-

Posts

463 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by GanDoonToonPet

-

-

2 hours ago, simon43 said:

I waited just 7 days.....

Me too, at the end of last year. That included registering with a new GP at the new medical centre just down the road from my parents' house.

I had to wait 2 months to get a (free) consultation with a surgeon though 😊

-

You should've done it by post. Mine only took 2 days 🤪

-

-

14 hours ago, snoop1130 said:

Research from Ramathibodi Hospital has underscored the severity of the issue, revealing that treatment for vaping-related illnesses such as chronic obstructive pulmonary disease, stroke, heart attack, and asthma cost the hospital approximately 306 million baht last year

I wonder how much vaping-related car accidents cost them last year 🤔

-

2

2

-

-

6 hours ago, Bredbury Blue said:

Interesting development.

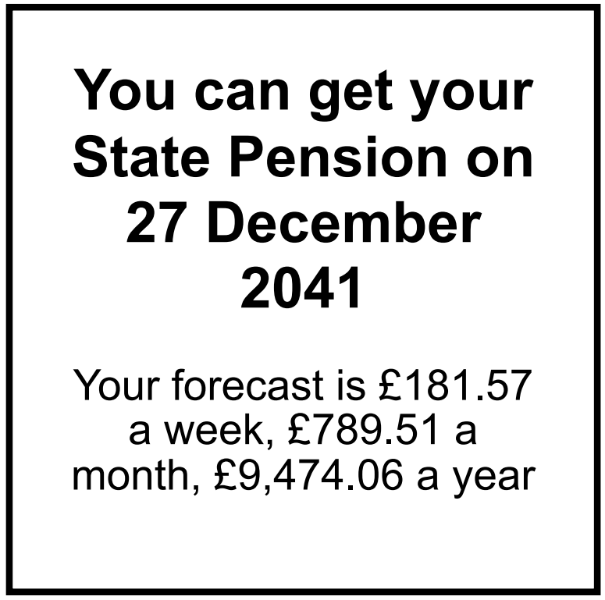

Until recently my NIC page on the HRMC website, showed (i) i had 16 years of gaps, showed (ii) my "Current estimate based on NI record up to 5 April 2024" and (ii) "Forecast if your contribute NI until 5 April 2025" pension amounts i would receive were £30.10 and £23.87 respectively less than the the full new State Pension amount for 2024.

The backdated payment for those 16 years of gaps i made in January 2025 (for the cheaper Class 2 contributions) still hasn't been credited to my account according to the website, but, the website today now shows:

(i) that 4 of those 16 years that were gaps are now full years,

(ii) my "Current estimate based on NI record up to 5 April 2024" is now only £5.11 less than the the full new State Pension amount, and,

(iii) my "Forecast if your contribute another year before 5 April 2025" is now showing the full new State Pension amount - very confusing!

It could be that the payment i made for 16 years Class 2 has been credited to the 4 years at Class 3, but that does work as the amount i paid would be insufficient to pay 4 years at Class 3.Looks like i'll have to do another call to Future Pension Centre (+44 191 218 3600).

Yes that's a very small increase for 16 years of contributions. It could be that some of those years don't actually increase your pension. Did you call FP to check before paying?

Good news is you paid the cheaper class 2, so didn't waste much, and you're on course for the full pension. 😊

-

OK then...guess we'll both have to wait until next year to see our NI record updated 😟

-

14 minutes ago, nauseus said:

Looks like you're good as long as you contribute until Jan 27.

Surely the tax year 2026 to 2027 won't add anything to his pension as it won't be a full tax year?

I think he still needs to contribute for the years 2024 to 2025 and 2025 to 2026 to receive the full pension as his forecast states that it is based on his 'National Insurance record up to 5 April 2024'

-

20 minutes ago, Upnotover said:

Based on that and my corresponding sections above, your forecast is the amount you receive 'if you contribute until [retirement date]'.

As long as you pay for the next 2 years you should get the full pension. Obviously those can't shown on your NI record yet. Are the shortfall years you paid showing as full on your NI record?

-

1

1

-

-

Can you post this part of your pension forecast?

