- Popular Post

patrick228

-

Posts

45 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by patrick228

-

-

OP: "To confirm, I visited the Wattana registration office with a Thai citizen who has a Thai ID card who I was hoping could be my witness. We're both learning about the process as we go along but it's a little frustrating given the amount of documentation I have prepared and have available!"

The Wattana office must have told you what has been lacking and what more documents they need, especially you went with a Thai who should have no communication problem.

-

I charged 2 months security deposit + 1 month rental in advance. My condo in Bangkok was rented out for a while till last year when the tenant decided to move out, for personal reasons, in mid term. The agent was fair enough to uphold the lease and the landlord such that it was the tenant's fault to break the lease, and thus forfeiting the security deposit, without rental arrears . More importantly, the unit was returned back in good condition. Pick a good tenant from the start!

-

Clarify with the local Land Office or lawyer if this waiver document is required.

If so, confirm the waiver content/description that will satisfy the requirement.

Next, ask if the Land Office accepts the waiver document that is signed overseas in the presence of the notary public or/and Thai embassy personal in the country where you are. Overseas embassy or consulate usually has a dedicated section to handle notarization matter. Call the embassy to ask for what documents they need to support your request for document notarization.

-

1

1

-

-

18 hours ago, teutonian said:

Address: Liberty Plaza Building, Klong Tan Nuea, Vadhana district, Bangkok 10110 Thailand

Open Hours: 08:00 AM - 4:00 PM (Monday - Friday)

Phone Number: 02 381 8930

E-mail: [email protected]

”

My condo is also located in the Vadhana, or Wattana district. The above address and phone number is correct, though I don't know about the email.

I start this thread and I have found the solution of my own questions today.

