Globenauta

Member-

Posts

53 -

Joined

-

Last visited

Globenauta's Achievements

-

Thanks again, Sheryl, this is very helpful. Since your last reply, I’ve started tracking my urination frequency more precisely. It turns out I’m averaging about every 2.0 to 2.5 hours while awake, which is more reasonable than the 1–2 hours I initially estimated. That said, I still get that uncomfortable “need to hold” sensation and urgency, even shortly after going. Also, thank you for the doctor recommendation. I’ll definitely keep that in mind if I decide to get a second opinion. I really appreciate your support, to be honest, this has been more helpful than my recent urology visit.

-

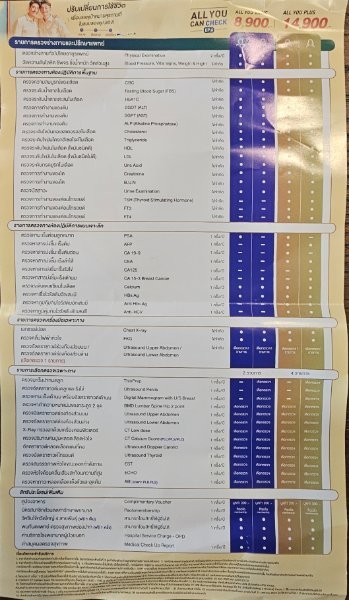

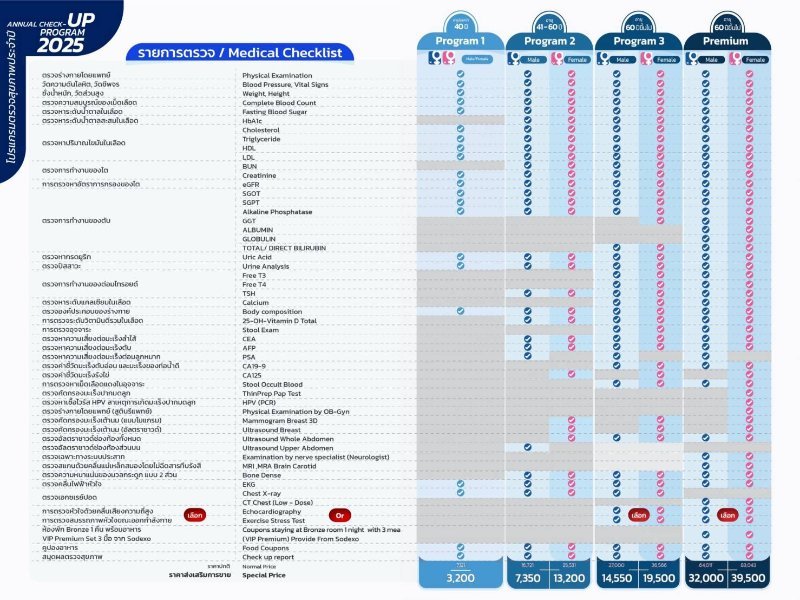

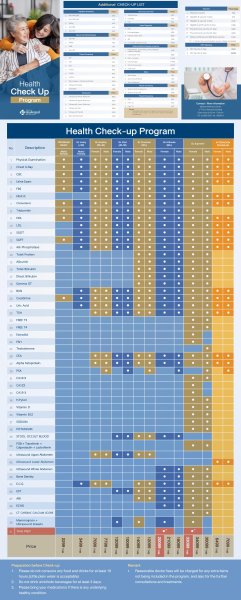

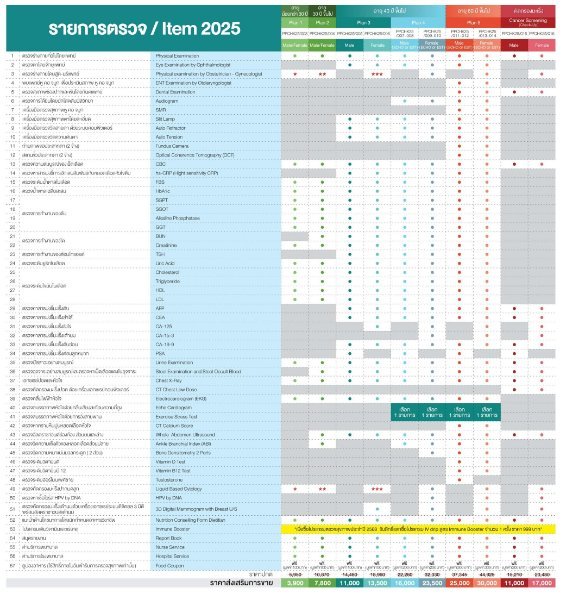

Just an update, we finally compared a few health check-up plans for my wife (53 yo, relatively healthy, on hormonal therapy for a condition that causes thickening of the uterine). I’ve attached the options we looked into. The Princ Hospital plan (Program 2) seems to be aligned with what’s truly needed: - CBC, HbA1c, lipids, liver/kidney, TSH - Mammogram, Pap smear - Bone density, ECG Princ hospital is also closer to home, so we’re leaning toward this one. Appreciate any recent feedback from those who’ve used Princ!

