bttao

-

Posts

103 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by bttao

-

-

2 hours ago, willyumcr said:

Thanks Ubonjoe. I am still on an extensioon of stay. I didn't think it would be made easy. I have my old passport for ten years of extensions of stays and visas. A lot of pages. I for sure will use an agency. For 1,000 baht not worth my time at this time of year. Thanks for your help and advice.

I thought an agency would charge more like 3000-5000 baht...

-

10 hours ago, Wake Up said:

As long as you don’t have a foreign bank account with a balance of 10,000 USA dollars (based on local currency) then you don’t have to fill out the FBAR. The balance only needs to be 10,000 for one day in the calendar year to require you to file FBAR. The FBAR online form is easier to fill out than it appears. If you knowingly fail to complete the FBAR yearly then you are probably ok until you are not. The government is lenient when you file late and even if your excuse is I did not know. But failure to file for many years makes the risk to you more if you are caught because you also must state on your IRS form that you complied with the yearly FBAR online filing so you have a FBAR homeland security issue and filing a wrong tax return issue. You must also declare as income to the IRS on your return for any interest earned on your foreign bank account. It is taxable. Not trying to say this is a big deal but I try to comply with all USA laws and if you have substantial money 100,000 K or more in a foreign bank account I would not risk not filing FBAR and proper tax return.

I did not say I had /have a Foreign Bank Account.. Just that I never heard of FBAR; just noticed the line on IRS Returns about the $10 K.

-

10 hours ago, Wake Up said:

You are smart. Personally unless you have a JP Morgan Chase privileged banking relationship or something similar I don’t know why every USA expat does not have a Charles Schwab account with free ATM card and a Capital One 1.5 percent rebate no foreign transaction credit card.

.

What is "JP Morgan Chase privileged banking relationship".

I hate that bank ( even though I opened recently a savings account for $15 K with a $200 bonus (and 0.001% interest) after 90 days; and count on closing it after 6 months (if closed before 180d they will take the $200 back).

They have a FEE for every little service... and they may add one for sneezing.

They may charge me a fee when I close my account, and ask for a check.... or will i have to carry it all in cash?

I read horror stories about their blocked CC in Thailand and elsewhere, leaving people stranded with no cash.

-

8 hours ago, Wake Up said:

The report you have to file if you have a foreign bank account in excess of 10,000 USA dollars is filed online with a federal agency FBAR that is not the IRS but is associated with homeland security. True you then tell the IRS on your tax return that you properly filed this FBAR report. But IMO the IRS and homeland security don’t care about people transferring amounts of 10k or 100K to Thailand which complies with all USA banking laws.

I never paid attention to this FBAR thing ... I never heard of it either...

It's insane: 7 Pages to fill out for 10K... 10k?

I doubt if any Drug Dealer would have to worry about filling it out, or having banking accounts in his name or filing tax returns... they usually have surrogates to do the dirty wash for them....

-

29 minutes ago, steven2018 said:

Transferring funds equal to 800k baht from the US to a Thai bank (over $10k USD) - would that trigger alarm bells in the US resulting in an inquiry by a three letter agency?

Sent from Android using Tapatalk

maybe ... may be not, since they use a Thai Bank in the US, as well as a US Routing number... and the money comes from a US Bank (even then, when you transfer money from Bank to Bank in the US, they (the bank) ask about the origin of that money).

However since it's above $10K deposited in a Foreign bank it must be declared on your IRS Returns.... and they will probably get the idea since your address on your return will be overseas too... as well as a "Retired" occupation.

-

6 minutes ago, Wake Up said:

True and great information you have provided but you also lose and additional 5000 baht comparing today’s TT rate with SuperRichTH Green (not SuperRichTH Orange.) and Bangkok bank —so costs $25 US plus 5,000 baht. As compared to bringing 50,000 dollars cash to BKk and converting it to baht at green SuperRichTH and then depositing cash into Bangkok bank. Not a recommendation just clarification of costs.