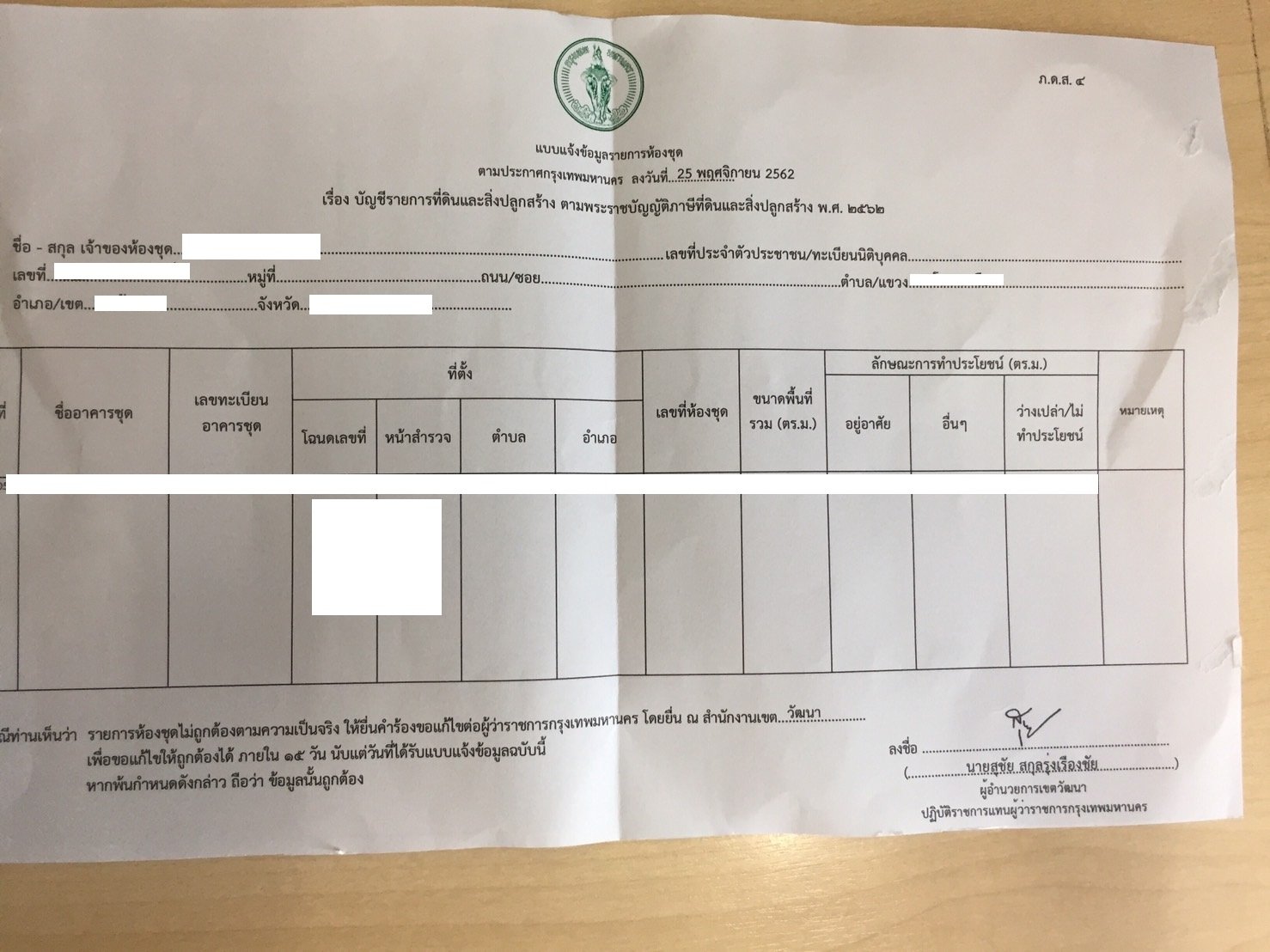

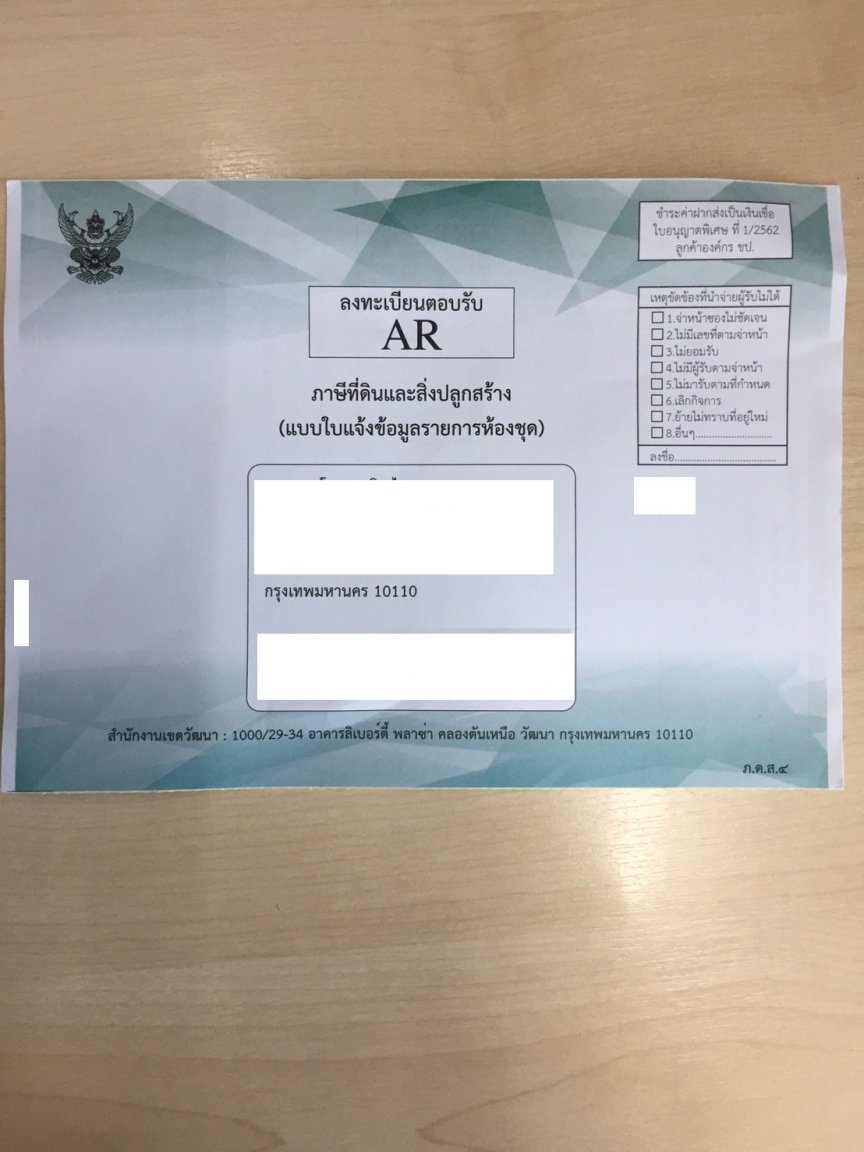

I managed to get someone to open my mailbox and find the notice from Tax Office. Inside shows a statement of the unit details. There is no tax amount shown. The person also called to the Wattana Land Office and they replied that if I stay in the unit and do not rent out, I don't need to pay this building tax. Therefore, I believe that's!

-

4 hours ago, jojothai said:

No. You only get a yellow book if you specifically want it and provide all the documents they need from you.

otherwise you get a blue book and as a foreigner it will not have your name in it.Most agents tell you that you need the book to sell the property.

That's correct. I bought the condo unit direct from the developer few years ago and I went to the Land Office with the developer to do the transfer on the spot. I got the chanote, and the blue book which didn't have my name inside. I went to a local bank to open a bank account. I got help from the bank staff, as an independent person, to verbally translate the chanote and the blue book content to me to ensure everything is in order.

There are few links from internet to look for information about blue or yellow house book, including this:

https://www.thailandlawonline.com/article-older-archive/thai-house-registration-and-resident-book

-

32 minutes ago, patrick228 said:

Thanks for info. The condo juristic office told me that they received the tax notices and distributed to the units' mailbox. Of course, the office can't say whether every unit or just some units have received the tax notice. OK, the next point is to open my mailbox to find out, which I am unable to do so. Even I can, and have found the tax notice, I have then to arrange for payment. Does anyone who has received this tax notice locate a "QR code" inside the tax notice and is it possible to make online payment, internet bank transfer, or something like that based on this QR code?

