-

Posts

10 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by oceanbluejewell

-

-

12 hours ago, khunPer said:

Some banks offers online trading platform. I use SCB, so that's the one I can inform about, but there might others equally good, or even better.

To use SCB you need to open a savings account with an ATM card, that is the dedicated bank account to your trading platform.

You need 30,000 baht minimum for opening a trading account.

After opening you can register online on SCB-online, just click on "Open New Account" next to the log-in. Follow the screen information, and print out the documents, which you bring to you your the SCB branch, where you have your account; they will send it all for you to the SCB Securities branch in Bangkok. Within about a week you'll be up running with online trading

When buying stocks on SET you should opt for buying stocks available as NVDR – that will be default marked in you online platform – which means that you as foreigner have no voting right, but will receive dividends and everything else like for example subscription rights for new stocks.

If you wish to buy stocks in a company without the NVDR option, you need to look for stocks with an "...-F" at the end in the code, for example "JASIF-F". That means it's in a lot of stocks available for foreign ownership, but it's traded by itself. The trading price can therefore be slightly different from the normal SET-price, as it's depending of, if other foreign owners wish to sell, so trading numbers might be limited. You can however buy without the "...-F"-extension, but you will not be eligible for dividend, however you can get the shares transferred as "-F", but they will then also be transferred in the "-F"-quoted price and traded in that lot; some experience a drop in value.

You can move money instantly from you bank account into the trading platform with a mouse-click; you can also move money out, from trading platform to your bank account with a mouse click, but transfer that way takes around 3 bank days. Any dividends are paid straight into your normal savings ank account.

You will have a so-called "credit limit" in you trading account, that's the amount you can trade for in one day. It's possible to get it changed. I've got an english speaking personal advisor assigned by SCB Securities, whom I can E-mail to or call, for example for changing the "credit limit".

About tax.

There is a 10 percent withholding tax on dividend pay outs. You don't need to do anymore tax-wise, if you accept the 10 percent tax. Capital gains from SET traded stocks are tax free, and loss cannot be deducted in tax; so you don't need to bother about Thai income tax when trading on SET. Any interest from money in your bank account, or cash in your tranding account, will be withholding taxed at present rate; the trading platform cash-account paid 1 percent pro annum minus 15 percent withholding tax, just like fixed term bank accounts, but lately the cash has not earned interest.I've found it fairly easy to use SCB-online, but little more complicated – or just different – from my Danish bank's trading platform. On SET you always buy/sell in lots of 100s of a stock – i.e. 100, 200, 500, 900, 1500, etc. – and you shall always place a quote in the line. There is a lunch break, so that might be why suddenly noting happens online during midday.

Depending of what portfolio you are looking for, I found based on the Thai stocks I've been investing in that SET lives a bit of it's own life, not strictly following the World market, or the Asian market, but in major situations – like during a pandemi – a downturn is a downturn. However local knowledge – or just "nose" – might see potential in some branches and stocks even during a crisis. Before the pandemi my 3 full trading years' experience was – and mind you, that's based on the stocks I had chosen for my portfolio, so not SET in general, and it could be a (very) different experience for others – my experience was an average of 3 percent cash annual dividend after tax of my total invested capital (without gain/loss), and an average of 7 percent annual capital gain.

????

Great Post thank you

There are 39 members of SET and 32 offer online trading. Someone better than others.

https://www.set.or.th/set/memberlist.do?language=en&country=US

My portfolio generates over 3% after deduction for 10% withholding tax. I declare all income in home country and recover the withholding tax paid as a credit.

-

1

1

-

-

The SET will give 4 years financials + current year for example SCC : THE SIAM CEMENT PUBLIC COMPANY LIMITED

As was mentioned Google finance and yahoo will have more data but it is often incorrect. Best place to verify is the INVESTOR RELATIONS website for each company. SCC Investor Relations - most companies will archive 10 year if they have been in operation that long and other like SCC.BK have data going back to 2000.

