Oorinara

-

Posts

163 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Oorinara

-

-

7 Microfinance institutions, beside banks, are licensed to take deposits.

http://www.nbc.org.kh/english/supervision/microfinance_deposit_taking_institutions.php

Microfinance deposit taking institutions offer higher interest rates, e.g. 8% p.a. in USD and 9% p.a. in THB, than banks in general.

-

Lao is financially underdeveloped, so country risk remains high. Capital control such as capping foreign currency outward remittance is NOT put in place as of now, but you never know. Lao PDR's sovereign rating is BBB+ by TRIS, Thai rating agency.

http://www.trisrating.com/news/press-release/3688-mbk050615.html

Besides, Lao banks are poorly regulated and some may be imprudently managed. Higher return, higher risk.

So what is your personal take on depositing a significant amount of foreign currency for an extended period.

I think proportion of person's financial asset to Lao banks, rather than the amount per se, matter. I have 3-5 years deposit with some of them, but not that big proportion among my asset. Choosing prudent banks, and of course diversifying investment by currency, bank and jurisdiction etc. always may be inevitable.

-

I find that Bank of Lao PDR, central bank, has capped interest rates of Lao Kip, both deposit and loan, since 3Q 2015.

Foreign currency deposits are not subjected by these regulations seemingly, but may be affected, I'm afraid.

-

Lao is financially underdeveloped, so country risk remains high. Capital control such as capping foreign currency outward remittance is NOT put in place as of now, but you never know. Lao PDR's sovereign rating is BBB+ by TRIS, Thai rating agency.

http://www.trisrating.com/news/press-release/3688-mbk050615.html

Besides, Lao banks are poorly regulated and some may be imprudently managed. Higher return, higher risk.

-

If you deposit US$ in a Laos bank, how do you get them out of the country at the end of the term?

Do they pay you in US$ or in Lao Kip? Same for Thai baht, do they pay you out in Thai Baht or in Lao Kip?

In the same currency, you can withdraw and remit back to Thailand or elsewhere. No forex risk as far as USD and THB are concerned.

-

When it comes to currency,

- Canadia, Cambodia Post Bank; USD, THB, KHR

- CAB; USD, KHR

- ABA, PPCB; USD

What's the experience (if any) of swift transfer into Cambodia in (for example) Aus$ and getting them to convert and invest in a US$ term deposit? What kinds of exchange rates would that produce - given that it's 2 changes.... ?

Have never tried forex conversion. Same currency SWIFT transfer, USD to USD or THB to THB, only so far.

-

Did any of them sort out proper internet banking yet?

As far as I observe, BCEL and Joint Development Bank have Internet banking derive for nominal monthly fees. BCEL also mobile app. Haven't tried yet though.

-

Which bank?you're too late.... interest rates are

This is BCEL but all banks have been ordered by the government to do the same.

Acleda Lao Bank and Indochina Bank, for example, show different rates, some part higher and others lower than BCEL. Has the Bank of Lao, central bank, capped interest rates???

-

When it comes to currency,

- Canadia, Cambodia Post Bank; USD, THB, KHR

- CAB; USD, KHR

- ABA, PPCB; USD

-

ABA Bank currently offers 5.75% for 1yr in USD.

https://www.ababank.com/personal/deposits/fixed-deposit/

Easy to open with passport and biz visa (unsure if tourist visa). Internet and mobile banking available. National Bank of Canada is a major shareholder.

