-

Posts

28 -

Joined

-

Last visited

Profile Information

-

Location

Mueang Prachuap Khiri Khan

Previous Fields

-

Location

Prachuap Khiri Khan

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

SupermaNZ's Achievements

-

Indeed. I am an abjectly lazy, useless individual. Thank you for alerting me to this. Without doubt, the best course would be for me to not contribute anything of any kind to this site. The community will be so much better for it. My apologies once again for my worthlessness. I am so sorry to have caused such distress for you. It was selfish of me. Thank you once again for your kindness in assisting me to understand the depth of my shortcomings (which are many - too numerous to make a full accounting). Have a lovely day 😀

-

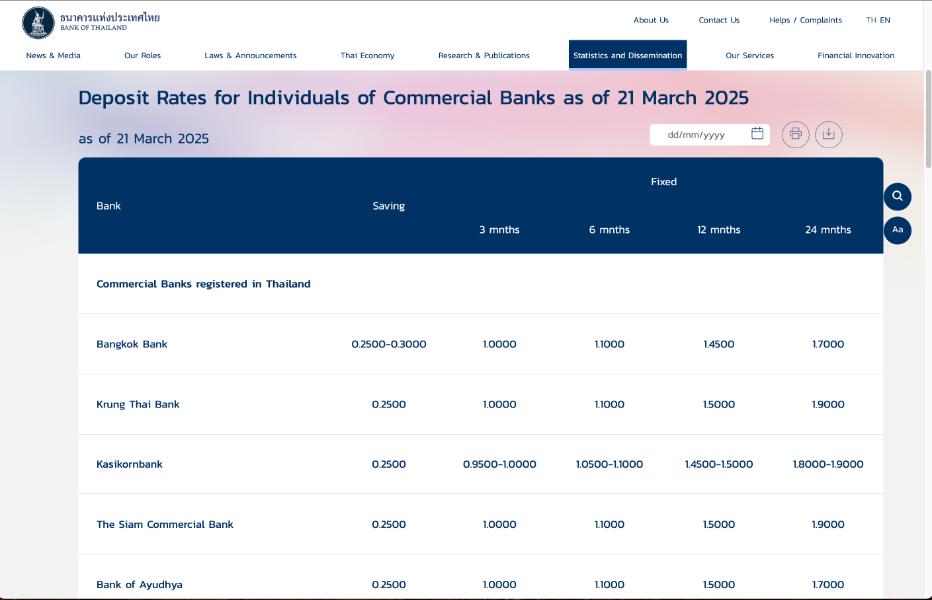

Helpful Tip: This is a very handy (first cut) summary of bank deposit rates for all banks operating in Thailand. It is put out (daily, the the applicable rates being for the previous day) by the Bank of Thailand. Note that whichever bank you choose - it needs to conform with Thai Immigration requirements as to the approved banks in which to hold your Visa-supporting funds: https://www.bot.or.th/en/statistics/interest-rate.html

-

Sadly, I am not a bank. The best thing to do is to pop in and visit BKK Bank/ SCB and talk with them. Some of the rates that I mentioned were expressly noted as being 'Promotions'. They are not there all of the time. There are 'special' savings rates from time-to-time (see, for example https://www.scb.co.th/getmedia/6d001fa8-29da-4773-9e77-1b7637d7d69d/td-bonus-24months-en.pdf). Much of the material online is in the Thai language - and even when in English - may not be entirely up-to-date. Many previous references to special rates now, when searched, lead to '404 Error - Page Not Found' issues.The easiest option is to personally speak with a representative of the bank that you are interested in exploring options with (and ask if promotions/ specials are due for release in the immediate future). The overview that I provided was to provide a broad context. The relative strengths of Thai banks can be assessed by simply using Yahoo Finance (see, for example https://finance.yahoo.com/quote/SCB.BK/?guccounter=1&guce_referrer=aHR0cHM6Ly9hc2Vhbm5vdy5jb20v&guce_referrer_sig=AQAAALVM3WEvSHBQ4346A8I2toX-LmBw7m5afSIkRCxZpCoZCkuEZUhTuCOCjteK0-9KkLCuNJysBILkEu7xNEF7xYQZywIsSrapRkzRKCoPKQxWx6TyHYZfyMEZmKtoWPyyXXH6_Ch0T8l_9oYn8JcawKuSfb9FwLabMVMXKAN1voFp). As I suggested - DYOR 😀

