Y Chang

Member-

Posts

76 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Y Chang's Achievements

-

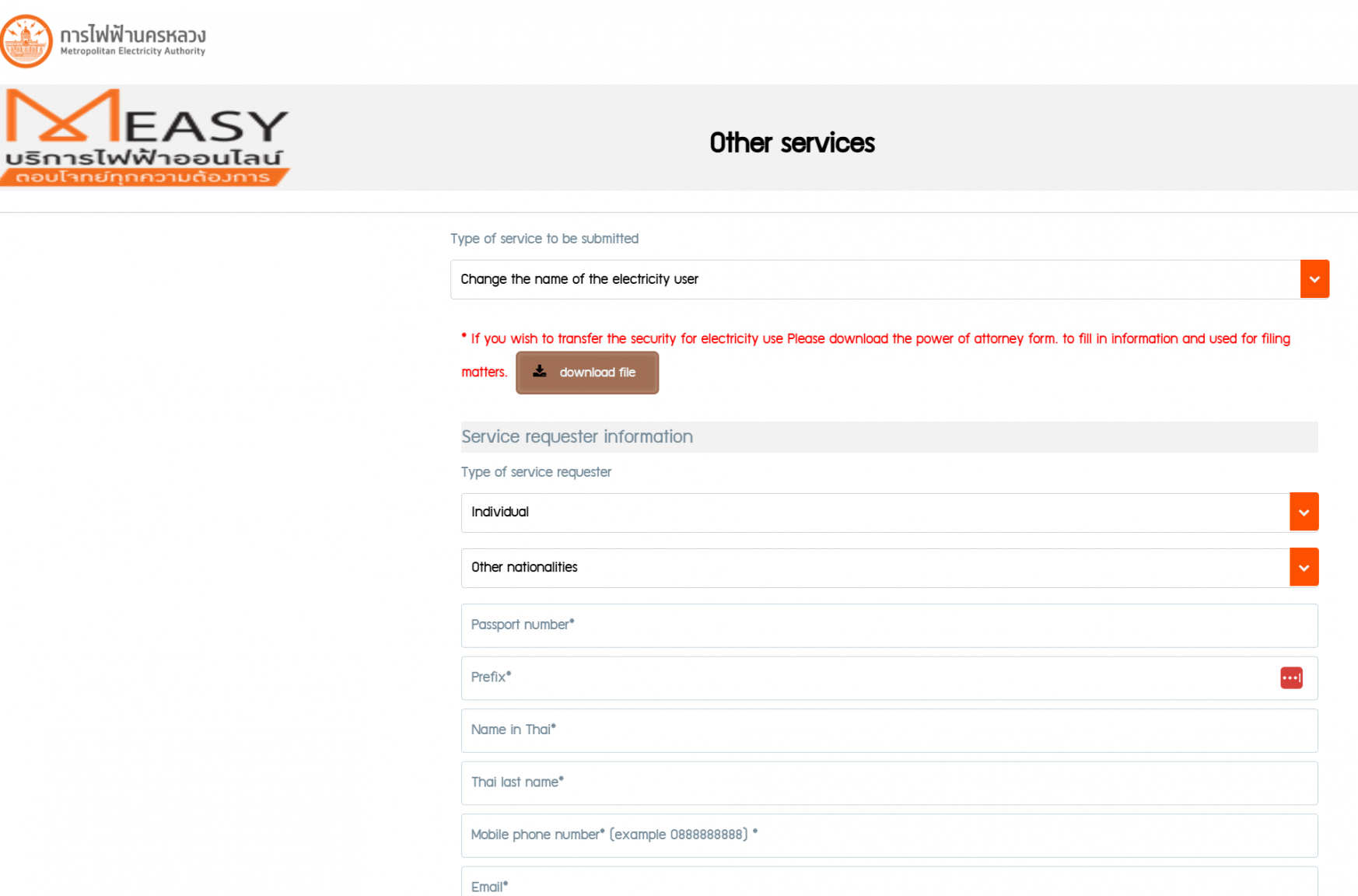

Thank you so much for everyone's input. As it turns out, my friend went to the MEA website to look for additional information. Per the website, there is an online service to change the name of the electricity user. See snip-it below. Out of an abundance of caution, my friend asked for the Chanote. The agent did provide the Chanote and the bluebook. She didn't go as far as cross-checking at the local Land Department for authenticity as suggested by John L. Instead she checked the credibility and the history of the agent. And she was quite confident of the authenticity of the condo ownership. Thank you so much for everyone's feedback. I have been living in Thailand for several years already, and still learn something new everyday!

-

A friend of mine has found a condo for rent in Bangkok. Prior to transferring the deposit, she asked the real estate agent to send her the property owner's ID and proof of ownership. For the proof of ID, she expected a title deed document. However, the agent told her that a electricity bill from MEA with the name of the owner and the address will be sufficient, because in Thailand only owner can set up electricity account. The agent further said that when one opens an electricity account, the person has to bring the title deed document to the MEA. Once the account is opened under the owner's name, it cannot be changed to a different name, until the property is sold to another person. I want to confirm if what he said is true. Thanks and look forward to any input.

