-

Posts

509 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by hagler

-

-

On 6/24/2018 at 10:05 AM, 4MyEgo said:

I like the sound of that, i.e. less than $200,000, no tax

So I can take out up to $200,000 now and pay no tax, wait to 60 to get the balance and pay no tax.

I was born after 1960, and based on the above, I could take out up to $200k without paying any tax as I have reached preservation age according to my calculations.....hmm, things must have changed since I last spoke to my accountant a few years ago, because he said as a non resident I would pay 32.5c in the $.

Will send him an email now and see what he says, because if I can take that amount out, without paying tax, I would be better off investing it.

Just to clear the air on the tax component here, its 32.5% if you hold a shares that are unfranked, meaning the company doesn't pay the tax on it when it pays you the dividend, like a fully franked dividend share does, i.e. pays the tax before it pays you your dividend (tax paid), so long as you sell the unfranked share before it pays its unfranked dividend you won't pay tax on it, unless you want to hold the share while it rises, pays its unfranked dividend and you pay the tax of 32.5% on it, remember, there is no capital gains tax payable on shares, and so as long as you stay within the boundaries of fully franked dividends your ok as far as no tax is payable.

I understand what your saying about Labour and Liberal thinking to start charging foreigners tax on investing in the ASX, but personally, I can't see that happening, for the reason being, that a hell of a lot of money would leave the ASX which would not be good for a lot of Australian companies, perhaps an ASX crash would happen.

So I am not fussed about their talk on this, besides the money to be made in the ASX is very good if you invest wisely, especially as there is no "current" tax payable for foreign residence, especially when you convert the money made to live in Thailand.

The difference is cut and dry, i.e. if I held onto my property, I would be paying 32.5% in tax, plus water and council rates, annual foreign resident land tax, levies if strata titled, insurances, maintenance, agents management fees, agents reletting fees, advertising fees, taking vacancy factors into consideration (if any), accountants fees and finally capital gains tax when you sell, so when you add the above, your at 50% plus and that doesn't take into capital gains tax into consideration because it only comes into play when you sell, so when you sell, it could go as high as 60%-70%-80% annualised, whereas the ASX is zero $, I know it sounds crazy, but it is the only loophole there is out there for us Xpats who may have some coins from all those hard years of working and being fortunate enough to have purchased property as an investment or place to live in, then being forced to sell because of the ATO's residency laws.

Getting rid of the funds as least 5 years prior, applying for the AAP as it is now referred to, and then getting the funds back, might be a bit sticky as you said in another post of mine, will just have to keep chipping away at the blackboard for fresh ideas, maybe a trust for the kids, the accountant will have to come up with some brainstorm idea I guess, Singapore perhaps, then back here in Thailand, who knows, not far off, 4 years to get rid of it, and no, will not be sending you guys any, nothing to do with trust 555

There is a lot of "misinformed facts" in a lot of what you have said. Not going to go into it in detail but an example would be that shares don't attract CGT. They do,

I would suggest you get professional informed and competent advice on on the taxation in relation to real estate , CGT, foreign residency requirements and obligations at a point in the near future before you make some serious missteps. And yep I am a practicing professional in that world. And no I'm not seeking new clients

Best of luck to you and hope you get things sorted properly

-

- Popular Post

- Popular Post

6 minutes ago, cardinalblue said:Thailand is not completely a free press. It is not surprising at all that there is limited or no progress coverage...

It's all about protecting face and should there be a bad outcome or even worse not be able to provide any substantial info, it sheds negative light on the culture and its image....

There are many, many "live" and very very frequently updated coverages of this event on both Thai Social Media and the Thai press.

How about leaving the "old western guy over 50 complaining about Thailand while still living there" stuff at home and spare your energies for positive thoughts for the kids on this one ?

-

5

5

-

2

2

-

I need to see a lot more uncensored pics before I can pass judgement on whether it is lewd or not

-

1

1

-

-

- Popular Post

- Popular Post

1 hour ago, FreddieRoyle said:From Wikipedia

The English are a nation and an ethnic group native to England who speak the English language. The English identity is of early medieval origin, when they were known in Old English as the Angelcynn ("family of the Angles").

https://en.wikipedia.org/wiki/English_people

I have no idea why it is not a hate crime to deny the Brits their history and culture. It is very hateful, but yes I know these days every race and culture are allowed to be proud of their country and heritage except for white people. Trump, I imagine will change this despicable hate of whiteness during his 2 terms.

So "traditional brits" are the only ones who feel scared of knives?