-

To determine the best-paying Thai bank account for the 800,000 THB retirement extension funds deposit requirement, along with the highest interest return per annum as of March 20, 2025, it is necessary to consider the specific requirements of the Thai Retirement Visa (Non-Immigrant O-A or O Extension) and evaluate available bank account options. The retirement extension mandates that 800,000 THB be held in a Thai bank account for at least two months prior to the application and maintained at that level for three months post-approval, after which it can drop to 400,000 THB until two months before the next renewal. The account must be accessible to Thai Immigration for verification (typically via a bank statement or passbook), making fixed deposit accounts a popular choice due to their higher interest rates compared to regular savings accounts, while still meeting these criteria if structured correctly. Key Considerations Eligibility: The account must be in the applicant’s name at a Thai commercial bank registered with the Bank of Thailand (BOT). Liquidity: Funds must be verifiable at all times during the initial three-month post-approval period, ruling out accounts with mandatory lock-ins exceeding this duration unless withdrawals are permitted with penalty. Interest Rates: Rates vary by bank, deposit term, and amount. For 800,000 THB, we’ll focus on terms of 3–12 months to align with visa rules, prioritizing the highest yield. Practicality: The account should allow easy updates (e.g., passbook) for Immigration and ideally offer ATM access for convenience, though some retirees limit this to avoid accidental withdrawals below the threshold. Analysis of Thai Bank Options Below is an evaluation of major Thai banks’ fixed deposit accounts suitable for the 800,000 THB requirement, based on the latest available data up to March 20, 2025. Interest rates reflect trends from late 2024 and early 2025, adjusted for the BOT’s key rate of 2.25% (lowered in October 2024), with some banks offering promotional rates. 1. Bangkok Bank (BBL) Account: 4-Month Fixed Deposit Interest Rate: 4.35% per annum (promotional rate as of February 2025). Minimum Deposit: 2,000 THB (800,000 THB qualifies). Conditions: Interest paid at maturity. Early withdrawal within 3 months yields no interest; after 3 months, it reverts to savings rate (~0.6%). Auto-renews to a 3-month term unless specified otherwise. Annual Return: 800,000 THB × 4.35% × (4/12) = ~11,600 THB (for 4 months); annualized ~34,800 THB if rolled over. Suitability: High rate, but the 4-month term requires planning to align with Immigration’s 3-month post-approval check. Passbook updates are straightforward at branches. Strengths: Largest bank, widely accepted by Immigration, extensive branch network. 2. Siam Commercial Bank (SCB) Account: 3-Month Fixed Deposit Interest Rate: 4.5% per annum (updated late 2024). Minimum Deposit: Typically 10,000 THB (800,000 THB exceeds this). Conditions: Interest at maturity. No interest if withdrawn within 3 months; savings rate (~0.65%) thereafter. Flexible renewal options. Annual Return: 800,000 THB × 4.5% × (3/12) = 9,000 THB (for 3 months); annualized ~36,000 THB. Suitability: Perfectly matches the 3-month post-approval period, ensuring funds remain intact and verifiable. Passbook or statement easily obtained. Strengths: High yield, aligns with visa timing, reliable for Immigration purposes. 3. Krung Thai Bank (KTB) Account: 4-Month Fixed Deposit Interest Rate: 4.4% per annum (elevated since late 2023). Minimum Deposit: 5,000 THB. Conditions: Interest at maturity. Early withdrawal penalties similar to peers (no interest < 3 months, savings rate ~0.5% after). Annual Return: 800,000 THB × 4.4% × (4/12) = ~11,733 THB (for 4 months); annualized ~35,200 THB. Suitability: Slightly longer than the 3-month requirement but manageable with timing. Government ownership adds stability. Strengths: Competitive rate, state-backed security, widely recognized by Immigration. 