-

Cataract surgery in the Bangkok and nearby area (some questions)

Y Chang replied to Y Chang's topic in Health and Medicine

Sheryl, thank you so much for sharing your thoughts. As I was weighing between monofocal and multifocal len, with a previous PRK in the equation, your opinion helps push towards monofocal being a more sensible choice in my situation. I have make an appointment with Dr. Roy, and will discuss further with him. Thanks again for your input, as always! -

Some background on my situation: doctor diagnosed I had cataract in my right eye, recommended surgery. Did some research afterwards. I am considering both monofocal and multifocal options. I have sent for price inquiry to a few hospitals and here are the replies: St Louis (start from 70,000THB, not including surgeon's fee, recommended Dr. Adisai); Bangkok Hospital (84,000 to 183,000THB); Samitivej Sriracha (no quote provided, just told us to make an appointment with a doctor); MedPark has a cataract surgery package with detailed pricing on each len option posted on their website (https://www.medparkhospital.com/en-US/packages/cataract-surgery-package). Here are my questions related to hospitals and doctors I would love to get your input: 1. Just based on the clarity on the pricing, MedPark seems to be my first choice at this point. Has anyone had their cataract surgery performed at this hospital? Who was your doctor? What was your experience? Was the final bill as expected, or was there any surprise? 2. Has anyone had cataract surgery performed by Dr. Adisai? Was it a monofocal or multifocal len(s) replacement? Was it at St. Louis or some other hospital? What was your experience was Dr. Adisai? Would you recommend him? 3. Any other recommended doctors and hospitals that are in the Bangkok and nearby area? Any pricing info will be appreciated as well. 4. Lastly, I had PRK about 20 years ago. Recommendation for a doctor who is experienced with patients with previous PRK will be helpful too. Thanks for your time in advance.

-

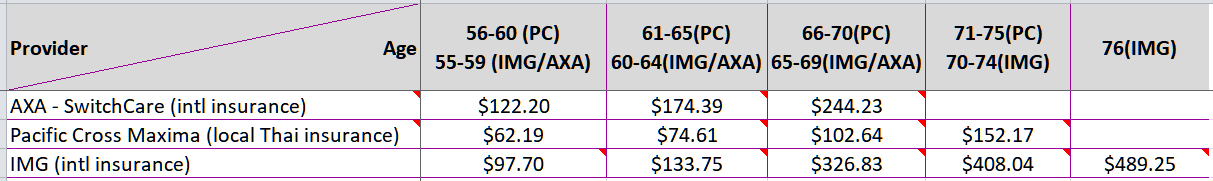

SooKee, I am the OP and thank you for sharing your thoughts. I completely concur with you! When I posted my inquiry regarding April insurance, I also explored other options. What I noticed was that there is a big jump of ~40% or more when hitting the 65/66 years old age band. For the other AseanNow members who might be interested, the table below includes a few examples to illustrate this jump: A quick calculation shows that there is a jump of at least 38% once one hits 65 or 66. These premium data are provided by the insurance company sales or broker and based on selecting the highest possible deductible; they apply to 2024's rate, so next year these numbers will again go up due to inflation, adjustment etc. SooKee, like you mention, finding the right balance between insurance and self-insured is tricky. The older we get, the harder it is! And again, thank you for sharing your experience.

-

Not me. It's someone I know.

-

Here is one data point for Scapho (secukinumab) injection from Bumrungrad back in 2022: There were a total of 9 injections. First 4 injections were once a week. Next 5 injections were either 3 or 4 weeks apart. The cost of each injection was either 15225 or 17082 thb. Physician fee for each visit ranged from 1000 to 1580 thb. Other hospital/nurse fee was 430 thb. There was also an initial imaging test that cost 1520 thb. Bumrungrad gave a 10% discount for the drug when paying via bank transfer. So total for the first month was 65820.6 thb. Each subsequent visit/injection was between 15000 to 18000 thb. Using the above numbers as reference, 50,000 thb for the first month may not be enough, but after the first month it is more than adequate. However, do note that this is one data point from Bumrungrad. Charges very likely will be lower at other hospitals. Hope that helps!

-

Thank you everyone for the reply, particularly Sheryl and Etaoin Shrdlu. I believe I was connected to expatinsurnce.com (and some other brokers) through ExpatDen. I filled in some basic personal info on ExpatDen and a few quotes came back. Expatinsurance.com being one of them. The broker introduced himself as a senior broker from Expat Insurance. He offered me the Global Medical Insurance Plan from IMG and the quote came directly from IMG. SiriusPoint is both the insurance carrier and the underwriter, while the plan administrator is IMG. I believe the insurance itself is legit. Also, the premium and benefits fit my criteria almost perfectly. I was looking for reviews regarding this particular plan so as to help me make a final decision whether I should go for it. But unfortunately the ones I found were on IMG's travel insurance products and almost all the reviews related to claims and payments were negative. I remember reading some AseanNow posts and some posters mentioned that brokers can act as a middle person and help resolve issues with the insurance providers. So I started looking for reviews on this brokerage firm. Unfortunately I didn't find any. Therefore in my original posting I was asking if any members have used this brokerage firm to buy health insurance. I then asked this broker suppose I need a pre-certification or make a claim after a treatment, do I contact IMG directly or go through him. He said he is a full service brokerage and can assist with pushing things along if anything ever gets stuck or I need help. I am very tempted to sign up for this insurance plan through this broker. What's really holding me up is that I am not having the confidence that when I need IMG to pay for treatment, will they look for all types of excuses not to pay... Besides looking for reviews on this insurance plan, any other suggestions on what else I can do to boost my confidence with this plan?

