Wyabcp

Member-

Posts

69 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Wyabcp

-

I'm a little concerned about the tm. 6 requirement, or TDAC. Prior to arriving in Thailand I filled in the TDAC, however i was never sent an email or given a reference number. I repeated the process and same result on the second attempt. When i did arrive at immigration on my non o 90 visa, i expected to be challenged about the TDAC however nothing was said, and my passport was correctly stamped with 90 day visa. I hope this isn't a problem...

-

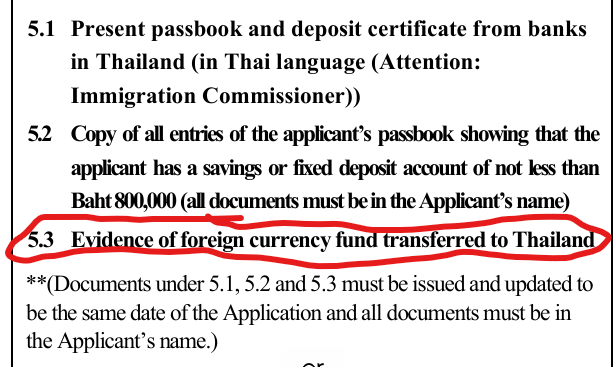

Hi all, I obtained my non O 90 day visa in the UK prior to travelling to Thailand. This will end next month and I now have booked an appointment with immigration on 18th July for a Extension Visa for Retirement at Ratthaprasasana Phakdi Building, this is scheduled for the morning, I have also a meeting booked in the afternoon for multi entry at the same location. Could someone please help and confirm required documents and evidence please ? for extension I have:- TM7 TM30 - provided by my agent Copy of my 1 year lease agreement Passport Photo's of passport ID page, stamp page, bio data page 4 x 4×6 cm photos of me Copy of bank statement book all pages also showing no less than 800,000 baht has been in account for no less than 62 days Hand drawn location map of my condo Rental receipts for past 3 months rent 1900 Baht for 1 year extension fee Also I understand that I need a letter from my bank too ? is that correct. Re-Entry TM8 Many thanks in advance

-

Thanks everyone for all the help, just an update, I've now transferred the 800k into my Krungsri account. 2 x Wise transfers from UK that happened in seconds, not minutes and not hours ... So all good, i now wait for the IMO appointment in. 2+ Months. Not sure why this conversation got side tracked into US tax requirements, but that's normal i guess on these platforms.. I'll update as i continue through the process... Thanks W