gearbox

-

Posts

2,382 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by gearbox

-

-

3 hours ago, JimHuaHin said:

This is secondhand, so I do not know how reliable it is.

Last year an old Australian friend who had been working in Thailand for about 20 years, but had not been back to Australia for 7-8 years, had to verify his identity online with his Australian bank. He was required to use 3 of 4 forms of identity - passport number, birth certificate number, Medicare card number or driver's license number - he used the first three, no problems.

From the government source:

https://www.smartraveller.gov.au/before-you-go/activities/retiring-overseas

Living overseas and Medicare

Only Australian residents can use Medicare. You can access Medicare for treatment in Australia up to 5 years after you move overseas.

After 5 years, you won’t be able to access Medicare unless you move back to Australia to live. You’ll need to re-enrol before you can access payments. You must show proof you intend to stay in Australia to re-enrol.

However this doesn't seem to be tracked and enforced at the moment. You are ok as long as you have an address in Australia to get Medicare card sent to. There is no guarantee it will be the same in the future. The government has the data from the border to track and enforce, but it seems low on their to do list.

-

1

1

-

-

2 hours ago, CaseyJones said:

Good day,

I have seen some healthy and informative discussion on the financial issues of being non tax resident of Australia.

Are there any other issues to be aware of that are not related to tax/income IE Health, immigration, partner visas etc?

Thanks,

Casey

AFAIK we lose Medicare access after 5 years of absence, but in practice it doesn't seem to be enforced.... probably there is no data matching yet between the border control and Medicare.

-

1

1

-

-

On 10/9/2024 at 8:24 AM, BruceWayne said:

The Camera was invented by a white man.

Try again.

Well I'll keep taking photos with my Sony, and you take photos with your "white man camera", post some photos here to see how it goes.

-

On 10/8/2024 at 12:47 PM, Tropicalevo said:

Thanks for that.

I went to Bank of Ayudhaya at Central Festival today.

Apart from the usual long wait (7 staff and only me in the queue!) I managed to get the USD there and then.

Not a great rate (buying at 33.8) but probably better than the airport.

If you have time at Suvarnabhumi airport there are fairly good exchange boots at the lowest level just before the train entry. I always buy AUD there.

Otherwise the green exchange office in central festival on the second floor opposite the bank offices.

-

19 hours ago, Lacessit said:

True. It still begs the question of why they would spend the money on property in Thailand, where they do not have either secure ownership or residence, rather than Sydney, where they do.

Not all the facts are known about this story. Anyway I wish them luck. In their circumstances I wouldn't move to Thailand without a few millions of income generating assets.

-

1

1

-

-

5 hours ago, Ben Zioner said:

There are some real idiots around. Leaving Manly for Thailand? Mind boggling. Nice surf at her door step, and a little paradise up North 20 minutes away. When they grow up her kids will kill her.

Manly is way overrated, they were paying more than 67k per year for rent there. Going to work to the city from there is pain, crowded ferries and slow busses. My kid rents a terrace in Newtown for nearly half the money and walks 10-15 minutes to work.

-

1

1

-

-

17 minutes ago, Lacessit said:

Perhaps you recall the saying about a fool and his money.

Something in the OP does not compute. They could not save enough for a house in Sydney, but can splash out the equivalent of AUD 1.2 million in Thailand?

If Fred is 60 he could get all his super as a lump sum tax free.

-

9 hours ago, PB172111 said:

Much much cheaper here than in Australia.

I don't think so...I pay $2100 AUD per year for hospital cover in Australia, it would cost me more here, not to mention the big yearly increases after 60-65.

-

7 hours ago, BruceWayne said:

Don't base your opinion of Brits to the ones in Thailand.

We don't send our best.

Some people believe our Governemtnt/MI5/MI6 actually trained thousands of Mamasans back in the 90s who in turned trained their girls to fool non-productive old British divs into selling up & moving to Thailand on the basis of the 'u handome man' type nonsense.

Obvs classified information though so we'll never be able to prove either way.

Seems to have worked though eh 👍

ANNNDDDD

Patents Schmatents.

Any fool can register a patent - does NOT mean they're of any use in THE REAL WORLD..