-

1

1

-

-

You could try HMRC Online chat. You can chat with an advisor, as opposed to a computer, during office hours.

https://www.tax.service.gov.uk/ask-hmrc/chat/online-services-helpdesk

-

HMRC have a community forum where official advisors respond to questions...or you can just look through the existing posts as people ask the same questions over and over again 🙂

-

11 hours ago, Bredbury Blue said:

February 2025 having heard nothing I called. 30 minutes wait, put through to a lady in Glasgow. She confirmed she could see the amount I paid and the relevant people would be in touch soon.

Having heard nothing I filled a form in online in March 2025. Form says 10 days for reply. No reply

I'm in the exact same situation as you, except I'm just about to call them to check that they've received my payment (it's been just over 8 weeks as they advise).

Current time from making payment to updating NI records is 65 weeks!

When you last called HMRC, did you inform them which years you want to allocate the payment to?

-

There seems to be a lot of confusion over what this is!

1. The Equality Act 2010 tells organisation when they can discriminate and when they can't, according to specific protected characteristics.

2. The Supreme Court ruled that the protected characteristic of 'sex' refers to 'biological sex', otherwise it would lead to contradictions in law.

3. Trans people are still protected against discrimination under the protected characteristic of 'gender reassignment'.

-

12 minutes ago, youreavinalaff said:

There is also a policy at BTP that males with gender recognition certificates can strip search a female suspect.

Not any more 🙂

-

1

1

-

-

-

On 4/16/2025 at 10:56 AM, snoop1130 said:

This incident serves as a poignant reminder of the need for empathy and understanding, especially towards older individuals in public settings

Someone should remind them about this one as well

-

I've just been through the exact same process, starting January this year.

After you completed the online CF83 form, did you recieve a letter with shortfall tables, detailing which weeks / years you are eligible to pay class 2 NIC?

-

On 4/11/2025 at 1:09 AM, Social Media said:

The force has stated publicly that early access does not provide an advantage in the application process and is only meant to attract a wider pool of candidates. “Enabling people from an ethnic minority background to apply early does not give them an advantage in the application process, it simply provides us with more opportunity to attract talent from a pool of applicants who reflect the diverse communities we serve,” WYP stated on its website.

Then why have the policy if it doesn't provide an advantage?

The advantage is that ethnic minorities can start their application and then submit it at any time whereas some white candidates were only given 2 days to complete their applications.

Having a longer time complete an application, for any job, gives a huge advantage as there is more time to review and refine the application.

As for 'simply providing more opportunity to attract talent from a pool of applicants', this just word salad management-speak designed purely to deflect away from the real reason.

-

1

1

-

-

55 minutes ago, blaze master said:

Address the person by their name only. Problem solved.

Address everyone as 'comrade' or 'thetan'. Problem solved

-

I'm going to send this guy...😂

-

24 minutes ago, bkk6060 said:

So you think that is some great increase for 15 years?

With inflation it is probably lower then 997.

Unfortunately, a poverty joke of a shameful pension.

Hard to predict inflation but Thai food / drinks, cost of labour etc not likely to increase in proportion to the UK pension.

If you own your own home, minimal increase in costs.

Hopefully the 800k threshold for retirement visa will still be in place, giving a comfortable cushion.

-

2 minutes ago, roo860 said:

£230.25 per week = £921 a month?

£230.25 per week = £921 every 4 weeks with 13 four-weekly payments

-

1

1

-

1

1

-

-

31 minutes ago, roo860 said:

Isn't the new payment £921 a month?

Currently £230.25 per week = £997 a month

When I retire in 2041 projected to be £2284 a month or over 100 000 THB at current rates

-

1

1

-

-

I managed to complete the process last month...easy when you know how 🤪

The deadline has now passed but for anyone else who has made payments and still has questions, HMRC have a discussion forum where you can post questions and they will be answered by HMRC staff.

The best thing to do is trawl through previous posts because people ask the same questions over and over again:

Thailand Digital Arrival Card. TDAC

in Thai Visas, Residency, and Work Permits

Posted

Makes me glad I'll be arriving on 30 April...maybe I'll fill one out anyway, just for peace of mind 🤔