You Sir are a xenophobic racist. Who lives in another country himself where he doesn't hold citizenship or have voting rights. Toddle back to your traditional home country then.

-

5

5

-

1

1

-

- Popular Post

- Popular Post

2 minutes ago, FreddieRoyle said:Traditional Brits

what's a "traditional Brit" ?

-

3

3

-

1

1

-

- Popular Post

lol...Im sure the French embassy staff ( well the French Consul in CM anyway) are going to bend over backwards to get em out of this.

It will be "here is a list of lawyers that you should contact and we will come back and see you in a week or 2"

Why do people who do idiotic things think that it is the embassies job to get em out of the <deleted> they got themselves into.

-

14

14

-

As someone who comes at this issue from the side of the fence of being a landlord with more than 5 properties I have been in the Kingdom since Monday signing new contracts with the existing tenants to reflect the changes to the legislation.

It is a kind of "win/win" in that the tenants get new rates of utility consumption and the most important section to a lot of tenants being able to end their contract with 30 days notice and I get new contracts with terms in some cases that are longer then the previous existing ones.

It is not compulsory to sign new leases and existing leases are "grandfathered" through until their expiry if both parties dont agree to end the current one by mutual consent.

-

2 hours ago, Peter Denis said:

No, I am not dreaming.

I paid 95 Euro (approx 4.000 Bath) for 1 full year of Travel Insurance, with quite generous conditions in case you need help.

The 95 Euro is for 1 person, for whole family it's only 130 Euro.

This Allianz Classic-Protection Insurance policy covers a.o.:

- full pay-back of all medical expenses abroad up to 250.000 Euro (yes, almost 10 million Bath)

- unlimited re-patriating costs

- medical after treatment in home country up to 6.250 Euro

- find and rescue costs up to 3.750 Euro

- etc.

On top of that you even get home assistance, when there is damage to your home when abroad.

The polis covers ALL your trips abroad during one year, only condition being that a trip is limited to 90 days.

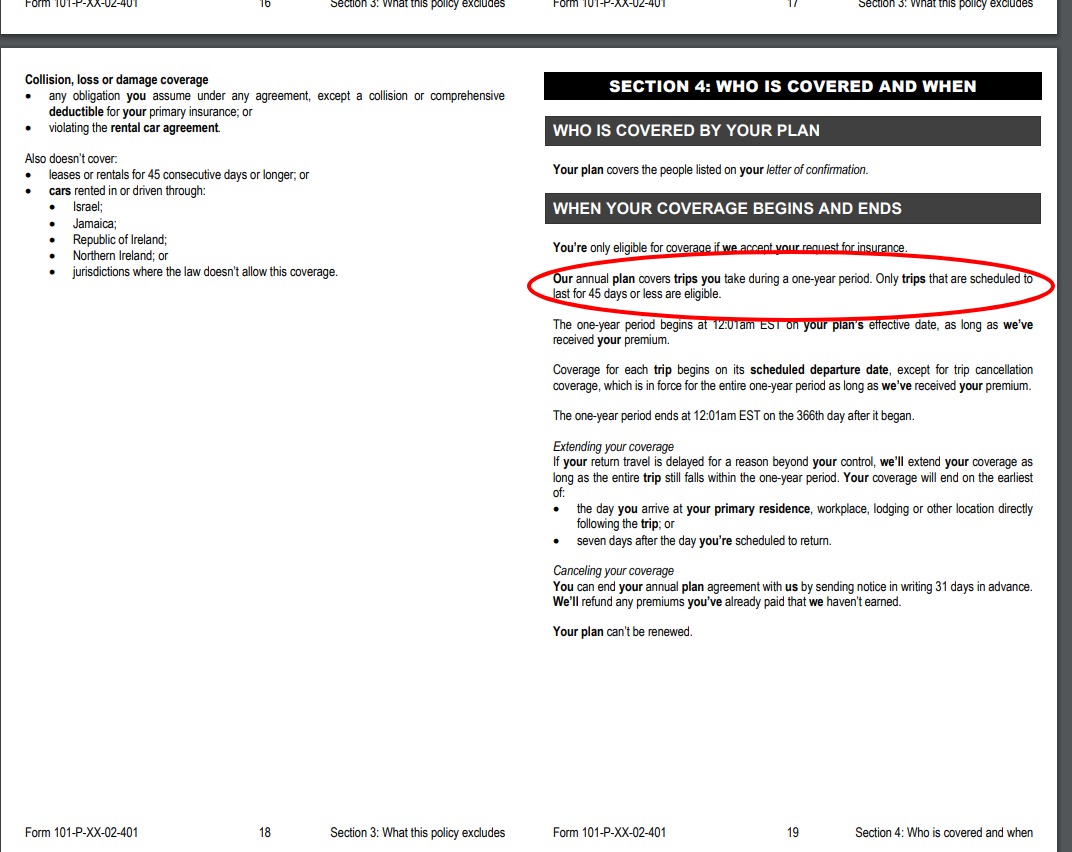

I have had a look at the policy for the Allianz Classic Protection insurance you are mentioning and it says that the max trip length is 45 days. I have taken a screenshot of the relevant page from the PDS.