Can you name any *REAL WORLD* innovations from those countries you're puffing up?

Won't hold my breath : )

I can just enter a real world shop for hi-tech goods and see myself...for example my Sony Alpha III camera is a real masterpiece backed by numerous patents. Only distinct goods I see from UK are bottles of single malt whisky. Huawei just produced a phone which can be unfolded and used as a tablet.

There were many core inventions in the past few centuries by the Europeans, but the world has moved on. The Arabs also invented the numbers, and so on, but that was also ages ago.

-

8 hours ago, BruceWayne said:

Lols. Do you have any examples of Singaporean innovations?

Asian innovation in the last few decades (apart from copycatting)?

And those fast trains were built on an innovations copied from this guy

According to the WIPO statistics Singapore has more residential patents per 1 million population than UK.

Three out of the top four nations in the rankings are from Asia - South Korea, Japan and China.

Most of the innovations these days are incremental, long gone are the days of the fundamental discoveries.

Anyway, being proud of country and race is popular with the low class...as they have nothing else to be proud of.

-

1

1

-

-

4 hours ago, newnative said:

I would question your first sentence but I welcome any statistics you have to back up your claim. I know about a dozen US millionaires, half of whom I am fairly familiar with their financials, and their homes make up about half of their million in assets, not 'most'. The other half would be stocks, 401ks, mutual funds, cars, furnishings, etc., other investments, and, in 3 or 4 cases, gold.

One example, of those I know. School teacher, retired, age 74. She has the two things I mentioned in my earlier post. 1. Greatest Generation parents. 2. Homeowner. She inherited money in the form of stocks from her parents in 2019. At the time the stocks were worth about $300,000. They are now worth $428,000.

Like many Americans, she purchased a home during her working years, which she now owns mortgage-free. The home has increased in value over the last 35 or 40 years and is now worth about $500,000. She and her husband, who did pool maintenance, own 2 cars with a combined value of about $50,000. They also own a large boat. I have no idea of the value but I have been on it and you can sleep aboard it. Let's say $50,000.

I think we are over 1 million already and I haven't figured in her husband's assets--he also inherited money from Greatest Generation parents. He and I have talked stocks and I know he also has a stock portfolio, which likely has grown, along with his wife's.

The key takeaway from my example is how ordinary these two are. Neither had an exotic, super high-paying job. Neither won the lottery. Neither, as far as I know, bought Apple at $22 a share when it went public. Neither did anything special except lucking out with GG parents and wisely buying a home. I think a good chunk of America's millionaires would be variations of this example.

Your second sentence makes little sense. Millionaires in the US are scattered all over, not lumped in one place. If 5% chose to sell at one time, the 5% would also be scattered all over, with little, if any, impact on the market. It could be that 5% of millionaires' homes are already on the market at any given time--I'm too lazy to check as it's not worth bothering with.

I also don't think millionaires have any more trouble selling their homes than anyone else does, should they choose to--especially with the number of millionaires growing every year--500,000 in 2019, for example. If a home is just half of someone's million in assets, as I think it is for many, the house selling would be in the 500,000 dollar range, a normal price in many places in the US and not a bridge too far for a lot of buyers.

Here are some stats about the millionaires in Australia, I would say the figures for NZ, UK and Canada won't be far off these numbers:

https://www.theadviser.com.au/borrower/45872-house-and-land-prices-bolstering-household-wealth-abs

"As a proportion of net household wealth, residential property accounted for around 67.9 per cent."

Also some figures for the US...more or less as expected:

https://www.pewresearch.org/2023/12/04/the-assets-households-own-and-the-debts-they-carry/

-

47 minutes ago, Cameroni said:

If you look back on the history of German industry, it started out copying British products. That's why "Made in Germany" was introduced by the British. It was meant as a warning. Don't buy this, it's a shoddy German product. The British could not fathom that German products would eventually become better than British ones. Eventually Made in Germany became a mark of quality.

Just like the British then you think the Chinese are just copyists. But in time they will be the innovators. They already file more patents than the US. The Japanese showed the same development. And the same will happen with Thailand, eventually. Given time.

History does not support this notion that only Europeans have a Monopoly on innovation and invention. It shows the opposite.

