-

Anyone have any experience with an insurance company...WrLife?

Glad to provide factual clarification of your previous potentially misleading statement, which is worth repeating: There is no connection between WrLife and William Russell. 🙂 If possible, please review your past comments for potentially misleading statements and correct them. Future readers will appreciate it. Thank you.

-

Welsh Father Faces Life-changing Reality After Thailand Holiday Accident

. Stats here: https://www.financial-ombudsman.org.uk/data-insight

-

What's the best expat insurance for expats in Thailand?

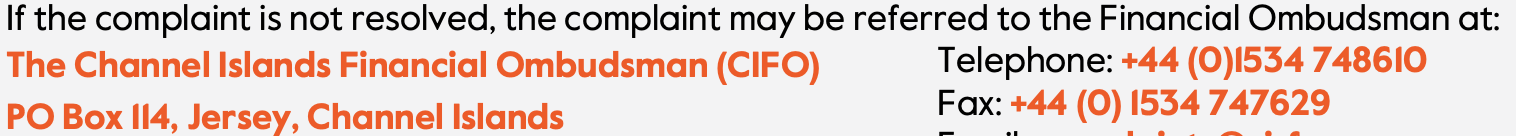

Maybe only be for UK citizens. https://www.cignaglobal.com/dvc-pdfs/UKCEIC-UKCEICP7/en/CGHO Policy Rules CEIC UK_EN_05_2023.pdf For non-UK expats, Cigna says it uses Channel Islands Financial Ombudsman. https://www.cignaglobal.com/dvc-pdfs/CGIC-EP31/en/CGHO Policy Rules CGIC_EN_02_2024.pdf I wonder how different the insurance regs & dispute resolution rules are between the UK and Channel Islands Ombudsman? 😐

-

Questions regarding April Expat Insurance

When comparing to April International, it's worth noting: - Pacific Cross Thai has no real limit on how high they can raise your premium. Their pricing formula is based on your medical history and the group of people who enrolled when you did. They also have a much less favorable Pre-Existing Conditions rule, which lets them deny coverage for any pre-existing condition (even ones you couldn't have known about) Contrast to IMG & CIGNA pre-existing condition rules. - IMG is EU based🙂 & truly international, but it's overall coverage limits are Life-Time and not Annual like April International. That difference lets IMG significantly reduce their risk and pass on savings to customers. But if you got an expensive chronic disease, you might regret choosing IMG? - I don't know much about AXA yet. It looks interesting. Google results seem to show AXA SwitchCare is a Thailand based policy. Personally, I'd pay more for EU/UK legal rules (and hopefully handling disputes in English). Anyone considering these policies, should probably compare future premium estimates to April's MyHealth Thailand policy.

-

Cigna International Medical Insurance Domicile (worldwide cover) Question

Thanks for providing details in a comments to https://aseannow.com/topic/1318255-questions-regarding-april-expat-insurance/

-

Questions regarding April Expat Insurance

If you have any details or experiences about April being a disaster, please share. It could help people like me, who are shopping for international medical insurance. Thank you. Oops never mind. I see your later comments where you gave details. Thank you!

-

Cigna International Medical Insurance Domicile (worldwide cover) Question

While reading through the Feb 2024 Policy Rules for CIGNA-EU and CIGNA-UK (Guernsey), I found a big difference between these policies. The CIGNA-UK policy is only for expats (country of habitual residence must be different from their country of nationality). Where as, the CIGNA-EU policy is only for people living in their country of nationality. It surprises me that the CIGNA-EU (international medical insurance policy) is not for people who live what I would call "internationally". Here's the actual language: CIGNA UK Policy Rules Section 1.1 (pg 4): This policy is only offered to beneficiaries whose country of habitual residence and country of nationality are the same designated country.

