h3ith

-

Posts

48 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by h3ith

-

-

3 minutes ago, dr_lucas said:

What about capital gain from abroad? Such as profits from stock market and/or commodities investments in other countries?

Current law: not taxable if you remit it to TH in the next calendar year: remittance principle.

The text of this new order does not clearly separate financial income from employment and business income. Foreign employment income is always taxable, whether or not the amount is transferred to TH. If they want to cancel the remittance principle for financial income, I'd imagine that the parliament would have to change the tax law. But this order just cites the current law.

-

1

1

-

-

1 minute ago, RupertIII said:

Last I saw Wise wasn't issuing debit/ATM cards to those living in Thailand,

No, hasn't changed. If your registered your Thai address with them, they don't issue a (new) debit card. They included Malaysia recently. TH, perhaps in 10 years?

-

13 minutes ago, ukrules said:

Also this seems a little bit odd considering it's September 18 today :

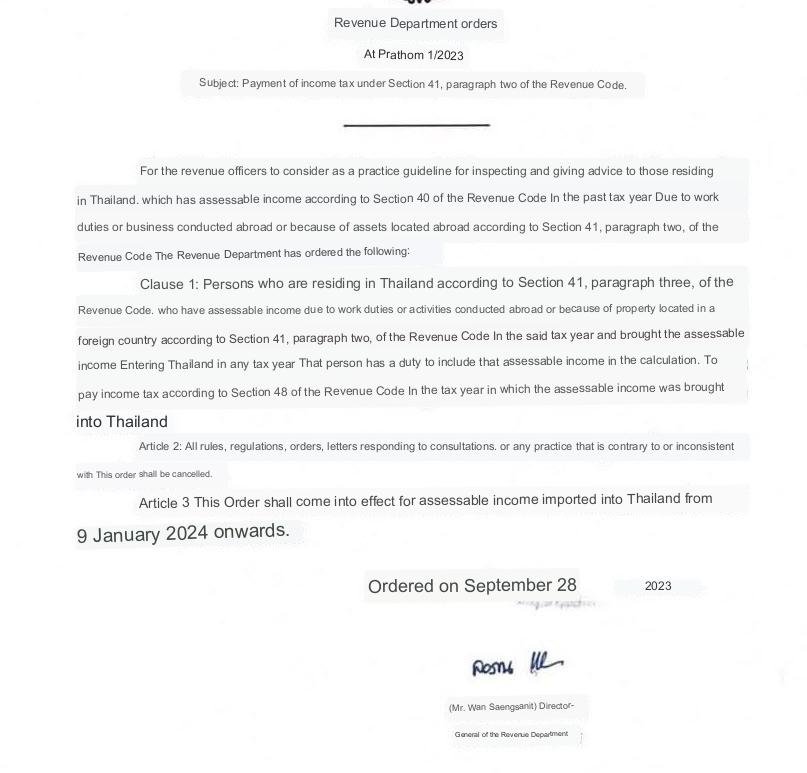

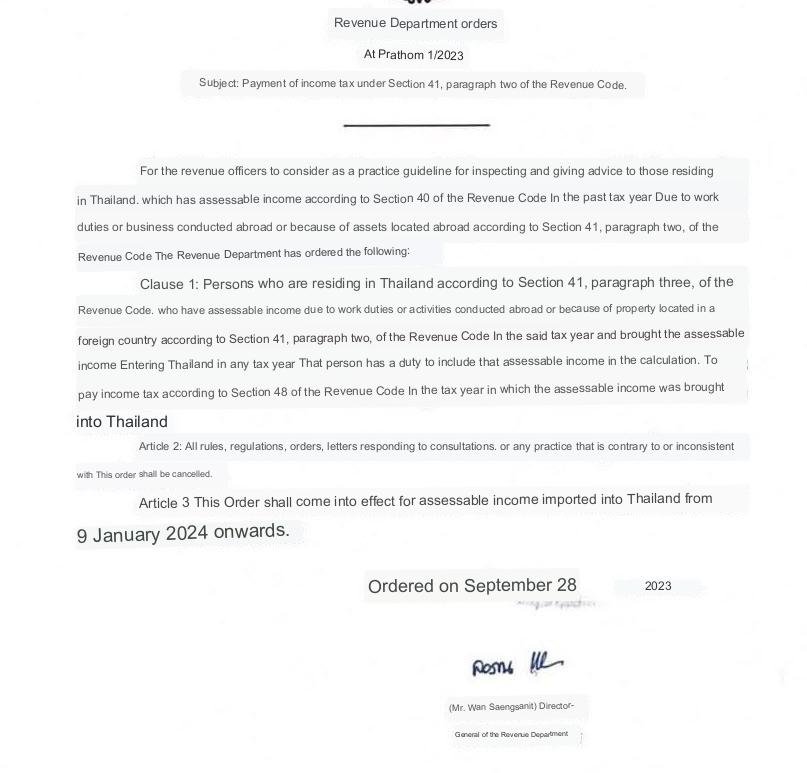

The date in the order seems to be handwritten, so Google Translate is struggling with it