Could you please give a link to the policy that you have as I must be getting the wrong one in my searches as I am interested in taking it out too if it is indeed 90 days .

Thanks in advance

-

1

1

-

-

3 weeks ago went through severe clear air turbulence on a flight to Singapore from Manila. Been flying around 100 flights a year for over 35 years now and first time ever.

Don't mind saying I <deleted> myself. Lol

-

- Popular Post

- Popular Post

4 minutes ago, darksidedog said:If he had an effective travel insurance policy that gave him cover at the time of the incident, that should not matter.

I dont know who comes off looking worse here, the insurance company for wriggling out of paying or the Hua Hin politicians who were very keen to get a photo with him, but now seem to be washing their hands of it, as it might involve lobbing out some cash. They are both missing a big PR opportunity.

He didn't have an effective travel insurance policy that covered him.

Therein lies the issue.

A lot of policies are "time limited" .

His obviously was.

Caveat emptor

-

19

19

-

1

1

-

3

3

-

13 minutes ago, ezzra said:

Chinese traders and investors are now deeply involved in Thailand's

fruit growing and wholesales business, so much so that many thai

frits have doubled and tripled their prices from only few years ago

before those Chinese got in the market, it's the case be careful of

what you wish for and whom do you let into your country to take

over and industry...

Don't think the growers will be complaining

-

25 minutes ago, sambum said:

Yes of course I did! "what happens if he cannot pay ?"

All I was saying was that the headline clearly states that he was uninsured yet we have someone saying that the "admissions team will be determining if he has insurance and if so will be contacting the insurance company."

ahhhh it must be the VI day today on here.

As the guy above you said I was answering the rhetorical question posed which was " what happens if he doesn't have insurance".

You have nice day now. lol

-

- Popular Post

- Popular Post

20 minutes ago, YetAnother said:what happens if he cannot pay ?

Based on very recent experience with a friend while we were riding through Korat the hospital will be getting him stabilised and at the same time the admissions team will be determining if he has insurance and if so will be contacting the insurance company.

If he doesnt have insurance they will get him stabilised and then he will be given minimal level of care to keep his vitals going. The family will be contacted ( if they cant then the embassy) and money will be sought for further treatment. No money. No more expensive treatment.

My friend was fully insured so the Bangkok Hospital in Korat took care of him in a world class manner.

-

6

6

-

1

1

-

- Popular Post

- Popular Post

there is a HUGE difference between doing porn videos with paid or willing participants and what this guy was doing.

he will be a very ,very lucky man indeed if he doesn't end up doing time for this even if he is back in the States

-

13

13

-

1

1

-

- Popular Post

- Popular Post

She knew the risks. Got caught and will now pay the penalty. Bimbo

-

6

6

-

6

6

-

My reading of your opening piece is that the landlord has told you he is selling the house not that he has sold the house

BIG difference.

-

The old geezer was 81 so he probably couldnt get insurance. The son was 54 and living in Thailand so he probably didnt have any insurance either going by 80% of the chancer expat community. The old duck was probably only thinking of re runs of Coronation Street and seeing her son so didnt even think about insurance. So all in all a clusterfluck all round.

Another storm in a teacup until some other titillating tale comes along.

Ooohh look theres a busty girl making somtam.....

-

As someone who is; and has been for over 30 years now ( gawd Im getting old) , in the property business both commercial and residential I have to say that you don't present as a client that

any reputable agency would want to be honest. That is not meant as a flame so please dont take it as such. No-one in any industry who is worth their salt is going to agree to

a situation where the outgoings involved don't have a chance of being recouped i.e. multiple agents doing the one job or the owner muddying the waters by staying involved. If you go to a decent mechanic

you don't get the chance to hang over the bonnet in the workshop while he works or put your own parts in. You drop your car off, put faith in the ability to get the job done and then pick it up when it is over.Very good chance that anyone who is willing to work under those terms of multi agency or where the owner keeps his sign up is average at best and inept at worst.

