-

UK Vodafone sim for sms

Yes, i was on o2 too. Now got Lebara Sim, £1.99 or 6 months and then £8 a month. It's on Vodafone network

-

UK Vodafone sim for sms

I don't like calling people... 🙂 Thanks though

-

UK Vodafone sim for sms

That's great thanks, I'm in the uk at the moment before i head back to Thailand in September. I'm moving from O2 to a much cheaper deal on Vodafone network...

-

UK Vodafone sim for sms

Hi all Could anyone let me know if they have a UK Vodafone sim and whether they are able to receive SMS messages? I have O2 and it works fine, wondering if it's the same for Vodafone sims Thanks

-

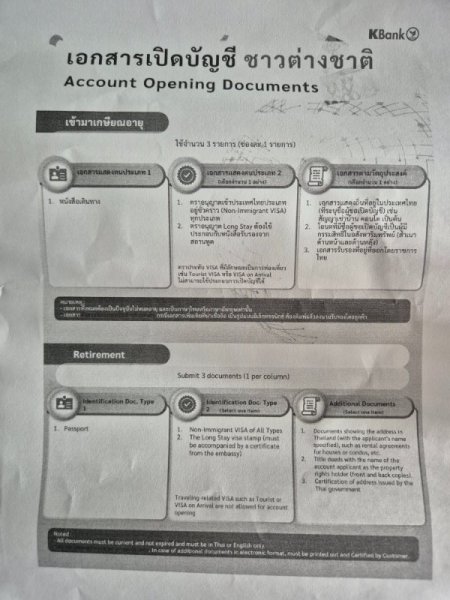

2nd Bank Account?

After a 10 minute wait, KBank at Exchange Tower Asoke set up my account in about 20 minutes. I provided my lease contract, passport with 1 year visa, and TM30. All good, now I'll let my main account just sit there... 🙂 Thanks everyone for all the guidance... 👍

-

2nd Bank Account?

At the exchange square asoke kbank now, tiny too and crazy busy lol

-

2nd Bank Account?

-

2nd Bank Account?

Oh yeah you're right, i hate that branch at emquartier. I stay at Asoke, so tomorrow I'll wander down Sukumvit tomorrow. I recall seeing at least one branch somewhere down there

-

2nd Bank Account?

Emquartier bangkok branch... I might just wait the 6 days

-

2nd Bank Account?

Just tried to open a kbank account, have to wait 6 days for an appointment. Shall i wait or go for scb or Bangkok bank... 🙂

-

2nd Bank Account?

Cool, thanks for your help

-

2nd Bank Account?

CW Krungsri was empty when i went for my paperwork... It was 10am though, maybe after the rush..

-

2nd Bank Account?

I wonder if any others will consolidate their branches with others.... Might be a trend

-

2nd Bank Account?

I plan to open 2nd account for day to day use , my main original account will keep the 800k all year untouched..

-

2nd Bank Account?

Thanks... Closing permanently?

Wyabcp

Member

-

Joined

-

Last visited