-

2

2

-

-

1 minute ago, ukrules said:

Please read again and ponder over the meaning of "in any tax year".

It's a decree or order. I'm not a Thai lawyer, but this order does not change the tax law, which should require an act of parliament.

"Any tax year" may refer to employment income and business profit, to which the remittance principle ("next calendar year") never applied. The order text just did not bother to separate work and business income from financial income.

-

1

1

-

1

1

-

-

9 minutes ago, Ben Zioner said:

You are right, it is income earned in the "said year" brought into the kingdom in "any year",

"Any year" could be a translation flaw. Imagine accumulating capital gains, interest or dividends for 20 years, and then transferring 5% of it to TH? How could anyone sort out how much of the incoming amount was based on financial income over the previous 20 years as opposed to original savings?

I imagine the revenue office may demand evidence that the incoming amount was not work or business income. And that it was not financial income earned in the current year. Which would be burdensome enough. But "any year" for 10 or 20 past years, for all incoming bank transfers, would be absurd.

-

1

1

-

2

2

-

-

2 minutes ago, ukrules said:

this is the precise 'loophole' which is being closed.

This decree cites the current tax law, Section 41, almost verbatim. "A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax in accordance with the provisions of this Part."

Since it does not differ from the current law, it does not seem to invalidate the remittance principle (calendar year seasoning). It seems to be an enforcement decree instead of a change of the law.

Employment and business income from abroad are always be taxable, irrespective of the year.

But perhaps they will force tax residents to prove that all incoming amounts did not comprise any current-year financial income (dividends, interest, capital gains), which would be a bureaucratic nightmare.

-

1

1

-

-

11 minutes ago, dayo202 said:

does this mean i will have to pay tax here in Thailand.

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/507424/uk-thailand-dtc180281_-_in_force.pdf This is the double taxation treaty.

1) "Interest ... may be taxed in that other state", i.e. Thailand. That's the case for most European countries.

2) But if you season your interest income in your UK bank acount and transfer it in the next calendar year, it would not be taxable in TH. https://taxsummaries.pwc.com/thailand/individual/taxes-on-personal-income

The new decree may mean that the TH revenue office will try to verify that you have not transferred current-year interest but only past-year interest income.

-

1

1

-

-

- Popular Post

- Popular Post

28 minutes ago, ThomasThBKK said:It says assets, that's literally everything including stocks, cash in bank, dividends, bonds...

But Sections 40 and 41 of the revenue code refer to assessable income. That's interest, dividends, capital gains. But not the capital stock that generates this financial income. If any cash that is transferred into TH would be subject to income tax (30% for 2 - 5mil THB, 20% for 1mil), the real estate market would collapse because that would be a wealth tax. No country imposes a 20% wealth tax on incoming payments.

And this decree does not change the current tax law. Currently, only foreign income (as opposed to foreign capital) that is transferred into TH in the same calendar year when it was earned is subject to TH income tax. That's not new, it was just not much enforced.

But from 2024, TH will get data from foreign bank accounts that are held by people who registered their Thai address with a foreign bank: Automatic Exchange of Information. So the TH revenue office probably plans to comb through these data and look for incoming payments from foreign businesses. "You live in TH all year long. How do you earn so much from a foreign business?"

-

3

3

-

- Popular Post

- Popular Post

The Google translation refers to (A) "income due to work duties or business conducted abroad" or (B) "because of property".

A) Section 40 of the revenue code:

A1) Any of us is a tax resident of TH if we stay more than 180 days. Tax residency has nothing to do with the immigration status or the type of extension.

A2) "Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, ..."

"Pension" among all these types of income seems to refer to private pensions paid by an employer, (perhaps) not government pensions.

The double-tax treaty between your country and TH regulates where government pensions and private pensions are taxable. In previous years, many retirees could not even get a Thai Tax ID even when they asked for one.

