-

Posts

214 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by BOOKEMDANO

-

-

On 6/29/2020 at 10:19 PM, rickudon said:

AS for keeping cash in ordinary savings accounts at less than 1% interest that is not useful. My immigration extension funds in Thailand are in a fixed deposit which pays 1.8% (less when it comes up for renewal).

Cash in the UK is either in high interest Current accounts (paying 1% plus) or in monthly savers paying 2%. It takes a bit of time juggling the money but average about 1.5% currently, and can hold between 7,000-12,000 GBP depending on time of year. That is my UK emergency cash - any surplus will be invested in dividend paying funds - value may vary but in the long term will almost certainly outperform a savings account. Banks paying a laughable 0.1% (or less!) on many savings accounts are doing very well, thank you.

Stocks and Shares ISA isn't such a terrible idea either.

Usually able to withdraw within 10 days without a massive penalty. -

8 hours ago, Leaver said:

As others have said, your OP mentions nothing about insurance.

I did state 'twice' that I already have a 'decent' health insurance plan here in Thailand. In addition, I contribute to regular UK payments, so for anything serious, I hope to be covered there, too.

Lots of good information here from many of you. I will certainly be checking that "fund book" as a way to park part of my 500,000 emergency cash fund.

Thanks again...

-

1 hour ago, khunPer said:

Therefore I decided to place the majority of my emergency funds shared with my trusted girlfriend, so she always can get some fairly instant cash on my behalf, and even her mother has an ATM to one account, in case something happens to both of us – we have a child together – but a solution like that is of course a question of trust, or calculated risk.

Very sensible...-

1

1

-

-

4 minutes ago, khunPer said:

I use SCBFP for my shared funds (Siam Commercial Bank), and I also use a Bualuang Thanatavee Fixed Income Fund for personal savings (Bangkok Bank); the latter a very safe mutual fund that I have had for more than 10 years.

It's not a recommendation for future fund performance, and there might other mutual funds worth checking.

Thank you kindly

-

2

2

-

-

16 minutes ago, khunPer said:

It's not a question a just putting the money in the bank, and you furthermore need to include a factor for inflation – at least 1 percent would be fair, 2 percent is the financial expert's target – 40,000 baht a month at age of 50-years might have a different buying power compared to 40,000 baht a month 40-years later at age of

A very salient point.

-

27 minutes ago, stouricks said:

How would you know that it is 'decent' plan until you do have to use it, and see if they pay out with no hassles.

I don’t. That’s why I said “I think”.

On paper it looks fine, however. I would consider it above average though as I am covered under its premium to grace the doors of Bumrungrad and BNH, and the like. Many standard plans exclude such establishments.

Besides, this is why having a 6 month cash reserve comes in handy for those “oh sh*#” moments in life.

-

1

1

-

-

32 minutes ago, khunPer said:

For deposit I have the funds split into three accounts. Some money in a normal savings account with ATM card for instant access. Some money in a 12-month fixed deposit account for better interest, but the money can be withdrawn at any bank-day with loss of interest from the ongoing last period. And some funds placed in a low-risk so-called "Fund Book" for best interest; funds can be sold on bank-days and will be available in the ATM-account within one to three bank-days.

Excellent advice here. Thank you.

May I ask the name of this “fund book”?

-

27 minutes ago, natway09 said:

I do know that I would not be betting on the GBP strengthening for 10 years.

They are in a real mess

Yes you could be right. If the baht remain overvalued in a decades time against the pound, then I may just as well continue to take advantage of that fact and top-up my savings account then in the UK.

13 minutes ago, scubascuba3 said:Exchange rates are difficult to predict, I wouldn't switch now it isn't clear what way it will go.

As for emergency fund, i never had 6 months as such, more years, i always invested and saved incl starting a pension at 18. The earlier you get into saving the better, it's amazing how many people can only survive a month or two without working. My advice is live below your means and save money, and invest in property and\or stocks and shares as appropriate

Absolutely right: The more the better.