And this notion that a harsh environment created an extra special white race more ingenious than others, again is the climate in Siberia not harsher by far? Why did Siberians not develop this technology gap? Or the Eskimos, by all accounts a harsher life, no technology gap there. The technology gap has other reasons.

I'm not hating on whites. I'm just being realistic. I thought like you. Harsh climate. Greater IQ.

Then I read the bell curve. The best book on IQ I ever read. Turns out Asians are ahead of us. Of course the IQ measurement went through a development stage. However, IQ is a fantastic predictor. It has correlations that are astounding. It is still the best predictor of scholastic and indeed professional success. There is a reason the US army routinely tests IQs of new recruits.

The superior German products were the real reason for the WWI, Germany had to be "contained". That also led us to the WWII.

Now another country needs to be contained, prepare for WW3.

-

21 hours ago, BruceWayne said:

This is why proper Europeans *were* TOPS and invented the modern world.

Our forefathers needed to exercise ingenuity over generations - otherwise they'd have died due to the harsh conditions.In hot countries you it was Easy St - at least easily accessible fruit and plant foot all year round - not so in Northern Europe where people had to PLAN AHEAD OR DIE hence they evolved to be smarter than others.

People might not like to acknowledge it but it is what is though I'm in now way asserting that all westerners all of much use -

Tough times create tough men... Easy times create weak men hence here we are.

That's rubbish...by this logic the Chukchas in Siberia would be the most innovative people on earth.

Singapore on the equator is far more innovative and developed than many countries in Europe, they have two universities in the top 20 in the world, outstanding achievement for a country of 5 million people.

And in the world IQ ranking most of the countries are Asian, none of them near the North Pole.

-

1

1

-

-

23 hours ago, newnative said:

'Americans are actually quite poor.', you say. I would disagree. It's true that there were 36.8 million Americans living in poverty in 2023. That's out of 345 million people. 36.8 million is a large number, yes, but many, many more Americans--over 300 million--are not living in poverty, they are not 'quite poor'.

As I said in an earlier post, the figure I found most interesting was the number of millionaires. One site said 24.5 million, another 23.7 million. With either figure, that's a lot, too. I actually think 24.5 million is way too low.

These days, it doesn't take much to hit a million dollars in assets in the US--you can come close with mostly just two things. 1. Have Greatest Generation parents. They worked hard, were thrifty, saved, and many passed along money and/or real estate to their children. This happened with a number of people I know.

2. Be a USA home owner. Lots of homes in the US, in lots of places, have appreciated in value to at least half a million dollars or more. The average price of a home where I used to live in the US is now over $600,000. My siblings and all my US friends are homeowners, and each home I know of is probably worth at least $400,000 to $500,000, or more. Combine that home value with inherited money and many Baby Boomers, not to mention others, are close to a million already--without even throwing in inherited money from a spouse's parents, 401k money, cars, furnishings, stocks, mutual funds, and other investments.

Someone recently said on a thread something to the effect that a million dollars in assets isn't that special these days and they are right--it no longer is. And, the number of millionaires in the US is bound to grow as Baby Boomers pass along not only their wealth, but the wealth they inherited from their Greatest Generation parents, to their children.

https://en.m.wikipedia.org/wiki/List_of_countries_by_number_of_millionaires

Most of the wealth of these millionaires is tied to their home, illiquid asset, so the majority of these millionaires need to stay where they are, and pay "millionaires" prices for everything.

For example if 5% of these millionaires try to sell their house and move somewhere else, they may find that they are not millionaires anymore, as the house prices will plummet, as there are not enough millionaires to buy them.

-

On 6/26/2024 at 8:19 AM, Sandboxer said:

Farm land with at least a 15 yr strategy if you're married to a Thai lady (or now, man) and are confident in your marriage lasting permanently.

Otherwise, just give me 2 million and I'll make you a millionaire within 24 hrs.

My gf has people in the family with durian farms claiming they are having quite a good revenue, but I'm quite suspicious. I haven't seen a profit and loss statement from a farm, so I suspect they count the revenue as profit without deducting expenses. If a small farm generates 1 million in revenue but 3 people work full time and has heaps of other expenses in the end there is not much money left.

