TravelerEastWest

-

Posts

1498 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by TravelerEastWest

-

-

11 hours ago, jayboy said:

Did these foreigners share their financial details with you? Many foreigners have Thai investments and business interests.Of course they would file tax returns.

Exactly.

But normally foreigners with businesses here have their CPAs file for them.

The CPAs know the law well.

They file quickly and save the businessman time - which is money when you are working.

So I wonder why they are filing...?

-

13 hours ago, topt said:

Of all the retired foreigners I know here and who I have spoken to about this none have ever filed a tax return other than the odd one to reclaim tax withheld on interest - which I think we all agree is not really filing as we are discussing. That's getting on for probably about 30 guys.

Topt,

Not a scientific survey or anything similar, but I agree with you 100%.

I have lived in Thailand a long time and have not met even one retired foreigner who files taxes or who owes taxes and certainly none who are knowingly evading taxes.

Key point they are retired many with low incomes and some with high incomes - all who bring money in from past years.

I pay personal and corporate taxes yearly in Thailand and individual taxes in America - but no corporate taxes in America ever - but I am required to file every year in America, even though I don't owe corporate taxes in America.

So for those in this thread who say you may have to file in Thailand even if you don't owe taxes - maybe they are right and maybe they are not correct - I don't know.

I am 99% certain (there are a couple of retired accountants on this thread with good solid ideas about Thai taxes- those are the only posters that should be listened to.) that the posters in this thread are well-meaning; but are not skilled enough with Thai taxes to render a reliable opinion. I have no idea why they don't consult a licensed Thai CPA who is bilingual... Again not expensive at all. If you are deep in the countryside find a good translator and then talk to a Thai CPA.

Note: I have friends who are not doctors who really and truly believe they know more than highly trained doctors with advanced degrees and modern science - so maybe I do understand hobbyists who think they know as much as or more than well-trained tax accountants and lawyers...

-

5 hours ago, Mike Teavee said:

I honestly wouldn't worry about it as Thai RD already know how to handle people who's only income comes from Pensions & you can be assured that unless you have a huge pension any tax due in Thailand will be minimal.

I'm not sure which country you're from but if you're from the UK you should get an annual statement for your Pensions (P60 for private ones, not sure what the State Pension one is called) & this/these are all you'll need to provide to the RD should you need to complete a Tax Return... They will pro-rata these out for you if your tax year doesn't align to the Thai Tax year (UK being 6th April - 5th April).

It's people who have more "Complicated" income like Salary/Income from Businesses outside of Thailand, Royalties, Capital Gains, Rental Income etc... That might have a harder job in completing their return & may need to file Tax Returns in the other countries to provide evidence to RD.

Bad Rabbit,

I agree with Mike - please don't worry, instead focus on your health - whatever you do don't take advice in tax matters from well meaning non professionals who know very little about Thai tax matters. This could possibly create serious problems for you.

I have a tax background but I don't read Thai and I would not considering trusting my own understanding of Thai tax laws... so I have a bilingual Thai CPA who went to a top university in Bangkok and has many years experience. Plus as needed I will consult with tax attorneys who are trained in Thai tax laws. But I have a Thai business and my situation is complicated - for you a Thai bilingual CPA should be fine. And not expensive! I repeat not expensive.

-

1

1

-

-

- Popular Post

- Popular Post

4 hours ago, Dogmatix said:I disagree that the thread should be closed. If people find it no longer useful or interesting, they will stop using it and it will die of natural causes. The same thing has been said about the PR and citizenship threads on occasion but both are now nearly 20 years old and still going strong. Members who are interested in the tax guide thread will find their own way there.

I agree with you 100%.

Speaking softly, politely, and gently I think a Tax Guide thread could perhaps give people a false sense of security in following its words - as it seems to be written by nontax professionals who are not native speakers of Thai (or near-native speakers). It also could open the forum up to legal issues if someone follows it and has problems...

Then again many people may prefer a tax guide thread as it is... and I am all for freedom of speech.

I love the Voltaire quote:

"I may detest what you have to say but I will die for your right to say it..."

