badge

-

Posts

792 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by badge

-

-

Hello gents

is this the new USDTHB topic thread?

Ive no idea how one searches forum topics or threads or posts, however many years ago I mentioned on a few threads that USDTHB should bottom or at very least bounce from 29.0 +/-

it did so in 2007 and again in 2011 and again this year

perhaps third times the charm

-

All the talk of Burgers is based on the infamous (but apparently not to this thread?) Economist Big Mac Index.

i'd like to hear your personal opinion on this Badge.

I think its a lighthearted attempt to gauge how far currencies are from their fair value, and is fully worthy of the 80 seconds in takes to read.

-

All the talk of Burgers is based on the infamous (but apparently not to this thread?) Economist Big Mac Index.

http://www.economist.com/blogs/dailychart/2011/07/big-mac-index

IT IS nearly 25 years since The Economist cooked up the Big Mac index.

The index is a lighthearted attempt to gauge how far currencies are from their fair value. It is based on the theory of purchasing-power parity (PPP), which argues that in the long run exchange rates should move to equalise the price of an identical basket of goods between two countries. Our basket consists of a single item, a Big Mac hamburger, produced in nearly 120 countries. The fair-value benchmark is the exchange rate that leaves burgers costing the same in America as elsewhere.

-

Some tumultuous trade for bulls en route, but in light of Gold flirting with $1600 Ive dusted the ruler off, and again I have large discrepancies in my data

(e.g the '80 high being $850, $875 or $887.5?)

(e.g the '80 high being $850, $875 or $887.5?) In anycase, from $1635 - $1660 seems to contains a number of Sell signals depending on each data set, so lets see

As the last Sell signal on Gold @ $1660 failed, Ive ran the ruler over Spot Gold again and have $2240, and then around $2280 by the looks of things.

-

S&P Cuts U.S. Rating for First Time on Deficit Reduction Pact

http://www.bloomberg.com/news/2011-08-06/u-s-credit-rating-cut-by-s-p-for-first-time-on-deficit-reduction-accord.html

An amazing week in financial markets, I hope you all did OK.

-

interesting graph:

Outstanding insight from Yoo...

One could select many markets, products, economic measures etc that correlate, in specific sample periods, to the price of Gold, or any other asset.

Yoo doesnt show the previous decade, where despite numerous raising of the Debt Ceiling Gold declined.

calling something "interesting" has nothing to do with "insight" and nor does it require to mention xyz irrelevant additional references

Interesting

-

interesting graph:

Outstanding insight from Yoo...

One could select many markets, products, economic measures etc that correlate, in specific sample periods, to the price of Gold, or any other asset.

Yoo doesnt show the previous decade, where despite numerous raising of the Debt Ceiling Gold declined.

-

Have opened Sterling at 1.6124 long with 20 point target @10

S/L at 1.6074

Edited in,

Just reading one of the many email articles I get on trading and one particular one I follow from ADVFN is advocating Gold at 1780 by year end...

Good morning or afternoon.

Risking 50 pips to make 20 pips Chivas seems quite aggressve. GL

ADVFN advocates alot!

-

So with Gold at new highs Ive ran my ruler over it, and depending on what data I put into my model I get varying Long Term targets, the most poignant of which lie at 1355/65/90, so really anywhere between 1350-1400(!), and then 1575-1600. All rather vague then!

Theres some less potentially significant targets along the way at 1365, 1460 and 1515 too.

Some tumultuous trade for bulls en route, but in light of Gold flirting with $1600 Ive dusted the ruler off, and again I have large discrepancies in my data

(e.g the '80 high being $850, $875 or $887.5?)

(e.g the '80 high being $850, $875 or $887.5?) In anycase, from $1635 - $1660 seems to contains a number of Sell signals depending on each data set, so lets see

And next Sell on spot AG is $42.95 then perhaps c.$44.