4. Kasikornbank (KBank) Account: 6-Month Fixed Deposit Interest Rate: ~1.05% per annum (standard rate; promotional rates unlisted online, but assume ~4% possible based on market trends). Minimum Deposit: 1,000 THB. Conditions: Interest at maturity. Early withdrawal penalties apply (savings rate ~0.5% if after 3 months). Annual Return: 800,000 THB × 4% × (6/12) = 16,000 THB (for 6 months); annualized ~32,000 THB. Suitability: Longer lock-in (6 months) exceeds the 3-month requirement, requiring careful renewal timing to avoid penalties during Immigration checks. Strengths: Strong digital banking, but rates lag unless promotions apply. 5. TMBThanachart Bank (ttb) Account: 3-Month Fixed Deposit Interest Rate: 4.5% per annum (highest among ttb’s USD rates, assumed similar for THB based on 2024 trends). Minimum Deposit: 10,000 THB. Conditions: Interest at maturity. Standard penalties for early withdrawal. Annual Return: 800,000 THB × 4.5% × (3/12) = 9,000 THB (for 3 months); annualized ~36,000 THB. Suitability: Matches the 3-month visa period perfectly, ensuring compliance and liquidity post-check. Strengths: Top-tier rate, smaller but growing bank, accepted by Immigration. Savings Account Baseline Typical Rate: 0.5%–0.6% (e.g., Bangkok Bank savings at 0.6%, SCB at 0.65%). Annual Return: 800,000 THB × 0.6% = 4,800 THB. Suitability: Fully liquid and Immigration-compliant but offers minimal returns. Best Option: SCB or ttb 3-Month Fixed Deposit Winner: Siam Commercial Bank (SCB) 3-Month Fixed Deposit and ttb 3-Month Fixed Deposit tie for the best-paying option at 4.5% per annum, yielding an annualized return of 36,000 THB on 800,000 THB. Why: Yield: Matches the highest rate among major banks for a term aligning with the visa’s 3-month post-approval requirement. Compliance: Funds remain intact and verifiable during the critical period, with interest paid at maturity (after Immigration’s check), avoiding withdrawal issues. Safety: SCB’s larger scale (market cap 350 billion THB, AAA local rating) edges out ttb’s smaller footprint (150 billion THB), but both are BOT-regulated and stable. Practicality: SCB’s extensive branch network and passbook system are Immigration-friendly, while ttb offers similar ease with growing presence (e.g., Pattaya, Bangkok). Return: 36,000 THB per year is the highest practical return, assuming no early withdrawal. Longer terms (e.g., Bangkok Bank’s 7-month at 4.2%) yield slightly less annually (~33,600 THB) and complicate timing. Practical Tips Open Early: Apply for the account upon arrival with a Non-Immigrant O visa (90-day validity), deposit 800,000 THB, and let it season for two months before the extension application. Documentation: Request a bank letter and updated passbook showing the balance and term start date for Immigration. Renewal Strategy: After the 3-month post-approval period, shift funds to a savings account (400,000 THB minimum) or reinvest in another fixed term, topping back to 800,000 THB two months before renewal. ATM Caution: Link a separate savings account for daily use to avoid dipping into the 800,000 THB. Caveats Rate Changes: Promotional rates (e.g., 4.5%) may expire; standard rates are lower (~1–2%). Verify with each bank at the time you are considering deposit. Branch Variability: Immigration offices (e.g., Jomtien) accept fixed deposits, but confirm local rules. Alternatives: If rates drop, consider the 65,000 THB/month income method to avoid tying up funds, though this requires 12 months of statements. Conclusion The SCB 3-Month Fixed Deposit at 4.5% per annum is the best-paying Thai bank account for the 800,000 THB retirement extension requirement, offering an annualized return (potentially tax assessable/ taxable) of 36,000 THB. It balances yield, compliance, and safety, with ttb as a close alternative. For maximum reliability, SCB’s scale and reputation make it the top choice (in my opinion) as of March 20, 2025. Disclaimer: This is not financial advice; consult a professional and verify rates with banks. Data reflects trends up to March 20, 2025, and may shift. Not immigration advice. Not marital advice. Not relationship advice. Not life advice. Returns and financials can change at any time. Do your own research 😀