-

1

1

-

2

2

-

-

48 minutes ago, Pib said:

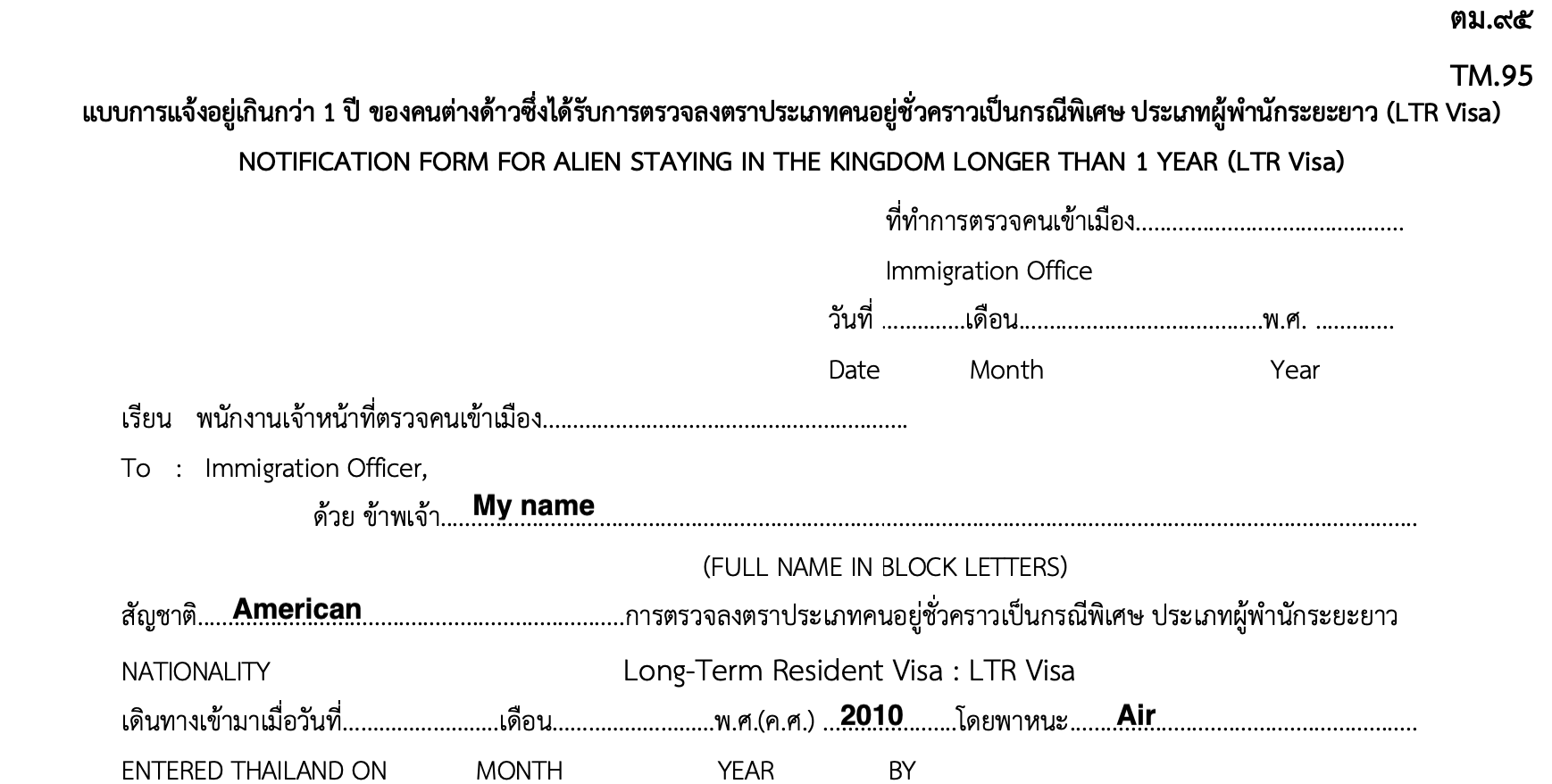

The TM47 paper version or online TM47 is for 90 day address reporting. As you infer the TM95 is for LTR address reporting. I know the online TM47 version has an area you can click if your visa is a BOI-related visa but Bangkok BOI Chamchuri Sq Immigration told me face-to-face two different times months apart that the online area dealt with BOI type visa's that require 90 day reporting; not 365 day reporting for the LTR or SMART visa. Told online report for LTR visa is not available.

Just to confirm, does your friend have an LTR visa? And is he sure he didn't get an address TM47 receipt for 90 days vs a TM95 receipt for 365 days?

He has an LTR Pensioner visa which he got just over a year ago - and he seems to be OK so far with using TM47 but I should ask what his receipt looks like...

-

10 hours ago, JimGant said:

Can you provide further details on this, like the online link? Thanx.