-

Thanks for your feedback. That was indeed the first question the Dr. asked me (if I am diabetic). I said that I have periodic annual checkups which include blood sugar test (FBS) that have always come back at around the average values of the normal range. The last one was just a couple of mouths ago. Personally, I am not sure if that's enough to rule out diabetes, but he seemed satisfied with it and didn't prescribe further tests.

-

Thanks, Sheryl, I actually asked the urologist during my recent appointment whether an infection could be part of the problem. He said it was theoretically possible but didn’t seem too inclined to investigate further once I mentioned I had recently done an STD panel. The panel included Chlamydia, Gonorrhea, Mycoplasma, Ureaplasma, Trichomonas, HSV 1 & 2, Candida, and a few others that all came back negative. Would that be enough to rule out a prostate infection or urethritis? I’m based in Samut Prakan, by the way. Thanks again, very helpful advice.

-

Hi everyone, I’m a 56-year-old male dealing with some mild but persistent lower urinary tract symptoms, and I’d appreciate hearing from others who’ve been through something similar. For the past year or so, I’ve been experiencing: Increased daytime urinary frequency (sometimes every 1–2 hours), Early morning urgency (often waking between 4-5 am), Weak urine flow, especially in the morning, Usually 1 wake-up per night, though occasionally I sleep through. I recently saw a urologist and had some basic tests done: Prostate volume on abdominal ultrasound: 26 ml (doctor says "mildly enlarged"), PSA: 1.01 ng/mL (previously around 0.4), Urine flow test: not dramatic, but mildly impaired, no flat curve, still shows a peak. The doctor did a rectal exam and said my prostate felt “rather enlarged,” though he didn’t repeat that at follow-up. He suggested that a transrectal ultrasound would be more accurate, but also said it wouldn’t change management much unless I pursue intervention. I did a 7-day trial of tamsulosin, and while there might have been some very minor improvement (e.g., one full night of sleep), it wasn’t dramatic. I also experienced retrograde ejaculation, which really affected my sexual experience. My doctor advised discontinuing tamsulosin, saying it likely wouldn’t give more benefit long-term. I asked about Duodart, but he advised against it due to high risk of sexual side effects (I already have ED and take tadalafil 5 mg every other day). We also briefly discussed options like Urolift, but he said it's usually for more severe symptoms (e.g., people waking up 3–4 times a night, or with serious retention). He didn’t recommend further tests like cystoscopy unless I plan to consider a procedure. So in the end, his advice was basically: try to live with it for now, and come back if symptoms get worse. I’m not sure if I’m doing the right thing by waiting. The symptoms are not disabling, but they are consistently frustrating and affecting my sleep and focus. I’m also uncertain how to assess “how bad is bad enough” when it comes to acting on this. Has anyone else been in a similar “grey zone”? Did your symptoms improve over time, stay stable, or eventually require treatment? Has anyone regretted or benefited from doing UroLift or similar procedures relatively early? Did anyone find alternatives to tamsulosin that helped without sexual side effects? Any shared experiences would be truly appreciated. Thanks in advance.

-

Actually, as it's explained in the thread by someone else, it's possible for the employer to cancel the WP a couple of weeks before the visa extension expires. So, it is doable and would give you time to apply for a marriage extension, which is what I did. My WP was cancelled and a few days later I went to my local immigration office and applied for a new marriage extension. Make sure you keep a copy of the WP before it is cancelled because, if I remember correctly, I was asked for it during the marriage extension application process.

-

Is Melatonin Unavailable in Thailand Now?

