dginoob

-

Posts

107 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by dginoob

-

-

16 hours ago, AlexRich said:

I think that is sensible, a fund that tracks the market will outperform 75% of fund managers. If you look at the graphs over 20 years you’ll see downward spikes with various crisis, but the trajectory is upwards over the long term.

If you want a British book that is very good for beginners I would recommend “The Naked Trader” by Robbie Burns. It is simple to read and takes you through the basics, and explains how to buy and sell shares through brokerages. My approach is different from his but his approach is very sensible. So if you dip your toe into share buying you at least follow a sensible path.

Thanks for the book recommendation. I've just ordered a copy from Amazon.

-

1

1

-

-

24 minutes ago, AlexRich said:

I don’t use ETF’s, I prefer individual shares, so I can’t help you with that one.My plan is to put the majority of my available income into index funds or ETF's and just forget about them for around 20 years (or hopefully less). A smaller amount I intend of using on individual stocks - though as I know so little at the moment this is tantamount to gambling for me. It seems like there is so much to learn, and the amount of information available is quite overwhelming.

-

So I opened up an account with Interactive Brokers. Their Trader Workstation PC app isn't super user friendly for beginners, but I'm sure I'll figure it all out.

Most disappointing however, is that there doesn't seem to be any GBP denominated index fund or ETF's (I have found a small number but none of them are what I'm looking for). There are plenty of USD funds available, but I am l loading with GBP and I'd 1. prefer not to have to convert to USD every time, and 2. to reduce my FOREX risk.

Not sure if I should just bite the bullet and go with USD ETF's or try to find another solution. Has anyone been in the same predicament?Thanks

-

8 hours ago, AlexRich said:

No, if you are careful. The Thai tax year runs from 1 Jan until 31 Dec I believe (if I’m wrong someone will post).

The important thing to understand is that if you bring profits from gains or dividend income into Thailand in the same tax year as they were earned, you are technically subject to Thai tax. So a dividend received in September 2020 can be brought into Thailand in January 2021 without incurring a tax liability. If you bring it in December 2020 it’s taxable.

I’m pretty sure that’s correct, but if I’m wrong someone will post.

Thanks, that's really useful to know!

-

On 3/23/2021 at 1:45 PM, AlexRich said:

You could set up a brokerage account outside the UK, as you are no longer a UK resident for tax purposes. That means that any capital gains or dividend income is not subjected to UK tax. There are many brokerages ... for example Swissquote, based in Luxembourg, offer access to the UK market, the US market, Hong Kong, Singapore and many European bourses. Best begin with what you know ... the UK ... a good time as it is one of the cheapest markets at the moment. You have to be careful moving money to Thailand. Only transfer profits made in the previous tax year, as moving in money earned in the current tax year is technically subject to tax. Good luck.Capital gains or dividend income will not be subjected to UK tax, but will it be subject to Thai tax?

-

On 3/21/2021 at 10:44 PM, realfunster said:

Hello - can’t profess to be an expert as I only started taking a more active interest in my investing last year, so cannot give financial advice but provide a few comments below :

- Investing in the Thai market sucks. UK is ‘OK’ and has friendly tax rules as a non-resident but I feel you really need to be in the US to be able to achieve a long-term 10%+ per year.

- Use Thai tax saving schemes, if it make sense to your circumstances and plans e.g SSF/RMF & company Provident Fund. These used to be restricted to Thai SET (been poor return for 5 years) but now you can make international investments as well.

- There are increasingly more local general options to invest in overseas markets, although the management fees are still high compared to the likes of Vanguard plus you have to accept some FOREX risk.

- I opened a brokerage account as a Thai-based expat/UK citizen with IBKR (other options exist) it was very easy to do. This gives me direct access to global stocks & ETFs. Don’t think there is a THB option, so you will need to fund via GBP/EUR/USD and bank transfers from Thailand.

- I can’t access Vanguard Life Strategy funds via IBKR but can access all their ETFs, pretty straightforward to make your own ‘Life Strategy’ fund using a handful of their ETFs. E.g S&P500 40%/Europe 10%/Japan 10%/Emerging Markets 10%/Bonds 30%.