Also if you open a foreign currency account at Bangkok bank they give you very little interest like one tenth of one percent —best to keep a savings account in USA ( interest 1.3 percent at Capital One) and if you ever withdraw dollars from you Bangkok bank account (instead of converting to baht) Bangkok bank charges you 1 percent to withdraw your dollars.

Also if bangkok bank goes under (not a prediction as it is a great bank with first class management) you lose your money in your foreign exchange account. Some argument about this but foreign banks rarely have foreign funds to pay depositors in disaster times and politics require Thai leaders to care more about Thai depositors in baht not dollars.

I have bangkok bank account and love it

I also have capital one credit card that pays interest and is great for charges in Thailand and the world and Charles Schwab debit card to use at atms in Thailand and all over the world.

Peace.

Good points...

I did not realize there are 2 SuperRich places...

I also did not think about the banking system overseas... and how they can suddenly fail/ close doors... it's something to keep in mind.

I was just exploring the best way to manage money... and it's not an easy thing to do... because it is beyond my/our control.

As far as what the interest one gets since 2008, it doesn't even keep up with the rate of inflation... so why even worry about it?

-

9 minutes ago, Gruff said:

Everybody forgets the good old Travellers Cheque. To exchange in Thailand (the fee is per cheque) is less than the cost of an ATM transaction and especially if you can get $US 500 cheques cheaply in your country they are still very cost effective, and of course safe.

you can hardly buy any TC anywhere in the US today'

Amex in most cases refused to pay for lost ones...

Amex has lost most of its glory... and i don't think it will be around for long.

-

6 minutes ago, accord25 said:

If you are from the US, open a Charles Schawb checking account. They refund all atm fee's and give you market rate on withdrawals. Its the easiest and cheapest way. Then if you have a bank account in Thailand just do a cash deposit. That way you save all the fee's and get a good exchange rate.

i think you can make a withdrawal at the bank using Schwab ATM/DEBIT without incurring any fee, instead of using an ATM machine ... because if you use atm it will automatically spit-out baht...

-

9 minutes ago, ubonjoe said:

It can be sent to your account by anybody. The social security administration sends one to me every month.

It is not much different than doing a SWIFT transfer other than it is a domestic transfer.

.

I think you are correct:

"Who can use it?

The service is available for holders of US bank accounts transferring funds to recipients with a Bangkok Bank account in Thailand. It is particularly useful for:- Making funds transfers via the internet banking services of US banks

- Receiving payments from US government agencies or private organizations (Direct Deposit service)

- Receiving E-Commerce payments from online payment service providers in the US"

-

45 minutes ago, leither69 said:

Transferwise. Have a look at it

to transfer $50K , it would cost:

$25 using bkk bank.... and $497 using Transferwise.

.

-

That's a good question...

I think they want all the accounts held by the same person... but you have to ask them for a definitive answer.

IMO, the bank sending the money might refuse... because they have to do some tests using amounts of less than $1 for account verification... and since the owners names are not the same, they might ark the owner of the account sending the money to sign some documents for their own protection...

-

4 minutes ago, 007 RED said:

Immigration will accept your FCA in US$ as funds for extension. You will need to request a letter from the bank (charge 100BHT) confirming funds available. Best to get this the day before you go to immigration. Imigration may also ask to see your passbook.

Thanks 007 RED, that's very helpful...

100bt is pretty cheap[... can you get the letter from any branch/online?

-

Thanks ubonjoe.

Could you please list the difficult Immig Offices?

I am thinking about the Cha-am district as of now.

-

Thanks all you guys for the help...

Another easy question:

Can the funds deposited in a Foreign Currency Account be used towards the Immigration 800K requirement for Thai Retirement Visa/yearly extension; or it has to be in Baht?

-

9 minutes ago, Tanoshi said:

BKK TT exchange rate is currently $32.71

Superrich $32.75.

