-

Posts

254 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by RedFxTrade

-

-

If interest rates are raised in the UK soon then lets see if it effects fuel prices.. I think not

those who pump and sell crude oil give a flying fart about UK interest rates.

rising oil prices and food causes inflation and raising interest rates doesnt effect this in any country..Get it??

Toffo, you don't understand what inflation is...You are not an advisor to Ben Bernanke or Merv King by any chance?

...

...Your proposition that oil is going up due to scarcity is only one part of the equation...Scarcity for oil is global...so why then is oil more expensive today in GBP than USD than 3 years ago. Why is oil cheaper priced in Gold? Why is oil cheaper in Swiss Francs than GBP? Reducing interest rates is not just an arbitrary undertaking, lowering the interest rate means they have to create money to keep the rate down...so creating more of something relative to something else means higher prices. They cannot create oil with the click of a mouse the way the Bank of England can.

-

I have been struggling to work out the connection between higher interest rates and bringing down inflation. Yes, I have read the theory that if credit is more expensive then less will be borrowed and so less money will be sloshing around looking for LED TV's to buy, and so the prices should fall.

I cannot buy into this.

because you are not willing to do some homework studying facts instead of developing your own theories.

I am an engineer. Facts are something or relationships that can be measured or proven absolutely, with crystal clear definitions.

Economics is not a science, it is all fuzzy.

So we read that inflation has risen by 2%. This is hard to consider a "fact", as not only there are several definitions of what inflation is, but also the measure of inflation is subject to fiddles by the government and the guys who issue the "fact". Items are swapped in and out of the basket of goods depending on some whim, and even the price of certain goods is not the real price but is adjusted by a "hedonic" factor. Or even the basic index used is completely changed, as when Brown's lot changed from the RPI to the CPI as a key measure.

So when I read about "the inflation rate is 3.9%", the only fact I can draw from that is that the government claims the inflation rate is 3.9%. But the actual inflation rate that most people are "feeling" is different and unfortunately higher.

Now look at the actual prices of stuff. I would claim that the prices of LED TV's will not be affected by a raise in the interest rate. The price is much more dependent on the manufacturing cost, which for hi-tech stuff has been going down at an incredible rate. I fully expect to see a brand new 50" 3D LED TV priced at less than 60% of today's price in twelve months. The price of rice, coffee potatoes is set on the world's market by supply and demand, with an unhealthy level of speculation on top.

And look at house price inflation, although house prices are not included in the CPI figures. In the States and the UK with historically low interest rates, prices are falling. In Australia with much higher and rising interest rates, the bubble is on. So there are other factors involved other than simply the interest rate.

I could go on.

But unless we are talking about a very simplistic economic model out of the text books, I simply do not buy into the idea that Merv, Ben and other central banks are able to "control" the rate of inflation by mechanically tweaking the interest rate level by 0.25%. There can be no direct control, there are simply too many other variables in the economy (both at the national and global level) all acting to push and pull the price of goods (which is the inflation most people think of, and not the increase in money supply).

Much more powerful is setting the expectations of the population. This is why Ben and Merv keep on mentioning that as long as the "inflation rate expectations are anchored" they are happy to go on with ZIRP and QE.

So come on then Naam, here's the challenge.....

Instead of firing off dozens of two liners all over TV everyday, how about putting together a clear description, complete with actual facts and examples of the direct relationship between a small tweak in interest rate to a change in inflation, which you appear to claim is unarguably a fact.

And I claim cannot be demonstrated or proven as a fact in a modern and real economy.

You posited some good questions 12DrinksMore...With inflation today perhaps you will need to change your username to 15 Drinksmore in keeping with inflation

, all kidding aside. From reading various sources and monetary history and texts over the last few years out of a strong curiosity to try and get to some inkling of the "truth" of cause and effect I have come up with my own idea or way of looking at inflation/deflation. When I say my own ideas I m affording myself too much credit (excuse the pun)...but I mean I have read and collated other peoples writings and views and tried to make them my own as a practical way of understanding this inflation/deflation debate, and in a way that stands up practically to real life scrutiny, ie, a way that can be observed if X (cause) happens today, then Y (effect)will happen at a undermined point in the future, as there is always a lag until the new information becomes available to observe whether or Y did occur due to X if you know what I mean.

