-

Transfer code for international transfer what does Immigration accept

The agent with the parking lot across from the airport immigration office has successfully obtained an extension recently using the monthly income method with social security deposits directly into Bangkok Bank showing TPP code, without an increase in the normal fee.

-

Is money sent to family from outside of Thailand subjected to the new foreign income tax?

Not including property acquired by either spouse during marriage through inheritance or gift. Thai Civil and Commercial Code, Chapter 4. Property of Husband and Wife Personal Property and Marital Property Last updated: 26 Sep 2023 https://www.lafs-legal.com/blog/9633/personal-property-and-marital-property Personal Property According to Section 1471 of Thailand’s Civil and Commercial Code, which governs matters related to family, personal property is defined as follows: 3. Property acquired by either spouse during marriage through inheritance or gift If a spouse acquires any assets or property during marriage through inheritance, whether as a statutory heir or a beneficiary named in a will, such assets are considered personal property of the acquiring spouse. The same applies to gifts received by either spouse, which are specifically intended for them and without any consideration. Such gifts are the sole property of the receiving spouse. This principle also applies when a spouse gives a gift to the other spouse, which will be deemed the separate property of the recipient, even during the marriage.

-

Thai wife being taxed on her US SS

This is not the DTA with the U.S. @khunjeff clarified the issue which appears to be a misapplication of Article 21 paragraph 2: 2. a) Any pension paid by, or out of funds created by, a Contracting State or political subdivision or a local authority thereof to an individual in respect of services rendered to that State or subdivision or authority shall be taxable only in that State. b) However, such pension shall be taxable only in the other Contracting State if the individual is a resident of, and a national of, that other State.

-

My Thai Tax Office Tax Filing Experience...

Except for Carden's office, one must still file a return to declare the remittance of pre-2024 income even though it is exempt from calculation of tax, so you still need his services to file using attachments to report what cannot be reported on the tax form.

-

My Thai Tax Office Tax Filing Experience...

In the video referenced above: Khun Pattharaphon Penjham, Senior Legal Officer at the Legal and Tax Collection Department, Pathum Thani Area Revenue Office, kindly joined our recent webinar to answer key questions. But the topic was a setup to get him to confirm the position taken by Expat Tax on cash in the bank. He did not exactly wholeheartedly make the point that only cash in the bank is acceptable. One might think that by limiting pre-2024 income this way, it would generate more business for tax advisory services; widening the meaning of pre-2024 savings would reduce the need for paid assistance on filing tax returns for years going forward.

-

My Thai Tax Office Tax Filing Experience...

Good approach, like getting a second opinion from another doctor. However, all of these differing opinions from 'tax doctors' is becoming like a surreal nightmare. While Carden's office refers to advice from TRD's legal staff, Expat Tax also claims that its' advice comes from TRDs' legal staff. Yet these two companies provide conflicting advice. For example, Carl Turner sets up the question of pre-2024 income as an issue limited to cash in the bank here: A Senior Legal Officer from Thailand’s Revenue Department Answers Expat Tax Questions Feb 5, 2025 https://www.youtube.com/watch?v=2_vGytBre2o Transcript 35:47 so next question we get this we get many questions on this how will pre 2024 cash 35:48 Pre-2024 income cash in the bank 35:53 in the bank so Savings in the bank before 2024 uh how will the savings be treated under the new rule so we're talking about cash in the bank so pre 2024 income or that was actually moved into Cash how is this treated uh for okay uh so called yeah the income cash uh saving in your bank the income that you earn before 2024 is not taxed if it remains offshore or is brought into Thailand in future calendar years yes is it clear yes but it's only a capital for bank accounts or cash accounts is exempt right clear yes the interest is still taxable right yeah yeah okay ex that uh you cannot apply this to the investment or pensions no right so so it's just for cash in the bank not pensions not pions not Investments yes yes fine that's clear right great that's really useful right fine and then the last question

-

Thai tax tangle: Expats warned of new rules on overseas income

I asked the TRD information call center 1161 what evidence is required to show pre-2024 assessable income that can be remitted exempt of taxation under P. 162. The official said: "hold the line, I will get the answer." The answer was: "You have to ask your local district tax office what evidence is required by them."

-

My Thai Tax Office Tax Filing Experience...

What is the monetary value of unrealized gains? If assets are converted into capital/cash, the value of the pre-2024 assessable income is the value of the cash; then one can calculate the original capital and the gains for tax assessment upon remittance. If this was done in 2023, then one can remit the cash with exemption from declaring and calculating for tax.

-

My Thai Tax Office Tax Filing Experience...

