-

Posts

6,831 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Dogmatix

-

PM Srettha forms team to clarify digital wallet scheme amidst confusion

Dogmatix replied to webfact's topic in Thailand News

What would happen is that they would issue domestic bonds to cover say 200 million of it. That is equivalent to 1% of GDP and would drain liquidity from the domestic banking system which only pays 0.5% on deposits, unchanged despite several interest rate hikes. Depositors would scramble to get the government bonds that would pay a lot more than 0.5% and actually less risk than bank deposits which now have only limited deposit insurance. That would drain domestic liquidity and put upward pressure on interest rates. Thailand's sovereign rating would probably be adjusted down, increasing the cost of borrowing offshore by the government and corporates. This would offset some of the stimulus effect which is likely to have a multiplier effect of less than 1x in an economy of this type, vs the finance ministry's heroic assumption of 3x. The ministry is relying on this projection to say the scam will be partly self funding through incremental VAT receipts in light of its huge multiplier assumption. The failure of this projection would lead to a shortfall of funding and greater unplanned deficit. Yes, there would also be an inflationary effect which would reduce real GDP growth generated adjusted for inflation. It looks like a freight train slowing chugging towards a concrete wall. From a macro perspective borrowing money to create a multiplier of less than one is like burning money, as you are borrowing 100 baht to generate 70 baht of incremental GDP. -

I think you are not far from the truth. The RD was placed under great pressure from PM and absentee finance minister Pink Sox to find some quick ways to boost revenue to show how he was going to fund the digital wallet. So they blurted out this little gem without giving it much thought and nor did the finance minster or deputy finance minister. They were unable to say how much incremental tax would be raised, if any, or what impact it might have on the economy but said they would form focus groups to assess it. Much the same has happened with the digital wallet which is now dying a slow death of a thousand cuts, as they slowly realise that it is not fundable in its original form and start proposing bigger and bigger exclusion groups.

-

Thailand's legal system is based on the European Roman law system, as opposed to Anglo Saxon common law. It relies on statutory laws, fleshed out with ministerial regulations, Royal Decrees etc but much is left open to interpretation which is what creates problems of similar cases being interpreted in different ways and ultimately makes it a not rule of law jurisdiction as laws are applied more or less favorably depending your status, connections and how much you can pay. It is wrong to say that precedents carry no weight at all. They do, especially at the supreme courts level but far less so than in common law.

-

PM Srettha forms team to clarify digital wallet scheme amidst confusion

Dogmatix replied to webfact's topic in Thailand News

He urged the public to wait patiently for official details, which he assured would be announced all at once in due course. Why do they need to wait? He already promised it will be paid in one shot to all Thais over 16 next February. 555. The latest suggestion from his committee was to reduce eligibility to 40 million Thais which is still a whopping 400 billion or 2.4% of GDP to fund somehow or another. But cutting it down from 56 to 40 million means he will be cutting into the bone, given that so few Thais live significantly above the bread line. Cutting out 16 million of whom only 3 million pay income tax means cutting out 13 million who are too poor to pay income tax as well as another 2 million who earn only just enough to pay tax. The committee has also suggested restricted it to 16 million with income of less than 8,000 a month. Limiting it to only very poor people will have multiplier effect of less than 1x, because they will not splurge on consumer goods. They will just use it to buy their daily necessities which will not be possible in village shops not registered for VAT. So they will sell their entitlement to chinese loan sharks at a discount to face value. The only positive thing is that PT will only be able to pitch a similar vote buying scam in future at the very poor who receive something from the digital wallet, if it happens at all. -

+1 for PE. Shipito also added a cheaper mail service which was about the same price as PE when I input some dimensions on a dry run.