There are 2 basic mistakes most people who cant sell their property make. They dont take the time to find out the industry experience of the person presenting to them ( there is a HUGE difference between a sales rep who passes himself off as an agent and a licensed agent who can employ sales reps) and/ or they overprice their listing. Any property, being it residential, commercial or industrial is only worth what the market will bear at the given time it is placed on the market. No amount of "spin", "creative marketing" or "hype" ever changes that and no matter what the owner thinks it is worth ultimately it is the market that determines what the selling price will be. A decent agents job is market the property and negotiate in a manner that brings the best result for the client, not be a miracle worker. As in everything in life you get what you pay for. The fees in my agencies ( yes I have more than one in more than 1 country) are right at the top of the industry scale with a not insignificant upfront vendor paid advertising component so as discourage the "fee shoppers". Those type of potential clients don't need an agency like ours and to be honest why would people who have been in their industry for 20 -30 years be willing to accept the same payscale as someone who has been doing it for a year or 2 by taking on clients like that? But our success rate is waaayyy above the industry average and we have a 86% client retention rate and most importantly we still all love going to work everyday. :-)

Find the 2 Agencies in CM that turn over the most property in your market demographic. Not hard to do. Ask to speak with the Principal of each. Agree to an exclusive 90 day listing (if residential, 180 days if commercial) with one of them and take their advice as to whom amongst their sales reps is going to best for your property. Set your price according the written comparative market appraisal of the properties current worth supplied by the agent. Pay the upfront non refundable marketing costs , hand over the keys and then get on with your life and let the agency do their job.

Ohh and any reasonable buyer NEVER wants to deal directly with the owner . ;-)

Best of luck. Sincerley

-

2 hours ago, tomwct said:

BUPA Policy you are talking about is a annual health Insurance Policy. I had them too for many years. This is Travel Insurance which is only good for a specified time. In fact, BUPA sells a Travel Insurance Policy, but limits the coverage for 90 days during your trip. You then need to return home and you can buy another 90 days for your next trip. The backpacker could have bought an annual health insurance policy from BUPA, but it would be more expensive and care limited to Thailand. To my knowldege you cannot

buy travel insurance for two plus years, consecutive. It is true, most Thai policies cover motorcycle accidents but only payout 50% of the medical costs.

No. its an annual travel insurance policy

-

1 minute ago, tomwct said:

Can you buy Travel Insurance for two plus years? I have problems buying my wife anything over 90 days.

I hope is family can get him home for medical care, but when your on motorcycles anything can happen.

I have an annual policy with IHI/BUPA that auto renews each year. Have had it for nearly 20 years now. Covers for everything except professional motor racing and high altitude mountaineering ( it used to cover for the mountaineering before BUPA took over IHI and that is why I took it with them in the first place)

That may be of assistance for your wife. She can take as many trips as she wants during that year and be covered but each trip must not be more than 30 days long. I am constantly on the move for work and lesiure so this works well for me however may not work for her.

IHI/BUPA will do 12 month policies and if you ask perhaps they do 2 year ones. Hope this helps you

-

25 minutes ago, colinneil said:

Please stop screaming about his insurance company, as we all know travel insurance does not cover riding motorbikes.

Umm actually they do. Been riding in third world countries all over the world now for over 35 years and have been covered the whole time.

-

Been with them since 1988 and never had an issue apart from the usual rare user error stuff of my own accord.

Got commercial and personal accounts with them.

Great Bank

-

ha ha ha ...funny stuff all the people who say they will scare away the punters and lose money.

Where are the guys gonna go?

It's the bottom of the barrel, overall cheapest place for mongering in SEA.

You cant get any lower.

Well actually you can but you end up in Angeles City in the Philippines and you really know you have come to the true bottom of the barrel. :-)

-

10 minutes in Tondo and you'll know about things getting real.

Abject shitehole of a country inhabited by the dumbest locals in Asia whose culinary expertise has reached the heights of cooking intestines on charcoal.

Dont go.

And this is from one poor soul who has been going in and out every 3 weeks for the last 5 years.

10 months to go ......

-

1

1

-

Australian Principal Place of Residence is now going to be taxed if you live overseas

in Home Country Forum

Posted

This will still trigger a CGT event at the time of the transfer to the family member regardless of the amount it was transferred for.

CGT will apply on the current market value of the property at the time you transfer. If the ATO believes the valuation you placed on the market value of the property is underestimated they will arrange to have the Valuer General in the State the property is in to conduct one