I read from a non-reliable source, saying that the tax authority has concluded the foreigners' owned units are considered as residential home. But to be exempt from tax as the first residential home under the scheme, the owner (including the foreign owner) has to be registered in the yellow house book. Without the registration, the foreigner's owned unit will not be exempt from this tax.

Back to my case, I would just assume that the tax notice has arrived into my condo mailbox which is beyond my reach in these few months. Now I assess the implication. Assuming the appraised property value is 10 million, the 0.2% tax rate will generate 2,000 baht tax liability before 90% discount or 200 baht net of discount. In addition, I read somewhere that the overdue penalty charge is progressively going up to 40%, or 80 baht in my example. With the above analysis, I will just let it be till I am able to travel to Bangkok to make the payment plus overdue penalty.

After I posted the above message, I realised I might have mistaken the condition for 90% discount in context of overdue. What I read elsewhere was that the discount is only applicable if the taxpayer settles the payment before 31 Aug 2020. That implies in case of the overdue, the original liable tax amount, or 2,000 baht will be used as a base for penalty calculation, i.e. (40% of 2,000) or 800 baht!

-

On 8/19/2020 at 11:20 PM, GrahamJ said:

Hi, you should have received a letter in June stating the classification of your property which is either "Stay" or "Other".

Stay means it's your main place of residence, your family home and is free of tax.

However, if its marked as Other then it's classified as a second property, rental, holiday home and will be taxed at 0.02% per million up to 50m which is due by the end of August.

Because of covid 19 the government has given all property owners a 90% discount this year.

