Thomas J

-

Posts

2,848 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Thomas J

-

-

You can check the delivery online Sometimes though the seller is located in Thailand the product comes via China and the delivery is slow. I have used both Lazada and Shopee a large number of times and never had a problem.

-

2

2

-

-

She should claim she worked for TAT and was just trying to attract new tourists.

-

- Popular Post

- Popular Post

20 minutes ago, webfact said:The TAT has predicted 10 million foreigners will visit in the second half of the year spending 50,000 baht each on average.The predictions are that total tourism will be up on 2020 - 44% up for foreigners, 33% up domestic.

-

11

11

-

4

4

-

Heck they found a cure for baldness centuries ago. The good news was that you did not lose your hair. The bad news was that your voice went up and for some you had to urinate sitting down. rather than standing up.

-

I would expect new testing kits to arrive from China any day now and new testing procedures put in place.

https://amp.theguardian.com/world/2021/jan/27/china-starts-using-anal-swabs-test-covid-high-infection-areas?fbclid=IwAR2szWHZ_8rnS0zwrVN_bMwD5YYTIUdD7GIZv_juHWfxrzfd7ucegsdOpRg -

21 hours ago, placeholder said:

At MAKRO you're wearing a mask. Difficult to eat at a restaurant that way.

Considering their effect on one's health, it may be foolish to drink soft drinks but they won't make you behave foolishly after you drink them. Unlike beer.

You seem to be of the impression that somehow a mask creates an impenetrable barrier preventing the spread of Covid. While masks are “helpful” they are far from creating a wall though which Covid can't escape through or be inhaled through. One Danish study showed that the use of masks provided something less than 50% better protection than no mask at all. Even if the figure is 70% common sense would tell you that you are far safer sitting at a restaurant table 2 meters away from someone not wearing a mask than you are standing shoulder to shoulder to people in Makro or worse yet packed in chairs in an enclosed government office with people sitting in rows next to, in front of, and behind you. That is particularly true if the restaurant is outdoors with fresh air dissipating any virus and during the day sunshine killing it.

I have seen you repeatedly post with absolute certainty that if drinking were allowed at restaurants that the patrons would become drunk, and “act foolishly” There certainly are no studies to back up that premise. I know I have dined at restaurants serving alcohol for over 6 decades and never have I had even a single instance where a patron became drunk, rude, obnoxious, and my table was confronted by their presence. I have been in Thailand for 3 years and not witnessed such behavior before Covid so I have no reason to think suddenly such behavior would exist.Since you speak with such 100% certainly of that happening I can only assume that your are either clairvoyant or that you have repeatedly witnessed such behavior at places you dine at. If that is the case, I might suggest you change the class of restaurants since where you dine at obviously appeal to a class of drunken boorish, classless, uncouth louts. Your other choice is stay home and not expose yourself.

https://www.bmj.com/content/371/bmj.m4586/rr-6 -

1 hour ago, CMBob said:

For clarification:

1) One of the major reasons a person creates a living trust in the US is to avoid all probate proceedings. To accomplish that, one creates a living trust AND transfers all assets (with some exception for accounts that have direct beneficiaries in most cases). If one doesn't transfers all assets (with noted exceptions) to one's living trust, then a probate of the assets is required to get the assets into the trust.

2) Almost always, the person who sets up the trust is the trustee.....and he/she continues as usual during lifetime to file normal income tax returns, etc. (the trust doesn't file anything during that time period and has no need to obtain any tax identification number during that time period). The IRS considers that one's assets in a revocable living trust (where the person setting up the trust is the trustee.....which is almost always the case) still belong to the trustee personally and he/she continues tax-wise as he/she has done before.

3) After death, the successor trustee(s) then follow the terms of the trust (paying any leftover debts and distributing trust assets according to the terms of the trust). If (typical) the trust provides for immediate distribution of assets, then that's done and the successor trustees will likely have to obtain a tax identification number for the trust and file tax returns for one year. If the trust provides for management of the assets (and, for example, periodic distribution of funds to named beneficiaries) over a period of years, then the successor trustees would be filing tax returns for that time period.

One the biggest errors in the whole living trust process is not properly funding one's trust (or, for example, obtaining a new bank account or investment account in one's own name versus the trust's name) as that leads to the hassle, expense, and time to probate assets to the trust. So creating a living trust and counting on your pour-over will to transfer assets to your trust is exactly the wrong thing to do in almost all cases.

I don't disagree. However if you have a will it avoids probate so the trust has nothing to do with avoiding probate. I would advise people setting up trusts to fund them (placing assets in the name of the trust)

in advance. If you recall the OP wanted to know about setting up an investment fund for his Thai wife. In the vast majority of instances assets that you have in banks, and investment companies offer the opportunity to name a beneficiary. That beneficiary can be the trust. There is nothing wrong with putting the bank accounts and investment accounts in the name of the trust. I did so myself. However, I also don't find much danger in having accounts at brokerage houses or banks with the trust named as beneficiary and worrying that the pour over will not take place. Since she is Thai any real estate here will automatically be in her name anyway.

