Ray394

-

Posts

23 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Ray394

-

-

On 9/8/2020 at 1:19 PM, Sheryl said:

Can you post the names of available hosputals hete? Then I can advise further

Hi Sheryl, here's the list I receive from my team.

-

Thanks to both! I almost decided to go for Christian hospital where provides a couple options/brands for their patients. I will decide which fits to me the best after talking to Dr.

2 hours ago, Sheryl said:I would steer clear of clinics for this and stick to hospital.

Thanks for the advice! Hospital would be a better idea than a clinic...

1 hour ago, RotBenz8888 said:We did ours at Chula 4y ago very good service.

Yeah! Chula was one of my options as well, since I read many positive reviews. Looks like it's about 15k these days. Thanks!

-

1

1

-

-

Hi,

I'm getting my 10 weeks of pregnancy soon. And my clinic suggested the NIPT test in their clinic. The brand name is Qualifi by NGG and it provides Down, Edward, Patau syndrome and a baby sex information.

However before I proceed, I did some research and there are a couple more NIPT brands in Thailand such as Panorama and Genode. I know Panorama is a famous on in USA but never heard of Genode system. One of the clinic offer a lot more DNA information with cheaper price.

However I'm not sure how accurate this one is.

Could anyone provide me some information about NIPT? Thanks.

-

It's been almost 2 months since I submitted the first application for the April International insurance through my broker AA.

April's reply always comes within 2 weeks. I had a pre-existing conditions, so they had to re-calculate the premiums, but when I saw the numbers something was off. So I requested to receive the break-downs since it was a family plan with my husband. Of course another 1.5 weeks to get the reply. And they came back with break-downs which was different than the original quote they emailed. So I had to talk to AA again to fix the premium again and without any apologies from April, they fixed the premium for another next 2 weeks.... (they couldn't even sum their own numbers.. first quote says $2453, and when breakdown came, it was total $2300...sigh)

Almost ready to sign, but I found that April made another mistake, put my husband birth year as 1981, but his actual birth year is 1987. Guess what, I'm again waiting for their reply to re-calculate the premiums based on my husband's real birth year. And it's been 1 week already, still no reply.

My AA broker always cc me whenever he emails to April so I know my broker works hard for me, but it is always April's side that's pending.

Is it really a trustful company? If submitting and accepting the application takes this long time, how smooth their claim process will be, I'm afraid.... very disappointed.

-

19 hours ago, Sheryl said:

You really should change yoyr SS hospital registration and there is probably enough time to do so.

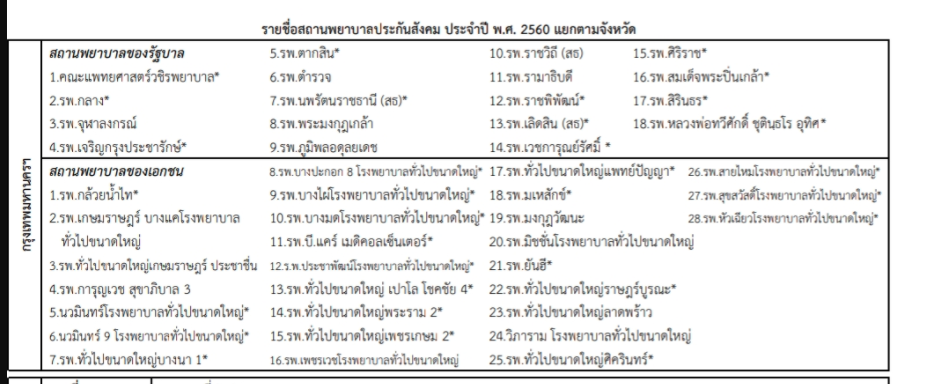

Yap definitely, now I'm looking at the list of hospitals but with my limit knowledge, it's a bit difficult to tell which is good one which is not. I'm still 5 weeks now so I will figure it out in next couple months!

Meanwhile Sheryl, do you happen to know a couple recommended hospital lists other than very famous one like Chula? I heard Chula is very difficult to get in. Thanks

-

Hi all, thanks SO much for all the advice and sharing your experiences. So it looks like the best option for me is... finding a nice public hospital where has NICU, and become a private patient from a certain doctor..

Anyway, I already chose myself to do a c-section, as I'm a very very small lady and my husband is very big and he was born over 4kg.. so I actually don't mind if private hospital is pushing me to do c-section. Although emergency care would be a problem there with extra, unexpected $$.

Thanks all.

-

On 9/6/2020 at 12:30 AM, BestB said:

i think he means extra loading on premium, ie extra 50% on top of the premium to include his pre conditions

Yeah that's what AA broker explained to me. However when I calculated it's actually more than 50% of charge of my original premium. So we are still waiting for reply from April....they are really really late on reply......