My friend used TM 47 I know it says 90 days report but that's what he used...

https://tm47.immigration.go.th/tm47/#/home

But TM 95 looks better - smiling!

-

3 hours ago, manon8 said:

Thanks a lot for your very detailed and helpful response.

I contacted BOI at the same time that I posted, and they replied to me in like 20 minutes! They confirmed rental income acceptable, and also that if country does not issue tax returns, payslips would do.

I just might hire one of those agents to make sure this works in practise.

Best regards

I started with an agent and later found that I did better on my own - as in faster and with more accuracy... buyer beware.

-

1

1

-

-

3 hours ago, JimGant said:

Can you provide further details on this, like the online link? Thanx.

I emailed my friend and asked for the form number - lets see what he reports...

-

1

1

-

-

On 1/9/2024 at 3:48 PM, JimGant said:

Has anybody done their one year report by mail? If so, can you describe the procedure -- and did you need to provide a return envelope to get your "due next year" reminder, which, I guess, doubles as a receipt of report, to staple in your passport? Thanx.

A friend did his report recently online...

-

4 hours ago, MistyBlue said:

I came across some information on this matter after researching another topic. It's covered in PWCs 2022-23 tax booklet on page 15. Link here: https://www.pwc.com/th/en/tax/assets/thai-tax/thai-tax-2022-23-booklet.pdf

I also found a lot of other useful information in the booklet, so hope they produce an updated one with the new interpretation for 2024 at some point.

Many thanks for the link - it looks like expert information in a clear format just what we need.

I also hope they provide an update on the current tax situation soon...

For those looking for Thai tax advice that is reliable stick with expert local Thai Tax CPAs and lawyers. CPAs will often be your go-to person to advise and prepare your Thai tax returns - they are far less expensive than CPAs back home let's say 5.000 baht for a small office CPA. Less for a simple tax return. If you can't afford to pay a CPA then you probably don't owe anything. Perhaps it might be best to wait for a couple of months before asking for help?

They can read all the laws, rules and regulations etc in Thai and have a good understanding of what works and doesn't work in Thailand.

Advice from well-meaning tax non-professionals (and in many cases the RD) can be useful to get you started - but also dangerous... Keep in mind that all over the world the RD is not on your side and often low to mid-level staff are not well trained.

-

1

1

-

1

1

-

-

On 8/13/2023 at 5:55 PM, clokwise said:

True. Especially during, and right after, COVID shipping rates were terrible too. But at least in 2023 so far shipping has been free, provided you stay within their specified minimum and maximum value/weight guidelines. I've found if I order too much for free shipping I just split it into two or more orders, done.

Unrelated, just last week I purchased an M.2 SSD off of Amazon.com and their shipping was free too. Never seen that before! If this keeps up Lazada, JIB, etc, with their insanely inflated prices and poor selection, are in big trouble.

Recently I have seen free shipping with iherb also - within certain min and max limits.

Exciting to hear about Amazon - any more details? electronics only? Books with free shipping would be great...

-

On 1/4/2024 at 4:42 PM, stat said:

@Mike ListerJerry is right on this one, there are a lot of countries that do not use the 180/183 day rule and therefore you can be tax resident in 2 or more countries. Another example: in Germany you are a tax resident if you have an abode in Germany. A garage with water and electricity that you could use to live in is sufficient. Even if you have not spend a second in Germany you are considered a tax resident for the whole year. @Mike Lister

No offense pls abstain from posting on issues where you have not checked the factuality in detail. It comes as a surprise to me that you have worked in the big 4, but my guess is not in a tax consultant role. I know a lot of big 4 audit and consulting partner who do not have a clue about taxes and openly admit it because they work in other fields.

I worked as a tax accountant a long time ago at a large International accounting firm in America and I can assure you that there is not a single audit partner or manager ( probably worldwide) who does not have a clue about taxes - not one. they were being modest when they spoke to you. Is an audit partner or manager at the same skill level as a tax partner or manager for the world of taxes - no. But taxes are considered in an audit and while the tax department of a firm is normally called in to help with the the audit the audit partner needs to understand and sign off on the audit a big responsibility...

Now someone who works for a large accounting firm in banking consulting or IT may not know about taxes... maybe that is what you mean when you say consulting partner a non accounting or tax position...