So basically if this condo is your place of residence then you will not pay any tax and have nothing to worry about. Even so you should get someone to open your letterbox and check the letter to ensure the property is classified correctly.

Thanks for info. The condo juristic office told me that they received the tax notices and distributed to the units' mailbox. Of course, the office can't say whether every unit or just some units have received the tax notice. OK, the next point is to open my mailbox to find out, which I am unable to do so. Even I can, and have found the tax notice, I have then to arrange for payment. Does anyone who has received this tax notice locate a "QR code" inside the tax notice and is it possible to make online payment, internet bank transfer, or something like that based on this QR code?

I read from a non-reliable source, saying that the tax authority has concluded the foreigners' owned units are considered as residential home. But to be exempt from tax as the first residential home under the scheme, the owner (including the foreign owner) has to be registered in the yellow house book. Without the registration, the foreigner's owned unit will not be exempt from this tax.

Back to my case, I would just assume that the tax notice has arrived into my condo mailbox which is beyond my reach in these few months. Now I assess the implication. Assuming the appraised property value is 10 million, the 0.2% tax rate will generate 2,000 baht tax liability before 90% discount or 200 baht net of discount. In addition, I read somewhere that the overdue penalty charge is progressively going up to 40%, or 80 baht in my example. With the above analysis, I will just let it be till I am able to travel to Bangkok to make the payment plus overdue penalty.

-

Not sure if this topic has been discussed elsewhere.

I have a condo in Bangkok but I am currently in overseas and not able to visit Bangkok these few months. Some background: I am a foreigner, I have the blue house book, sole owner, property value much less than 50M Baht.

I just came across this new Tax Act and the requirements, knowing that the deadline for filing is end of this month, August 2020.

Various sites indicate that tax assessment letter/notices should be issued to the taxpayers in June 2020.

Questions:

1. Did the Thai government issue this particular "tax assessment" to the owner of each house or condo according to the property address and regardless they are locals or foreigners? as I have no idea if it exists, it is in my mailbox or not.

2. Do the taxpayers have to complete this designated tax assessment or tax return? whether the owner is exempted from paying the tax, or liable for taxes?

3. Can the owner file another format of the tax report / return, rather than the received tax assessment, if it is ever issued to each owner to the property address?

Thank you.

-

15 hours ago, moontang said:

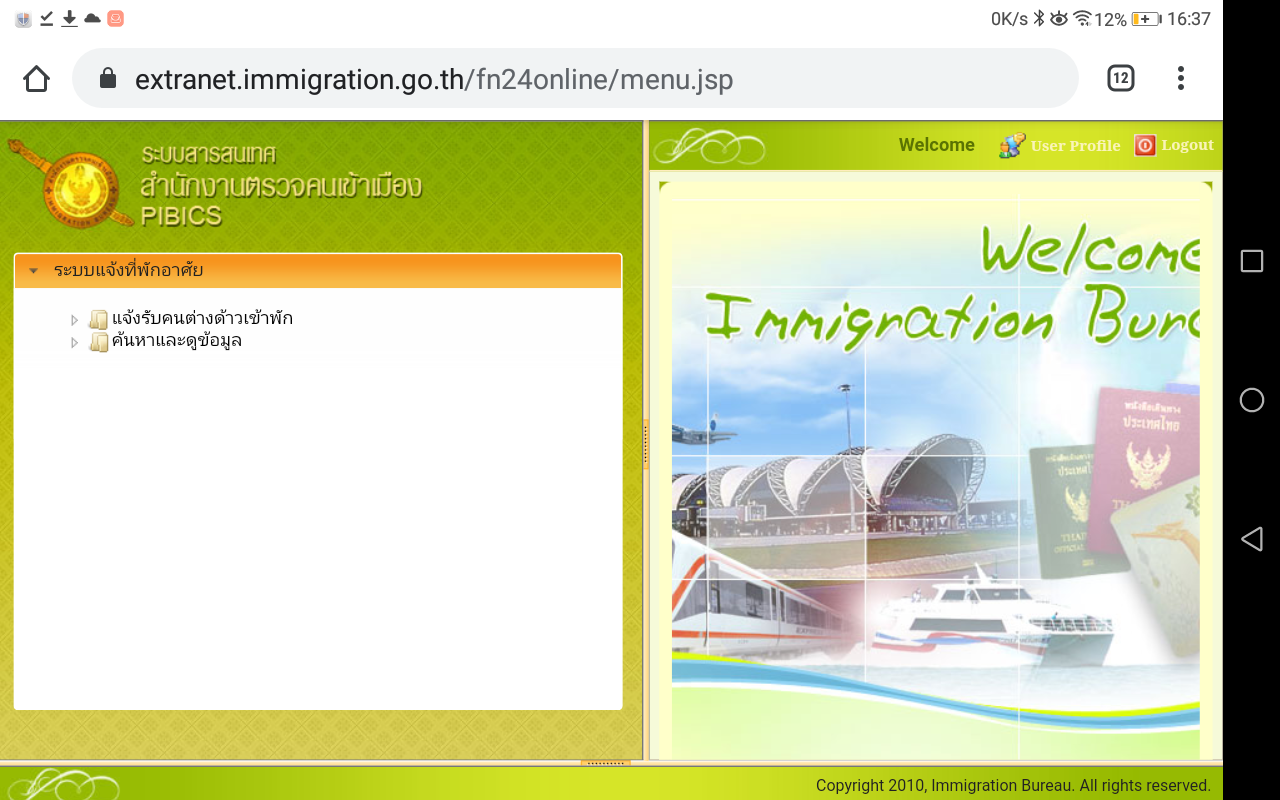

Anyone residing outside Thailand now and is able to access the TM30 website or the S.38 mobile app?

I am currently outside Thailand and unable to access both. Few months ago, I was able to access while inside and outside Thailand.

I suspect the access has been modified and restricted to the local Thai servers only.

-

Have not visited this TM30 for awhile. Unable to access:

1. The website: https://extranet.immigration.go.th/fn24online/# but found error message to open the webiste.

2. The S.38 mobile APP (version 1.0.22) today but found the following screeshot. I don't understand the Thai message, but I could not continue with my ID and password.

Are TM30 and S.38 app still in operation? Is the denial of access is temporary or whatever?

Thanks for help.

-

Sorry to ask as I have not been following the Thai quarantine requirement.

Are these teachers/students having self (voluntary) 14 days quarantine? OR

Has the Thai government already imposed mandatory quarantine requirement on local residents travelling aboard or on foreign visitors coming from some countries, such as China/Hong Kong/South Korea .... etc...?

As far as I know, visitors coming from China, Hong Kong, or South Korea can still come to Thailand for short visits and move around for sightseeing freely. Appreciate anyone to confirm or correct this!

-

Any idea for the taxi fare from central Pattaya to Laem Chabang Container Terminal where the cruiseship docks during the daytime? If I remember correctly, the taxi fare from Central Pattaya to Suvarnabhumi airport is about 800 baht?

Thanks.

-

I have read much posts and experience sharing from many posters in the forum. If you have a short stay in Thailand without the need to extend your visa (short term visit) at the local immigration department, then you don't need to worry about TM30, regardless you stay in a hotel, someone's home, or a home/unit/condo under your own name.

I own a condo in Bangkok and I have user ID to access Section 38 web based and mobile app for TM 30 online registration. I was in Bangkok for more than 2 weeks in August 2019 (last month) and within that period, I left the country once and returned back. I stayed in my own condo while I was in Bangkok. I didn't file the TM30 online registration for myself. I had no problem at the international airport on those 2 departures.

-

On 8/14/2019 at 2:55 PM, mtls2005 said:

The Section38 app (Android) was updated yesterday or today from 1.0.19 to 1.0.20

Not sure how you originally loaded it, but unless you have a Google account created in Thailand the app won't automagically update. Nor will you be able to update it.