-

14 hours ago, webfact said:

Foreigners who have been vaccinated against COVID-19 could be allowed to visit Thailand without the need to quarantine, according to new proposals from the Tourism Authority of Thailand (TAT).

I had no doubt that Thailand officials having all the financial resources of the government, all the best world experts, all the medical specialists in the world, matched with the intelligence of the elected leaders would gather all the facts, get numerous ideas to spur the economy submitted and after careful and and exhaustive study implement a reasonable policy. That is after they tried and failed with all other methods that had absolutely no chance of increasing tourism and re-igniting the economy. That is with the possible exception of the Cannibis food selection for foreigners.

-

25 minutes ago, Refresh said:

Its the law - many nations have changed the 'document of record' from paper to electronic for certain documents e.g. invoices, receipts, contracts although not usually for land (notarised)or wills

I am not sure about if its the law, however even the delivery people for Grab, J&T, Kerry etc. have cell phones. You hit print and it can convert anything to a pdf document for free. If it needs to be signed there are numerous sites such as Doc Hub where they can be uploaded, signed and then dowloaded. Even if what you say regarding the lack of technology for the mom and pop store is true, that still does not explain why Thai immigration has everything in paper. You go to an airport in China or the USA they don't use paper forms. You go to a kiosk where you answer the questions, sign the form and it automatically takes a photo of you. All digital, all filed.

-

1

1

-

-

2 hours ago, silverhawk_usa said:

ust follow the instructions on the IRS website. It would be difficult for them to follow all the steps if you were gone. My wife is a beneficiary on a U.S. Mutual Fund and will need the ITIN when the time comes. Also, I am able to file U.S. taxes as Married filing jointly with her ITIN which made a big difference in tax owed.

Biggest problem right now is that to get an ITIN you need to mail it hard copy snail mail. With Covid mail service between Thailand and the USA was suspended. I have not checked recently but the last time I went to Thai Post they said letters to the USA were strictly UPS and DHL and neither of those will deliver to a post office box number which is what the IRS uses to collect mail.

-

3 minutes ago, Phulublub said:

While I too cannot pay PEA direct from the BKK app, I can pay direct from my account using the PEA app.

I also have Bangkok Bank but another account at SCB. Never looked at paying the electric from Bangkok but PEA automatically debits the SCB account each month to pay the bill.

-

1 hour ago, supertomdee said:

All these things are just for doing without any particular use. Just like writing down the names and mobile numbers at the book of a shop or restaurant. Who will check or bother to check its accuracy ? Inside a restaurant, even family members say 4 were told not to sit in the same table, why ? They are from the same household and sit down together to eat at home. This is ok and legal. Why they have to sit separately when they together at a restaurant ? "Lack of common sense disease" catched from whom ?

Many years ago I was working for a major bank that was encountering financial problems because of the oil price decline in Texas. The bank came out with a statement of the actions it was going to take. I was talking to a man in our investment area and I said, Phil, these actions do nothing to address the problem. He laughed and said, Tom most actions are intended to create the illusion of progress. I think this is the case with the Coronavirus. The media has hyped it to the point where the government feels compelled to implement rules to show it is addressing the problem even if those actions do absolutely nothing.

Consider, it is ok to be shoulder to shoulder at Makro but not in a restaurant. It is ok to drink a soft drink at a restaurant but not a beer. At one point there was a curfew you could not be out past. I guess Covid spreads more after curfew. All of this points to how ludicrous the rules are.-

1

1

-

-

1 hour ago, Isaan Alan said:

I can't pay my PEA electricity bill

That is strange however my electric bill is automatically debited against the account. I also have bills from 3bb and AIS which I use Air Pay. Shopee provides a 50 baht coupon. So I use the coupon it automatically looks up my bill and I hit pay. To reload Airpay I just hit the Top Up on the Bangkok Bank app and again it remembers my Airpay account. As said, some aspects of Thai Banks are very modern but the passbook and having to order a statement is definitely something you have not seen in the USA in decades.

-

1 hour ago, Bill97 said:

Real estate can easily be put into a revocable trust prior to death then is easy to handle after death. I have done it

Yes it is easier prior to death than afterwards and I have done it also. You just go and change the deed to the name of the trust and have it filed at the County Register of Deeds. After death a bit more complicated. You have to have the death certificates, papers listing you as the executor of the estate, signature guarantees. copy of the trust, death certificate. The easy ones are the bank and investment accounts. Just put the name of the Trust on the beneficiary designation. When you file the death certificate the financial institution changes the name. If the person does not mind, it is just as easy to change those prior to death also. It just means that the title of the account is in the name of the trust and you execute any action as the trustee. After death whoever is the contingent trustee assumes power.

