andre47

-

Posts

583 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by andre47

-

-

The price for my medicine has increased 28% since last year.

another observation:

6 weeks ago a bought some medicine in a Uttaradit which I bought before always in Pattaya. The price in Uttaradit was 50% cheaper.-

1

1

-

-

21 hours ago, DrJack54 said:

No it does not.

It's all about continuity of permission of stay.

Traveling throughout Thailand and even international travel with a reentry permit does NOT require a TM30 upon return to your home address.

That TM30 is required if you do change of address.

Different from just random changes.

The TM30 laws were changed June 2020.

Sadly CM decided to ignore that.

Stupid office

In Pattaya this has changed. Last time when I needed a Certificate of Residence they looked at my 90 days report and my last enter into Thailand and she said that now you have to report TM30 each time after you entered Thailand within 24 hours. If you travel within Thailand the TM30 is not needed (for Pattaya Immigration)

-

1

1

-

-

My understanding is that money that I earned and paid tax on before I became taxable in Thailand can be brought to Thailand tax-free.

-

1

1

-

1

1

-

-

4 hours ago, ChaiyaTH said:

I need them quite often for purposes, I always pay 1K baht to a notary to translate and seal it. They state what the document is, my name, address, passport number etc, always works.

Guess for official purposes with governments you would need to translate at the MFA.I do same but pay just 500 Baht 5555

-

29 minutes ago, Kalasin Jo said:

Did you get it? You don't say. What did your Thai tax office want from you to issue the TIN.

in Pattaya/Jomtien - certificate of residence and my passport (and a photo (not sure anymore)) - 15 minutes very easy

-

I went to the revenue office and asked for a TIN. Many foreign banks want you to show a TIN in order to be exempt from the final withholding tax. I have no income in Thailand and have never filed a tax return.

-

40 minutes ago, dr_lucas said:

What about capital gain from abroad? Such as profits from stock market and/or commodities investments in other countries?

If you bring these gains to Thailand you have to pay tax on it. This has not changed. Even now you have to pay tax, but now only if you bring these profits in the same year to Thailand. In future you have to pay tax on it never mind when you have earned these profits.

-

Persons who are residing in Thailand according to Section 41, paragraph three, of the Revenue Code. who have assessable income due to work duties or activities conducted abroad or because of property located in a foreign country according to Section 41, paragraph two, of the Revenue Code In the said tax year and brought the assessable income Entering Thailand in any tax year That person has a duty to include that assessable income in the calculation. To pay income tax according to Section 48 of the Revenue Code In the tax year in which the assessable income was brought into Thailand

Section 41, paragraph two means: In the case where the ownership or possessory right in an immovable property is transferred without any consideration, the transferor shall be treated as a taxpayer and pay tax in accordance with the provisions of this Part.7

As I understand the Thai text, the only thing that has changed is that in the future you have to pay tax on profits from work, from commercial activities, or from the sale of real estate in Thailand if you bring these profits to Thailand, regardless of the year. Previously, you had to pay tax on these profits, but only if you bring them to Thailand in the same year in which they were earned.

It is explicitly spoken of profits/income. It does not mean existing assets.

-

1

1

-

-

I also have problems using the Lazada website with the Chrome browser.

1. login data is no longer saved

2. when I select items from my shopping cart to pay, the system hangs and does not let me pay

3. when I want to upload pictures in Lazada messenger or return input, it doesn't work either.

I use Firefox now, everything works without problems.

-

2

2

-

-

Since a few days this website is down with the following error message:

402: PAYMENT_REQUIREDCode:DEPLOYMENT_DISABLEDID:sin1::jtmh6-1680913308558-8965ab559938

I'm desperate. In my opinion this website is one of the best Thai dictionaries. The disappearance of this website would be a great loss for many who wish to learn the Thai language.

Does anybody know what happened?

Does anybody know the website admin and how to contact him?-

1

1

-

-

25 minutes ago, Mavideol said:

if these guys are "legally" registered, have proper passengers insurance and pay taxes on their income, then have to agree with them and fine all the "illegal" ones that have no insurance to carry passengers and not paying any tax... police knows who they are but (again the brown envelopes) turn the other way when seeing them "illegally" picking up people

yes, but only if they are using the meter

-

2

2

-

-

- Popular Post

- Popular Post

I never pay more than 100 plus tip. 150 is a tourist price....

-

2

2

-

1

1

-

-

1 minute ago, lopburi3 said:

No I am not wrong on point 1 - if he needs to convert tourist entry to non immigrant money must show foreign origin - and even if not doing that money can come from abroad.