-

So with Gold at new highs Ive ran my ruler over it, and depending on what data I put into my model I get varying Long Term targets, the most poignant of which lie at 1355/65/90, so really anywhere between 1350-1400(!), and then 1575-1600. All rather vague then!

Theres some less potentially significant targets along the way at 1365, 1460 and 1515 too.

Some tumultuous trade for bulls en route, but in light of Gold flirting with $1600 Ive dusted the ruler off, and again I have large discrepancies in my data

(e.g the '80 high being $850, $875 or $887.5?)

(e.g the '80 high being $850, $875 or $887.5?) In anycase, from $1635 - $1660 seems to contains a number of Sell signals depending on each data set, so lets see

-

If anyone is in dispute with this, please post. No dought i will hear from Badge as he works in the financial industry and relies on you as a customer to get commission, thus being the reason i suspect he dislikes my Free signals.

OK, I'll bite Paulo

But what on earth makes you think I work in the financial industry? And even if I were, I think youre being a bit optimistic if you think your 'free signals' are significant to any market participants

As I noted on here before, IMVHO anyone taking free signals is a fool, and anyone offering free signals should concentrate on their own trading, just my opinion.

Im certain I read you offering mentoring, teaching, signal services etc etc before on this thread, over the years, but if I simply have my wires crossed, and youre just a chap in New Zealand that likes giving 'free signals' to a bunch of expats in Thailand for no reason other than the thanks it garners and your own generosity then fair play to you, thats a wonderfully benevolent move.

-

Ron Paul : Why do central banks hold Gold?

Bernanke : Tradition

Bernanke is correct. Gold is an asset. Banks hold gold as an asset in reserve as they hold bonds, stocks and other paper assets.

If Villa start accepting gold, and giving back change in micro-grams (?) then gold will at least be getting closer to becoming money, but right now, money is the only money

-

Anyone have any problems trading from Thailand with slippage. My brokers are UK based and was thinking about trading from Thailand for a while and was just wondering which ISP's are the better than others. Ping/latency/reliability etc. Although i'm not a scalper i do trade off 5 minute charts.

Thanks in advance.

Not sure if anyone else is connected to London, but bandwidth depends where you are in Thailand? Or at least it did in my experience. Any slippage will be more down to the broker than net latency I imagine.

Personally I had to leave Phuket as had huge latency issues and have been in BKK 5/6yrs now, and in general its got noticeably better.

Originally had dedicated leased line via pafcificnet in singapore that was routed directly to MFglobal in London, and it was good 90% of the time, but 250k pcm.

Nowdays you can just use a business line (larger bandwidth) with True internet or even a personal ADSL line if you go for the 10MB package, which of course you wont get anywhere near; mines clearly been limited to 1mb down/100kbps up.

TIT

-

Paulo my dear,

Why you think Id want to reveal to you, or any other stranger on this forum, anything to do with my business is beyond me? Why not ask the colonel for his secret recipe and let me know his response

Youre in the business of selling tips, so its imperative you appear successful.

However, sadly you have no credibility in my opnion.

Get yourself registered with the financial regulator in NZ or wherever youre originally from, and instantly that would give you infinitely more credibility, because it would mean you cant just make up performance stats, which with mere graphs and text one can only assume is the case. Claiming "ive made xxx pips, see its on the graph" really isnt a substitute.

Another point is that offering advice is much easier than making money from it, and the fact you claim to teach/mentor and ask people to pay for tips leads me to believe you have no capital base, otherwise why bother? Those who cant, teach

especially when you can make an almost unlimited amount taking your own tips.

especially when you can make an almost unlimited amount taking your own tips. But then you have another issue, as taking substantial positions is alot harder than writing where you think a crncy pair might move, its why trading a demo account is no use whatsoever. From Jesse Livermore:

It is like the old story of the man who was going to fight a duel the next day.

His second asked him, "Are you a good shot?"

"Well," said the duelist, "I can snap the stem of a wineglass at twenty paces," and he looked modest.

"That's all very well," said the unimpressed second. "But can you snap the stem of the wineglass while the wineglass is pointing a loaded pistol straight at your heart?"

