-

Posts

745 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Gold Star

-

While on holiday in Kenya and walking through the bush a man comes across an elephant standing with one leg raised in the air. The elephant seems distressed so the man approaches very carefully. He gets down on one knee and inspects the bottom of the elephant's foot only to find a large thorn deeply embedded. As carefully and as gently as he can he removes the thorn and the elephant gingerly puts its foot down. The elephant turns to face the man and with a rather stern look on its face, stares at him. For a good ten minutes the man stands frozen - thinking of nothing else but being trampled. Eventually the elephant turns and walks away. For years after, the man often remembers and ponders the events of that day. Years later the man is walking through the zoo with his son. As they approach the elephant enclosure, one of the elephants turns and walks over to where they are standing at the rail. It stares at him and the man can't help wondering if this is the same elephant. The man climbs tentatively over the railing and makes his way into the enclosure. He walks right up to the elephant and stares back in wonder. Suddenly the elephant wraps its trunk around one of the man's legs and swings him wildly back and forth along the railing, instantly killing him. Probably not the same elephant.

-

Suthisan police bust "new" place of prostitution

Gold Star replied to webfact's topic in Bangkok News

But the pleasure per litre ratio is the highest of all uses that I can possibly imagine. -

Thai logic: More tourists = Must raise prices as there is so much demand. Less tourists = Must raise prices to make more profit from less sales to make up the difference.

- 172 replies

-

- 31

-

-

-

-

-

Thailand offers 5 year-visas to HK influencers to promote tourism

Gold Star replied to webfact's topic in Thailand News

What about something to thank the thousands of expats with strong ties to Thailand, or living here that have stuck it out through the tough times of the pandemic? We have transferred our funds during hard times, and injected money in the local economy to support families, friends, and other less well off Thai people stranded in the devastated economies, ignored and left to fend for themselves. Those in power have shiny ball syndrome, thinking China is the future, while ignoring core support. I for one feel snubbed. Throw us dogs a bone here... -

Thailand gets ready for return of Chinese tourism

Gold Star replied to webfact's topic in Thailand News

Vax certs are not a problem. Forcing people to buy the manditory Thai Covid insurance is. Why no mention of it here? -

Motorcyclist Crashes into a Minivan and Dies in Chonburi

Gold Star replied to snoop1130's topic in Pattaya News

A helmet would have been a better gift. -

Thailand Remains Popular Destination for Russian Tourists

Gold Star replied to snoop1130's topic in Thailand News

I got a Russian advent calendar this year. Every day I open a window, an Oligarch falls out.- 56 replies

-

- 14

-

-

-

-

Before they descend on us again like locusts, has Thailand really solved the Chinese zero dollar tour problem? They used to arrive on Chinese aircraft, ride Chinese busses, stay in Chinese hotels, eat at Chinese restaurants, and be herded into Chinese souvenir shops. They crowded tourist sites, and clogged the roadways, sidewalks, and buffets making one wish they wore hockey equipment to dinner. Not much money remained in Thailand compared with other visitors. I hope that this time they have changed the model so that the invasion is at least worth the agony, displacement, and disturbance to all the other tourists and Thais.

-

Ex-Navy Officer: Warship’s Front Left Hull Was Cracked

Gold Star replied to webfact's topic in Thailand News

Modern warships just don't 'sink', no matter what the seas may throw at it. There must have been something catastrophic that caused the engines to fail, then the pumps, either technical, or gross negligence. A hull crack may be a possible cause. We may never know the truth. Very sad for all those lost. Ferrys or warships in Thailand, make sure you have your own lifevest.- 53 replies

-

- 17

-

-

-

-

What a stupid idea. People come to walk along the seaside and along the beach, stopping along the way, not be crammed into a hot metal box from end to end. It seems they want to address foot traffic, unless you can hang your vehicle below the cablecar. Why not just send a drone, and people could just watch the beach online from their own country?

- 143 replies

-

- 29

-

-

-

-

-

-

Man buys gold bars with 120,000 baht in ten baht coins

Gold Star replied to webfact's topic in Thailand News

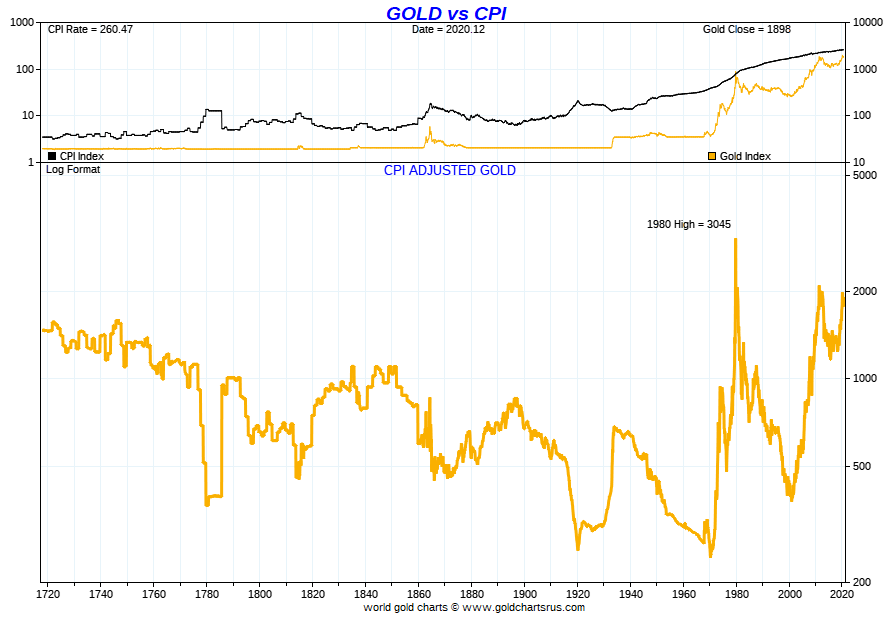

The last 300 years have been neutral. However, gold is still better than cash, which buys you less each year. -

Man buys gold bars with 120,000 baht in ten baht coins

Gold Star replied to webfact's topic in Thailand News

Gold is a poor inflation hedge. Buy oil.