Globenauta replied to racket's topic in Health and Medicine

I have been using Seroquel (quetiapine) in a low dose (1/4 of a 25mg tablet) for years. Last year I decided to stop. Since then I have had trouble sleeping, of course. I tried melatonin years ago (I think it was 2mg tablets), during a previous attempt, with no success. I would like to give it another try now, as the quetiapine should be out of my system now after months of stopping. Someone also suggested magnesium glycinate, is it helpful or not? And if so, is it available in Thailand? Also, as an occasional substitute, for non-continuous use, I was suggested Doxylamine, sold in Thailand as Sominar. It is actually an antihistamine but would have a sedative effect and should not have the long-term side effects of quetiapine. Has anyone tried these? -

Health Insurance in Thailand After Leaving Employment

Globenauta replied to Globenauta's topic in Insurance in Thailand

Quick update: I now have only a few days left to decide whether to withdraw the lump sum or leave it for a future pension. It seems I can still keep my health coverage even if I withdraw, so now my main question is: Is it financially worth keeping the contributions for a pension, or is the payout too small to matter? Any insights from those who have made this decision would be really helpful. Thanks! -

Update: I now have only a few days left to apply for SSO Section 39 and keep my health insurance, so I need to make a final decision soon. During my last visit to the SSO office, the officer told me I can withdraw a lump sum of my past contributions (about 90k THB). However, I wasn’t able to get a clear answer on whether taking this lump sum would mean losing the ability to apply for Section 39 and continue receiving health coverage. Recently, I was toldvI can still apply for Section 39 after withdrawing the lump sum, but I won’t get a pension later (even if I reach eligibility in the future). My main concern is keeping health coverage, but I’m also wondering if keeping my contributions for a future pension is worth it. I know SSO pensions are very small, but since they are paid for life, they could eventually outweigh the 90k lump sum. I’d really appreciate hearing from anyone who has faced this decision: Did you take the lump sum or keep your contributions and later receive a pension? Was it really a choice, or were you forced into one option? Any feedback would be very helpful before I go back to SSO. Thanks in advance!

-

Hi everyone, I originally posted this in the "Insurance in Thailand" section, but I didn’t get clear responses. Since this is also a financial planning issue, I hope someone in this section has first- hand experience or insightsabout SSo pensions & health coveragedecisions. My situation: I recently left my job and now have the option to apply for SSO Section 39 (self-funded) to continue health insurance and social security contributions. However, the SSO officer also mentioned that I can withdraw a lump sum, which is the total amount I contributed over my working years. I was told conflicting things: some say taking the lump sum cancels Section 39 eligibility, others say it does not. What I need ot decide: If I take the lump sum, can I still apply for Section 39 and keep health insurance? Would it be financially smarter to take the lump sum or continue contributions for a pension? Has anyone been through this process? What was your experience? - My priority is keeping the health insurance under SSO - Pension consideration: If I reach 15 years of contributions, I might get a small monthly pension. But some say it’s so small that taking the lump sum is always the better option. If you’ve been in this situation or know someone who has, please share your experience! I really appreciate any advice before I go back to the SSO office. Thanks in advance!

-

Health Insurance in Thailand After Leaving Employment

Globenauta replied to Globenauta's topic in Insurance in Thailand

Following up on my last post, as I haven’t received a clear answer yet... I’m now ready to apply for Section 39 (self-funded SSO insurance) after leaving my job. However, when I visited the SSO office last week, they mentioned a lump sum withdrawal option, and I’m still unclear about it. I’ve heard that taking the lump sum might cancel my ability to keep Section 39 health insurance, but I haven’t been able to confirm this 100%. Can anyone who has faced this decision share their experience? Did you take the lump sum and later regret it? Were you able to get back on Section 39 afterward? I’d really appreciate any recent updates or personal experiences before I go back to the SSO office. Thanks in advance! -

Health Insurance in Thailand After Leaving Employment

Globenauta replied to Globenauta's topic in Insurance in Thailand

Hi everyone, I appreciate all the insights previously shared about continuing SSO coverage. I recently visited my local SSO office to switch from Section 33 (employee) to Section 39 (self-funded) so I can keep public health insurance. During the visit, the officer mentioned a lump sum withdrawal option, but the discussion was in Thai, and I didn’t fully understand it. My wife tried to follow along, but we’re still unclear on how this affects my options. What I understand so far: Since I haven’t reached 180 months of contributions, I wouldn’t qualify for a pension yet. Taking the lump sum now might mean losing future pension eligibility. If I stay in Section 39 and continue contributing, I could eventually qualify for a monthly pension. I can keep SSO health coverage for ฿432/month, but I’m unsure if taking the lump sum affects this. Questions: If I take the lump sum, can I still keep Section 39 health insurance? Has anyone taken the lump sum and later regretted it? Once I take the lump sum, can I later rejoin the pension scheme or is it final? I’d love to hear from anyone who has been through this process. Any advice or clarifications would be greatly appreciated before I go back to the SSO office. Thanks in advance for your help! -

Thank you so much, Sheryl! Your explanation about cancer screening is very helpful. We’ll definitely use your suggested list of tests as a guide and look into a basic package where we can add the necessary items. My wife had a colonoscopy last year, so it’s good to know that isn’t necessary again for now. Thanks again for taking the time to share your valuable advice!