-

Yes - Tops Market Hua Hin has Australian-made Vegemite. It is very difficult to find genuine Marmite, however. Most Marmites appear to be cheap Chinese/Other knock-offs, that are runny/ a little strange tasting ..... 😀

-

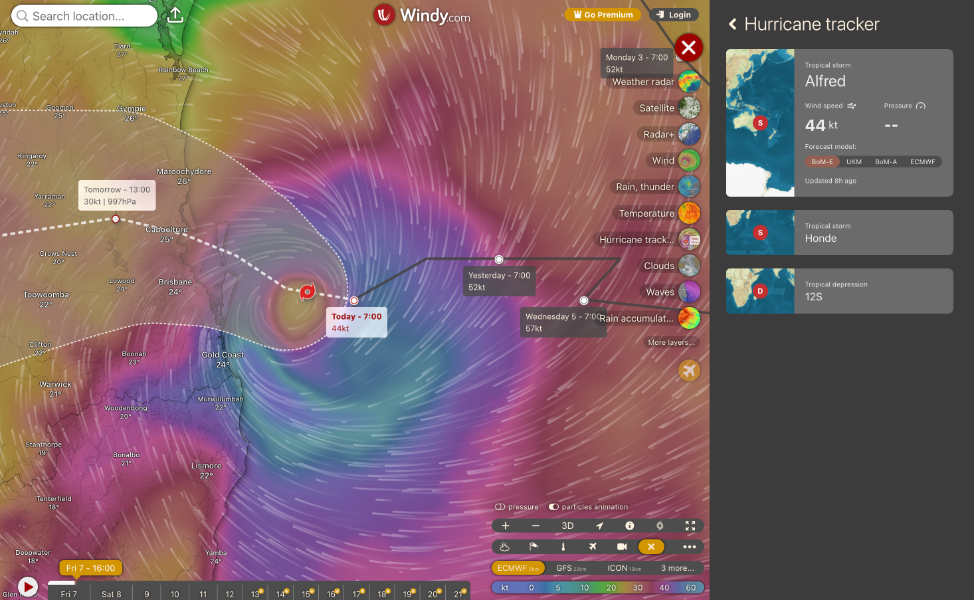

For the Australians amongst you who may be concerned about specific areas in Australia that may be impacted by Cyclone Alfred, this resource is exceptionally useful. You can search for a location, and then (after deleting the 'current weather' bar at the base of the screen - play a forecast for factors such as wind, rain & thunderstorms etc ....). You can also use the 'Hurricane Tracker' to track the projected path of the cyclone. If you have family there - may they continue to be safe, and avoid significant property loss ..... https://www.windy.com/-Hurricane-tracker/hurricanes/alfred?gust,2025030900,-27.601,154.498,8

- 1 reply

-

- 1

-

-

I'm unsure what the Danish rules are, but it may be possible (as for New Zealanders) for an application to be made (prior to permanently leaving your home country) for your Superannuation to be converted to the untaxed option. The untaxed payment is then brought in to Thailand, and the (lower) Thailand rate of tax then applies. Of course, this will be of no use to you if you have already retired/elected to continue to be taxed in your home country (if there is no retrospective option) - but for those that may be soon considering migrating to Thailand - this option may possibly be well worth investigating/considering.

-

Following a recurrence of 'frozen shoulder' (adhesive capsulitis), I looked for a local physiotherapist in Mueang Prachuap Khiri Khan. The Prachuap Physio Clinic provided excellent care, and had the equipment to do Extracorporeal Shockwave Treatment (ESWT), ultrasound, etc. My treatment (yours may differ) cost (a very reasonable) 399 Baht/ session. I am very happy with the service. Perhaps worth a visit before heading to Hua Hin (with its 3 hour return trip) ....?

-

Is It Just Me, Or Are Thai Staff Getting Ruder By The Day?

SupermaNZ replied to SoCal1990's topic in ASEAN NOW Community Pub

Have you considered the possibility that you were not being served by a Thai person, but by a migrant from Myanmar? Myanmar service folk are extremely common on many of the islands (as well as in touristy locations on the mainland). Invariably, when we receive blunt/ unsmiling/ take-it-or-leave-it service, it is invariably from (lowly paid, granted) Myanmar staff. That's not to say that all Myanmar personnel involved in the service industry are that way - in fact many are not - some can be extremely helpful. However - it's my view that when confronted with unpleasant service, the first question that should go through one's mind is 'Is this person actually Thai?'. The answer to that will almost invariably be 'No', as Thai people pride themselves on their friendliness and politeness. Myanmar people - not so much ..... Added to that is the complication that some Myanmar people have very limited Thai. So - even if you speak to them in Thai - there is no guarantee that your message/instructions will have been both received and understood (quite apart from the challenge of getting your own Thai 'spot on') ..... Perhaps this is the reason that, in very high-end resorts, you will invariably find only Thai citizens facing guests. I have never seen a Myanmar person greet guests at a 5-Star resort. Perhaps others have, but not us. The owners of these resorts appear to be very much alert to the risk of 'brand dilution' and ensure that only Thai employees interact with guests. When you factor this in to a visit - sometimes we are willing to adjust our expectations with respect to the pleasantness of the service staff interactions. On other occasions - we've made a mental note to not re-visit. As to why some resorts/ cafes etc utilise Myanmar staff - we are ironically part of the cause. Increasing popularity of island/touristy areas raises employment. Raised employment = increased demand for housing. Increased demand for housing (for both staff and foreigners enamoured with the area) = increased rental/ purchase costs for property. Increased cost of rentals/property = many local Thais no longer being able to afford housing in the area. Reduction in the size of the available Thai employment pool = need to import cheap Myanmar labor (who often live many to a room) .... and so on it goes. So we can't complain too loudly, really, can we .....? We are part of the problem. 🤔 -