I am in the business of trading financial markets, so its imperative I sell for more than I buy. My appearance to strangers online and whether they like me or are interested is meaningless to my business.

The forums are just a bit of fun, of course I give you the benefit of the doubt and am sure youre a capable trader, but if you want to make a business out of selling tips, do it the right way and get regulated, it counts

-

Yes, Ive always found the most successful traders I know use CAPS LOCK and meaningless graphs, to try and convince strangers, online, that theyre actually very skilled and wealthy

If you want to continue being abusive thats fine, but Ive certainly no inclination to prove or demonstrate anything to you or anyone else here.

Im not selling anything you see, so it doesnt matter what appearance I have to strangers on a forum.

Perhaps you're an exception to the rule and for whatever reason, youre a great trader who can make almost unlimited amounts from financial markets, but choose to offer tips for a few dollars instead. Perhaps.

In my experience tip selling is for failed traders, but theres nothing wrong with that. Trading is an extremely tough business, psychologically, and very few can make any real money at it, consistently.

Lots of people ask me about trading as it appears so appealing, but I tell them not to bother with it in the first place! Become a Dr, do something constructive to earn a crust!

If you dont have a background in finance, where you can learn the ropes while at least getting paid for a few years, you'll still have to learn the ropes but not only will you likely lose your money, you'll have wasted prime money-earning years with no pay.

My advice would be if you want to get into financial markets, get a job in the financial sector and get paid while you trade and learn.

-

Every Forex Broker who is offering THB pairs lets you trade them with smaller tickets than 1 Million. What makes it hard or almost impossible to profit from the fluctuations is the very low volume and wide spreads as already mentioned from somebody else here. Anyway here is a better chart.

What other borkers are you aware of that offer THB PCA? And are you refering to a lack of liquidity in their Spot offerings, as the NDF market should still be accomodating to even the deeper pocketed amongst us.

Edit: Infact on closer inspection it clearly states that upto $10m is executable on Spot through oanda. More than enough THB for me!

I can't speak for PCA but when I mentioned low volume / less liquidity as a reason for not dabbling in USD/THB, I didn't mean that a broker will not be able to execute your order, merely that sharp moves are possible that can wipe out your profit without warning and the wide spread means you will need a larger move in your favour to make a profit. The wide spread is due to less liquidity. If you take a long position in EUR/USD for example, and the market moves against you, it is possible to rescue your position by adding to it at lower levels (assuming that the charts are not indicating you made a complete balls-up in which case it would be better to cut your losses) but this would be an expensive modus operandi in a currency with a spread that equals about .3% of its value. The Euro, in comparison has a bid / offer spread of less than .01% of its value against the dollar (with oanda and other retail brokers). Unless you are taking long term positions, I can't see the point of private investors trading THB. If you do take long-term positions going short of THB over a period of days, weeks or months then you need to include the cost of overnight interest to your calculations.

P.S I'm not trying to impress you or pretend that I know everything, because I know very little. Just trying to offer some advice, which you are free to ignore of course!

Sensible enough advice, apart from perhaps adding to a losing position, but it works for some to be sure.

Ive worked buy side and sell side and traded my own account for many years, so hopefully I'll survive

-

it is interesting to follow the results of published signals Paulo. however, TA signals cannot forecast events like the outcome of tomorrows vote in the Greek parliament which will most probably affect EURUSD. should your signal be correct then it will be nothing but coincidence.

my personal opinion: if TA would work as it is proclaimed and taught, the learned ones would keep it a top secret using it to mint money whilst sitting on their private islands in the Caribic and pondering whether the 100' yacht should be replaced or the latest model of a Learjet should be ordered.

but... keep up the good job and post your signals. it takes guts to do so!

I echo these thoughts almost entirely

-

27th June 2011 I will began post free signals[...]

