Everything posted by offset

-

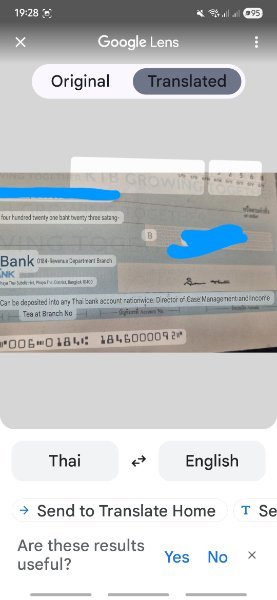

Thai bank account to child upon death?

A child in Thailand cannot directly receive any money from a will if they are under 20 years of age

-

Second renewal of Non O for Retirement banking requirements

The bottom of the TM30 should be stapled in you passport, they may require a copy of a current lease agreement or prove of where you live

-

Residence address options

If you have a Thai ID number does that mean you can get a pink ID card

-

Bangkok Bank for expats

Changed banks when I move province I have had accounts with Krungsri, SCB, K 3 times and Krungthai I open 2 accounts 1 with a debit card and 1 without, and only carry small amounts in my debit card account, i use the Internet to top it up from the other account

-

Bangkok Bank for expats

I have always got two accounts of the same type, one with a Debt card and one without, and that is on four different banks

-

More "Wise" Bad News For Wise Customers Residing in Thailand

Not all true personal allowance in the UK is not taxed

-

Opening Krungsri bank account

They moving existing customers to Krungsri Biz and did not need to have a business Not sure about new customers

-

65000 baht renewal and wise

I did not supply the Immigration office was because her paperwork was not good enough unless she paid money then it was all ok and she got her extension

-

65000 baht renewal and wise

Sorryi have been waiting to see if a Wise statement has been used before A couple that that i am good friends with, went to do their extension for the first time after using an agent before The husband used the 800000 method and had no problem, but when the wife wanted to use the 65000 method she had a 13 months of statements from BB Bank which were not accepted although she said they had FTT for all foreign transaction, (to be honest I am not convinced that was correct) she was then asked to show Wise statements, which she did but these were not accepted because it was listed the wrong way, the only way to get here extension was to pay money which she did

-

65000 baht renewal and wise

So nobody as tried or been ask for a yearly statement from Wise to confirm a foreign transaction

-

65000 baht renewal and wise

Has anybody been asked for a yearly statement from Wise when doing a renewal Retirement Extension

-

Does anyone use the Nationwide UK bank in Thailand?

Going by memory i was told that you do not have to activate the card any more but it must of worked in Thailand because I changed my pass number Sorry to be so vague but it was a little time ago

-

Does anyone use the Nationwide UK bank in Thailand?

I have had a card sent to Thailand from Nationwide it takes a little time and the card and password came in the same delivery

-

Revenue Department to amend tax on foreign income remittance

Krungsri cash in my tax checks into my account with no problem. If i remember correctly it states on the paper that comes with the check that you can cash it in any bank

-

Current UK banking arrangements for British in Thailand

I have a Nationwide account with my Thai address had no problems with them

-

Krungsri Banking App

Just came back from my branch she did not have a clue what I wanted so she rang head office Head office told me I have to do nothing till I get a notification online and telephone with the details of uploading to Krungsri online biz to be sent to me on the 1st of July

-

Krungsri Banking App

I have an online biz with Kbank and I do not have a business I have been told by head office to go to a Krungsri branch and change over to a online biz account with I will try to do soon

-

Kasikorn Bank App: Facial Recognition required for certain transactions/functions from Jul 2

I have just spoken to Krungsri on the phone they are only closing Krungsri Online They are not closing Krungsri Biz so if using Online you have to go to the bank to open Krungsri biz It seems like the only way to use a Krungsri account

-

Can no longer do Wise transfers to my personal account at KBank

I am not sure that you are correct about withdrawing money without probate you should check that

-

Taxation of worldwide income for Thailand Tax Residents?

Not quite true they will refund withheld tax from your savings in Thailand if you owe no tax here

-

Revenue Department to amend tax on foreign income remittance

Just for info should be able to cash tax checks at any Thai bank as stated on the check I have just cashed my checks in Krungsri bank (yellow bank)

- Introduction to Personal Income Tax in Thailand

- Introduction to Personal Income Tax in Thailand

-

income tax question

People must remember you are only taxed on accesable tax that is brought into Thailand not everything brought here Also any money you bring in from savings held before the 1st of January 2024 is not taxable

-

Advice?? Bank accounts on death

Some accounts in joint names maybe frozen on death