-

Story Of My Thai Citizenship Application

Dogmatix replied to dbrenn's topic in Thai Visas, Residency, and Work Permits

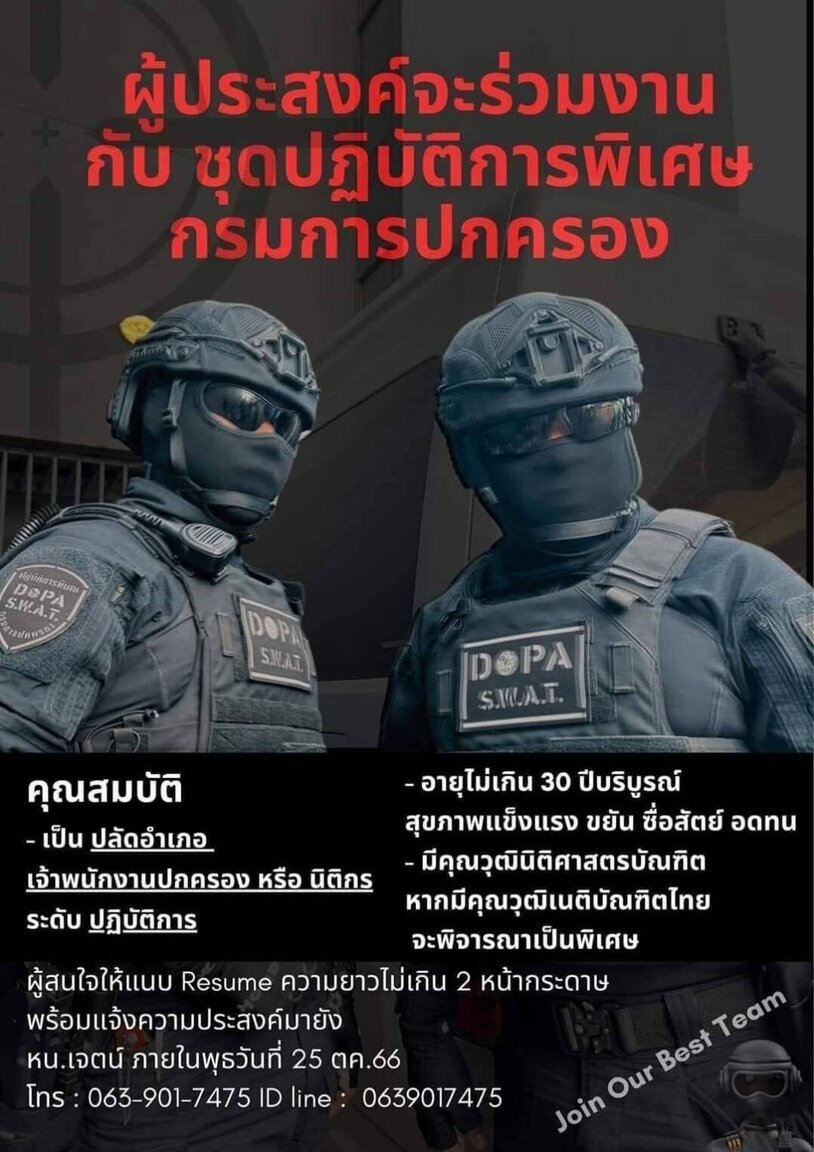

I have only seen it on LINE and originally thought it might be a joke. But now I think it could be genuine because I can now confirm that the DOPA Swat team really exists. There is a picture of one of them during a raid on a pub in Chiang Rai in July under the caretaker government with apparently no police present. It would not be surprising, if DOPA had decided to expand its Swat team to go after influential figures under the new Interior management. Involving local police would probably tip them off. Anyway, as I said, only indirectly relevant to citizenship, as it seems consistent with the current Interior ministry's interest in overhauling things and taking over things previously done by police. -