I suggest creating a second GMail account, then add that account to the Play app, then you can downlaod the Section38 app, and it will update automatically in the future.

After creating my TM30/Section 38 web based account in overseas with the receipt of user ID and password within 7 calendar days, I have come to Bangkok. I tried different means/VPN to "fool" the Google Play Store of my location (i.e. from a non-Thailand location to Thailand), but was unable to search for Section 38 Android App.

Today I created another Gmail account here in Bangkok using my Thai phone number and used the new Gmail account to access the Google Play Store. Finally I was able to search for the Section 38 App and have download it.

I logged into the Section 38 App and it displayed correctly of my unit address. I downloaded the User Guide Manual from this App but it is written in Thai only. My questions:

1. Is it required to "Take Photo / Scan MRZ" together with the submission? What photo does this App require and what is MRZ?

2. Down to the bottom of the screen before SUBMIT button, it is default to show "ผู้พักอาศัย" which google translate shows "Roomer". Who is the Roomer? I recalled when I created the web based registration, I saw there were 3 choices as follows. If I am the owner, am I supposed to amend the default display of the roomer into owner, assuming I am the one to update the record?

ลูกค้า Customer ผู้พักอาศัย Roomer เจ้าของบ้าน Owner

3. The App screen shows "Date of Arrival" and the "?" explains it is the date as shown in the Thai Immigration Stamp in the passport. However, I notice that it is a discrepancy in the XLS as it shows "Date of Issue" which I think other posters consider it to be the passport issue date.

Thanks.

-

On 8/20/2019 at 9:07 AM, andreww said:Quote

3. I see there could be a discrepancy of translation as Date of Arrival for website input field, while it is Date of Issue in the XLS, I guess.

Date of issue relates to passport issue date

The sample register provided by the IO on the 2nd worksheet of the XLS seems to show that the "Date of Issue" is the TM30 issue date or Thailand entry date.

In the example, item 1 has 90 days visa, while item 3-5 had 30 day visa.

No.

ลำดับFirst Name

ชื่อLast Name

นามสกุลMiddle Name

ชื่อกลางSex

เพศ

(M-ชาย,F-หญิง)Nationality

สัญชาติPassport No.

หนังสือเดินทางDate of Issue (mm/dd/yyyy) (A.D.)

วันที่เดินทางเข้า

(เดือน/วัน/ปี ค.ศ.) เช่น 09/20/2013Type of Visa

ประเภทวีซ่า

(2 หลัก)Expire Date of Stay (mm/dd/yyyy) (A.D.)

วันครบกำหนดอนุญาต

(เดือน/วัน/ปี ค.ศ.) เช่น 01/19/20141 ALEX JEAN M A01 L39939000 12/30/2010 03 03/30/2011 2 ANNA LEE F A05 L39828919 3 SIJI LIU F C10 G59422550 09/27/2012 09 10/25/2012 4 MEI ZHANG F C10 G36963328 09/27/2012 09 10/25/2012 5 LINLIN PAN M C10 G39636381 09/27/2012 09 10/25/2012 -

On 8/11/2019 at 5:08 PM, andreww said:

olks,

The XLS file you get from https://extranet.immigration.go.th/fn24online/loginFnServlet?mode=download&doc=2 provides pre-filled examples and all codes (port of entry, type of visa etc) necessary, just check other SHEETS there (tabs/pages). I'm attaching screenshots below just to spread this useful info.

I just got the user ID and password and have accessed my account. I understand the information required for the XLS file. Few questions:

1. I see the website showing a lot of descriptions in Thai language without much English, except for those blank fields available for input. Any other button that may display English version?

2. In the page บันทึกแจ้งรับคนต่างด้าวเข้าพัก(Notification TM.30) where the owner/processor is to report the detail, I see an input field for "check in date", then followed by "Import excel file" for upload. Further below are the particulars of every single detail. Does it mean that I only need to fill in the check in date + uploading the XLS file and I can IGNORE the remaining fields for completion?