, all kidding aside. From reading various sources and monetary history and texts over the last few years out of a strong curiosity to try and get to some inkling of the "truth" of cause and effect I have come up with my own idea or way of looking at inflation/deflation. When I say my own ideas I m affording myself too much credit (excuse the pun)...but I mean I have read and collated other peoples writings and views and tried to make them my own as a practical way of understanding this inflation/deflation debate, and in a way that stands up practically to real life scrutiny, ie, a way that can be observed if X (cause) happens today, then Y (effect)will happen at a undermined point in the future, as there is always a lag until the new information becomes available to observe whether or Y did occur due to X if you know what I mean.My understanding is that inflation is an increase in money and credit as marked to an asset price, and an increase in money and credit will be exhibited in those assets where the fundamentals are most the most favourable or optimal.

The first part , an increase in money and credit has an easily observable effect. An example would be if you look at the growth in mortgage debt in a country, when this is expanding, you will see an increase in house prices. The tricky part though is asking why Central banking reserves, and the endogenous nature of money and credit creation within the commercial banks should manifest itself in home loans...and why house prices should rise when money and credit is expanding rather than some other asset in the economy. Thats the part that comes down to fundamentals...There will be periods where housing as asset is under valued, or at fair value...favourable fundamentals for housing say in the US back in the early 2000s were many, that allowed the excessive money and credit to flow to this asset. When I say favourable they were not really that favourable but government initiatives and banking initiatives manufactured one, ie, interventionism led to unintended consequences.

1. This sickening speech by Bush back in May shows one of the fundamentals or catalysts of the housing bubble.

http://www.youtube.com/watch?v=kNqQx7sjoS8

2. Flat yield curve, banks and society in search for yield, came up with many more creative way in search of yield, securitisation

3. Fannie Mae and Freddie Mac, subsidisation of the entire mortgage market.

4. Tax credits, down payments paid by the government, removal of the small print on mortgages, or failure to disclose it.

5. As real estate assets began to rise then reserves increased in banks due to an increase in deposits throughout the banking system. Then more loans could be fractionalised on the new loans. Its at this point that marked to market helps to perpetuate the increasing money and credit growth. As an example, house prices are bid up 10% in a year. I sell my house to you 12Drinks more, I receive the new money from the house sale plus my 10% profit...I then place that in my bank account, and it then increases the banks reserves and acts as "collateral" to pyramid more loans from my deposit, and the process continues until prices for a while, perpetuated by sentiment and speculative activity until it becomes a bubble. Thats why when assets are marked to the market a rising asset will encourage more loan growth, as it increases reserves in commercial banks, due to people selling at ever higher prices and then depositing the new money as deposits/reserves.

6. Another factor is that governments , although they never said it, government policy seemed to be polarised between "good" and "bad" inflation. Rising house prices and stocks good inflation. Rising consumer goods and food, energy "bad Inflation"...I see them both as coming from the same source.

Today all the stimulus, money printing and credit is flowing to where the fundamentals are favourable, ie,commodities, and to some extent stocks, and emerging markets. Although one could say emerging markets are somewhat bubbles in certain areas of these economies.

-

I agree with you Naam, that makes a change,eh

on the interest rates rises will be peanuts and it probably will not really help sterling anyway as its fundamentally and structurally a flawed currency anyway...but I certainly do not agree that oil prices will remain static no matter how various currencies perform...

on the interest rates rises will be peanuts and it probably will not really help sterling anyway as its fundamentally and structurally a flawed currency anyway...but I certainly do not agree that oil prices will remain static no matter how various currencies perform...there... there... Red. read again what i said

short-sighted is to assume that... and short-sighted as well is that crude prices will remain static no matter how various currencies performit mussed bee ze lack off my kommand off der enklish lankvitch zat ziss kind off misoonderstundings happen

Lol,,,just booked in for an appointment at the opticians this afternoon...

...I really need to stop skim reading in this busy schedule of laying in bed with a laptop with a cup of coffee first thing in the morning,haha...its making me eyes lazy.

...I really need to stop skim reading in this busy schedule of laying in bed with a laptop with a cup of coffee first thing in the morning,haha...its making me eyes lazy.

-

uhm,...at least they tell you it`s CLASSIFIED!

Haha,,,,what a pointless vote...when you don't know what your voting for....I really wish the guy had slipped up and said one of the classifieds out loud...then we could have pieced it all together...Cannot see them letting Ron Paul read that out for fear of that actually happening.

-

That's right 12DrinkMore. Naam never stops to go back to first principles and work out if his "facts" are actually facts or simply religious convictions by modern day economic priests.