B) Section 41 paragraph 2: capital gains, interest, dividends. "A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax."

This decree does not change the current tax law, which only imposes tax on financial income if you transfer it into TH in the same calendar year when it was earned.

Employment income is different - it's always taxable in TH if you earn it while you are in TH, even if you receive it from a foreign employer and park it in a foreign bank account.

(C) Income tax on capital, i.e. on the savings you transfer from your foreign savings account to TH: No, cannot happen. If you transfer 5mil THB of savings to buy a condo and TH were to impose 25% income tax on the incoming 5mil, then the real estate market would implode. This decree does not change the tax law, which only taxes income but not the substance or capital.

In the worst case, the revenue office may demand proof of how much financial income was included in the 5mil, e.g. 200,000 interest income in the months before it was transferred. Then they could impose a 5% tax on the 50,000 of interest that exceeds 150,000. That's not a new tax law. It was just not enforced.

(D) TH has signed up for the Automatic Exchange of Information with most other countries. So if an account owner is registered with a TH residence address with his bank in the EU, ANZ or UK, then the TH revenue department will receive data about incoming payments the next year. In 2025, a foreigner who received a 2024 stream of payments from some Western business in his Western bank account may be asked to explain the source: "We've got these data from your foreign bank. Did you earn foreign business or employment income while you lived (and apparently worked) in TH?"

-

1

1

-

4

4

-

- Popular Post

- Popular Post

-

Starting this year, Thailand participates in the Automatic Information Exchange of bank data with almost all other countries. The foreign bank in which you receive your earnings will report your bank data to their national tax office in 2024, which will report it to the Thai tax office. At some point, TH will start to analyze these data and may ask how you generated this income while you spent 365 days in TH. If you work online from Thailand, even if all your customers are located offshore, you generate income that is taxable in TH.

-

2 minutes ago, h3ith said:

But now they tell me the permit is required for everyone prior to departing home country.

The import permit is free, unlike the process at the airport.

You just send the filled PDF form by email to the Department of Live Stock and get the reply email with the Notification for Import 1-3 days later.

It's the easiest step of the process. Even if someone claims it is not required for a pet on the same flight (which I haven't read in any English-language guidance), you should send the email.

-

1

1

-

-

17 hours ago, HeijoshinCool said:

But now they tell me the permit is required for everyone prior to departing home country.

True or False? Will the airlines demand an import permit?

These are Thai regulations, not airline requirements. The airlines just check if your dog's documents are complete to avoid import problems at the destination.

-

14 minutes ago, Nong Khai Man said:

They settled for 5,000 Baht ( Each )

times 4, that might be the tariff

-

We brought our dog to Thailand this year.

Because of ASQ (not for the dog, but for us), we had to arrange its transport on a cargo flight, since we could not have picked it up after our own arrival at Suvarnabhumi, nor taken her for a wee walk on any ASQ hotel's small balcony.

The requirements for the dog are the same, with or without ASQ. Also the import permit is required no matter how the dog arrives.

Bringing Pets Into Thailand - Royal Thai Consulate-General, Los Angeles (thaiconsulatela.org)

1) Import permit: see further below

2) Transport as cabin luggage:

If yours is smaller than 8kg (7kg for some airlines), including the weight of the box, and it fits in a IATA-conforming transport box, then some airlines allow them in the cabin. Middle Eastern airlines plus some others don't allow pets in the cabin.

Theoretically, you can transport the dog as cabin luggage, but I guess for dogs larger than a yorkshire the box will be difficult to stow near or beneath your seat in practice. Not sure if the cabin crew would put the pet box in some luggage cabinet.

3) Transport as checked baggage:

If heavier than 8 kg, as checked luggage in a IATA box. You pick up its box at the luggage belt in Suvarnabhumi, with your suitcase, but you MUST go to the veterinary office at Suvarnabhumi office to clear him for import. I suppose some airport or customs employee will make sure that you don't abscond with your dog. They may take the box and bring it from the luggae center to the Quarantine Station, with or without you directly in tow.

Tax: theoretically, the import tax will be much lower if the dog flies on the same plane as you,not as cargo. If as cargo, customs will charge 30-35% import tax, quite officially, not inofficially, on what they estimate is the combined value of the dog plus its freight cost according to the freight letter.

If you are on the same flight, they may charge a few hundred or thousand Baht of administrative processing fees, but not 20+ thousand.