-

Absolutely true. I can not believe that once completed and filed they are ever looked at assuming that one you actually retrieve those paper copies. If they are scanned and filed why not make them digitized to begin with. In opening accounts including Lazada, Shopee, Air Pay and even foreign domiciled investment accounts, they ask for things like passports, and application forms in electronic format. Perhaps it is job security. Gives paper shufflers something to do, and then of course there are the jobs for those who have to stamp the papers, and finally those who have to file them.

-

2

2

-

-

I had to go the Bangkok Bank today to pick up my one year bank statement for my visa extension. Though they told me last week it would be available today when I arrived they said, sorry it had not arrived and to wait 3 or 4 more days. As a person who worked for major banks for over 3 decades I am constantly struck by the dichotomy in the banking system here in Thailand. On the one hand, you have apps on your phone where you can transfer money, pay bills, scan QR codes for payments, do withdrawals at ATM's without a card etc. On the other hand, savings accounts are still with a passbook and machine posted which I have not seen in the USA in at least 2 decades. Further, to get a statement, I have to go to a branch, fill out a form, show my passport, sign a copy of my passport, wait a week and then return to pick it up. By contrast, my bank in the USA is in New York City. I can go to my computer and print off any statement going back years. Why the local branch office at least does not have the capability to print a statement electronically is truly stone age. While it may be unfair to compare US banks to Thailand, I can get my transaction history on Lazada, or Shopee. I can print the statements and history for AirPay. So the technology exists, but why the Thai banks embrace the new technology yet cling to relics of the past is truly baffling.

-

1 hour ago, Dante99 said:

Many people put assets into the trust before death, infact most do

You are correct, that is an option. It is advisable but not required to fund the trust prior to death. Many do it and it is a prudent thing to do. Others like bank and investment account have beneficiary designations and you can name the trust as the beneficiary.

Some assets like real estate get complicated after the death of the grantor. Probate and Trusts are two different things. If you die without a will, then the estate must be probated. If you die and have no will it is called dying intestate.

In any event, for the original OP I would suggest he contact an estate planning attorney. If his primary concern is her lack of investment expertise and money management, a trust is the best way to make sure she is taken care of in the future and not fleeced. I don't know what country the OP is from but I would certainly trust the financial institutions in the USA/Canada/Switzerland/UK/Germany etc far more than I would trust the Thai Banks. Lets face it, Thailand in recent years went through a coup. There is no telling what "might" occur if there was political or financial instability in the country.

-

Merely a guess on my part but few Thai's drink wine compared to beer and hard alcohol. Just like Florida has no income tax which helps it residents, it has a high sales tax, and resort tax which catches the tourists. I suspect they know they are taxing a higher percentage of non-thais.

-

3 hours ago, Dante99 said:

This is not true for Revocable Trusts set up by individuals. I know for a fact that no tax identification number or tax return is normally required while the grantor is alive and the trustee.