I too am surprised at how many colleagues of mine would be in dire straits after only 2 months of no income.

This is why a 6 month cushion (more would be better) is necessary to maintain a current lifestyle until plan B arrives.

1 hour ago, ianezy0 said:OP, as you say, you have medical insurance plus other investments so an emergency fund of 500k baht sounds fine.

I guess it depends on what you are classing as an emergency if your health is already covered?

True!

definitions of what ‘emergency’ and ‘emergency fund’ differs from person to person.

I see this as if I were to lose my primary income, this ‘emergency cash fund’ is there to provide me time enough (6 months worth) to get back on my feet, as it were, without the need to touch others investments.

-

1 hour ago, tiocfaidh said:

I am in UK atm.

With the pound is threatening to drop below 38 baht and the potential no-deal brexit it will drop further i do not want to exchange £ for THB.

What I am doing is investing in buy to let property in UK, as the market drops over the next 2 years.

Then I have an income for retirement in Thailand.

I already own a condo and vehicles in Thailand, so low overheads fir my retirement.

Good idea.

I also considered 'buy to let' options as the property market looks set to drop, as you say. Would be hard to secure a buy-to-let mortgage by myself now though. Good luck with that anyway.

Going back to the point you made about exchanging pounds for baht, I agree that wouldn't be the best move now. It does look likely to drop further with a no deal Brexit looming. However, exchanging baht into pounds and moving this into a fixed savings account in the UK could be a good move.

For example, the more the (£) pound drops off gives me more bang for my baht, therefore boosting the 'emergency fund', plus the added advantage of that 0.75% AER/Gross interest rate back home, too.

Is moving baht into the UK a good idea now? Possibly..Will I keep some of that emergency fund here in Thailand. Yes I will.

-

I have a decent medical plan (I think) with Pacific Cross. Haven’t (luckily) had to use it for an emergency yet.

I also continue to contribute to paying taxes in the UK, which may, or may not, entitle me to free health care in the UK if it comes to that.

I do have other investments, but just not an emergency fund.

Of course retirement planning is important too, but that’s a different topic.

-

Hello all,

I have always read that saving a 6 month fund is worthwhile, but never took that advice seriously until now. Given the current situation, I suppose.

I have a target in mind, 500,000 baht, and working toward that figure at a slow and steady pace. Not before time, many of you may say.

My question is, might it be better to keep a % in the home country, and the remainder here in Thailand? Currently the UK bank I use offers 0.75% AER/Gross fixed for 12 months. Thai banks I am not sure about?

I do speak with a number of friends and colleagues here, and I am surprised how few of them actually have an emergency fund, so to speak. They may have other means of security elsewhere, but seldom have a 6 month reserve.

-

1

1

-

-

I know a very competent electrician who recently re-wired my entire kitchen space. I highly recommend him.

PM me for his contact details.-

1

1

-

-

I have an existing 16,000 (I think) BTU air-conditioner that runs well enough, but would like a second (bigger 20,000 BTU unit) installed a few meters away in the same room.

1) Is it possible to link the second unit from the existing cable (see picture A) via a simple junction box without overloading the breaker box when ultimately both units begin to run simultaneously?

2) Or should each air-con run on its on dedicated cable directly to the breaker?

Not very knowledgable about electrics. Appreciate your feedback in advance ????

-

- Popular Post

- Popular Post

Don't wish to destroy the hive, so will conform with local social distancing rules. ????-

5

5

-

-

-

- Popular Post

- Popular Post

Boris Johnson is not the smartest man alive.

Wear a mask. Keep your distance. Stay home as much as possible.-

3

3

-

Wonder if anybody can share their knowledge about owning either a Brio, March or Mirage?

We need a second car, one that is good for getting around a city (fuel economy is important) but so too is safety. We do have a young baby, and boot (trunk) space is also a factor.