-

Has any AseanNow member used this broker (www.expatinsurance.com) to purchase international health insurance? Are they helpful when you have issues with payment to the medical providers? Do you recommend this broker?

-

I am considering the above insurance plan. It is underwritten and insured by SiriusPoint (a US company), and is administered by IMG (a subsidiary of SiriusPoint). The plan comes in 4 tiers: Bronze, Silver, Gold, and Platinum. Everything looks great on paper, from the coverage area to the benefits. However, there are very little reviews available online regarding this expat health insurance plan. Most reviews on IMG are related to their travel insurance products. If any Asean Now members are (or had been) insured by this plan, would you kindly share your experience? In particular, I am interested in the following: 1. Pre-certification: How long did it take IMG to process the pre-certification? What was the outcome, did they issue or did they reject? If reject, what was the reason? 2. Direct-billing: Assume the treatment was pre-certified, did they pay the medical providers after the treatment as they had promised? Were they any issues or dispute in terms of the payment amount? 3. Claims/reimbursement: If you have filed a claim after treatment, how long did it take for IMG to process your claim? What was the outcome, did they approve and pay, or did they reject? If they reject, what was the reason? 4. Renewal: This plan should provide lifetime coverage. Have you been denied renewal? If you have, what was the reason? 5. Premium: What is the percentage increase in annual premium within an age bracket? And from one age bracket to the next? If there is anything I have overlooked, please feel free to share as well. Look forward to hearing your thoughts. As always, appreciate your time in advance.

-

Well, it makes sense now why the few sales reps I interacted with were quite eager to sell me the moratorium policy! Sheryl, thank you for your input. They are highly respected, as always! They have helped me tremendously in avoiding many traps in this long journey of looking for the right expat insurance.

-

I posted some questions on expat health insurance not too long ago. Now I am considering the insurance underwriting type, ie. full medical vs moratorium. While each type has its own pros and cons, full medical underwriting seems to be more straight forward to me. I declare my medical history during the application process and all the exclusions and inclusions are spelled out upfront. However, for moratorium, there is no review process involved; although I can get insurance right away, I won't know exactly what is excluded until I make a claim. Do any of you purchase the moratorium type of insurance? Can you share your experience of the claim filing process and the outcome?

-

Thank you for the detailed explanation, Sheryl, and thanks for your time, as always! Will definitely check out AOC.

-

Thank you everyone for your input, particularly Sheryl and richard_smith237’s. The discussion help me clarify a few things now: 1. APRIL France is a wholesale broker. 2. APRIL International offers health insurance. The plan is MyHEALTH. There is a MyHEALTH Hong Kong, MyHEALTH Thailand and MyHEALTH Asia, just a few flavors I am aware of. Here is my story so far: I went to April France website, then select April International. Under “look for a plan”, I entered long term insurance in Thailand. The website returned with “MyHEALTH Thailand”. I then entered some other personal information to ask for a quote. A day later, a lady with a Thai name and with email extension “@April.com” contacted me. I asked her if she represented April out of Thailand or France, she said she was representing APRIL Asia. She suggested MyHEALTH Hong Kong (for a few reasons) and she confirmed that it is an international health insurance plan. I have a few questions at this point, and will appreciate any input: 1. @Sheryl, as you got your insurance from APRIL France, and APRIL France is a broker, which means APRIL France is not the insurer. Who is the insurer then? Are you also under MyHEALTH? If you are, which region does it cover? (Please feel free to let me know if you feel that this information is too personal or too intrusive, I understand). 2. Is it safe to take the words from this lady from APRIL, that the policy she is selling me is indeed an international policy? Is there anywhere I can verify additionally, or any documents I can ask for or check? 3. My goal really is to get a truly international insurance and I hope to avoid purchasing a local Thai policy unknowingly. If there are other safer brokers or insurance providers I can go to, please feel free to make any suggestions. 4. FYI, some approaches I have already made or will make: a. I have already approached ICI (International Citizens Insurance), they can’t provide any plans that fit my budget. b. I have contacted Expat Insurance and waiting for their response. c. GeoBlue is too expensive. d. Cigna Healthcare seems to have a plan that fits my budget, but they have very bad reviews. e. I will contact AOC, as suggested by Sheryl. f. Will also look into VUMI, as mentioned by richard_smith237. Thank you so much for everyone’s time, and as usual, I learn something new all the time!

-

Thank you for the info topt. I was wondering, are you currently with April International then? What is the difference between April France and April International? Regarding the reference from Sheryl, I was only able to retrieve her direction to AA-World. Unfortunately, their website has still not been launched yet. Sheryl, do you mind provide the contact info of your French agent again? Thank you so much.