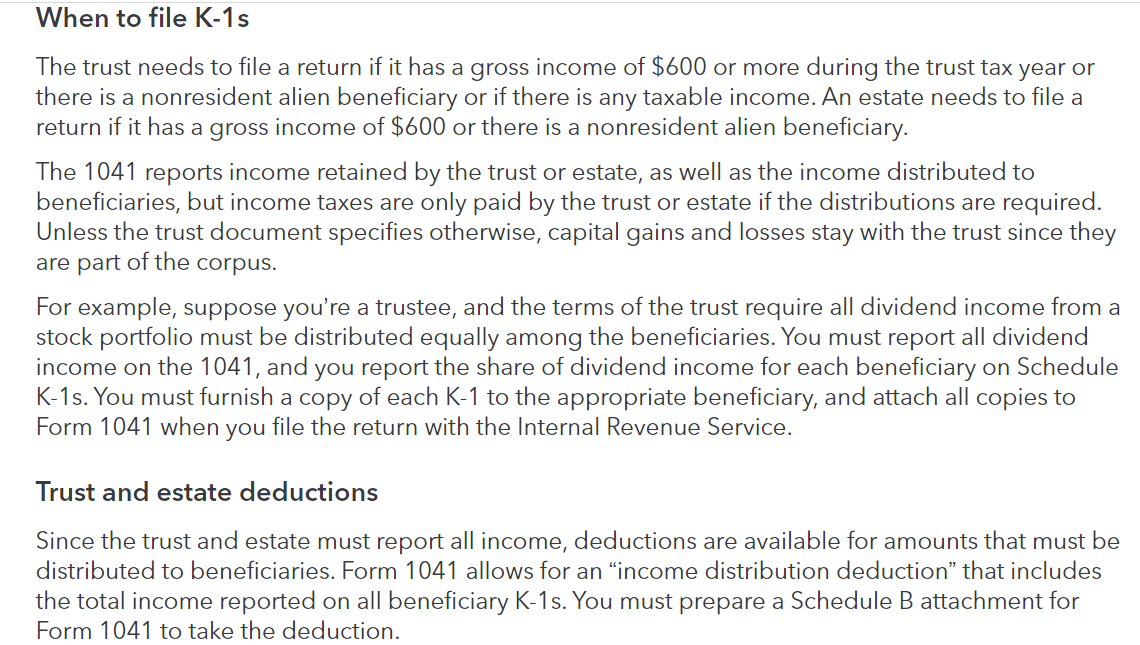

The trust is not even funded until the death of the grantor. In the persons will, they instruct that all of their assets are sent to the trust. Until then, there is no money in the trust and hence no income to file a tax return on. However, my point was that once the trust was funded and it had income, it would have to have a tax ID number file a tax return and distribute K-1's to any beneficiary receiving monies from it.

-

2 hours ago, Yellowtail said:

If you are not paying and they continue to maintain the area, why rock the boat?

That is exactly what we did until they instructed the security guard to block the entrance and exits to the village with a rolling gate. Since we were "not paying" they instructed the security guard not to remove them. Mind you we already have paid for an electric rolling gate but they instructed him to use the manual steel rolling gate while on duty.

-

23 hours ago, Bill97 said:

I think you are guessing and know several lawyers who would disagree.

If the Trust was established in the USA it would have a tax identification number and file an annual return. Any money distributed to the beneficiary would receive a K-1. The trust in the USA would be liable for income taxes on any USA based investments. The beneficiary would also file a USA tax return and be liable to pay USA income taxes on any income distributed to her but that would be a deduction for the trust. I was not in the personal trust side of the business so though I am familiar with grantor trusts (living trusts) and their adminstration a person contemplating setting one up, should consult with a US estate planning attorney.

With respect to making payments abroad that is something I can tell you unequivocally we did in the Trust Department all the time. Our single largest client was Ford Motor company and we made payments to their retirees, all over the world. Additionally, the bank was headquartered in Detroit which is just across the river from Canada. A very large number of Canadians worked in the USA were not U.S. Citizens but received payments from the bank from trusts established for them, or more typically retirement benefits they received from the US company they worked for.

-

5 hours ago, Cake Monster said:

FYI

It is a legal requirement that all Monies paid into the" Village Estate " and all outgoings , are published and placed in a prominent position within the Village in order that the Residents can freely inspect the Accounts at any time. This has to be done on a Monthly Basis.

Account to show Name / s ( Juristic person )on Account, Bank Branch and Account Number.

IE A profit and loss Account

BTW

The Village has to operate as a Non profit Business,

Yes,

I am aware of that. However at this point there is no legal entity. So I am not sure what the situation is relative to the requirement to show a profit and loss, balance sheet and a separate bank account. In a legal sense those paying are doing so voluntarily to a non-entity. I asked the land office if there were any penalties for failure to register as an entity and still operating as one. The man said no. That does not make sense to me, that you have a law requiring you to form an entity and how it is run, then no penalties for failure to do so. -

11 hours ago, topt said:

Unfortunately it wouldn't necessarily.

While technically true, as a legal entity you can go to the land office and file against the property of those not paying. That prevents them from ever selling the property without settling up for the monies that are due. I don't know if there are any more enforcement options such as a lien against bank accounts etc. but I do know the filing at the land office means that eventually the village would get paid.

-

1 hour ago, NancyL said:

This is good advice for a U.S.-based partner, but not necessarily for one based in Thailand who will remain in Thailand. I've seen too many Thai surviving partners who end up basically scammed out of their money because they don't understand how to access their U.S. based inheritance. Remember, he's looking for advice relevant to Thailand, where the rules regarding trusts are very, very different.

I would disagree. The entire point of the Trust is so she can't access the money. Prior to his death, the trust is established along with the rules that govern it. The Trustee then distributes the money as directed in the Trust. If she is Thai and remains in Thailand, the Trustee is given the banking information here in Thailand. If she receives a specific amount each month, or a variable amount based on income, whatever the amount, is then transferred to the Thai bank account that is specified. I would certainly trust banking institutions and trustees based in places like the USA, Canada, Switzerland, Germany or the UK far more than any here in Thailand.

U.S. stands with SE Asian countries against China pressure - Blinken

in World News

Posted

I was in Vietnam a few years ago and visited the Cu Chi tunnels which were part of a tour showing the tunnels and various devices used by the Vietnamese during the war. I apologized to the Vietnamese host for what the USA did. The Vietnam war was a prefabricated reason to enrich some US businesses associated with profiting from war materials. He responded that it was actually a PROXY war in part pushed by China. It was really China on one side and the USA on the other with Vietnam stuck in the middle.