Free signals? As opposed to charging for signals? How very generous of you Paulo

May I ask, if indeed you have any talent for diving consistant profitable trades, why not make a near unlimited amount of money from the tips yourself, instead of just trying to sell tips to people online? Kovner, Soros, Taylor, all successful fx traders, yet none try to sell tips to people online?

...There seems an obvious answer

And do they offer free signals Badge? Do you offer free signals?

They dont offer signals, they successfully trade.

I dont offer signals, I successfully trade (most of the time

).

).I think you missed the point Paulo; 'signals' are for the foolish to buy and the inept to sell.

-

Every Forex Broker who is offering THB pairs lets you trade them with smaller tickets than 1 Million. What makes it hard or almost impossible to profit from the fluctuations is the very low volume and wide spreads as already mentioned from somebody else here. Anyway here is a better chart.

What other borkers are you aware of that offer THB PCA? And are you refering to a lack of liquidity in their Spot offerings, as the NDF market should still be accomodating to even the deeper pocketed amongst us.

Edit: Infact on closer inspection it clearly states that upto $10m is executable on Spot through oanda. More than enough THB for me!

-

@badge Retail brokers such as Oanda will let you trade in much smaller lots than $1M, although interbank lot min. is usually $5m, if that is what you were referring to. The spread will kill you on baht trades though.

[...]

Do please provide a link to oanda where they detail much smaller lots than $1m on USDTHB.

Ive already left a link for an interbank broker dealing in min $1m lots in USDTHB, but Id also point you towards FXall.

http://www.forextrad...ws-Oanda_Review Expand the tradable instruments section, just under where it says the minium trade size is 1/10,000,000. I can't see them expecting their customers to put up $20,000 margin as a minimum to trade any of the currencies that they offer. Their minute lot sizes attract customers with little money to play with.

Thats very interesting thanks.

I called oanda to double check this thid parties info and was told its only been in the last 2-3 months theyve offered SPOT USDTHB trading, which was my belief as I enquired several years ago and was told that they dont offer any action inTHB, and got the same line with most brokers.

For the record they offer Spot, 10:1 - 50:1 leverage and spread is .10, so current quote 30.873/.973. Obviously when dealing with more exotic currencies a wider spread is to be expected.

Im very impressed by their offering, and may have to rethink my stance on only following THB for living costs, and not outright shorting it

-

-

@badge Retail brokers such as Oanda will let you trade in much smaller lots than $1M, although interbank lot min. is usually $5m, if that is what you were referring to. The spread will kill you on baht trades though.

[...]

Do please provide a link to oanda where they detail much smaller lots than $1m on USDTHB.

Ive already left a link for an interbank broker dealing in min $1m lots in USDTHB, but Id also point you towards FXall.

-

27th June 2011 I will began post free signals[...]

Free signals? As opposed to charging for signals? How very generous of you Paulo

May I ask, if indeed you have any talent for diving consistant profitable trades, why not make a near unlimited amount of money from the tips yourself, instead of just trying to sell tips to people online? Kovner, Soros, Taylor, all successful fx traders, yet none try to sell tips to people online?

...There seems an obvious answer

-

Gold vs commods is rather irrelevant as theyre freely manipulated by the naughty powers that be, are they not?

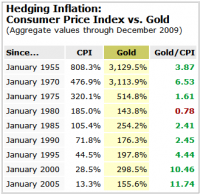

Gold vs money supply or CPI would perhaps be a better gauge (certainly as its purportedly an inflation hedge), and its currently overvalued against CPI to the tune of roughly 2000% if we go back to WW1.

Over the past 200 years it has averaged $300-$600 per ounce (2010 dollars), and having currently turned lower from the previous, adjusted all time high in 1980, is therefore overvalued by 300% - 500%, see 2nd graph (from June 2010).

Where Is Gold Going In This Market

in Jobs, Economy, Banking, Business, Investments

Posted

Well the next hurdles for spot lie at 1440 and 50, lets see how they afre first

As for CL it needs to overcome 112.5 before taking on the previous high of '11

all +/- a tad of course