Story Of My Thai Citizenship Application

Dogmatix replied to dbrenn's topic in Thai Visas, Residency, and Work Permits

This picture is doing the rounds of Thai social media. I have no idea if it is genuine but it purports to be an ad to recruit people for a new DOPA swat team. DOPA raided a large pub in Patum Thani recently without any police, using armed Local Defense Volunteers instead. If genuine, the pic may represent a move to recruit a regular SWAT team that could enforce its powers over licensing to raid pubs, casinos, brothels and the like in the pursuit of the MoI's crackdown on influential figures and their criminal activities. Since DOPA is the department of the MoI responsible among many other things for citizenship and PR, it may be interesting for some of you to know about this potential new string to its bow. As far as the citizenship process is concerned, it is as well to know that big changes are afoot at DOPA and the MoI under the new BJP minister and deputy minister which may or may extend to the citizenship process. Any inclination towards DOPA taking over responsibilities from the police would be consistent with the minister going ahead with the revised ministerial regulations on citizenship and getting DOPA to take over SB's role in initial processing of applications. However, reforms to the citizenship process may not be a priority to the minister right now, as he seems to have a lot on his plate. -

Fiscal Policy Office cuts 2023 economic growth projection to 2.7%

Dogmatix replied to snoop1130's topic in Thailand News

Time to borrow a massive 3% of GDP to fund a digital wallet to add 1% to GDP growth. Pink Sox will be able to figure out the maths. -

A right air head that one.

-

Meet the new uniform, same as the old one.

-

Thais are largest group of dead foreigners in Israel

Dogmatix replied to webfact's topic in Thailand News

Apparently Hamas targeted them. Probably because they resent them taking jobs that used to go to Palestinians with border passes in years gone by. -

Will the Srettha government pursue debt-fuelled growth?

Dogmatix replied to webfact's topic in Thailand News

The US just generated 4.9% GDP growth in 3Q and Thailand, a developing country can hardly get to .3% now. We have this idiotic nominee PM in pink socks running about desperately begging Chinese tourists to come and foreign companies to invest and trying to borrow money to buy GDP growth, as if you can buy anything with other people's money. -

Will the Srettha government pursue debt-fuelled growth?

Dogmatix replied to webfact's topic in Thailand News

Not sure if they really can borrow enough. Government debt already over 60% of GDP and consumer debt is over 80%. Along comes the roadshow clown in red sox with a plan handed to him by some joker to borrow another 2.7% of GDP to generate incremental GDP of 2.7%. Wow this is magic he said. Let’s do it. What could possibly go wrong? But what do we do after that? Keep on begging low end tourists to come from the motherland. They will come to our rescue. -

That's right. There is also a flat rate of 15% on interest applied in exactly the same way as dividends. The other important concession is on Thai immoveable property sales on which there is a complex formula to charge tax at the Land Office on a transactional basis. It is not a capital gains tax and you also have to pay, if you made a loss but in most cases the tax is not more than about 5% of the appraisal price which may be a lot less than the actual transaction case, as sellers and buyers routinely understate the price. Take an example where a seller sells property he bought for 100 million for a 30% profit. Tax would be around 6.5 million, assuming the actual sales price were declared. But if that were proceeds on an overseas property remitted to Thailand, the profit would taxed at 35% and tax would be 10.5 million. Taxing all overseas income at up to 35% is an incredibly stupid thing to do, especially when they give concessionary rates on all types of investment income in Thailand. There is just no incentive to remit money and reinvest.

-

Winter festival in Thailand to boost tourism through creative events

Dogmatix replied to webfact's topic in Thailand News

Does Thailand have a winter? No. Whoops! Most of the tourists come for warm weather in December like the Mediterranean summer. The clown will put people off from coming, if he convinces them it will be winter. What an idiot. -

Winter festival in Thailand to boost tourism through creative events

Dogmatix replied to webfact's topic in Thailand News

The clown in pink sox should give the digital wallet to Chinese tourists. Make it 20k and it will still be cheaper than giving it to Thais. That would guarantee an increase in the Chinese tourism he is panting for. Thais have no idea why foreign tourists come to Thailand or why they stop coming. -