-

1

1

-

-

23 hours ago, Ben Zioner said:

Well I have made a transfer of 100 000 USD that should be there by first business day 2024 (tomorrow). How could one think it was earned this year? I'll show them my FCD book, and my USB statement and remittance advice. I hope I am not the only one to have done so.

A good point!

I think that common sense will solve many of these issues new regulations or not.

For the tough issues with large amounts of money - normally you hire an expert...

-

On 1/2/2024 at 5:36 PM, FritsSikkink said:

Let's think a bit bigger, Car manufacturer wants to build factory in Thailand but first needs to pay tax on an investment of billions THB. The whole idea is insane.

Is that a good example? I would think the BOI would be sure to take care of taxes for a big investment including no import taxes on machinery and maybe a tax holiday for a number of years?

-

8 minutes ago, Ben Zioner said:

I think there are. One should explore the exact rules and practices regarding "gifts". And I draw your attention to the fact that our billionaire PM has received one of those "gifts" THB 20M I think, from his children. This was published here recently.

This also leads me to think that moving to tax overseas income and not ruling against these "gifts" was indeed directed against foreigners, as we are much less likely to benefit from such donations. It could have been intentional, or not, I don't want to overestimate them.

Any man who has kids who gives him large gifts is very lucky. My two kids very much need regular supplies of money but they assure me they will take care of me when I am old - so all is well.

Gifts are indeed an interesting idea for tax planning. If the gifts are real then they should work if not real then they could be more trouble then they are worth.

Before someone says the RD has to prove they are not gifts let me say they can do whatever they want (IRS also) and then it is up to you to go to court for Justice. Which can be a slow and expensive process.

I wonder if this is like the US IRS where they can lose a tax case in one part of the country but still follow their view somewhere else?

Example they lose in Bangkok but in Chiang mai they legally still follow their view of the law.

People talk about immigration offices being different in the rules they follow and complain - don't forget in America we have state law and each state can have different rules much more complicated than Thailand.

-

1

1

-

-

- Popular Post

- Popular Post

35 minutes ago, stat said:180 or 183 days it is you can look it up. Laws are in the open plus you can google personal income tax thailand and you will get a detailed tax guides from the big 4. Only 179 days in TH should work to be free of TH income tax.

Actually as I mentioned that was only an example of how a tax question can come up on what seems to be clear... Sorry if it seemed like a real question.

"1. Residents of Thailand If you stay in Thailand for the total of at least 180 days in the tax year, you are considered a “resident of Thailand” for tax purposes. You have to file a return on the income that you received if you meet one of the following conditions: (1) Your total income exceeded 120,000 baht in the tax year.

(2) You were married and your income combined with that of your spouse exceeded 220,000 baht in the tax year. 2. Non-residents of Thailand If you stayed in Thailand for less than 180 days..."

But the above Rd statement doesn't go into details. What if you are a permanent resident or Thai citizen does that change things and make you always a tax resident? (Just a rhetorical question.) I think my friends in America with Green cards told me that they always owe taxes in America regardless of how many days they are in America after getting their Green card.

Also the above RD statement is a translation which is slanted to their point of view - same thing happens with IRS publications - which are not the law only an IRS view of the law - but not a translation normally.

If I had a lot of money I would hire an expert to help me - but I don't have a lot of money so I will keep reading this thread...

-

2

2

-

1

1

-

3 hours ago, jayboy said:

Not sure how it happened - apologies for the duplicate posts!

-

2 hours ago, jayboy said:

You make some very good points, in particular drawing attention to the credentials and added value - particularly RD experience - of the Thai professionals working there.I have now looked at their website.Everything looks kosher.I wonder what their charges are.

My position is that information supplied by the RD so far doesn't really need a professional spin/explanation because the whole initiative remains work in progress and the announcements are easily understood (though I recognize some on this forum might disagree). All that might change as we move forward.In summary I agree your comments in full with the caveat that legislative developments are rarely if ever conducted transparently in Thailand.

Once when I lived in Bangkok a long time ago I spoke with a Thai tax accountant who used to work as a partner for one of the large international accounting firms. Great education, spoke English well - good experience etc he was very expensive - around $500 per hour. My tax needs were not that complicated so I didn't hire him.

i do not know how much this firm charges but it is probably a lot...

I agree that the new rules are a work in progress and the average person doesn't need high level advice - but a large corporation needs to plan ahead as best they can and can afford $500 per hour for a tax partner to brief them and help to plan.. I understood their summary very quickly it was well written. But I don't speak Thai very well or read Thai at all so in the sense that to understand tax law you need to understand Thai at a native speaker's level or close to it - not me...) and understand taxation. Understanding international taxation comes after you understand domestic taxation.

