any advice on an airline that might know what they're doing?

-

Thanks for everyone's replies. You read all these different sites saying the same things but differently and you're wondering if you're reading things right. So thanks for clarifying.

What exactly constitutes a pre-existing condition?

in Insurance in Thailand

Posted

The colonoscopy was in a section worded similarly under gastro. And I stated it more in terms of, “Colonoscopy as part of 50+ physical.”

I’ll try your suggestion about explaining to them. My age is under 60 so that should not be the issue.