-

Posts

215 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Tom100's Achievements

-

Bought mine on Lazada for 150 baht delivered. It works as well as the Omron I had in the US that cost over 2000 baht. Dara Pharmacy is near Fascino and may be a cheaper option in Chiang Mai.

-

Tourism Record-Breaking: 2M Indian Tourists Visit Thailand

Tom100 replied to snoop1130's topic in Thailand News

The Tourism Authority of Thailand (TAT) seeks to attract high-value travellers in line with national tourism strategy — driving toward its year-end target of 39 million visitors and 2.23 trillion Baht in revenue. TAT assumes the average tourist will spend 50,000 baht in Thailand per visit (not flights to/from Thailand). Now TAT celebrates low-dollar travelers. -

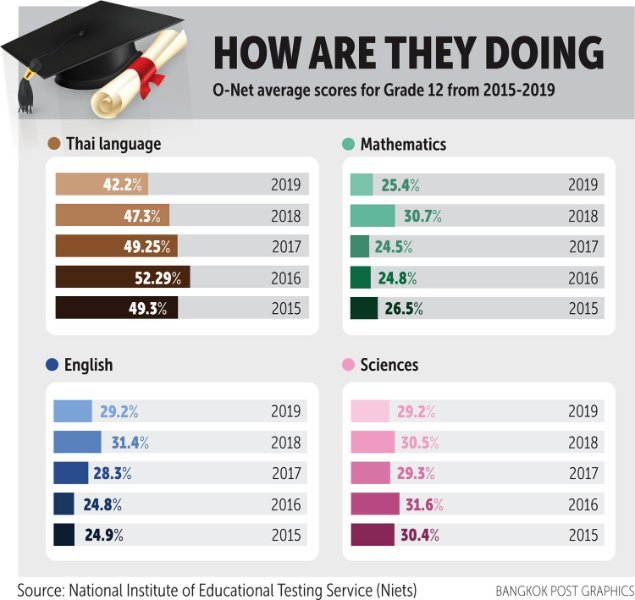

Report Thailand's Future at Risk: Education and Job Woes Loom

Tom100 replied to snoop1130's topic in Thailand News

-

Tourism Thailand’s Tourism Confidence Dips Amid Economic Challenges

Tom100 replied to snoop1130's topic in Thailand News

AI says: Thailand has three main organizations involved in tourism—the Ministry of Tourism and Sports, the Tourism Authority of Thailand (TAT), and the Tourism Council of Thailand (TCT)—because they serve different roles in the policy-making, promotion, and industry coordination of tourism. Here's how their responsibilities differ: 1. Ministry of Tourism and Sports (MOTS) Type: Government ministry Role: Policy maker and regulator Responsibilities: Develops national tourism strategy and policy Oversees legal frameworks, regulations, and development plans for tourism and sports Coordinates with other ministries for tourism infrastructure, immigration, and safety Supervises government agencies like the TAT Think of this as the top-level authority setting the direction for the tourism sector at the national level. 2. Tourism Authority of Thailand (TAT) Type: Government agency (under MOTS) Role: Marketing and promotion agency Responsibilities: Promotes Thailand as a tourism destination internationally and domestically Runs advertising campaigns, travel fairs, and public relations Operates TAT offices in Thailand and abroad Provides market intelligence, travel trends, and visitor statistics This is the "sales and marketing arm" of Thai tourism, actively attracting tourists and improving Thailand’s image abroad. 3. Tourism Council of Thailand (TCT) Type: Private sector umbrella organization Role: Industry representative and advisor Responsibilities: Represents private tourism-related businesses (hotels, tour operators, airlines, etc.) Provides feedback to government on industry needs and concerns Supports tourism standards and workforce development Acts as a bridge between the public and private sectors TCT ensures the voice of tourism businesses is heard in national planning and helps coordinate the private sector’s response to policies and crises. Summary Comparison Organization Type Main Role Key Focus Ministry of Tourism and Sports Government ministry Policy, regulation, oversight Strategy, infrastructure, governance TAT Government agency Promotion and marketing Tourist campaigns, branding, market research TCT Private sector body Industry coordination and advocacy Business interests, collaboration, standards Why three organizations? Because tourism is a complex, multi-stakeholder sector, involving: Government planning and infrastructure (MOTS) Active promotion to attract tourists (TAT) Input and support from businesses that serve tourists (TCT) Having specialized entities helps Thailand balance public policy, market promotion, and industry collaboration effectively. -

Tourism Thailand’s Tourism Confidence Dips Amid Economic Challenges

Tom100 replied to snoop1130's topic in Thailand News

Here is this week's update from the Bangkok Post...Thai tourism has been struggling to regain prepandemic peak https://www.bangkokpost.com/business/general/3072756/tourism-revival-goes-into-reverse. View our policies at http://goo.gl/9HgTd and http://goo.gl/ou6Ip. © Bangkok Post PCL. All rights reserved. -

Anybody planning to go back to the US?

Tom100 replied to Knight Rider's topic in ASEAN NOW Community Pub

No. I went back to Chicago in fall 2024 after 7 years away. It was very very bad...far worse than 2017. The airports are full of migrants who live indoors on the floors The downtown lost its good spenders b/c the white-collar office folks WFH since covid. At least 50% office & retail vacancy rates. Migrants sleeping on the streets, begging and hitting on the women. I loved the US as a young guy in the 1960s...but it now makes me sick. -

My landlord is raising my rent.