Just for fun let's look at the often stated idea in this thread that you qualify as a tax resident each year - do we really know that? Or does the RD have another unpublished interpretation where you qualify as a tax resident and then you are one until you are not...? Probably not but this is the type of question that is difficult to answer sometimes. also it is interesting like a puzzle.

Someone recently posted an idea where an expat can move to Thailand mid year and not be a tax resident for that year and buy a Condo and presumably not have tax liabilities. He may have been joking but it actually sounds like a good idea? Probably there are many legal ways that don't require great wealth to avoid most of the tax consequences of the new rules. Sometimes a good tax accountant can put together a plan quickly and help you with the paperwork, and be worth their fees especially if you are still working and not retired.

It becomes even more confusing if the legislative developments are not conducted openly. CPSAN in America used to broadcast lots of legislative sessions - some very boring. The British legislative sessions were much more interesting in comparison! The politicians were very witty and sarcastic.

-

2 hours ago, jayboy said:

You make some very good points, in particular drawing attention to the credentials and added value - particularly RD experience - of the Thai professionals working there.I have now looked at their website.Everything looks kosher.I wonder what their charges are.

My position is that information supplied by the RD so far doesn't really need a professional spin/explanation because the whole initiative remains work in progress and the announcements are easily understood (though I recognize some on this forum might disagree). All that might change as we move forward.In summary I agree your comments in full with the caveat that legislative developments are rarely if ever conducted transparently in Thailand.

Once when I lived in Bangkok a long time ago I spoke with a Thai tax accountant who used to work as a partner for one of the large international accounting firms. Great education, spoke English well - good experience etc he was very expensive - around $500 per hour. My tax needs were not that complicated so I didn't hire him.

i do not know how much this firm charges but it is probably a lot...

I agree that the new rules are a work in progress and the average person doesn't need high level advice - but a large corporation needs to plan ahead as best they can and can afford $500 per hour for a tax partner to brief them and help to plan.. I understood their summary very quickly it was well written. But I don't speak Thai very well or read Thai at all so in the sense that to understand tax law you need to understand Thai at a native speaker's level or close to it - not me...) and understand taxation. Understanding international taxation comes after you understand domestic taxation.

Just for fun let's look at the often stated idea in this thread that you qualify as a tax resident each year - do we really know that? Or does the RD have another unpublished interpretation where you qualify as a tax resident and then you are one until you are not...? Probably not but this is the type of question that is difficult to answer sometimes. also it is interesting like a puzzle.

Someone recently posted an idea where an expat can move to Thailand mid year and not be a tax resident for that year and buy a Condo and presumably not have tax liabilities. He may have been joking but it actually sounds like a good idea? Probably there are many legal ways that don't require great wealth to avoid most of the tax consequences of the new rules. Sometimes a good tax accountant can put together a plan quickly and help you with the paperwork, and be worth their fees especially if you are still working and not retired.

It becomes even more confusing if the legislative developments are not conducted openly. CPSAN in America used to broadcast lots of legislative sessions - some very boring. The British legislative sessions were much more interesting in comparison! The politicians were very witty and sarcastic.

-

2 hours ago, jayboy said:

You make some very good points, in particular drawing attention to the credentials and added value - particularly RD experience - of the Thai professionals working there.I have now looked at their website.Everything looks kosher.I wonder what their charges are.

My position is that information supplied by the RD so far doesn't really need a professional spin/explanation because the whole initiative remains work in progress and the announcements are easily understood (though I recognize some on this forum might disagree). All that might change as we move forward.In summary I agree your comments in full with the caveat that legislative developments are rarely if ever conducted transparently in Thailand.

Once when I lived in Bangkok a long time ago I spoke with a Thai tax accountant who used to work as a partner for one of the large international accounting firms. Great education, spoke English well - good experience etc he was very expensive - around $500 per hour. My tax needs were not that complicated so I didn't hire him.

i not know how much this firm charges but it is probably a lot...

I agree that the new rules are a work in progress and the average person doesn't need high level advice - but a large corporation needs to plan ahead as best they can and can afford $500 per hour for a tax partner to brief them and help to plan.. I understood their summary very quickly it was well written. But I don't speak Thai very well or read Thai at all so in the sense that to understand tax law you need to understand Thai at a native speaker's level or close to it - not me...) and understand taxation. Understanding international taxation comes after you understand domestic taxation.