-

Cigna International Medical Insurance Domicile (worldwide cover) Question

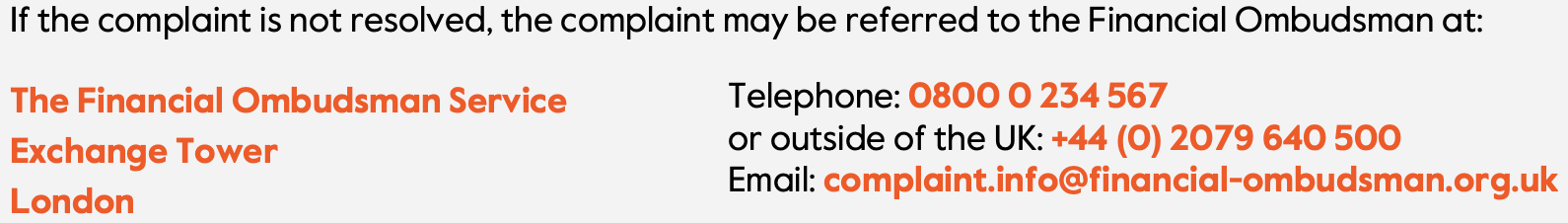

Interesting. Thanks for PDF link! Bottom of last page appears to be dated 2018. I wonder if Cigna honors it, or if every year when you renew, your policy becomes governed by the latest Policy Rules document ? Policy Rules I received yesterday (dated Feb 2024), which only lists the UK ombudsman (image in previous comment) https://www.cignaglobal.com/dvc-pdfs/CLICE-EP26/en/CGHO Policy Rules CLICE EXP_EN_02_2024.pdf I'm surprised that after Brexit, the EU allows an EU domiciled health insurance company to specify a non-EU ombudsman. I'll follow up with the AOC broker on this question. Nevertheless, I'm more likely to buy from Cigna-EU because, without knowing anything about the UK or Guernsey ombudsman, I'd choose the UK one.

-

Cigna International Medical Insurance Domicile (worldwide cover) Question

Comparing the Cigna-EU vs Cigna-Guernsey "Policy Rules" docs (see image), the EU version says disputes will be handled by: The Financial Ombudsman Service, Exchange Tower, London whereas, the Cigna-Guernsey doc says (see image) disputes are handled by: The Channel Islands Financial Ombudsman, Jersey, Channel Islands Interestingly, an AOC broker said Cigna-EU complaints are handled by the "financial ombudsman and or the European regulator in case of problems".

-

Cigna International Medical Insurance Domicile (worldwide cover) Question

Actually, my question is about insurance regulations & consumer protections imposed by the domicile (EU vs Guernsey) on insurance companies, which would supersede their stated general conditions. For example, EU's GDPR controls what a company, such as Google, can and can't do with an EU user's personal information, regardless of Google's corporate privacy policy. Anyone signing up for Gmail from within the EU gets the GDPR protections. I think Google paid a few billion$ to the EU for violating GDPR. https://www.compliancejunction.com/gdpr-frequently-asked-questions/ "Does GDPR Apply to non-European Union Citizens?" Just today I received an email from an AOC broker. He said they sell insurance from the EU Cigna. He also said the EU Cigna offers more consumer protections than Cigna Guernsey. Unfortunately, he gave no examples 😞 I now have the Cigna "Policy Rules" from both domiciles. Next step is to compare them for differences. (BTW I think I read a previous comment of yours, which said you switched from Cigna to April. If true, did you ever say why you switched, in a post or comment you can point me to? Thanks)

-

Cigna International Medical Insurance Domicile (worldwide cover) Question

Cigna offers international medical insurance (worldwide cover) from at least two different domiciles, in particular: Guernsey & Belgium. I'm concerned Cigna chose its Guernsey domicile to avoid stricter UK consumer protection regulations. Cigna also sells this insurance through its Belgium domicile, which I suspect offers better consumer protection. By consumer protection, I mean things like rules on maximum processing time for pre-approval and claim payment request. Also, if there's a dispute with Cigna, a customer wants the most transparent appeal process with reasonable time limit on decisions. My questions are: 1) Does Cigna international medical insurance sold by its Belgium company offer better consumer protection than its Guernsey company? 2) Can a customer choose which Cigna domiciled company they buy from? If so, how? (I'm a US citizen.)

-

Ozempic/Semaglutide

Ozempic is easily available in popular expat cities, like Pattaya. Available in hospitals and clinics (eg Pulse $450/pen, lasts ~6 weeks). Once a week injection with "pen" is much simple. I hate needles, but the pen needle is the smallest shortest needle I ever saw. I don't feel it. Injection takes under 7 seconds. Taking the pill is daily and more complicated. If you take the pill incorrectly, the dose will have little or no effect, because it will no pass through the stomach wall into the blood. The main effect of Ozempic is that you lose your appetite and get full very quickly. Long-term, lost weight will return after you stop taking Ozempic if you resume previous eating habits. Personally, my goal is to use Ozempic to loose weigh and change my eating habits: Two small meals per day. Instead eating big meals and snacking at night.

traveldan

Member

-

Joined

-

Last visited