-

Hi,

I just found out that I'm pregnant. My husband and I both have SSO with Pecharavej hospital. And no private insurance to cover the birth in a private hospital.

I would prefer to go to one of the private hospitals and just saw the birth package which is a lot expensive but still affordable, however I read a story here that one lady had a birth in Bumrungrad and baby had to stay in NICU, which costed....$1,000 per night??? No one knows what will happen to me and baby, so I'm a bit worried to choose the private hospitals without an insurance.

Right now, my public hospital (Petcharavej) is not that bad for us to do a simple checkups, but the condition is definitely not suitable for baby birth.. (I think..) If anyone had an experience of baby birth in one of the public hospitals, could you please share a story and recommended hospitals? Then I could consider to move my SSO there.

Thanks,

-

1 hour ago, Sheryl said:

No idea what that means, might help to see it in context

You really, really should be doing this through a broker. They would then be able to explain ti to you.

Using a broker does not cost more, and has the advantage that the broker can help afterwards if there are any issues with claims

I am going through this with AA broker, but somehow April always replied me back directly... So then I include my broker again. I already messaged back to both April and my broker about this.

And there was no context at all but just new offer says, here's a condition "50% increased Medical expenses" that's it ????

-

On 7/30/2020 at 9:59 PM, Sheryl said:

Pretty much all insurers require pre-approval for hospitalizations. In an emergency can inform them after arrival at the hospital but should be within 24 hours.

Also, for direct billing (payment of the hospital by the insurer, leaving you out of it except for any deductible - definitely the preferred arrangement) the hospital has to submit some paperwork (treatment plan, estimated cost etc) to the insurer which then provides them with a "Guarantee of Payment" and most private hospitals will not want to treat - at least not for anything costly - until they get the GOP. This process takes a few hours at least (and speediness may depend on the hospital at least as much as the insurer i.e. some are better than others at churning out the paperwork).

Should you be in a government hospital it will usually nto be possible to get a GOP and you'll have to pay and be reimbursed afterwards, not because of the insurer but because the hospitals don't have the capacity and staff to handle it and set up diorect billing. Possibly the really big ones in Bangkok differ in this regard, I don't know.

In my case the hospital took care of contacting the insurer. We got the go-ahead in about 4-6 hours (on a Sunday). As I needed immediate surgery the hospital gave me the option of making a deposit with my credit card pending the insurance authorization or else delaying the surgery by several hours, I chose the former (turned out to have been a wise move, medically) and when the insurance OK came through they tore up the credit card deposit. For a planned hospitalization of course no problem. In an emergency the hospital might ask you to front a deposit to cover the initial costs pending the insurance OK especially if something costly like surgery is needed right away.

Hi Sheryl, so April came back with the offer and they will cover my existing conditions with higher quote but there's a condition saying '50% increased Medical expenses' do you know what does this mean? I emailed back to April but they takes more than 3 weeks to reply.... ???? just want to know if it's a common terms in insurance world, cause I don't know if that's benefit to us or them.

-

2 hours ago, Sheryl said:

Yes, you must record this if it fits the questions asked. For example if they ask anout any surgeries ever or if they ask about surgeries in the past X years and this surgery was within that time frame.

Also if they ask (as they surely will) about any chronic condition.

Endometriosis is a chronic condition and unless you have passed menopause or had a complete hysterectomy, you still have it even though the surgery may have removed the symptoms for now.

Depends on the insurer but usually when there is a chronic condition like this they will just list it as an exclusion (no effect on your premium) or give you the option of paying a higher premium or accepting an exclusion.

Lying/witholding information on an application is fraud and can invalidate the entire policy. Do not do that.

You are absolutely right! I just filled in it with honesty. I'm applying April International and there's no Chronic diseases question though, only question is 'have you ever been hospitalized within last 10 years' that's it. And I'm putting my surgery condition there.

-

On 8/1/2020 at 9:30 PM, Sheryl said:

All insurers increase premiums as you age.

Some do it yearly, some do it in 5 year brackets. Those that do it in 5 year brackets, when you cross an age bracket the jump is very big e.g. 30-40%. those that do it annually, increase will be under 10% each year. Works out the same over the long term.

I've had April for 3 years now, virtually no change in premium cost, because I am still in the same age bracket. I have been very happy with them.

Sorry for another question Sheryl! I'm about to submit my application to a broker.

I had my endometriosis removal surgery a couple years ago in my home country. Do I have to write this down? I'm... Curious how is France insurance company can find out my medical record in my country... especially in Aisa?!