Sadly, this lack of willingness to reconsider many of these "facts" are exactly what is driving the global collapse. Raising interest rates will not help inflation when the inflation is being driven by high energy prices and scarce resources. All you will do is allow other countries to consume more at your expense. Paradoxically, the best thing you can do right now is to lower your rates and encourage your citizens to consume all you can before someone else does. Prices will go up anyway. This is a race to the bottom.

Oh, there are political solutions that might work to mitigate collapse, but without a global political will to implement it, individual countries have no choice but to join the race to the bottom.

Traditional economic "facts" are going to be consigned to the dustbin of history the same way those "facts" about alchemy were rightfully discarded.

Prices are not inflation Greg...Really, so if thats the case in the statement in bold above why is energy cheaper in USD than GBP, and whys it more expensive in Zimbabwe Dollars ? Surely by this theory if it is all to do with scare resources then we would all be being exactly the same amount? More over, my cost of energy/petrol is much lower now than a few years ago due to using gold, and silver as a unit of exchange rather than GBP whereas people in the UK I know who fill their cars up are paying 800% more than 10 years ago. I also have some CHF in a forex account, my energy is cheaper in this currency also than GBP.

Its a monetary phenomenon, excessive money and credit, which will bid up prices in the area where fundamentals are most optimal. Your right in that there is a scarcity on the limits of daily production possible of cheaper oil...however, that situation is the same globally and a constant factor. Yet certain units of account of account if you like have had a deflationary impact on energy prices, and the majority have had an inflationary impact. Econ 101...when you ask the price or value of something you need to define it terms of something else,,,like a ratio. To say energy is going up due to scarcity means nothings....going up in terms of what,,,,

-

short-sighted is to assume that a peanuts interest rate increase (more than peanuts is not in the cards given UK's economic situation) will be positive for GBPUSD and short-sighted as well is that crude prices will remain static no matter how various currencies perform. last not least i consider it short-sighted not taking into consideration that UK oil imports amount to only ~10% of the country's consumption.

summary: interest rate hike = zero sum game as far as fuel prices at the pump are concerned :jap:

I agree with you Naam, that makes a change,eh

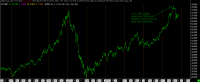

on the interest rates rises will be peanuts and it probably will not really help sterling anyway as its fundamentally and structurally a flawed currency anyway...but I certainly do not agree that oil prices will remain static no matter how various currencies perform...One of things I study in currency fundamentals is Oil imports as a % of GDP. The UK is at a level, its eased slightly that has always led to a recession in the past...The chart below is GBP/OIL I constructed a while back to follow how much the increases in month on month costs are to the UK economy based on current consumption levels.

on the interest rates rises will be peanuts and it probably will not really help sterling anyway as its fundamentally and structurally a flawed currency anyway...but I certainly do not agree that oil prices will remain static no matter how various currencies perform...One of things I study in currency fundamentals is Oil imports as a % of GDP. The UK is at a level, its eased slightly that has always led to a recession in the past...The chart below is GBP/OIL I constructed a while back to follow how much the increases in month on month costs are to the UK economy based on current consumption levels. You can see that the price of oil in GBP has already surpassed the 2008 high and made new highs, despite the USD high of $147 in 2008 not being reached yet. So to say that it is not impacted by currency performance is in short totally wrong, priced in USD oil is below its all time high 3 years later (hey perhaps we should be hysterical about a Sterling collapse more so than a USD collapse

)...and also try a figure close to 40% for of UK demand is imported now...Mostly from Norway, the Americas and Africa...lets not kid ourselves to the reasons why they are so closely involved in Libya...it is not because their main export is broccoli.

)...and also try a figure close to 40% for of UK demand is imported now...Mostly from Norway, the Americas and Africa...lets not kid ourselves to the reasons why they are so closely involved in Libya...it is not because their main export is broccoli.

-

i won't to show "any vs. any". all what i said that using "2008" and "higher" is generalising and wrong if no specific dates are mentioned. it is correct if used in context "when people were talking..".

but who the eff cares or makes a decision today based on what happened when "people where talking..." three years ago?

Bear Sterns and the infamous triple A rated mortgage rubbish caused the Dollar to drop to (what i consider real value).