4) Cargo flight:

The airline cargo staff will bring the box with your dog to the Animal Quarantine Station at Suvarnabhumi airport. Be prepared for several hours of waiting time in their Animal Quarantine Customs office before you can finally show the papers for your dog and finally pick him up. Probably, we could have sped up the waiting time, if we had foreseen it, by hiring a Thai agent who knew how the "speedier" process works. We had all the necessary papers, nothing was missing. My wife is Thai, so it was not language barriers, either. She arrived at the office half an hour before it opened and half an hour before the plane landed. After more than 6 hours, with the help of some external agent she met there, she got the stamps and the dog, with a fee paid to the helpful agent.

I don't suppose a plane full of hungry hyenas had landed before the quarantine office opened and had to be processed with priority.

5) Papers:

5a) Import permit from Department of Live Stock,

some weeks before the flight:

A maximum of 60 days (and a minimum of probably 7 days) before the flight, you need to send an Import Request Form to the Department of Livestock, via email. Permit-form-R-1-1.pdf (thaiembdc.org)

They answer relatively fast, by email, within 1-3 days, with a stamped PDF document: "NOTIFICATION FOR IMPORTATION OF ANIMAL(S)". In our case, within 2 days.

Your dog needs to arrive in Bangkok within 60 days, or else you would need to request a new permit. Your airline would not accept the dog without the Notification document.

I was advised that the import permit would be necessary no matter how the dog arrives, whether as cabin luggage, checked-in on the same flight, or as cargo.

You will still need to get through animal customs clearance in Bangkok.

The PDF import permit you request is just your announcement that you plan to request clearance for a pet on the day when the flight arrives. To leave the Airport Animal Quarantine Station with the dog, you need to go through the "real" customs clearance process, get stamps on "real" papers, and pay the fees.

5b) Veterinary health certificate:

A few days before the flight (not more than 1 week), a government-accredited veterinarian in your home country (not only a private pet doctor, but a veterinary office of your city or state) needs to confirm with signature and stamp the vaccination status and fit-to-fly status of your dog.

At least 21 days before the flight and no more than 1 year before:

vaccinations against rabies, leptospirosis, distemper, canine hepatitis and parvovirus

dog must be at least 4 months old (because they must not be vaccinated against rabies if younger than 3 months).

no pitbulls or staffordshire

For leptospirosis, a test no more than 30 days before the flight may replace a missing lepto vaccination. But dogs can get a combi vaccine for lepto, distemper, hepatitis and parvo, so you can cover all requirements with 2 shots: rabies and then all others. Note that there must be 4 weeks of time between the 2 shots.

The same veterinarian needs also to confirm that the dog is fit to fly regarding its general health status.

Without the confirmation of these vaccinations by your local government veterinary office, your dog may go into quarantine in Bangkok or worse - unless your airline already refuses to transport him when you try to check him in without all vet documents.

At your home airport, on the day of the flight, another veterinarian will check your dog's health after check-in, probably just by glancing at him while he stays in his transport box. He will not issue papers to you or to Thai offices. His job is only to prevent liabilities for the airline should your dog appear to be in a precarious state.

5c) Other papers you need to attach to your dog's transport box, with copies in your own bag:

copy of shipper's passport

copy of pickup person's passport

address in your home country

address in Thailand where the dog will stay

flight itinerary, with date, time, any connection flights (book a direct flight)

the bill of lading, which the airline will prepare during check-in; perhaps just a baggage tag on the box if it is not a cargo flight

-

1

1

-

-

2 hours ago, WorriedNoodle said:

It's TD Ameritrade.

Saxo Bank Singapore is another alternative, besides Interactive Brokers.

I haven't opened a Singapore account yet, but would be surprised if Saxo or Interactive Brokers had the same quirk as TD Ameritrade.

They require a reference bank account in your own name for transfers in and out of your brokerage account. But they don't state that your reference bank account needs to be in a certain country.

Normally, brokers and banks only require proof of identity (passport), proof of residence (e.g., a residence certificate by immigration office, or a bank statement from your Thai bank showing your address), and a Thai tax identification number or a reason why you don't have a TIN.

-

On 7/2/2021 at 8:17 PM, ubonjoe said:

Your first 90 day report will be due 90 days from the day you apply for the extension.

update for anyone interested in due dates for the 90-reports (different immigration offices may apply different rules):

my 90-day report is due 90 days after the extension was approved, according to the 90-day reminder stapled into my passport together with the extension.

Not 90 days after application, nor 90 days after the 1-year extension starts.