Sorry to say that, if you can read and understand Thai, you will understand from the Thai media coverage that the English version is complete nonsense. The tank referred to was not a water tank at all. It was a fire extinguisher but some bone head translated that as a water tank because in Thai they use the word "tank" for both. The bomb was assembled in a fire extinguisher cylinder which, like cooking gas cylinders, are commonly used by insurgents to make bombs. The cylinder creates pressure for the explosion and, as it disintegrates it makes dangerous shrapnel fly around. If you look at the videos of the explosion. You can see the remains of the cylinder the next morning. In the TV clip there is no mention of the water tank or the alleged heroic action of the shop owner. That was a complete invention, probably by a farang trying to make an interesting story from a garbled translation. The article was ascribed to reporters James Morris and Son Nguyen and I would be willing to bet that neither of them can read or understand much Thai.

-

‘The Well-To-Do’ Might Not Get 10,000-Baht Digital Wallet: Julapun

Dogmatix replied to webfact's topic in Thailand News

I wonder, if it is taxable. They probably haven't got that far in their thinking yet. -

‘The Well-To-Do’ Might Not Get 10,000-Baht Digital Wallet: Julapun

Dogmatix replied to webfact's topic in Thailand News

So great. They've now downgraded it to a means tested vote buying hand out and cut out 12.5% of the recipients to rebut criticism and put the blame on the governor of the Bank of Thailand who would prefer they scrap the whole scam. But they still haven't explained how they will fund the reduced amount of 490 billion which is a big problem only slightly smaller than it was. -

‘The Well-To-Do’ Might Not Get 10,000-Baht Digital Wallet: Julapun

Dogmatix replied to webfact's topic in Thailand News

No. -

‘The Well-To-Do’ Might Not Get 10,000-Baht Digital Wallet: Julapun

Dogmatix replied to webfact's topic in Thailand News

No. They didn't vote for this criminal's party and his clown of a nominee PM in pink socks.. They voted for some one else to be PM. -

Thaksin Had Four Shoulder Incisions: Paetongtarn

Dogmatix replied to webfact's topic in Thailand News

So Thaksin had acupuncture. Love Ung Ing's tiara. It really suits her. -

Thai Interior minister hails the arrest of deputy’s son-in-law

Dogmatix replied to webfact's topic in Thailand News

A peculiar comment by Anutin. It does sound as you say that Anutin is trying to make out that Chada accepted a large dowry from the suspect with no idea that he was a criminal and he was receiving ill gotten gains. But if, as is likely, it was a very substantial dowry, Chada must have had his suspicions about how a lowly local mayor could have acquired it. -

Thai Interior minister hails the arrest of deputy’s son-in-law

Dogmatix replied to webfact's topic in Thailand News

This was a big raid on 8 different locations with several high level cops and officials from the PACC which deals with public sector corruption. It must have been sanctioned from the top of the police force. Thaksin was obviously not happy at having to give up the interior ministry to BJP as Anutin's price for supporting Srettha as PM but had no choice. Thaksin is an ex-cop and has always promoted police interests above other agencies. Anutin and Chada have already got above themselves usurping police powers, as in the raid on a Patum Thani pub without any police involved and drawing up death lists of local kamnans etc. This looks a bit like a power struggle to stop Anutin and Chada off police patches. A bit loss of face for them that mafia local officials are lurking in Chada's own family when he is claiming to go to war with them but, of course, keeping all the details secret which is highly suspicious. If the Interior Ministry has information of criminal activities amongst local officials appointed by the ministry itself, it should provide all the information to police and conduct an internal investigate as who in the ministry appointed all of these criminals and why. -

Chada’s Son-In-Law Nabbed On Bribery Charges

Dogmatix replied to webfact's topic in Central Thailand News

If you google Chada you will find a lot of unsavory cases he has been implicated in in the past, including murder, drug and firearms offences. He has always managed to walk for lack of evidence. One of his sons was killed in a road rage incident when two of his sons allegedly opened fire on another driver who unexpectedly returned fire and killed the son. Chada's parents and his brother were all murdered in gangland style assassinations.