Nightmare at the Prachuap tax office

SupermaNZ replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

https://efiling.rd.go.th/rd-efiling-web/tax/dashboard. Use Google Chrome browser (or any other that offers automatic translation from Thai -> English/ whichever language you require). -

Nightmare at the Prachuap tax office

SupermaNZ replied to thesetat's topic in Jobs, Economy, Banking, Business, Investments

Sorry to hear that you had a frustrating experience. In fairness to the staff at the Mueang Prachuap Khiri Khan Office - I filed my tax return there yesterday. As this is the first year that I have been required to file - I was interested to see how the experience went. The officer dealing with me was extremely helpful, and assisted me with setting up my e-filing account so that I can file future returns online instead of needing to visit an RD Thailand office. They entered all of my data for me, linked my Thai wife's Thai ID to my account (for verification of the taxation allowance granted with respect to her) - and completed the tax return there and then on the spot. They then printed a copy of everything that they had done for my records, free of charge. I couldn't have been happier with their service. I'm sure that it is as difficult for some Thai people dealing with foreigners as it is for us dealing with them, given the complexity of the Thai language, and the low level of English language skills sometimes encountered. While not advice of any kind - perhaps one approach that you could take is to adhere to the large warning signs posted throughout RD Thailand offices - reminding customers that RD Thailand staff are there solely to administratively assist, and that it is the (sole) responsibility of the individual filing their tax return to ensure the completeness/accuracy of their own tax return. If you are confident that a particular income stream is not assessable, then treat it as such but (as others have mentioned) - keep full records for future reference should there be any future audit. The RD Thailand e-filing site is available here: https://efiling.rd.go.th/rd-efiling-web/tax/dashboard. Tip: Use Google Chrome browser (or any other that offers automatic translation from Thai -> English/ whichever language you require). Further Tip: for those having difficulty with viewing their completed/filed tax return on the RD Thailand e-filing site, as we do not hold a Thai ID Number - simply enter '0' in the field where a Thai citizen would usually enter their Thai ID Number - and your completed documentation will be successfully retrieved and displayed. I hope this is of some help ..... -

I am leaving Thailand - yes taxes!!!

SupermaNZ replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Sad to hear that you feel this way. The modern approach to international taxation is via Tax Treaties which aim to ensure an equitable approach to taxation throughout the world, while expressly avoiding double taxation. The following is not tax advice - just my understanding of the situation. If you have paid tax in Canada - you will not be subject to further tax in Thailand. If you receive a superannuation payment which would normally be taxable in Canada (but was not taxed due to any application made by you prior to your departure from your country for it to be untaxed) - you are then (naturally) subject to taxation on that income in Thailand. As the tax rate in Thailand is (almost certainly) lower than that in most other developed countries - you are still on the positive side of the ledger, so to speak. It seems that the lack of clarity provided by Thai taxation authorities has led to unnecessary confusion and concern. Best of luck for your future plans ..... -

I tried the True Money wallet

SupermaNZ replied to Delta Shift's topic in Jobs, Economy, Banking, Business, Investments

Interesting. While we all hope there will not be another COVID-19 lockdown during our lifetimes (knock wood) - I did contract COVID-19 during the height of the pandemic - and when secluded in a Thai government hospital for recovery - was grateful for the presence of my wife (she insisted on joining me in the hospital for the duration of my stay, God Bless her) - and she used her 7-Eleven App on an extra Thai-bought phone to order food etc that kept us a little bit more comfortable during the 2 week seclusion ...... So in circumstances like that - having a Thai bought phone/ 7-Eleven App is a definite plus. Hopefully - none of us will ever need it again..... 🙂