In the video it was asked and answered if one has assessable income that is below the filing thresholds, does one need to file? The tax return assessable income filing thresholds are (single) 60k/120k and (married combined) 120k/220k, as stated in Section 56 of the Tax Code. There are no thresholds for filing that incorporate deduction of expenses and allowances and the first 150k of the 0% tax band. The threshold referred to is for filing, not for taxation. For example, if you are filing single aged over 65, there is an exemption of 190k. If your assessable income remitted to Thailand is 150k, you still need to file -- because the filing threshold is 120k.

-

Thai tax tangle: Expats warned of new rules on overseas income

Department of the Treasury Technical Explanation of the Convention between the United States and Thailand which was signed on November 26, 1996. https://www.irs.gov/pub/irs-trty/thaitech.pdf Article 20 (Pensions and Social Security Payments) Article 20 deals with the taxation of private (i.e., non-government) pensions, annuities, social security, and similar benefits. Paragraph 1 Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient. The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. In the United States, the plans encompassed by Paragraph 1 include: qualified plans under section 401(a), individual retirement plans (including individual retirement plans that are part of a simplified employee pension plan that satisfies section 408(k), individual retirement accounts and section 408(p) accounts), non-discriminatory section 457 plans, section 403(a) qualified annuity plans, and section 403(b) plans. https://www.irs.gov/retirement-plans/plan-sponsor/types-of-retirement-plans Types of Retirement Plans Individual Retirement Arrangements (IRAs) Roth IRAs 401(k) Plans SIMPLE 401(k) Plans 403(b) Plans SIMPLE IRA Plans (Savings Incentive Match Plans for Employees) SEP Plans (Simplified Employee Pension) SARSEP Plans (Salary Reduction Simplified Employee Pension) Payroll Deduction IRAs Profit-Sharing Plans Defined Benefit Plans Money Purchase Plans Employee Stock Ownership Plans (ESOPs) Governmental Plans 457 Plans Multiple Employer Plans

-

Thai tax tangle: Expats warned of new rules on overseas income

More from my one hour phone consultation with the TRD call center today: Q: If I invested income 40 years ago into a life insurance annuity and now I am receiving return of original capital, is that receipt of the original capital exempt from Thai taxes upon remittance under P. 162A regarding pre-2024 income? A: Unless the life insurance annuity is with a Thai company, the RD considers that assessable income arises when you receive the annuity payment from the life insurance company regardless of the fact that you deposited the funds 40 years ago. Q: According to a prominent Thai tax advisory services company website, annuities are to be reported under income category 40(3); is this correct? Understanding Assessable Income from Intellectual Property and Annuities (Section 40(3)) Paragraph 3 of Section 40 of the Thai Revenue Code addresses income derived from intellectual property rights, annuities, and similar revenues. This category includes: Goodwill: Payments received for utilizing a business’s strong reputation or brand identity. Copyrights and Other Rights: Income from intellectual property such as copyrights, trademarks, patents, or other proprietary rights. Annuities: Ongoing payments from sources like private retirement plans, investments, or insurance products. Annual Payments: Regularly received fixed sums stipulated by a will or other legal agreements. Income from Juristic Acts or Court Decisions: Payments mandated by legal rulings, including settlements or other court-awarded compensations. https://www.expattaxthailand.com/understanding-assessable-foreign-sourced-income-in-thailand/ A: Assessable income from a life insurance annuity is to be reported under category 40(8) under "other," not under category 40(3), which only applies to court-ordered payments of compensation. The fact that you deposited assessable income into the annuity under a legal contract 40 years ago is irrelevant for Thai income taxation. The tax year when you receive the repayment of your principal is when you receive assessable income that is subject to taxation upon remittance to Thailand. The overwhelming influence of the recent RD Order P. 162A vis-a-vis the tax code and standard Thai taxation practices does not appear to have been taken into consideration by the call center official. P. 162A is only now undergoing it first test in the real world of the Thai remittance-based income tax system. Live & learn!

-

Thai tax tangle: Expats warned of new rules on overseas income

Normally, withholding tax complies with the Thai tax system for employers and banks for withholding tax on income derived in Thailand. Fudging the numbers is falsifying a report of payment of withholding tax to the RD that did not occur. Signing a tax return with known falsification of data is illegal. Slippery slopes ...

-

Thai tax tangle: Expats warned of new rules on overseas income

According to Carl Turner at Expat Tax, we can use FIFO for remittances. The TRD crypto handbook states that a taxpayer can use FIFO, LIFO, or cost averaging, but the same method must be used for an entire tax year.