A email to investor_relations will get you all you want.

I agree with previous comments about the level of knowledge required to research individual stocks.

If you open a brokerage account they will provide you with many tools for research often referred to as "PRE-TRADE" and you can look at fundimental data and technical data until your blue in the face.

The SET wants foreign investment and has published a handbook - attached. (Caution - some stocks have very little or no liquidity and depending on type you buy "F - foreign" or "R -Non-Voting depository receipt (NVDR)". Thus need to check daily volumes.

Again unless you have vast experience in foreign emerging markets, stay with what you know.

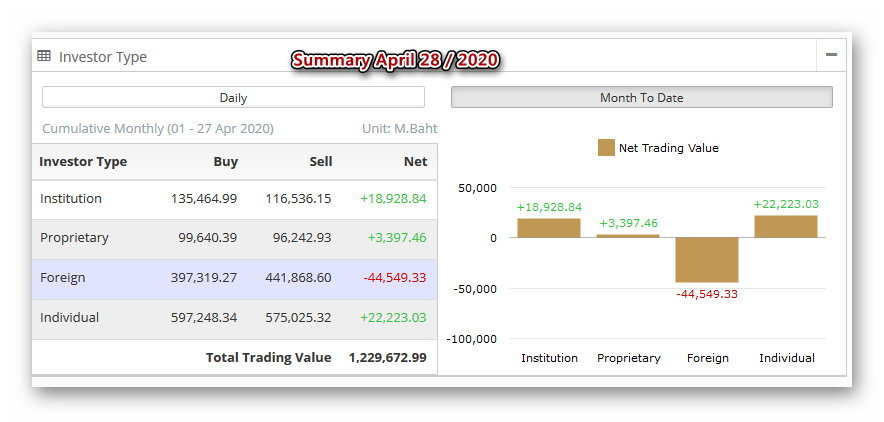

Most of the buying in last month has been institutional and local individuals - foreign investors are running for the hills. See attached image.

I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ oceanbluejewell

-

This is a tremendously volatile time in all world markets - I would advise one to tread carefully.

IPO's can be accessed via online brokerage accounts with changes to notifications so you become aware of offerings and you may require assistance of your broker if the offer is fully sold by the underwriting banks before it is floated on the market.

I would recommend to go visit couple brokerages and ask your questions.

List of member Brokers with phone numbers

I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ oceanbluejewell

-

- Interest Rate Of Cash Balance was 1.1% per year(before Tax) Ex: 100,000 baht * 1.1% = 1,100 - tax (15%) = 935 / 12 =779

- SET fee, CLEARING fee, and are included in avg.price. But we have sent documents that separate the com and vat values in the email

- Commission is 0.15% for buy and sell + Vat 7% on Commission.

- (Trading Fee) 0.005% + ค่าธรรมเนียมการกำกับดูแล (Regulatory Fee) 0.001%

-

You will need open a brokerage account in Thailand. I use BLS as I Bank with Bangkok Bank.

Visit your branch and ask see a manager for referral to the brokerage you wish use. They will do letter and application and forward (takes about 3 business days)

Make sure provide a Line id and email address as the representatives don't speak great English. They will contact you to vet you on your experience and determine how much margin they will give you on the "collateral investment account".

Once the account is open you must fund it - this may require you change you current savings To a version of the banks iBanking. Again limits of transfer are small so a visit to branch again to apply higher limits maybe required. (Increased mine to 100,000 / day)

Once the account is funded with cash you can research equities with a variety of tools. (Streaming - trade & research tool, iAlgo - complicated conditional trades)

I would suggest also registering with the SET so you can access company financial information and details on what kind of trading is allowed.

I mostly use the "streaming app" and iAlgo for more complicated trades.

Equity stocks are either full rights BBL-F or restricted NVDR meaning non voting dividend receiving symbol BBL-R

Full shares are or have no liquidity. The NVDR shares were established to encourage foreign investment and have more liquidity.