Tom100 replied to Fabio1980's topic in Real Estate, Housing, House and Land Ownership

Do not pay increased amount. Landlord will get the message. Plan to move and lose deposit. My last Bangkok condo (around Phrom Phong) increased rents 25% in fall 2024. I moved to Chiang Mai. -

USA Trump Accuses Obama of Treason, Shares AI-Arrest Video in Explosive Claim

Tom100 replied to webfact's topic in World News

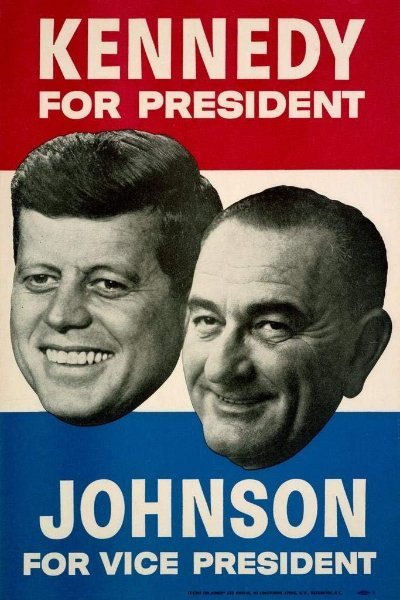

Wait. Are you suggesting that scumbag South Texas politician LBJ, brought on as the JFK VP to win southern votes, wanted to be POTUS and may have conspired with bad hombres? But Trump said he would release all the files... -

USA Trump Accuses Obama of Treason, Shares AI-Arrest Video in Explosive Claim

Tom100 replied to webfact's topic in World News

Obama Awarded Nobel Prize For Exemplary Work Planning Russian Collusion Hoax Hillary should get credit for promoting it. Trump is right on this matter. The Russia-gate hoax was an Obama-led covert ILLEGAL & UNCONSTITUTIONAL US intelligence operation that tried to terminate a democratically elected US President. This is treason against Trump and the US democracy. For reference, read this: In *What Happened*, Hillary Clinton repeatedly claimed that Russian interference significantly contributed to her 2016 election loss, promoting the "Russian collusion hoax." Throughout the book, she repeats the unsupported claim that Trump’s campaign colluded with the Kremlin. Clinton cites the U.S. intelligence community’s assessment that Russia interfered in the election, but she goes further by implying a direct connection between Trump and Russian operatives. She repeatedly portrays herself as the victim of a foreign plot and uses this narrative to deflect attention from her campaign’s strategic failures, such as neglecting key battleground states and underestimating voter dissatisfaction. Rather than taking responsibility for her role in the loss, Clinton devotes significant attention to external forces—Russia chief among them—framing the election as stolen. This narrative helped fuel years of partisan division, led to the fake Mueller investigation, and shaped public perception in a way that many now view as treasonous. Critics argue that in doing so, Clinton undermined trust in democratic institutions and contributed to a climate of conspiracy and distrust—ironically mirroring the tactics she accused her opponent of using. I voted for Trump in 2016, from a polling booth in Chicago Illinois. I voted against Hillary and Obama (both from Illinois) because I know that they are total frauds, not because of Russian influence. -

Politics Thaksin Unveils Vision to Transform Thailand into ASEAN Powerhouse

Tom100 replied to snoop1130's topic in Thailand News

China is the regional/global leader in aviation, electric vehicles, and green energy. Thailand is not even a competitor. So WTF is he smoking? -

Travel Chiang Mai Crowned Asia's Best City, Bangkok Shines in Third

Tom100 replied to webfact's topic in Thailand News

Travel + Leisure publishes annual ratings based on subscriber polls -- Anyone with a subscription can vote. Any city can boost its ratings by buying hundreds of subscriptions and voting for itself. How else could India have 3 highly-rated cities on list? Who cares? T&L is rubbish. -

USA Trump's Mass Layoff Plan at Ed Department Clears Legal Hurdle

Tom100 replied to webfact's topic in World News

As a retired teacher, let me correct you, The National Center for Education Statistics (NCES) is paid by the DOE to summarize state level education results but its simple work can be replicated by anyone. I could do a better job working 10 hours a week. AI can do this job in seconds. The Federal DOE NCES data is also extremely misleading regarding education -- it reports what percent of white/black students are officially graduated but ignores what percent of graduated students have met educational grade level objectives. This is political: Democrats prefer to indoctrinate & graduate rather than educate.- 53 replies

-

- 10

-

-

-

-

-

USA Trump's Mass Layoff Plan at Ed Department Clears Legal Hurdle

Tom100 replied to webfact's topic in World News

Great news. I support the TOTAL elimination of the US Federal Department of Education. After living in 5 US states and seeing education levels declining, I see no need at all for the Federal department. Plus, I am sure they are 99% Democrats. Under the U.S. Constitution, providing a public high school education is the responsibility of states. This is based on the 10th Amendment to the Constitution, which reserves powers not delegated to the federal government, nor prohibited to the states, to the states or the people. The Federal Department supports DEI hiring and mis-education and LGBTQ plus .