Youtube channel Pensioncraft is a good place to start and has some reviews of various investing strategies and funds available.

Thanks for the info. I think what I will do is try to open a Vanguard investment ISA using my mothers address and see how that goes. If that's doesn't work then I'll open a brokerage account as you have done. What are the tax implications for any gains you make on your account?

Good recommendation on Pensioncraft. I am already subscribed to his YouTube channel and newsletter. Have even considered booking a "power hour" with him.

Thanks again, -

23 hours ago, realfunster said:

I believe that’s correct. My full comment was referring to capital gains & dividends.

AFAIK - the first are avoided as a non-resident and the latter reduced to only a deemed 10% tax at source, I am not 100% clear on this but it also appears to essentially be tax free.

I'm a UK citizen, but non-resident (I live and work here), though I do have a small salary in the UK on which I pay no tax but I do pay national insurance.

I've never invested before but I am in a position now where I really need to think about retirement and investing for that.

My initial idea was to open an investment ISA with Vanguard and put my current savings and salary going forward into one of their Life Strategy funds, but I found that it's not possible if I do not live in the UK. So I am trying to find out what my options are and what the best solutions are tax wise.

Would you have any advice you could share? -

- Popular Post

- Popular Post

On 3/8/2021 at 4:13 AM, Jaycomet said:Because I have heard that even if you have a degree depending on your job you are unlikely to earn more then 10000 baht a month(unless of other exceptions)

What you have heard is total nonsense.

-

4

4

-

Thanks Sheryl.

-

Thanks for the info. BTW what is RCT?

-

Hi, thanks for the reply. I know they are currently closed, but hopefully they will be open soon.

I'd like to find out what my options are for when they do reopen.

Do you have any clinic you have used for similar treatments that you would recommend?Thanks

-

Hi,

Can anyone recommend a good value for money dental clinic in Bangkok for crowns and veneers? Searching online seems to only bring up sites targeting medical/dental tourists.

Thanks -

38 minutes ago, The manic said:

And if you are classified as free lance?

If you are freelance then you are working for yourself, so I imagine if you are sick you don't get paid.

-

10 hours ago, Jimjim1968 said:

Update: I had a buddy from EP (I'm regular kids) read out his contract (I presume it's the same). There is no mention of holidays, only 10 days for sick/personal business. Looks like we're screwed. but they have lost all my good will. I'll finish the contract in March and leave.

By law companies must provide 30 days of sick leave per year. At least in the private sector.

-

1

1

-

-

10 hours ago, Shiver said:

Surprised. In UK I did "buy to let" (mid 90's) before it was a 'thing', and had 70% mortgage (buy cash/renovate/mortgage/next property) with roughly 1.5x monthly income to mortgage (since nothing is ever 100% rented). This was North West England suburban which is hardly the centre of high prices, but even then (more than 2 decades ago) it was perhaps 15-16K per month in todays exchange rate. Oh how I wish I'd been here at that time with that kind of income x that number of properties at that exchange rate.... and then '97, which I was completely unaware of. Buggr, you miss all the opportunities you don't take part in I guess.

A former business partner however who was here in Thailand said that in his country (Aus) it was the other way around, in that you pay less for rent than mortgage since you'll never own it. The UK (then) was "you're not committing to 25 years, so there's a premium". I guess YMMV depending of quite a few factors (location, timing, social attitude and more).

The rent I get is more than the mortgage payments, so I'm not complaining. But it is much less than my condo rent (40k per month)

-

2 hours ago, mommysboy said:

Exceptions can be found, but they are not the rule.

Some might say that a 600k flat in London is hardly the rule.

-

36 minutes ago, mommysboy said:

Housing cost is a big issue too- UK and Thailand are poles apart on that score.

Generally, you get more bang for your buck out here! Though not as before.

Depends where you live in the UK. I bought a 3-bedroom house for £50k 5 or 6 years ago (granted it hadn't been decorated since the 70's, and I subsequently spent 15k or so on it). The rent I get from that is less than half of what my rent is here for a condo.