Bear Sterns and the infamous triple A rated mortgage rubbish caused the Dollar to drop to (what i consider real value). then post Lehman we had (as so often) a flight into "quality". the latter can happen again if EUroland doesn't solve its well known problems. fundamentally the currency of the Greatest Nation on Earth™, who's revenues are 14% of its debt, combined with the fact that the debt is still increasing is doomed. not necessarily today and not necessarily next year but it's only a matter of time.

disclaimer: i hold (17% of my portfolio) cash as well as paper USD

Because there have been many times when I have used sentiment as a trading tool, one such way is to combine retail positioning, large speculator positioning, and a proliferation of sensational head lines by such groups as the United Nations, the well renowned currency trading institution ...However, whether it is based on talking or facts, the facts remains that the USD is off its all time lows against the mentioned currencies. Thats facts are the numbers regardless of what people are saying...and those numbers are that the USD is above its lows of mentioned currencies.

-

and everyone wants their economies to grow out of this situation to reduce their debt - but Where is the growth coming from - S/E Asia/Africa and India etc can grow to some extent but to get the west out of this mess - I cannot see it /

The only solution at this stage is to print print and hope for the best ?

Exactly the absolute best scenario for gold would be a global contraction, interest rates expectations to drop, G20 meetings discussing more stimulus, or printing as we like to call it, and a couple of wars thrown in for good measure,haha. I hope that does not happen by the way. But dealing past form from CB's and Governments and the illusion that the global economy is growing, when really its only excess liquidity and when they are faced with the other side of that illusion which we seeing I can only see more stimulus, extraordinary measures...

Might a good time to revisit bernankes paper from 2002...as Napier said in a recent interview the QE was only step one and mild compared to some of the "tools" he had devised in "Deflation: Making Sure It Does Not Happen Here"...

Have you heard the one that if people are not spending, they will invalidate 5% of the serial numbers on USD bills in circulation. A lottery when on average everyone will hold money that 5% of it will have a sell by date...so spend it before that sell by date...truly scary and nuts...I think there is also a suggestion about buying stocks with printed money...car loans etc etc...Lets hope that citizens will not allow that to happen.

-

Well, in some ways that may be the case, but I m specifically talking about the USD against other currencies...and 3 years later the USD is higher against the CAD, NZD is around the same level, USD is higher against the Euro and the GBP than in 2008, its higher against the NOK and SEK than 2008.

= misinformation based on unspecific generalisation! i can prove that all your claims are wrong if i pick my specific dates in 2008.

Well, since we are talking about USD collapse I m talking at the time in 2008 when people were talking about a USD collapse...that was namely when the USD was plunging against the CAD, the CHF, the AUD, the NOK, SEK and oil was soaring to 147 USD and the FED started to cut rates, etc...and I m talking about the absolute lows...can you show me that the USD lows of 2011 are lower than 2008 lows the USD made against the NOK,SEK, GBP, EUR, CAD, HUF...three years later? Whatever date you pick over the last three years to be more precise without generalisations you the USD is higher against the USD, SEK, NOK, HUF, GBP, CAD, EUR...Thats why to say the USD is collapsing when it is higher than its absolute lows against those currencies is inaccurate.

-

Why is it irrational to think that people might want to withdraw money and their life savings from an insolvent bank?

not irrational at all but

1. until this very moment there are no insolvent greek banks (no matter how often you repeat it).

2. i keep daily close contact with three greek colleagues in a financial forum (two live in Athens, one lives in Saloniki) who would have definitely mentioned any obvious bank run that happened last week. take a wild guess what the most discussed topic in this forum is. i'll give you some hints: it's not the prevailing bride price a headhunter has to pay to his future father-in-law in Papua New Guinea and it's not the possible outcome of a soccer game between Manchester United and Dynamo Vladivostok.

I tend to disagree, Greek banks are insolvent, the extend and pretend game is in play. If those Greek bonds that the ECB has bought up were dumped onto the market, rather than artificially propped up by the ECB then they would be gone. On paper they are insolvent, technically. But if one lies, and uses accounting chicanery, that can be postponed, but it does not change the fact they the Greek banks liabilities far outweigh their assets. If Greek banks do not take the loss, then it will be the ECB who will take it,,,or print it away, either way it is default.

