Bravehart

Member-

Posts

9 -

Joined

-

Last visited

Bravehart's Achievements

-

are you sure it covers any accident - falling down stairs? I would have thought a moto policy only deals with moto matters. I have the full policy and can't see any non-moto accident coverage - not using a phone app quote. Anyway, the terms of the accident coverage may differ, if the bike in question is very old vs new - yours says Cat 1 and that isn't available for old bikes, I think. I was even told a few years ago by a broker, that I was only eligible for Cat 3 ! So the info seems to be random. Not sure what personal accident 50k means - if medical expenses are 200k (lose your eye and didn't end up going to a hospital?) That's the problem with advice on insurances - like for like comparisons. Some people are talking about getting it in their home country, needing full comprehensive medical cover or have a motorbike focus.

-

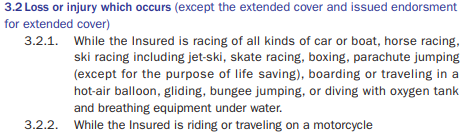

Yes, that's the defunct policy and the new one has the same name but ends in MED. 2 calls to the company with management checks resulted in "medical expenses exclude anything to do with motos". Would be interesting to see what happens if a Thai calls about that policy. There is a misleading pdf poster on the web for the MED policy which goes something like, line 1 - up to 5m THB for accidental death line 2- covers accidents driving or passenger on moto line 3 - covers medical expenses up to 500,000 As far as I am aware, line 2 is linked to line 1 (but there is a big drop in the pay-out for moto-related) and "medical expenses" simply does not cover moto accidents. It even states that in 3.2.2 of the policy (it is possible that policy doc hasn't changed since the original Sabuyjai product). And if you had emails from AXA saying 3.2.2 is an error for the old policy - you might want to check if you ever renew. Although AXA don't sell the old policy anymore - maybe they keep it open for those who had it and renew it. Staff could not tell me what date the new policy replaced the old policy. I thought buying insurance - with well written docs in English - would be less problematic than dealing with banks or immigration. Unfortunately not. It seems like a few agencies are also misinterpreting Death/Dismemberment/Disability (due to moto) vs Hospital medical expenses (due to moto). I was clear with companies that I was not interested in opd, death, cancer, chronic illnesses, etc but only accidents. They don't seem to get it, wasted time on the phone and in banks & insurance cos. In the end I might just take a risk! If the AXA product really is still available - or something similar - they should make a killing out of selling it to teachers, who never realize their card won't help them if they end up in Bangkok Hospital or Bunrumgrad after their win moto gets T boned. None of my language centres nor schools ever mentioned this. For those who are only concerned about moto accidents ONLY or putting a new stripe down the side of a porche with your handle bar, then Roojai do a 4500B moto insurance policy with 200k medical (matching axa) and up to 600k for the damage to another vehicle. Its called Class2+ and is available for those who ride very old small bikes (meaning they will rightly only pay out 10k if my bike is damaged or written off). Btw I did the stripe thing 10 years ago and is cost me 8k ???? but I still don't bother with that kind of insurance.

-

Ppnomads 24.000 baht if Thailand is country of travel and UK is residence. You can't put Thailand for both. Not sure if its breaking the law, but certainly will be voiding the insurance by saying you are in the UK when applying - if you are not. Even if you are in the UK at the time, there is usually a rule about having been in the UK for the past 6 months/spend 185 days a year in the UK.

-

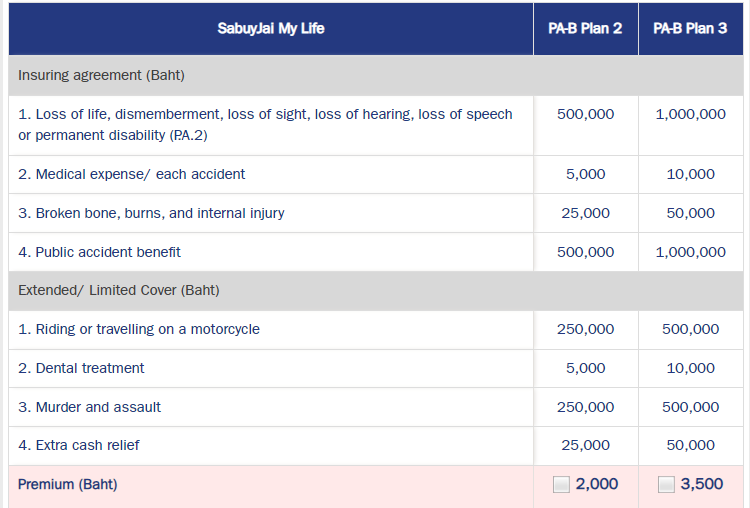

Policy would begin during non-B extension to stay, but could change into TV at some point, before returning to extension to stay. Point was - anyone ever been asked to present passport at time of a claim. Presenting passport to insurance office (or give to broker, if used) when taking out policy, is fine. AXA now say Sabuyjai My Exclusive product did include motorbike, but that policy is no longer available. It is now called AXA Sabuyjai My Exclusive MED and that excludes motorbikes. I was told their Sabuyjai My Life plans will cover motorbike, but it looks like only 10,000 medical expenses (plan 3). I think the 500,000 for riding or travelling on a motorcycle, refers to the limits on the 1,000,000 due to being on a bike... correct? Otherwise 3,500B pa is a steal. If it is only 10,000B medical for motos, then it looks like MSIG might be the best bet. Well done to those who got the original Sabuyjai - but it might be worthwhile to check the terms of any renewals.