My approval date was several days prior to the start of the 1-year-extension. E.g. approval on July 10 ( had applied 1 month before I needed the extension and got the approval after 2 weeks of processing time). The 1-year extension will expire on 25 July 2022.

Next 90-day deadline October 08 = 90 days after the approval of extension.

I couldn't get an answer from the IO on whether the first 90-day report can be done online. Or if the first report must still be done in person.

-

12 hours ago, WorriedNoodle said:

the Singapore brokers receiving account is another bank in the USA

It's not the Singapore branches of Interactive Brokers or TD Ameritrade, I hope? I was thinking about opening an account with them.

-

- Popular Post

- Popular Post

On 8/13/2021 at 7:13 AM, tonray said:Best advice would be to continue working remotely and keep it quiet, IE don't tell anyone outside of your wife. Keep life simple.

A Thai company registration requires that you hire at least 4 Thai employees, excluding your wife and her family, to my knowledge. I'm not sure about the minimum salaries you have to offer those 4: THB 15,000 per month? Thus, you'd have a "licensing fee" of THB 60,000 in the form of these 4 salaries every month and would have to think about what kind of work the 4 can contribute for their salary. Your wife may give you the evil eye if you try to hire 4 nubile "personal assistants" in tight pencil skirts.

You can sign an employment contract with an IT service company licensed by the Board of Investment (BoI). The company will obtain an official work permit for you.

They will usually take a 30% cut of your client's payments, but this includes the withholding tax (income tax) on your Thai salary. Example: Your client pays GBP 5,000 monthly to your employer. You will receive a THB salary pay-out equivalent to GBP 3,500. The deduction of 1,500 also covers your Thai income tax (e.g. ~20%pts tax are included in the deduction of 30%; the remaining 10%pts are the profit margin of the BoI company). Thai personal income tax rates are lower than in many European countries, so the 30% may be a bargain, unless you realize even lower UK tax rates on dividends.

-

3

3

-

4 minutes ago, ubonjoe said:

Your first 90 day report will be due 90 days from the day you apply for the extension.

So if I apply on day 60, the first 90-day report will be due on day 150 = ca 60 days after the extension of day will be approved?

Thx, that was new to me.

This first 90-day report on day 150 must be done in person instead of online, right?

-

Is it true that after you file your very first application of extension of stay (60 days after first arrival on a Non-O visa), you do not need to submit a separate TM47 report during the ca. 30 days while the application will be under consideration?

Your first 1-year extension application replaces/subsumes the first 90-day report?

If the "under consideration" period for the first extension starts on day 70 and ends on day 100, do you have to file a TM47 on day 90 to avoid a fine?

-

In July, I'll have to go from my province to Bangkok, for some hours of governmental bureaucracy.

Assuming that the situation remains as earlier in June, i.e. no lockdown of all roads in and out of Bangkok:

I'm hearing from Thai acquaintances that if you don't stay overnight in a dark red zone but arrive and leave the zone within some hours (like delivery drivers), you don't have to go into home isolation for 14 days when you return to your home province.

Did any of you see a more official source for this interpretation, regarding "transit through dark red zones"?

(always assuming that roadblocks don't pop up around Bangkok, some weeks from now)

-

1 hour ago, canopus1969 said:

Does the Rental Contract have her name on it?

no, only my name. I suppose a witness statement from the landlord, that she lives here too, might serve.

But the question is if something like proof of address, certified by an amphoe, exists in Thailand.

-

Foreigners can obtain a "certificate of residence" from the immigration office, as proof of address to a bank outside Thailand.

But which kind of document can my wife obtain as proof that she lives with me in the same rented home?

Her tabian baan is for her parental home, decades old. Thai landlords rarely agree to put the names of tenants in their tabian baan.

Do you know if the local amphoe office would stamp a certificate of address for her, e.g. based on some witness statement?

Thai government to tax all income from abroad for tax residents starting 2024

in Jobs, Economy, Banking, Business, Investments

Posted

Could be worse: Assume you purchased Apple or Amazon stock 10 or 20 years ago. If you sell them and transfer cash to TH to buy a condo, 90% of the amount would be old capital gains. Would TH revenue office calculate the capital gain starting with the stock price on 31 Dec 2023? Or the original stock purchase price of 10 years ago?

Or if your original savings of 100,000 came from your after-tax salary, 10 or 20 years ago, how do you prove to the TH tax office that this original capital should not be taxed as Thai income because the money had already been taxed by the home country?