-

5 minutes ago, BritManToo said:

I've given up eating beef in Thailand, like you said, quality is generally poor no matter how much you pay.

Pork, chicken, fish, seafood all really cheap (and good quality) compared to the UK.

You can get very good quality beef, but the prices are very high.

If you are giving up some of the things you used to eat in the west, then you cannot claim to be living a western lifestyle on 20k per month.

-

1 minute ago, BritManToo said:

Walk in the jungle and mountains, read books, listen to music, watch Tv and movies, drink beer.

Most of those free, internet 740bht/month, U-beer 52bht/bottle.

Flours 26-38bht/kg, fat 50bt/kg, spagetti 77bht/kg, chips 99bht/2kg.

All my bread/pizza/cakes/biscuits/pies are easily made from that.

What western food do you think I am missing?

Steak, wine, cider, olive oil, capsicum peppers, broccoli, breakfast cereals, tabasco sauce... to name but a few of the things that are much more expensive than back home.

It's great you are able to cook things from scratch, but I don't have the time (or skill) to do that. -

15 hours ago, BritManToo said:

Come on we all know the guys spending $$$$s have a new McMansion, new Fortuna and a gold-digger (with extended family) hanging off them.

I live a completely western lifestyle on 20k + housing, but I do cook all my own western food.

How is this possible? Where do you buy western food to cook, and keep your monthly spend at 20k?

-

2 hours ago, james1995 said:

well, what about being a digital nomad? i'm bringing in 5-10k baht daily here. sky is the limit. i spend just two hours on my macbook each day and "work" is done. don't tell him to go home. tell him to get on that laptop and start earning money.

By doing what exactly?