Tutorials are in Thai for all applications so a helpful thai friend if you can't understand.

The SET has good English language tutorials for about 60% of contents and financials. Are in English or Thai.

Dividends are never paid directly in to the collateral account. They are taxed and paid to your bank account. Only one company currently offers dividend reinvestment. You should get a tax number (TIN). You can then recover some if not all the tax on dividends and declare the income in home country.

Dividends are taxes @ 10%

Interest @ 15%

Capital gains are exempt.

Your plan and risk profile will determine your appetite for investments. Proceed with caution.

I own bank, 2 telco's, 1 high tech and 1 hospital chain.

Best of luck.

I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ oceanbluejewell

-

1

1

-

-

Which ever broker you pick ensure they offer support for Streaming and iAlgo apps and access to SET research tools.

I use BLS as I Bank with bangkok bank. The commission fees are low but will have VAT charged as well SET charges trade fee and clearance fees.

Tracking ACB can be tricky but is possible.

Depending on the broker the research you have access to will vary. Again as a dividend investor BLS came out on top for my needs.

-

You will need open a brokerage account in Thailand. I use BLS as I Bank with Bangkok Bank.

Visit your branch and ask see a manager for referral to the brokerage you wish use. They will do letter and application and forward (takes about 3 business days)

Make sure provide a Line id and email address as the representatives don't speak great English. They will contact you to vet you on your experience and determine how much margin they will give you on the "collateral investment account".

Once the account is open you must fund it - this may require you change you current savings To a version of the banks iBanking. Again limits of transfer are small so a visit to branch again to apply higher limits maybe required. (Increased mine to 100,000 / day)

Once the account is funded with cash you can research equities with a variety of tools. (Streaming - trade & research tool, iAlgo - complicated conditional trades)

I would suggest also registering with the SET so you can access company financial information and details on what kind of trading is allowed.

I mostly use the "streaming app" and iAlgo for more complicated trades.

Equity stocks are either full rights BBL-F or restricted NVDR meaning non voting dividend receiving symbol BBL-R

Full shares are or have no liquidity. The NVDR shares were established to encourage foreign investment and have more liquidity.

Tutorials are in Thai for all applications so a helpful thai friend if you can't understand.

The SET has good English language tutorials for about 60% of contents and financials. Are in English or Thai.

Dividends are never paid directly in to the collateral account. They are taxed and paid to your bank account. Only one company currently offers dividend reinvestment. You should get a tax number (TIN). You can then recover some if not all the tax on dividends and declare the income in home country.

Dividends are taxes @ 10%

Interest @ 15%

Capital gains are exempt.

Your plan and risk profile will determine your appetite for investments. Proceed with caution.

I own bank, 2 telco's, 1 high tech and 1 hospital chain.

Best of luck.

I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ oceanbluejewell

-

1

1

-

-

History will tell a bitter tale ...

Anyone wanting an alternative point of view should read this article.

"When the definitive history of the coronavirus pandemic is written, the date 20 January 2020 is certain to feature prominently. It was on that day that a 35-year-old man in Washington state, recently returned from visiting family in Wuhan in China, became the first person in the US to be diagnosed with the virus the very same day, 5,000 miles away in Asia, the first confirmed case of Covid-19 was reported in South Korea. The confluence was striking, but there the similarities ended." ...

The sad reality is that as the virus penetrates deeper into a population (saturation) many people will die from this virus.