I don't really care much for the aesthetics of the car. As this will be for her as Tesco run, trip to the zoo, kind of car. So:

- safety

- fuel economy

- load capacity

Any suggestions from current owners of the aforementioned cars?

-

There is currently no cure for hand, foot and mouth disease, so treatment involves making your child feel as comfortable as possible while waiting for the infection to take its course.

Possible treatment options include:

using paracetamol, ibuprofen and mouth gels to relieve the pain of mouth ulcers

drinking plenty of fluids to help relieve a high temperature

-

1

1

-

-

With regards to some members previous posts about "cycling", the fix to this problem seemed to be to drain the tank out and Turn on the outlets allowing the tank to be filled once again. Some members reported success with this as any trapped air was quickly equalised.

In my case, as well as turning on all faucets as already mentioned, might this also be worth a shot?

It is worth stating that I have both increased and decreased the pressure switch, but to no avail.

-

The pump is a Mitsubishi EP-305Q3 - constant pressure.

Not all that old and models of these can be bought today in big c stores.

-

Unlike many posts on this forum (the ones I have read) my water pump has a mind of its own.

Typically, after the morning shower, and rinsing of the breakfast items, we would seldom need to draw water from any faucet or hose line - unless of course we are in need of the toilet. However, this does not stop the pump from switching itself on/off.

The mornings seem to be its most aggravated time of the day. Turning on for 2 seconds and then nothing for approximately 2 minutes until it decides to fire-up again for that 2 second burst of life. As mentioned, nobody is using any water during these periods and there are no noticeable leaks. This could go on for hours, so I would usually disconnect the pump until late afternoon.

When it behaves, it works fine with very little cycling - if any. Sometimes an evening shower would require me to open an extra faucet to produce the necessary power to the second floor bathroom, but generally it's a decent pump. It is simply the annoyance of repetitive on/off for no obvious reason to me.

Any suggestions greatly welcomed.

-

Whilst being relatively young still - 32 - I need to start thinking seriously about putting money away for the future.

I earn a respectable salary and worked-out I could save 30,000 per month (45,000 after the car is paid off) each month. This still gives me enough to enjoy trips and day to day living. I still continue paying tax and national insurance back in my home country to ensure a possible pension payout of 9,000 per year and to keep the door open for a possible return there in the future.

But what I would like to ask is what you do to prepare for a pension either here or abroad? I will look into mutual funds here with Bangkok bank for tax credits and a nice 5 year lump sum -hopefully- at the end of it. But what else is there?

Property?

Home country Isa?

Local pension plans?

Any feedback is welcomed as I am sure not to be the only one with this question tag hanging over them for their future peace of mind.

-

May we see the birth of "the traffic warden"?

-

2

2

-

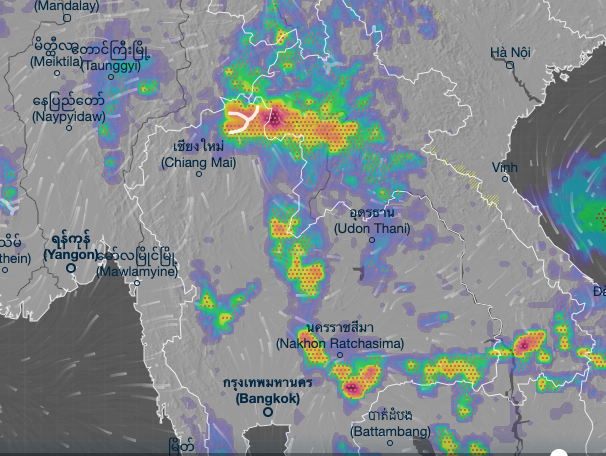

Has CM had any recent covid outbreaks?

in Chiang Mai

Posted

Any update regarding this story? Rumours abound here in Bangkok that Chiang Mai is about to enter lockdown and anyone who leaves that province for another is being asked to do a 14 day quarantine period.

Again, just rumours but the situation seems to be heading south rather rapidly..