Beerzy65

-

Posts

12 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Beerzy65

-

-

great article but forgot to post link on the app

-

You obviously did something wrong in Phuket. Flying in on visa exemptions or overstay? Time to get a visa as I didn't read what visa you have

-

On 1/12/2024 at 2:56 PM, siwiek said:

follow up to

So like an honest citizen I followed what the Phuket immigration police told me (then again, they were 20 year old intern girls talking to me because the police officers refused to answer any questions during that experience)... and I stayed out of Thailand until 2024 and tried to enter again via Laos border.

I told the IO my story and he kind of grinned and said don't worry, it's a new year you can enter here no problem. Then he saw something on my profile in the Thai Immigration database that confused him so we went to chat with the boss. She was also very nice and couldn't believe my story, but she seemed unsure what to do because of this warning on my profile. She said that since Phuket's initial reason for denying me entry was because they suspected I had fake boarding passes, this was therefore an airport problem and she asked me to go back to Laos and fly into Thailand into Bangkok airport to "clear this" and said after that I would have no more problems. Of course, no information about exactly what I'm "clearing" or how to "clear" it and also no guarantee Bangkok will allow me into Thailand despite her assurances.

After the Suvanabumi Airport immigration asked for 25,000 bribe in December that I politely turned down, I decided to do everything honestly and visit Laos like the Phuket intern girls instructed me (they said Chiang Mai airport is also fine).

But of course this also failed and I'm out $800 in airline tickets so far trying to come back to Thailand since December.

-

14 hours ago, Puccini said:

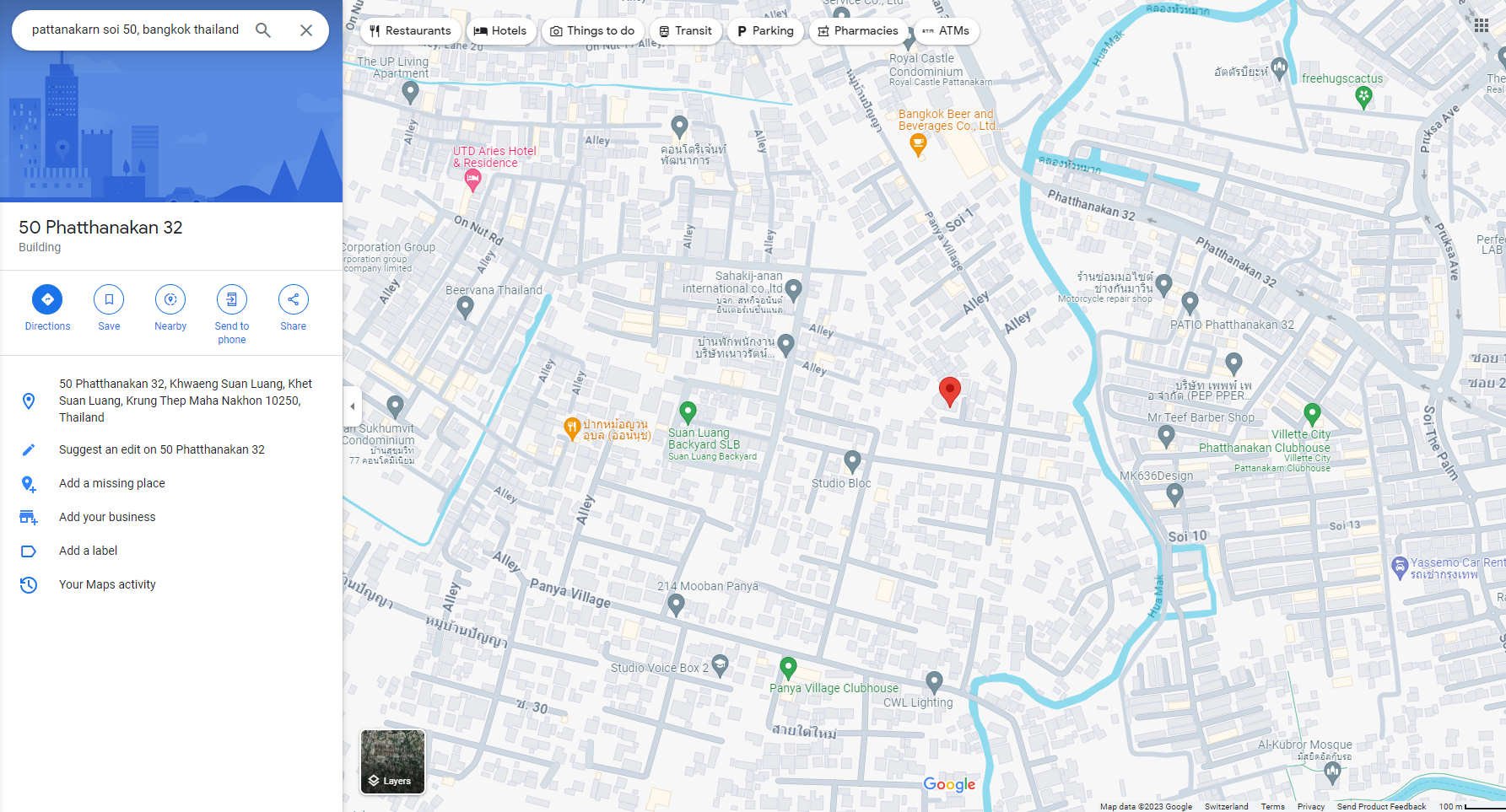

There's lots of hospitals. One's only 499 metres from there. Use Google maps.

-

Yes absolutely is bad for Thailands reputation but what do you expect when a few cops can be bribed?

-

7 hours ago, 24Catty said:

Yes, but they added a question about CRS.

They say everybody has to fill in the form, Thais too.

The funny thing is that in this form it is not possible to state that one is a foreigner, but a tax resident only in Thailand. But that is actually the normal way things are, if a foreigner lives in Thailand.

Only Americans are always subject to tax in their home country.

Only Americans are always subject to tax in their home country.

This is incorrect as I am subject to tax in my home country

-

2

2

-

-

Do you have his contact details please

Maneerat in Soi Post Office 13\2, Pattaya

-

I was ripped off buy a Bolt driver a year ago 99 baht for 7 minute trip down Sukhumvit road. He took me via sukhumvit 63 road and Sukhumvit road. Now I use Indrive and never had another r r problem. Yes use grab too occaisionally

-

Ok The old English, Royal Oak, the Robin Hood, and several bars in Sukhumvit Soi 13 all under 400 baht

-

1

1

-

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Mobile banking users not affected yet by new regulation : NBTC

in Thailand News

Posted

More info please