3. I see there could be a discrepancy of translation as Date of Arrival for website input field, while it is Date of Issue in the XLS, I guess.

4. In the page ค้นหาข้อมูลแจ้งรับคนต่างด้าวเข้าพัก(Search TM.30) where I think it shows the record of all previous submission (well, I have not reached that stage yet, but just ask), the check in date from and to, I believe, will tie to what we input under the Notification date, right? As I see the table below with all headings in Thai language, are there anywhere we will have the English version/translation?

5. If I rent out my unit to a tenant and I want to provide the tenant the evidence of TM30 submission, will it be the table under the page ค้นหาข้อมูลแจ้งรับคนต่างด้าวเข้าพัก(Search TM.30) ?

-

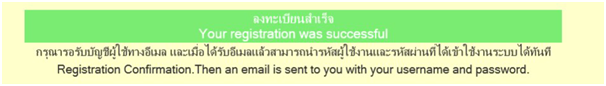

This is to update that I have received the user ID, password today and have accessed the account.

-

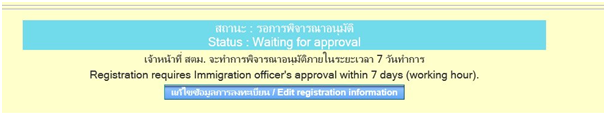

Thank you ALL for information. I registered successfully this morning with the following message.

In the process of uploading the passport copy, I noticed that the English remark asks for the certified passport copy, while the google translation from the Thai does not mention "certified". I shall see.

-

1

1

-

-

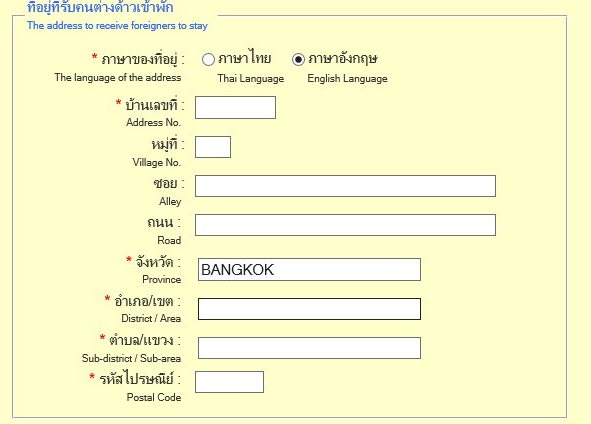

I own a condo in Bangkok and I try to register a new account today on the website. https://extranet.immigration.go.th/fn24online/#

My condo is located in Bangkok (as a province), Watthana (as a district), Phra Khanong Nuea (as a sub-district).

When I come to the address section, I notice province, district and sub-district are all restricted by the drop down menu with locations already pre-set in the system. I was able to select and put in Bangkok as a province, but I could not locate Watthana as a district, nor could I continue to select sub-district.

I did some research to have a full list of districts in Bangkok and then sample checked against the pre-defined districts in the drop down menu. I noticed that not all the districts are available for selection.

I appreciate suggestion on how I can proceed.

Thanks.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Explanation of land and building tax

in Real Estate, Housing, House and Land Ownership

Posted

1. "where it is the case that the DLA has not sent an assessment notification to the taxpayer, it is considered the taxpayer has no burden to pay tax under the law."

=> sounds good. But hang on!

2. "If the taxpayer receives a tax assessment notification from the local administrative organization late, such as being notified later than August, the taxpayer can submit an objection to the assessment of the local administrators within 30 days of the date of receipt of the assessment notification."

=> meaning everyone needs to keep eyes on the mailbox. But again, hang on!

3. "Ministry of Finance, explained that should a member of the public not receive a tax assessment notification, or the deadline for tax payment is extended or postponed, they will not have to pay a fine or surcharges. "

=> Is there still a possibility that tax assessment notification will never arrive at the mailbox at all.... yet the owner is still liable for tax (in an unknown circumstance)? although the overdue does not incur fine/surcharge.