-

thanks replies. I will persevere getting email/document from AXA that motos are 100% included. Call another day = another version of the policy. "Residency in Thailand" is the next hurdle, not sure if some insurers are less stringent about what this means -- don't insist on looking at the passport when a claim goes in. Could be an issue if slip into TVs at some point during policy. Same goes for travel insurance (worldwide/SE Asia) which is next on the to do list due to frequent holidays

-

When I get the bike taxed, I pay an extra 300 Baht for Road Accident Victims Protection Co Ltd. I don't really know why I have to get it, but I think it is the minimum mandatory insurance. Other threads mention this includes some hospital cover - several people didn't know that - not just me! The small print really is small - there is 500k for death (great/useless) but hospital medical expenses is not mentioned at all. That's why I'm trying to cover this issue properly. If I have an accident its highly likely to involve a motorcycle ???? Class 1 for a 10yr old small bike, scoopy ?

-

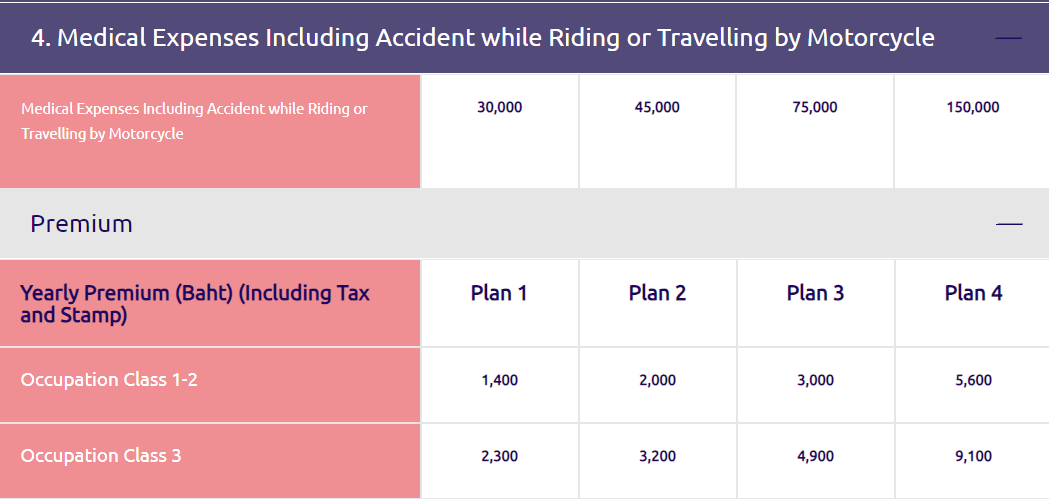

It's not an ad. I'm just looking for an answer. I called AXA and the staff checked with her manager - the answer was motorcycles are not included for medical expenses! I doubt the Thai staff would understand if I started probing about extended cover/endorsements. If the company can't produce a document in English that clearly states an exemption to 3.2.2, then that is concerning - I am not sure what an email from one staff member is worth who says, "don't worry, moto accidents are included". Some people mentioned Chubb - I called them and they said they do not do any such policy. MSIG have two that specify motorbike. The first one I understand - covers to 150k medical expenses. Name is PA Health individual. 5600 THB for low risk (office type) workers. The other one is called PA Kit Tueng Jumbo (incl. daily hospital benefit). Their 'table of policy details' is a mess and misses out Medical expenses. But motorbikes gets more mention. Anyone know the med. expenses for this one? Staff said these could be bought online but they didn't explain how and I couldn't find the part of the webpage. In the end, staff said maybe it cant be bought online - come to the office. If people are more concerned with motobike accident medical expenses - can this be covered through "motorbike insurance policy"? Anyone know a company/policy name that offers high medical expenses - ideally 500k - for a bike more than 10 years old and also covers you as passenger on any bike.

-

This post does not involve insurance bought from home country. There are a few threads about this. The outcome is usually that the AXA Sabuyjai My Exclusive Plans 1 or 2 DO cover moto related incidents. The outline of the policy suggests that, because it mentions motorcycle in section 1.2. But that is the reduction from 2 or 5 million for loss of life/limb or disability and NOT anything to do which medical expenses like broken bones. The max. medical expense for any trip to the hospital is actually 200 or 500k (exclusive plan 1 or 2). Some people buy insurance (from Thai banks - often incorporated into debit/credit cards) believing their hospital medical bills are covered for line 1.1 and the reality is they are only covered for 10 - 30k. For those who never drive or take a moto, this policy may be good value. Unfortunately, the medical expenses excludes motos. Refer to the policy document, section 3: this policy excludes: This policy can not be bought online - make appointment with head office or broker. Don't get confused with the inferior Sabuyjai My Life policies that are available online. Any info on how to extend the Sabuyjai My exclusive policy (6300 TH + ???), so that it DOES cover moto incidents would be useful, or the name of another company/policy that 100% covers moto accidents that can be bought online or at an office - ideally avoiding use of a broker ????

-

800000 BHT for immigration

Bravehart replied to fulhamboy's topic in Thai Visas, Residency, and Work Permits

Can the 800k come from a longstanding Thai savings account with no transactions in the last 12 months? It was salary from previous employment in Thailand and not inward foreign transfer. If it 'depends on the immigration office', then any advice on which ones do and don't work would be useful. I would rather not move money out and back into Thailand. But if that's the only option, would a Wise USD holding account be the best way to do that based on lower buy-sell spreads and the inward remittance of the 800k showing up as FTT.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)