I don't think that would be a significant amount, unless we're dealing with hundreds of Millions...

and does SupeRich have any hidden fee

-

12 minutes ago, ubonjoe said:

There is very little difference between banks when comes to exchange rates for international transfers.

You could open a foreign currency account and keep all your money in USD,

.

Thanks ubonjoe... that's good to know.

I have another question (silly maybe) ...

If i open a Foreign Currency Account, will they deposit the transferred money directly to it, or will they do a Baht exchange "Buying" (charging fees); and revert back to USD "Selling" (another fee)?

And is there an interest rate for such accounts?

.

-

thanks Tim.

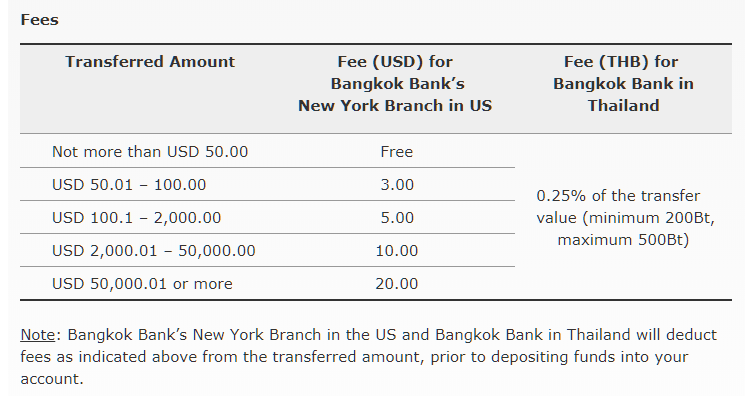

I am not concerned with the cost of the transfer itself, but The exchange rate you get at the bank used to do it:

the BBK Bank charges a set amount :

.

Ideally it would be better if one transfers $50,000 at once because the fees between the 2 ( New York and Thai Branches) would be $25 ($10 + $15 (500Bt)) the same, whether you transfer $20K or $50K

But how about the Exchange Rate at that bank (BBK Bank)... is it one of the lowest?

and can you keep half of the $50K in USD (to take out of Thailand if you choose?)?

and is allowed by the US regulations to transfer over $10K?

According to BBK Bank in NY it is OK because it uses the US Routing System... but doesn't say if there is a limit on the amount.

-

What's the less costly way to bring funds to cover monthly expenses?

Cash

ATM

SCHAWB

Credit Cards

Money Transfer thru BKK in NY

...

-

1

1

-

-

17 minutes ago, Langsuan Man said:

No, you don't have to give in, you can just wait....... no one seems to get freaked out when the Post Office charges me more for overnight delivery versus "snail" mail but let Immigration charge for expedited service and it now becomes corruption

.

Or the US Department of State charging for expedited New/renewal Passport:

"All Additional Services Fees are per application. For example, if you want to expedite your application and your child's, you must pay an additional $60 for each application." 2,000 baht each

Is that corruption too?

.

-

2

2

-

-

On 11/12/2017 at 7:49 PM, micked58 said:

Hi all,

I have been in Thailand since November 2017, so far I have used two tourist visas, and now 4 visa exempt entrys(with 2 extended). I am going to Myanmar on the 15th of this month for 4 days, I am then coming back through on visa exempt(don muang). I am getting another visa exempt because I am only staying for 20 more days then going home.

Do you think there will be an issue coming through this last time?. If so is they anything I can do on my end.I will make sure I have 10k baht in cash and my flights out for proof. Is there anything else I should bring with me or have ready?

Last time I came in 2 months ago the IO asked "how long you stay this time"... If I was to get rejected this time, would there be any trouble? or just me getting a flight somewhere(i wont have a visa for Myanmar for I assume I can go to KL or Singapore?)