I don't know anymore which is better at this time the Euro or USD - and GBP is looking very weak after today's figures ! Nobody seems to be being honest - trichet wants support for the Euro so he is indicating higher rates - But the Euro Zone cannot afford higher rates / Ben needs a weaker USD and low interest rates but will not admit it /

and so Gold , the alternative , should be rising /

A good piece in today's FT The eurozone's intolerable choices

' A euro in a Greek bank is today no longer the same as a euro in a German bank. In this situation, there is not only the risk of a run on a bank but also the risk of a run on a national banking system. This is, of course, what the federal government has prevented in the US. '

'Debt restructuring looks inevitable. Yet it is also easy to see why it would be a nightmare, particularly if, as Bini Smaghi insists, the ECB would refuse to lend against the debt of defaulting states. In the absence of ECB support, banks would collapse. Governments would surely have to freeze bank accounts and redenominate debt in a new currency. A run from the public and private debts of every other fragile country would ensue. That would drive these countries towards a similar catastrophe. The eurozone would then unravel. The alternative would be a politically explosive operation to recycle fleeing outflows via public sector inflows. '

'The eurozone confronts a choice between two intolerable options: either default and partial dissolution or open-ended official support. The existence of this choice proves that an enduring union will at the very least need deeper financial integration and greater fiscal support than was originally envisaged. How will the politics of these choices now play out? I truly have no idea. I wonder whether anybody does. '

Good Links, thanks.

GREECE: German official Frikke affirms that Germany cannot make their contribution to the next tranche of aid if the IMF doesnt do its part.

1 Jun 11:26:11

Things starting to heat up again...also Portugal bond auction shows weak demand this morning and covered at a much higher yield...You begin to get the feeling that just as the market might get over this Greece situation, that it has forgotten about Portugal and Ireland, Spain and Italy. All data from the Eurozone this morning missing expectations,retails sales plunge in Italy yesterday, PMI manufacturing in Italy and Spain contract....Seems to be a trend world wide. US data weak, Chinese PMI coming in weaker and Australian economy contracted in first quarter, lending coming in weaker, UK PMI contracted, mortgage lending fell and M4 came in below expectations...The USD has a lot of ugly sisters at the moment. Not to mention Japans credit outlook on negative.

-

Look at how people searching world wide for USD collapse back in 2008, just as it made one its most ferocious rally in a decade.

you cannot surely compare conditions back in 2008 to now ?

Back in 2008 many people were too shy to publicly admit the emperor has no clothes

Well, in some ways that may be the case, but I m specifically talking about the USD against other currencies...and 3 years later the USD is higher against the CAD, NZD is around the same level, USD is higher against the Euro and the GBP than in 2008, its higher against the NOK and SEK than 2008.

The European banking system is weaker now than in 2008 and systemic risks are higher.

The Australian economy is in a credit bubble, and China has a fixed asset bubble.

My time frame is a few months to be long USD. The USD was at a much lower level against many currencies back in 2008 when they were calling a USD collapse, today it is higher against many currencies and considerably higher against a few like the EUR and GBP , 3 years later. Futures positioning data suggests people are no less or more shy regarding the USD today than in 2008. Infact the shorts at this moment have eased according to the latest speculative positioning data, and speculative positioning is showing people being less short the USD than 2008...I can only go with the facts, until they change. At this moment the facts are that USD shorts are easing. It reminds a little of last June the hysterical calls all over the media as plunged down to 1.2000 and then to 1.1900, everyone was calling Euro to parity. I went long at that point with initial small positions and as priced moved up added more. I targeted 1.3600, and in the end under estimated the strength of the rally.

Longer term I expect the USD to be weaker against real assets but the judge is still out on how weak it will be against the other ugly sisters. To call USD collapse against other currencies is too USD centric. If you look at the fundamentals for Australia, Europe, the UK, they too have many problems. I m in for the short to medium term, short AUDUSD a few weeks back and long USDCHF. If I m wrong well, I still own my gold and silver, and have my stops on my positions. Time will tell.

-

either the current bounce continues or perhaps the 68 level will be visited.

But this kind of headline doesn't help sentiment?

United Nations report warns of dollar "collapse"

Or on the other hand headlines like that favour a brave contrarian...and more likely to hear that at market extremes.

I use google insights to find trends in certain things and it can be a good gauge of sentiment...I typed in the search trend for the term "USD Collapse" and here is the chart attached.

Look at how people searching world wide for USD collapse back in 2008, just as it made one its most ferocious rally in a decade. Once again people have been jumping on the search engines searching USD collapse. I tend to fade these hysterical headlines.

-

I thought I 'd up date some of your musical likes...

I just arrived here to live, but as I have no work, no girlfriend and it seems no life, lol I maybe suffering a bit of too much of my own splendid company.