On the other end I've seen a major newspaper article about the durian farmers in Thailand and Malaysia making good money and buying pickups with cash.

IMO a farm to make some money here need to be big enough, in the south that probably requires 10-20 million baht investment.

-

6 minutes ago, Will B Good said:

Why would anyone invest markets they are not fully familiar with on exchanges they haven't previously used?

Why not just trade via an app in your home country??

My Thai gf would be investing. Her home country is Thailand. Investing in different jurisdiction other than your home country brings tax complications.

-

1

1

-

1

1

-

-

4 minutes ago, oceanbluejewell said:

I opened a BLS trading account in 2018 mostly b/c we (my family) banked with Bangkok Bank (BBL) over period of 3 years I built a small dividend portfolio which covers my living expenses in Thailand.

Most investment platforms will assign you an advisor - which is useful when we encountered technical issues. I don't use the advisor other wise. Foreigners can have cash investment accounts, margin accounts (requires a lot of paper work) and special ETF and bond buying options if you are well funded.

We keep it simple and have enough dividend income cover living expenses after the 10% thai tax.

BTW I'm CFP designated without the international designation so I do my own research.

Tips: become member of SET to access financial statements in English.

Disclaimer:

I am not an investment professional; consult your professional investment advisor and/or legal counsel and/or professional accountant before making any investment decision. While all reasonable effort is made to ensure the accuracy of information and data contained herein, accuracy cannot be guaranteed. Past performance is not a good predictor of future performance. Results are not guaranteed and I assume no liability whatsoever for any material losses that may occur. No compensation for suggesting particular securities or financial advisors is solicited or accepted. The information in this document is not intended to be educational, nor does it constitute financial advice nor is it a suggestion or recommendation. Investing is risky and may result in substantial losses.

Hi,

I opened similar thread not long ago. Do you mind sharing the stocks in your investment portfolio? You can PM me if you don't want to post it here.

-

53 minutes ago, BrianStar said:

Yes, I did read about the controls on pork due to illness outbreaks and pork is easy to obtain in Thailand so I don't know why anyone would bother to bring it. I plan to bring USA beef ribeye along with cheese.

Pork meat is easy to obtain but a few kilos of Serrano ham here are worth almost as one way ticket to Europe.

-

2

2

-

-

- Popular Post

- Popular Post

I brought cheese many times, up to 5-7kg, never had any issues. Coming back after a month and will load cheese again.

Don't bring pork products, the penalties are up to 200k baht fine and/or 2 years jail. At least it was like this 2 years ago.

-

1

1

-

2

2

-

2

2

-

- Popular Post

1 hour ago, Jerry777 said:It would really be appreciate if the news guys and gals here would say 'British Passport Holder; rather than a British man which is obviously not his full ethnicity.

Do you ask the world press to refer to your ex-prime minister as "British Passport Holder"?

-

1

1

-

2

2

-

8 hours ago, newnative said:

And, average USA household net worth was $1,059,470 in 2023, up from $746,821 in 2020. Sounds about right.

Average means people like Musk are included in the calculation. I eat chicken, you eat rice, average is chicken with rice.

-

2

2

-

-

16 hours ago, Sandboxer said:

People with real money (at least US$ 10m+) live in the Carribbean or other nice places. Thailand is "ok" for us single digit non-pensioned millionaires because it allows us to get a glimpse of what life as a real money millionaire can be like.

1 million US$ is frankly f-all in today's western world, easily achieved by anyone with even only half a brain who starts investing in their late teens/early 20s.

These non-pensioned mythical millionaires roaming Thailand resemble the loads of ex-special forces in the Pattaya bars.

The median net worth of a household in the US is 192k. By your own words there is a lot of brain deficiency there.