IF I booked for a ticket to kuala lumpur now on the same day I am supposed to go through immigration, If I got rejected would I be able to use my already purchased flight, or would they make me book a new one I wonder? (I arrive Bangkok at 10am, I could book a flight for that late afternoon)

Cheers10K is only $300... I read somewhere ( if I am not mistaken) the minimum to be $600/$700 cash?

-

On 11/10/2017 at 5:00 AM, ubonjoe said:

Requirements I posted in #5. https://www.immigration.go.th/content/service_80

The income affidavit will be accepted by all offices but a few may want the consular officers signature on it verified by the department of consular affairs.

The requirements I posted are for Bangkok immigration. You cannot do it there unless you have an address for Bangkok.

#6 - A guarantee letter from the local or overseas Embassy or Consulate, proving the monthly pension of the Applicant not less than Baht 65,000 per month (together with reference documents showing the source of said monthly pension)

So, it also requires providing documents showing the sources: such as a letter, pay stubs, bank statements may be?...

-

Is this acceptable as a reason for TM.86 Conversion application?

"I Wish to apply for a non-immigrant visa

to permit me to apply for an extension to stay in the Kingdom, for Retirement."

thanks for the help everybody.

-

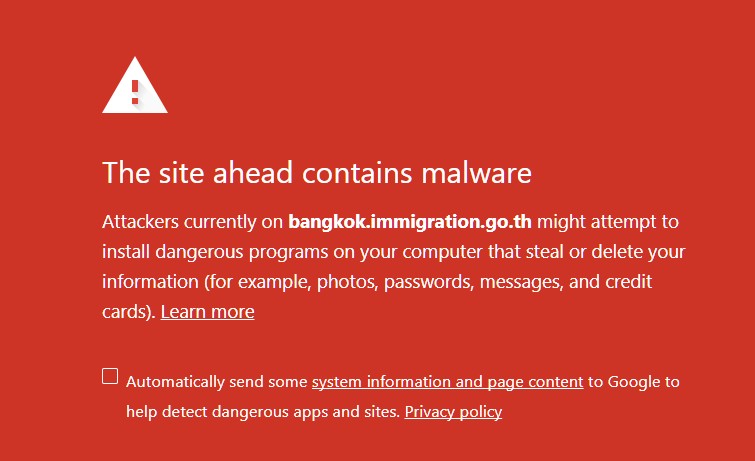

I was looking to find and download TM.86 Form (Conversion)

But got this WARNING:

-

5 hours ago, BritTim said:

That is about right, though there is probably no reason to extend your original tourist entry if going for the conversion. Just apply for the conversion about, say, 25 days before your original 60-day entry expires. Also, you actually get a bit more than 15 months, as the conversion cancels your original entry, giving you a fresh 90-day entry before the one-year extension. With the timing I suggest, you receive a little more than 16 months. With the tourist entry extension you posit using, it would be a little over 17 months, but at an additional cost of about $60.

.

Thanks Tim, that's good to know, that there is no need to extend the 60 day Tourist Visa... and the cost drops down to $190 for 17 months (less than the Non-O - $200 if applied at DC Embassy for just 365 days) :

60 days for TR visa + 90 days for Non-O Conversion visa + 365 days for Non-O Extension... for a total of 515 days (unless they cancel the remainder of the 60 days when I apply for the Non-O Conversion).

How long can you stay out of Thailand, If and when you need to go to the US or anywhere... do you buy 1 Entry for 1900 baht the day you're leaving?

Do they make you buy a Thai Health Insurance, even if you have a US BCBS which can be used overseas?

Rejected entry to Thailand because too many tourist visa

in Thai Visas, Residency, and Work Permits

Posted

.

How does the "VISA" exchange rate for the day compare, with that of the Bangkok Bank?

I noticed that there are 3 different exchange rates depending on what bank notes are being exchanged :

1- for bills of $50-$100 (gets the highest exchange Rate)

2- for bills of $5-$20.

3- for bills $1-$2

The difference is usually about 0.40 baht between each one of the 3.