I know it's silly but I'm just worrying that my application would be denied by this or premium would be very high.

-

On 8/1/2020 at 9:30 PM, Sheryl said:

All insurers increase premiums as you age.

Is there a 'fixed premium' for health insurance in Thailand? In my country, there are two ways to pay your premium, which are fixed and non-fixed. Non fixed premium is just like how we normally pay. It increases as you age. Fixed premium is, you pay same amount of money till 80 years or above.

For example, I'm 40 and non fixed price will quote me $100 a month and it increase every year or 5 years, however fixed premium will charge me $160 a month but never increase.

In my country, it's a very common way to join a health insurance but cannot find similar policy in Thailand. Have you heard of any insurance company does this?

-

On 7/31/2019 at 5:35 AM, Sheryl said:

I have it to (he international one). Very happy with it. I got it through AA Brokers and very happy with them as well.

They do cover take home medications but you have to pay first and get reimbursed same as for the follow up visits. Which are unlimited but within the 30 days after discharge. I was fully reimbursed for about 60K baht of discharge meds and follow up OPD visits after a recent hospitalization. Again, I have the international plan, don't know if the Thailand plan differs,

My AA broker also introduced me April international. But there's a big note saying 'treatment exceeding $2,000 needs prior approval from the company'. Is yours also have the same policy? If yes, how easy is the approval process?

-

Hi I'm shopping for private insurances in Thailand. I have a few options with all similar prices.

1. Cigna

- Inpatient/ Cancer full coverage

- Cover area: Thailand and country of origin

- Prescribed medicines that I take home after hospitalisation is not covered however.

- Max coverage usd500k, but max 250k per condition. (I'm thinking, who would have two major conditions in a year... I know it could happen, but it sounds like max coverage is only 250k per year to me)

- Semi private room only (I read online that Thailand's high end hospitals such as Bumrungrad only have private rooms, in this case it cannot be covered right?)

- $1500 deductible per year

2. April TH

- CInpatient / Cancer full coverage / 0 deductible

- Cover area: Worldwide Excl USA

- 16.375 Baht 60 days before and after the hospitalisation (it sounds like any medicines and drugs can be covered with a limit for non inpatient cases, which is slightly better than above plan)

- Private room

- I like this plan the most, however under the Terms and Conditions it states that "we can end your contract or increase premium due to high claims" whilst Cigna specifically mentioned that that won't. I mentioned this part to my AA broker and he said it's due to law they have to mention it, however it won't happen.... (true?)

3. April International

- Inpatient / Cancer / 0 deductible

- Thailand only

- Two bed

- Similar to others but in the benefits, it says "any treatment that's exceeding $2,000 needs prior approval from April" Is it normal? Same AA broker answered me "If you need to be hospitalized the Insurance Company always need to give a PRIOR APPROVAL if you want direct billing between company and hospital. All insurers work the same way. The hospital has to ask for it." Is it true?

I'm very new to this insurance world... so I need to learn many details of TnC... please help me to choose the right one.

Thanks,

-

I'm back to my own post. After researching and getting quotations from the brokers, I ended up with these two plans.

1. April

Looks like there are two different ways to join, one is for the international and one is Thai based. Still not sure what's the differences are and pros/cons. Quotation was from Myhealth, Thai based one, IPD only, full cancer coverage, up to 16M THB (around USD500k) cover. No deductible (which I prefer.)

2. Cigna

I contacted to Jimmy (found his email from this forum), he called me right after I emailed him and introduced me the Close Care plan. Coverage is same as above $500k IPD only and full cancer coverage but $1500 deductible per year. One benefit of Cigna seems like, I don't need to pay to the hospital first as they pay direct and I pay the rest, also it allows me to get a treatment from my country of origin as well for a certain period of time.

Both plans monthly prices are same. In this case which one should I go with? I read the full t and c of April already but Cigna didn't send it to me yet. On April's TnC says "ending the contract is fully company's right" something like that.. Is it normal or all other insurance's TnC would have it?

-

Hi

My husband and I are under 35 and living in Thailand for 4 years so far. We only have SSO (government insurance).

We'd like to have an extra private insurance that covers 100% inpatients for any diseases and surgeries plus cancers.

My question is, those general coverage for inpatients, includes any type of cancers as well or not? We are still young but both families have history of cancers so we'd like to be covered in early age.

I checked AXA insurance and they seem reasonable but they have extra cancer insurance, so it made me confused. Does that mean cancer will be covered only under extra cancer insurance?

Our budget is around $1500 p/y per person, if you know any good other company/ suggestions, please let me know.

Thanks in advance.

Baby birth in public or private hospital?

in Health and Medicine

Posted

Thanks a lot Sheryl!