-

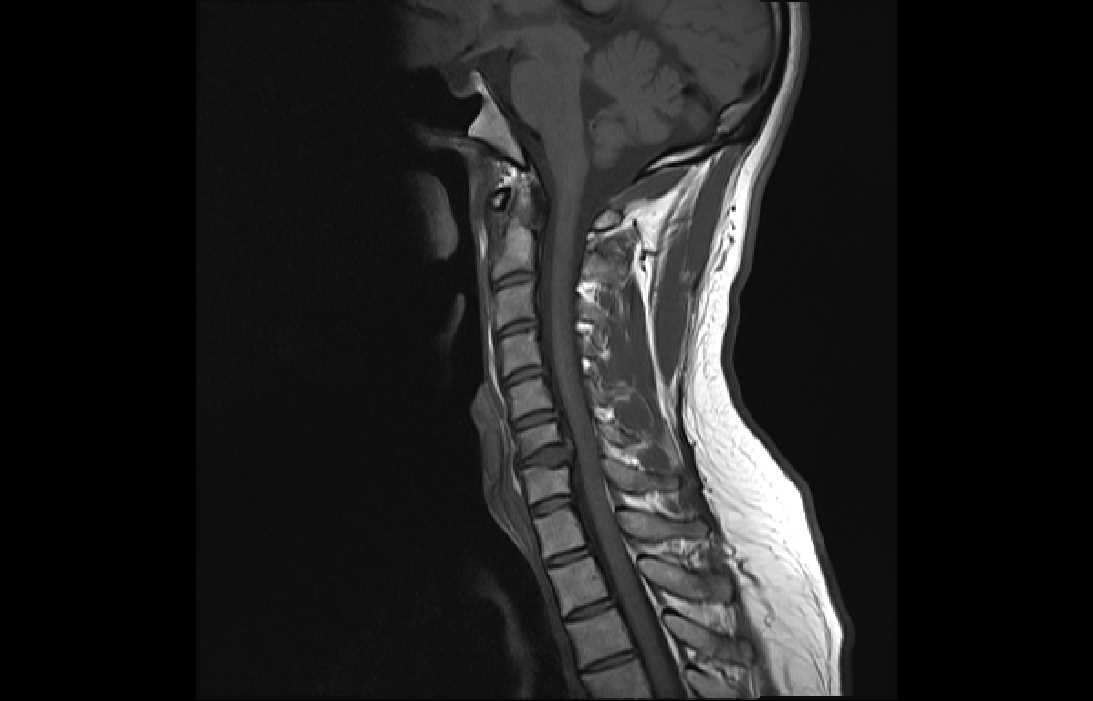

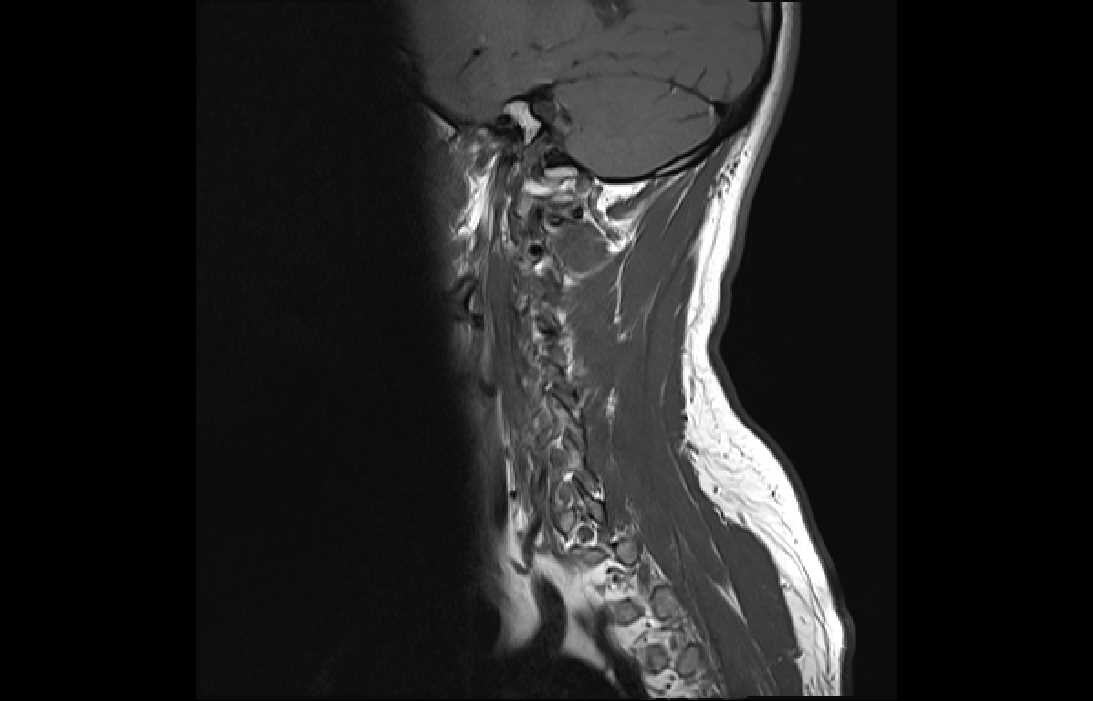

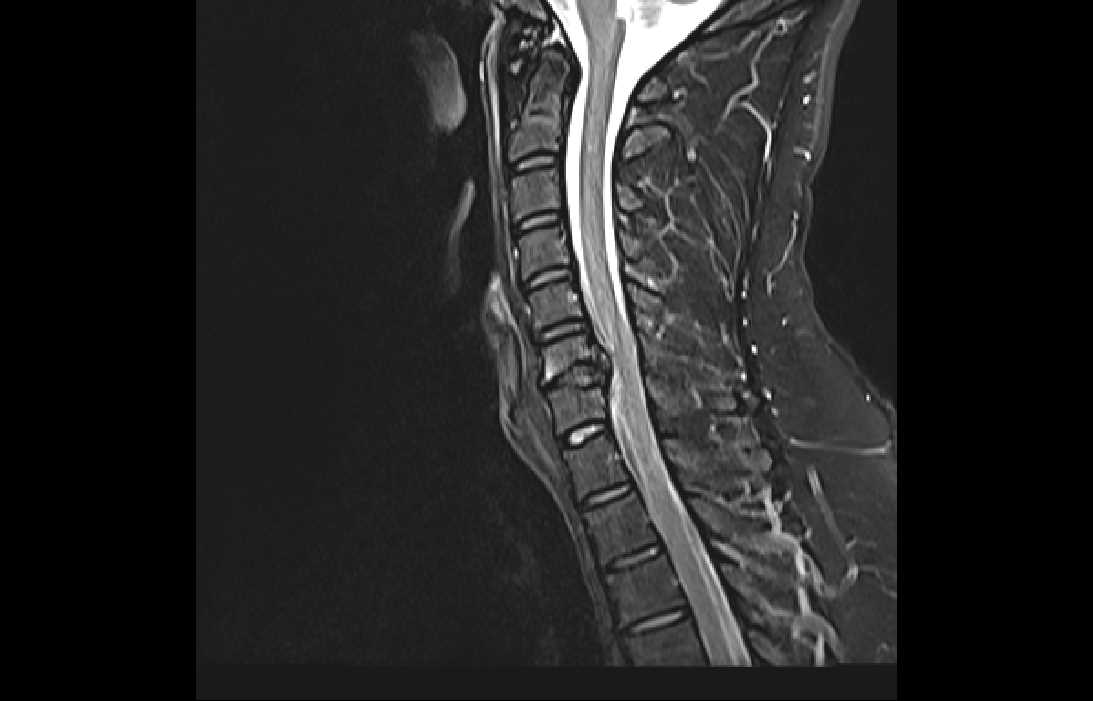

Hi All,

Just thought I'd post some of my scans in case anyone is interested/curious.

-

22 hours ago, Sheryl said:

No guarantee the NHS would give you a prosthetic disk. They might just do a fusion. With just one level of spine involved the difference is not that great.

While you said the disk was pressing on the spinal cord I suspect not, rather pressing on the nerve root. If pressing on the cord you would be losing sensation in your lower body and it would be a dire emergency.

No problem at all to get films etc from the hospital, just go to medical records with your passport.

Hard to say how much of a wait you would have with the NHS. Depends on the severity. If you are experiencing numbness/weakness in the affected arm then there is a need to act fairly quickly. The surgery will remove the pain and prevent any subsequent nerve damage but cannot undo any nerve damage that has already occurred, so important to intervene quickly if the compression is severe enough to affect motor function.

As an aside, longer term you need to get health insurance. Right now you have a problem that there is time to decide how to tackle, and for which you can travel back to the UK. If you are in a major accident, have a stroke, heart attack etc you would not be and even in a government hospital costs can easily exceed 1 million baht. Of course with this now pre-exisitng condition, any insurance you get will exclude spinal problems but you can be covered for all else.

Hi Sheryl, yes you are right, it is on the nerve root (it just looked like that on the images).