The exchange rate is a bit lower than Wise but with Wise the fee increases with amount and for 800k it will pay to use Swift in most cases.

nobody has mentioned a tourist visa

bla bla bla - nonsense-

1

1

-

-

1 minute ago, GrandPapillon said:

like I said, someone here did a test over 100K USD with WISE and SWIFT and didn't find any fundamental differences

it's somewhere in one of the many WISE threads,

the numbers speak, it's facts, the rest is just opinions and arguments ????

unpossible!

Wise allow transfers only up to 2 Mill THB.

You are writing nonsense!-

1

1

-

-

2 minutes ago, GrandPapillon said:

the exchange rates is not fundamentally different, only 0.10THB at best

the timing is better with WISE though, and you know the exchange rate before the transfer

it's awesome for small transfers, bigger transfer, I would rather use SWIFT

if you want to time perfectly exchange rates, then you need to buy SWAPs at a brokerage to cover your exchange rates

you don't know what you are talking about

good luck for your money!-

1

1

-

-

4 minutes ago, lopburi3 said:

Indeed you are totally wrong - you never want to send baht from USA - only send USD. If you send Baht US banks will use a very, very bad exchange rate. If you send USD Thai bank will provide published rate which will be better. Sending 800k should be done by a Swift international transfer send USD more than the amount to allow for fees as this will insure low cost and recording as overseas transfer. If you are planning on converting to non immigrant O visa in Thailand the money must show as from overseas for the conversion - so best not to use WISE (and for 800k will be cheaper not to do so).

wrong

1. the money must not come frome abroad

2. the exchange rate from the Thai bank is much much worse than the Wise exchange rate -

1 hour ago, GrandPapillon said:

just do the calculations, someone else here did it too for 100K USD per year transfer, WISE was far more expensive with little rates advantages

they charge something like 90 USD for 30K USD when you can go with SWIFT for like 25 USD or 35 USD

sorry, again: don't look only at the fees...you must look at the exchange rate

but...up to you... it's your money-

1

1

-

-

32 minutes ago, GrandPapillon said:

WISE is very expensive for large transfer, 2 or 3 times the price of SWIFT, killing any advantages of best THB rates you could get

therefore avoid like the plague for 10K or more,

wrong

-

2

2

-

-

26 minutes ago, DogNo1 said:

I don’t take any chances. I always do an international wire transfer (SWIFT) from my brokerage in USD to my Bangkok Bank account. Brokerage charges me nothing and Bangkok Bank charges me 200 baht. The rate is favorable. There has never been an error and the transfer arrives one working day later. I use the monthly 65,000 baht option so that I can spend the money immediately. The downside is that I must telephone the brokerage to initiate the transfer every month. There is a standing order on file so I don’t need to provide the details. I just specify the amount in USD and my Bangkok Bank account. Some people are willing to chance transfer errors to save a little money. I am not. Also, I never cut it close on the amount transferred and leave a generous margin to avoid an insufficient amount of baht transferred.

The difference is not the bank fee (200 Baht in your case), but the exchange rate. This can be an enormous amount.

-

1

1

-

-

- Popular Post

- Popular Post

There is no need that the money came from abroad. Just the balance 800K is important.

-

3

3

-

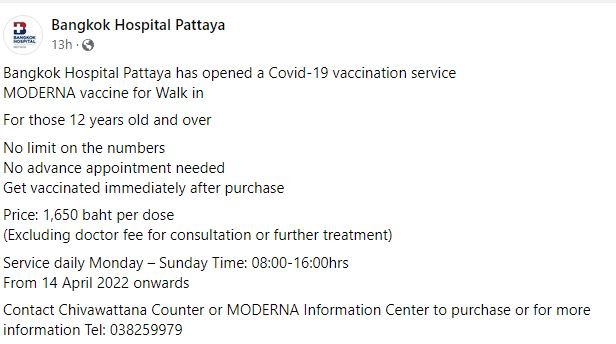

Yes, you need be fully vaccinated. You can also provide a valid ATK kit test or RT-PCR not older than 72 hours.

But I suggest you to get fully vaccinated. Without vaccination you even cannot return to Thailand if you like to travel abroad. -

2 minutes ago, kokopelli said:

This insurance covers only Covid. Now you will need a general Insurance which covers all cases including Covid,

-

6 minutes ago, bwanajohn said:

We discussed renting this out with our lawyer. We were told its technically illegal as most foreigners do not have a visa etc that allows them to earn income in Thailand.

Foreigners can earn income in Thailand (rent, interest etc.), but they need a work permit if they want work in Thailand. Foreigners also can get a tax id in Thailand without having a work permit.

-

1

1

-

Expat Tax Twists in Thailand: Navigating the New Landscape in 2024

in Thailand News

Posted

you should look for a new tax office.

I went to my local revenue office and got the TIN without any questions.

If you have a bank account in Europe the bank demands from you a TIN. When I live in Thailand more than 180 days per year I am tax resident in Thailand and I can obtain a Thai TIN.