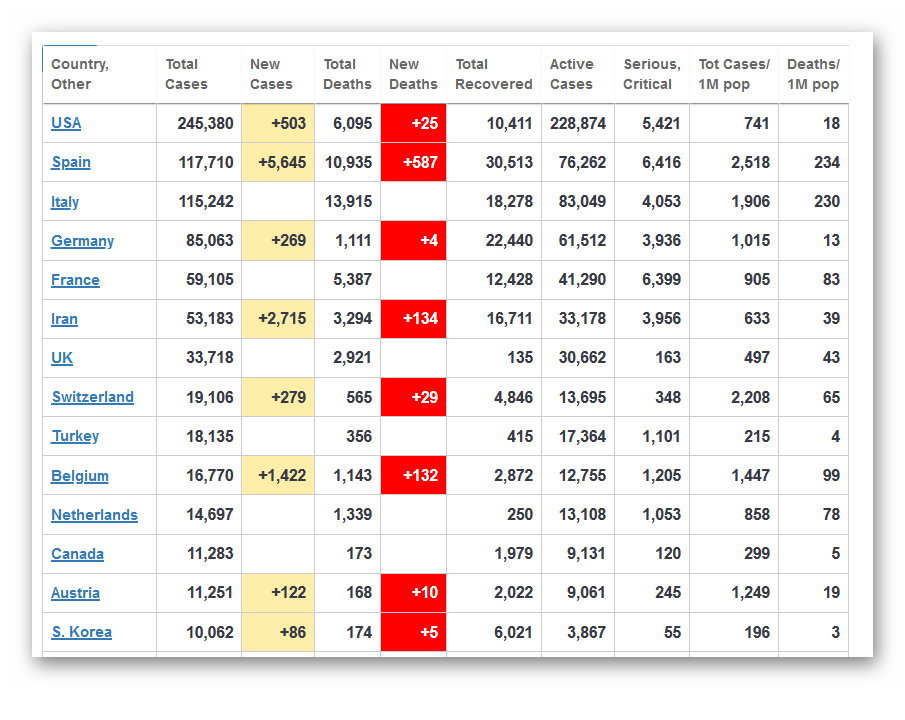

Stay safe and keep calm, America is lite up with COVID 19 like my Christmas Tree!!

For daily stats courtesy of Worldometers

-

1

1

-

-

On 11/2/2019 at 1:05 AM, Sheryl said:

There is currently no provision for accepting anything other than private insurance from the companies specified. No exemption for people covered under Thai SS, civil service (through spouse) or regular (through prior employment).

Anyone covered by the Civil Service SS scheme would, however, be eligible for extension based on marriage or being parent of a Thai and thus the insurance requirement would not apply.

the big problem is for people with regular SS...and the many of us with foreign insurance.

this will be interesting

i am married to a thai national who works for gov't revenue division as an auditor.

I have health card issued with my photo & have used it on 4 or 5 occasions.

According to her inquiry the coverage is valid.

Notes: 1st year I have a type ME O IMM and not sure who she talked to as I'm out of country. Will arrive shortly and do a test run. She's a hard ass so if it is not accepted they will start a dispute similar to a war. We don't have children yet nor do I have a Social insurance number.

I arrive shortly and wonder if I will have issues as my type O imm was issued in Canada.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Fund transfer from TH to Interactive Brokers Account

in Jobs, Economy, Banking, Business, Investments

Posted

You will need to verify the SWIFT CODE for interactive brokers. Once you confident that you have correct swift code, most banks can make the transfer for you. Unfortunately often this is not done correctly by Thai-Banks so I use a third party FX exchange service to make the transfer. The important part of the transaction is not just getting the money to Interactive Brokers but credited to your account with them. A quick search shows:

that IBKRUS33 - SWIFT Code (BIC) - INTERACTIVE BROKERS LLC in GREENWICH,CT - UNITED STATES

BIC / Swift Code IBKRUS33 is the unique bank identifier for INTERACTIVE BROKERS LLC's head office branch located in GREENWICH,CT - UNITED STATES and it's used to verify financial transactions such as a bank wire transfers (international wire transfers). BUT YOU SHOULD VERIFY WITH Interactive Brokers.

I use a third party foreign exchange service for the THB to USD and then transfer and deposit for me.

TransferWise

or XE Transfer

I have more favorable choice on the exchange and when moving money USD->THB or THB->CAD and then to the investment accounts.

I also recommend a small initial amount as a test.

IB has a video to teach you how here How to by IB

Hope this helps

I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.~ OceanBlueJewell