Just for fun let's look at the often stated idea in this thread that you qualify as a tax resident each year - do we really know that? Or does the RD have another unpublished interpretation where you qualify as a tax resident and then you are one until you are not...? Probably not but this is the type of question that is difficult to answer sometimes. also it is interesting like a puzzle.

Someone recently posted an idea where an expat can move to Thailand mid year and not be a tax resident for that year and buy a Condo and presumably not have tax liabilities. He may have been joking but it actually sounds like a good idea? Probably there are many legal ways that don't require great wealth to avoid most of the tax consequences of the new rules. Sometimes a good tax accountant can put together a plan quickly and help you with the paperwork, and be worth their fees especially if you are still working and not retired.

It becomes even more confusing if the legislative developments are not conducted openly. CPSAN in America used to broadcast lots of legislative sessions - some very boring. The British legislative sessions were much more interesting in comparison! The politicians were very witty and sarcastic.

-

2

2

-

-

6 hours ago, jayboy said:

You are aware presumably that this small tax consultancy firm - which I have no reason to believe isn't competent - have at this moment no more knowledge of how these developments will pan out in practice than any well informed layman?

I disagree - I took a look at their staff backgrounds and they are experienced professionals. This means they have a clear understanding of past tax laws and practices and will keep up to date on formal tax laws which everyone can read and internal meetings where details are worked out.

Several of the staff have RD backgrounds and they will Thai style keep in touch with those they worked with. I don't know how legislative developments are reported if at all in Thailand before being finalised. In America, it is mostly very open, and legislative debates, etc are public knowledge Lexis Nexus used to be a good source of as-it-happens tax developments.

So tax professionals can know the trend and make reasonable predictions that lay people are not qualified to do. Also I liked their summary - very clear and easy to understand - greatly appreciated - most likely their Thai tax experts did the research, wrote the summary, and then a native speaker reviewed and edited it - good work.

But no one knows for sure last minute changes can happen.

As a side note I like this thread it provides good questions to ask and is calming to talk about important issues as a group.

-

2

2

-

-

5 hours ago, bugger bognor said:

You. Are delusional that would require new laws to be made unenforceable and would be frowned upon globally! Thailand would be a laughing stock and pray tell me any countries in th world that taxes money at source

And India used to require tax clearance to leave the country after a one year stay.

-

19 hours ago, stat said:

They will and cannot hit you at the source of the bank if your bank is not in Thailand. Not even the mighty IRS of the USA managed to deduct at source a capital gain of a share that arises anywhere in the world (Switzerland, Germany, Canada etc).

Interesting - I remember a while back around ten years ago maybe... America was pressuring Swiss banks with a great deal of success... I think they were after big criminals and terrorists but normal people got caught up...

As a result, Swiss banks are not what they used to be...

-

1

1

-

Thai government to tax all income from abroad for tax residents starting 2024

in Jobs, Economy, Banking, Business, Investments

Posted · Edited by TravelerEastWest

Mike Lister,

You are a native speaker of English (I think) and you seem to have not understood my post.

My comment had nothing to do with tax rules. It was to why individuals would file themselves rather than having a Thai CPA file in Thai for them correctly, at a low cost, and quickly. Your post supports my thoughts that you need a high level of training and skill (both with languages and tax law) to advise on international tax matters.

As a side note working in banking and finance for many years does not in any way qualify anyone to prepare or advise on international tax returns especially when they are not a native (or near-native speaker) of the language. Working for Deloitte for years means you are probably very smart and hard-working but says nothing about your tax skills and you know this very well. If you have any doubt at all about this call a Deloitte tax partner and ask...

Now if you tell me that you were not a banking consultant or something like that for four years - but were a tax specialist and you have a recent education in taxation then all bets are off and I will ask you for advice on Thai tax matters. I believe that you are a nice person and want to help people but I think the possibility exists that you can cause more harm than good.

In America, we have lots of people who are convinced they know a lot about taxes to the point at times where they feel that Income taxes are not legal - and tax practitioners don't take them seriously. Sometimes they end up in jail...

I am not saying that you are that extreme - actually, you are quite reasonable and friendly.

PS If you don't see anywhere on a form a place to do something like rely on a DTA or exclude nontaxable money - this is something tax accountants are trained to do correctly in a way that won't trigger an audit. This is a very practical example of why not trained and educated (In taxation) individuals should not give tax advice.