-

Posts

1,407 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by stat

-

Thanks! You are on to smomething as it is always important to look at both the taxes paid by the company and also the taxes the individual has to pay before investing. UK shares have the big benefit (vs for example german 26.3% or US shares 15% which incur withholding tax) that they incur no withholding tax, which is great when you are thai tax resident or no resident at all.

-

Thanks for all the feedback regarding the UK tax situation! I think you "only" pay this 8.xx % as long as you are a UK tax resident. UK and Ireland +SG do not levy any withholding tax on dividends. Ireland is kind of strange cause it happens sometimes there but UK should be safe IMHO. Withholding tax is only for foreigners regarding the country of origin of the company. So a UK guy along with any other guy should not have to pay any withholding tax on a UK dividend if he is not a tax resident in the UK (for that year).

-

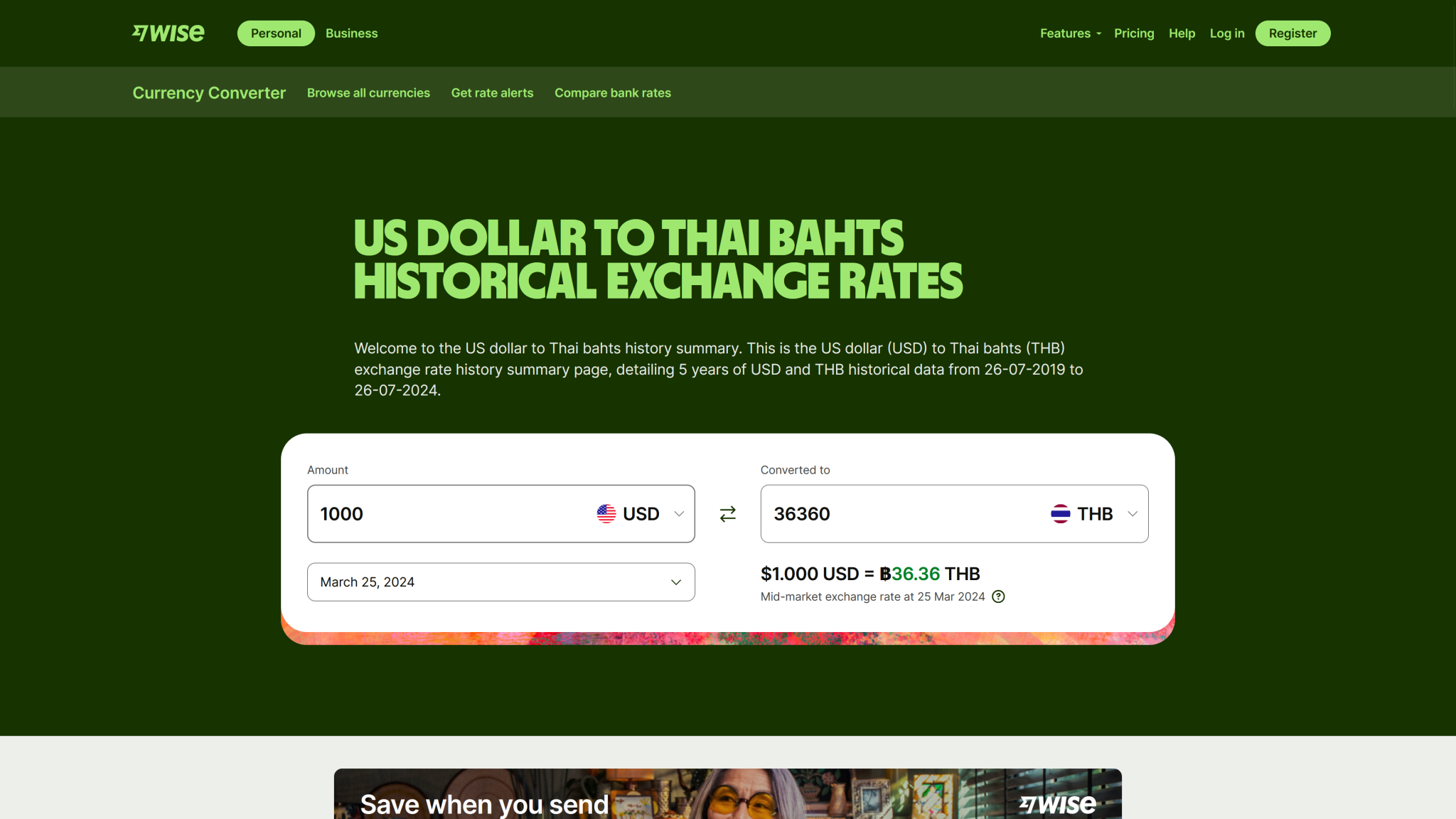

https://www.keycurrency.co.uk/swift-transfer/ Can you cite an example of what exchange rate was used? The fees usually pale in comparision to the mark up in the exchange rate. https://wise.com/us/currency-converter/currencies/thb-thai-baht Maybe check the fx rate next time when you exchange with the ones from wise or revolut. https://wise.com/us/exchange-rate/bangkok-bank-exchange-rate Wise claims to be cheaper in this case. They even point out if they are more expensive but real life picture could be different. Pls let us know, thanks!

-

It is far easier and cheaper to live 178 days in TH and the rest of the year either in the Phils or split the rest between 2 countries UK included. You realize your cap gains in this special year et voila no cap gains anywhere is possible. This is not working however for real estate as most countries reserve the right to tax it according to the country where the real estate is situated. It works perfectly with interest income and stocks, less so with dividends (withholding tax).

-

German DTA with TH states that TH has the sole right to tax but TH so far did not tax any german government pension, so tax "free". Should still work as long as you are able to not transmit your pension and live off other savings. Germany taxes some german company pensions however. Anyway pensions in Germany have been built by investment of already taxed money until 2015 or thereabout.

-