-

- Popular Post

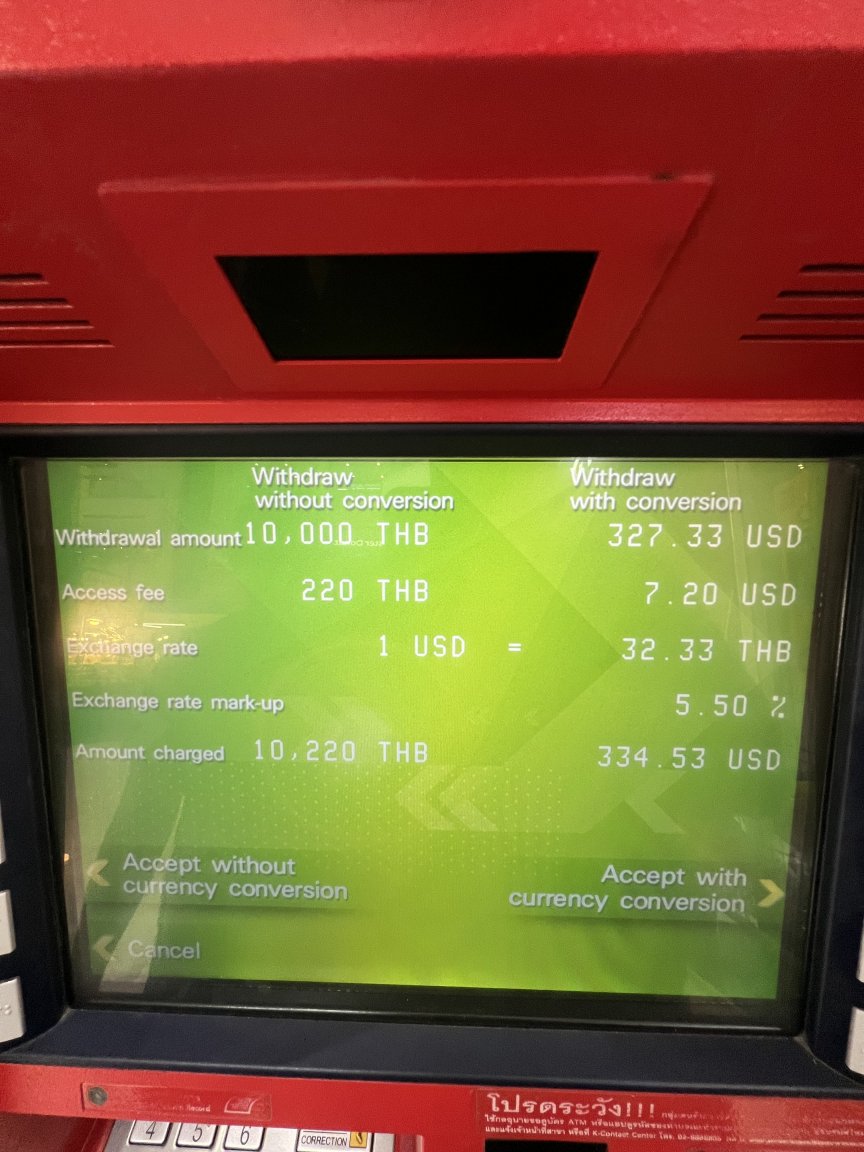

23 minutes ago, Luka77 said:Press the option on the left "Accept without currency conversion" to withdraw without the 5.5% conversion fee. This attempt to use bad conversion rate is common in many countries.

-

1

1

-

1

1

-

2

2

-

- Popular Post

- Popular Post

19 minutes ago, Celsius said:Life is too short to be whining about UK and AUS pensions yet every month there is a whining and whining thread about it.

Yea... Thailand is great until you run out of money. Then back to NHS as soon as you get sick.

Indeed, life is too short to be whinging about pension, it is what it is, stuff mostly beyond pensioner's control. They should find a way to enjoy life with what they have. Thailand has plenty to offer.

-

1

1

-

2

2

Australian non tax resident- non-financial issues.

in Australia & Oceania Topics and Events

Posted

Further to that....as everything else there are grey areas.

https://www.expattaxes.com.au/medicare-for-australian-citizens-overseas/

It is not very clear what happens if you are tax resident and pay Medicare levy but live overseas.

As discussed in the above article the government may take Medicare access as a factor when deciding on tax residency.

And also one subtle thing about travel insurance - all the insurers I know about require the policyholder to be a resident of some country for medical purposes. It is usually the country of citizenship. If the ongoing medical expenses are piling up, they may decide to dump the policyholder to the national health service and terminate the cover. So it is not clear what happens if you are in trouble, have travel insurance, but not Medicare.