-

Thai tax tangle: Expats warned of new rules on overseas income

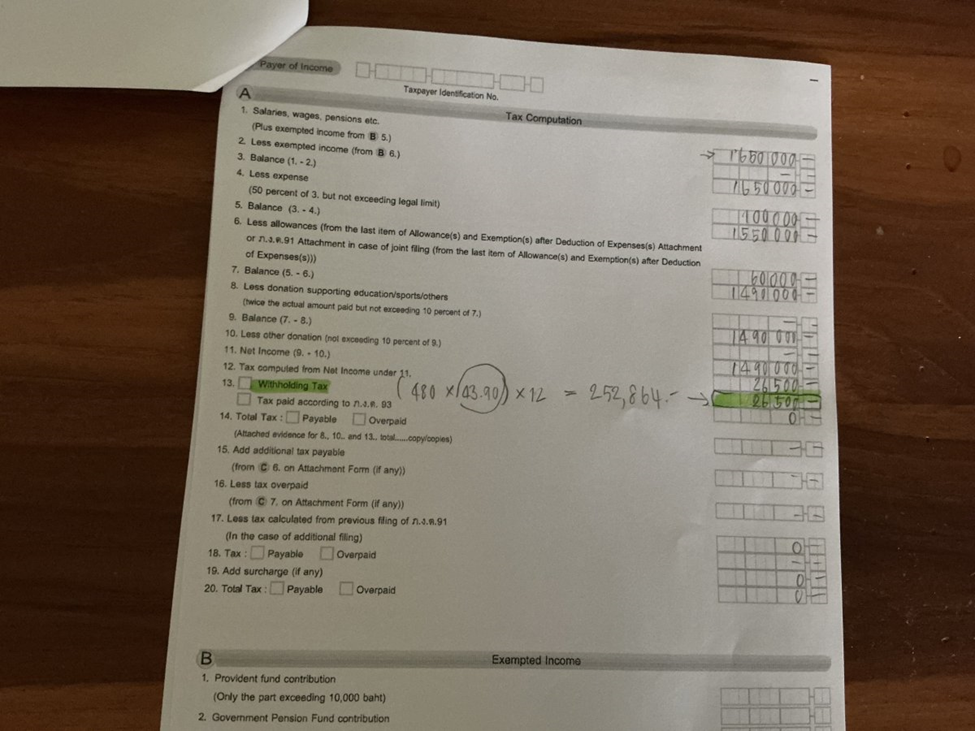

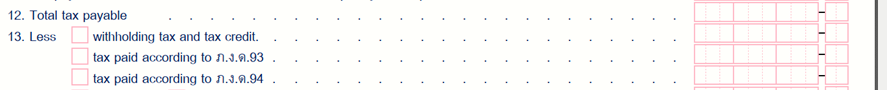

Fellow TROT (Tax Resident Of Thailand), I suspect that the last time you went there, her penciled calculation based upon 480 per month multiplied by the exchange rate into Baht was her helpful attempt to cancel out your apparent tax liability (which shouldn't have appeared) on your foreign-sourced income by entering that amount at item 13 as withholding tax to cancel-out the tax liability that appeared at item 12. She entered the exact amount of your tax liability on item 12 into item 13, even though her calculation of your "withholding tax" exceeded the tax liability by almost tenfold. So she merely hacked the system by entering only the exact amount needed to cancel-out your apparent tax liability. Problem solved for her and for you, even though it might be difficult to explain to AN English-speaking expats, AN users, and such perfectionists. Look at item 13 Withholding Tax Here is the same item in unofficial translation of PND 90: Notice that item 13 is "withholding tax and tax credit." She gave you a tax credit for something -- ? the tax you paid in the UK @480 monthly. And that hack by her solved her problem of how to absolve you of an apparent tax liability -- she did her best to help you, even though she mistakenly entered your tax-exempt UK govt. pension into the PND 91 form that she never had to use if she understood the DTA. But she didn't, yet she did her best to hack the system to solve her problem of how to get rid of you while performing her duties correctly. Mai pen rai -- happy to help you, TIT! And for your nemeses on AN: Here is a place where a DTA tax credit can be accessed in the Thai income tax filing form PND 90 and PND 91 on the paper forms! PND 90 states "tax credit" in Thai.

-

Thai tax tangle: Expats warned of new rules on overseas income

I specifically tried to limit the scope of the inquiry to clear examples that could form the basis to infer the principle in the tax code: exempt from inclusion in tax calculation = not reportable = no need to file.

Guavaman

Member

-

Joined

-

Last visited