Correct but then you only pay on your UK income and cap gains on UK property and you can not use the allowances to my understanding. So UK tax rules should only bother those that are still tax resident in the UK. When I moved to TH the german IRS did not bother me at all as I made sure I had no German income.

-

Thank you for your post! That sound troubeling to a western mind who likes to have peace of mind and a law he can point to if troube arises. I understand this is TiT but there are big sums involved if in the end you have to pay tax for x years. What did the elite visa guys reverse on? There could be a rerun in case of LTR visa and its "tax ememption" status? Thanks!

-

That is what I said. TRD wants to tax ww income according to the head of TRD. Several reports were listed here. They want to do it but if they have the means and the political power remains to be seen. Few "rich" expats like to run the risk of having a potential huge tax bill. I am not saying it will happen.

-

I am talking about anyone who cares about paying taxes will consider leavin depending on the circumstances. You state people will stay, I disagree. When and if TRD starts collection taxes by force people will start to leave. Half the expat community is still not aware. Offshore companies will work for Thais that was my point or for someone who intends to stay in TH for a long time and never return to their home country.

-

I am not talking about people working in TH. I am consulting on international tax matters already and I can tell you there is no easy and cost efficient way to circumvent ww income tax in Thailand (if it comes to pass in 2025). An offhshore company is a possibility but relative expensive for most people and the whole thing could blow up in your face big time when you go back to your home country or any other country, as now you have to pay taxes on your company. There will always be people who believe just hiring a tax consultant results in close to zero tax. Let me tell you it is not true if we are talking about a "working" taxation system like the US, Germany, France etc. A lot of people that are free (i.e. unbound wife, kids, healthy etc)will leave instead of testing a new setup to prevent paying hundreds of thousands USDs IMHO.

-

The loophole for Thais will not be closed as you can simply park your money in an offshore tax company without ever paying a penny (current status). Now please do not come up with the reply farangs could do the same as westetn tax systems tax the money inside the company even if not remitted or a divdend is paid.