-

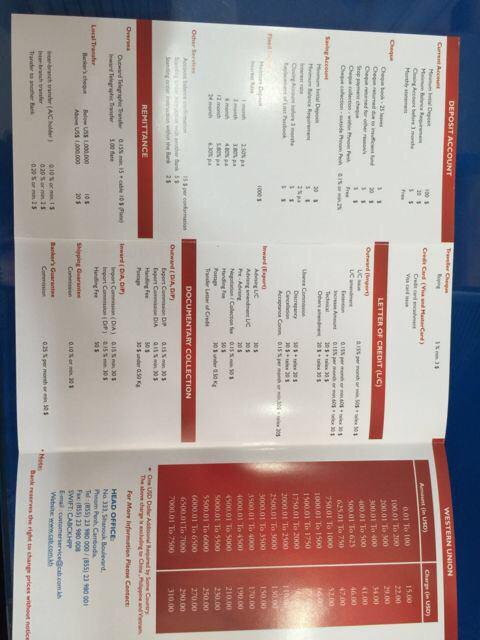

Cambodia Asia Bank (CAB)

USD fixed deposit rates of 5.8% for 1yr, 6.3% for 2 yr. Account openable with passport, visa (unsure if tourist visa) and "self declared" local address and mobile no. Internet banking exists.

Their website features extensive broken links -- can't find much about deposits, and nothing about rates...

http://www.cab.com.kh/personal_deposit.html#

Perhaps you have a direct link to their rates page?

I have no link to their deposit rates. Just enquired over the counter and obtained the leaflet as pictured.

Yes, their website seems nonstarter. Unsure if and how their internet banking works!

-

Cambodia Asia Bank (CAB)

USD fixed deposit rates of 5.8% for 1yr, 6.3% for 2 yr. Account openable with passport, visa (unsure if tourist visa) and "self declared" local address and mobile no. Internet banking exists.

-

Acleda Bank seems to accept account opening by nonresident (see "Information and other requirements for opening, operating and closing account from overseas")

http://www.acledabank.com.kh/kh/eng/ps_deposit

Has anyone tried this recently?

Acleda at PP headquarters doesn't entertain application by nonresident, per my recent try.

-

Canadia Bank, ABA Bank, Cambodia Asia Bank, Phnom Penh Commercial Bank and Cambodia Post Bank require passport, visa and "self declared" local address and mobile phone number. Canadia, ABA and CAB have Internet and/or mobile banking services,

Acleda and Foreign Trade Bank require passport, visa with 6mo+ validity, local business or employment certificate and local residential contract. Both have Internet banking too.

Above per recent experiences of me and my friend in Phnom Penh.

-

Acleda Bank seems to accept account opening by nonresident (see "Information and other requirements for opening, operating and closing account from overseas")

http://www.acledabank.com.kh/kh/eng/ps_deposit

Has anyone tried this recently?

-

2

2

-

-

FYI, PPCB categorizes 6 month or longer visa holders as residents, who can enjoy lower withholding tax.

-

Blood sucking US taxman, no other country taxes their citizens when they are not resident in their country!

The UK does.

The Philippines does too, though their enforcement is very loose.

-

you're too late.... interest rates are

Which bank?

-

Govt Housing Bank (GHB) 2% fixed until Jun 2016

-

My friends experience on documentary requirements for account opening last week.

- Phongsavanh Bank: passport and entry visa and stamp

- Acleda Lao Bank: passport and its copy authenticated by Lao Ministry of Foreign Affairs (which first requires certification by his/her Consulate General in Vientiane, I suppose)

- BCEL (Kip account for stock trading): passport and endorsement letter from BCEL-KT Securities

-

Thai Govt Savings Bond, 3% p.a.

Not strikingly interest rate, but bond coupon rate, though.

-

Documentary requirement varies among banks there in Vientiane, per my experiences.

-

Well, indeed depending on the amount of deposit and the length of placement, of course.It's all very good sounding but if you actually do the detailed calculation of costs of visas, travel, tax, etc, the net rate is not so clever.

-

Cambodia Post Bank

Fixed Deposit Rate (in case of interest upon maturity)

THB 7% for 1yr, 8% for 2 yr

USD 6.25% for 1 yr, 7.25% for 2 yr

That link is to their home page, but I can not find their rates pages. Any clues?

Visited its headquarters in PP a few weeks ago. KHR same rate with THB.

Fixed Terms Deposits in Cambodia - recommendations?

in Cambodia General Chat

Posted

None of them, I'm afraid. Most banks there either.