I don't have any weakness, that I can tell of, but my thumb and 2 finger haven been numb for a couple of weeks now.

-

Thanks Sheryl,

Dr. Wicharn did say that with older patients he would opt for fusion, but for someone my age it would be better to have a prosthetic to preserve mobility. I have to say I agree with him.

I have another appointment with Dr. Wicharn on Saturday morning, so I will discuss my options with him then. The cheapest option for me may be to go back to the UK and have the surgery on the NHS. Hopefully I would be able to get the X-Ray and MRI files from BNH (don't see why not as I paid enough for them!), which I could show to the doctors back home.

Not sure how long I would need to wait though. I could end up having to come back here to Thailand while waiting then travel back again for the op. If this is the case then it may not work out as the cheapest option.

Thanks again.

Investing in UK shares

in Jobs, Economy, Banking, Business, Investments

Posted

I was looking at all the LSE ETF's, but you're could be right that I'm not looking in the right way. Basically I am looking for something similar to the Vanguard LifeStrategy 100% equity accumulation funds. Before my last post I hadn't found any GBP ones that looked as diverse as I'd like.

However, this morning I have found a new Vanguard ETF, which is listed on the LSE - V3AB: Vanguard ESG Global All Cap UCITS ETF (USD/GBP/EUR)

https://www.vanguard.co.uk/professional/product/etf/equity/9470/esg-global-all-cap-ucits-etf-usd-accumulating

It's brand new, but it looks interesting. I am considering buying this later today.