I just arrived here to live, but as I have no work, no girlfriend and it seems no life, lol I maybe suffering a bit of too much of my own splendid company.If there is anyone on this website who would like to meet up for a coffee or a beer then all offers would be gratefully received, but people with an interest in any one of the following are especially welcome to cast me a social life jacket.

Sarcasm

Kindness

English football, even the stuff not played by millionaires

Did the Uk welfare state make me the lazy bugger I am today?

Morrissey, other music I like is Lies, lies, lies by Toni Braxton, Sweet Little Lies by Fleetwood Mac and Lies by Evanescense

Playing chess

Girls

Playing chess while looking at girls

Anything published by Dawkins, Pinker or Heffner

Talking about ideas rather than about people, unless she is attractive

I live in ploenchit, next to Chidlom but I am happy to meet anywhere on sky train route.

My schedule is enbarrassingly open.

-

Well Baan Khanita looks most likely, by virtue of its location..... (bit close to Cowboy though!) or else Baan Khun Mae.

I haven't given p looking yet thought

I could chicken out and bow to pressure, and just select a roof top centara grand or similar venue ..... the vistas never fail to dissappoint!

Bit pricey though - anyone been there recently?

Bit pricey though - anyone been there recently?Not that recently, but it when I have been it has been excellent. I think the bill for two of us came to just over 300o baht, though there was some alcohol in there.

-

More confusion:

on Jan 5

I am still legally married to a well educated, lovely Thai woman, but we are now 100% friends only. She doesnt mind staying married to help with my visa.

I trust her 1000%

It just gets better and better...

-

Sorry people, I didn't realise my absence would cause such uproar....

Yes, beaten by a better side, outclassed and outplayed.

Berba does need to go, while we can still get a penny or two for him. We need a goalkeeper, De Gea seems to be the chosen one, Stenkellenburg is another on the lips. Wesley Schnieder is the man in the midfield that must be acquired, he likes United and has expressed a desire to play for us.......... Ashley Young and Jack Rodwell are the way forward too. taht should see us right, seriously....!!

redrus

I knew there was more to the Berbatov situation when Ferguson was interviewed before the game....Ferguson said due to UEFA substitution rules. But Berbatov was the top scorer for UTD and it seems almost incredulous that he would opt for Owen over Berbatov. Cannot quite understand his thinking around Berbatov, he was flying earlier in the season then was just dropped...I think he will be a bad player to lose for UTD at a crucial time...Scholes (just seeing Scholes has officially retired), Giggs, Owen on way out, Van Der Saar retired. If Berbatov leaves then you could see that Ferguson will need to buy 4-5 players just to get the team back to the stage it is at. As for improving the team, another couple of players. Berbatov, Scholes are play makers, who now will be UTD play makers, the center of their creativity with the type of football UTD like to play. Fletcher, Carrick,,,hardly playmakers....Even if Ferguson signs a couple of players he is really only replacing whats there without actually expanding the squad.

-

Not a tourist? Lots of tourists insist on Thai food, but many expats are tired of it and want a taste of other kinds of foods.

To be honest, I generally find western food appauling in Thailand - always have. There are a few exceptions, but to be honest I think most expats have become accustomed to accepting / calling average food good, simply by comparison. We kid ourselves with comments like "that place is great, its justl ike home" ....... but in reality, what we mean is that it is nearly as good as home..... nearly. The oposite is the case in the real world, where Thai cuisine is watered down to local taste, and generally lacks authenticity.

I think my emphasis was more on the "Thai Style" - as in the type of place a tourist would struggle because menu's in Thai (or Tinglish at best) and the staff speaking less english than the average taxi driver..... not being an tourist, that is not an issue for me

BTW - Thanks to everyone for your suggestions ...... I have been busy trying to google them etc and figure out how to get there.

Good luck, sure report back when you have been and let is know the verdict and where you went

-

I've got to start vaporizing a different strain, nothing on this thread is making sense any more...

Yeah +1

Remember when this thread was about where gold is going?

Apart from the pedantic nature of a few posts between Naam (his statements always draw me in) and myself yesterday...I think the solvency of an EU member is highly relevant to where Gold is going unless I m missing something

Here is a set of very interesting charts of the USD Index going back 3-4 decades. USD Powerful Rally Coming. I have been long USD for a few weeks now. The point worth remembering that being long USD is not necessarily an anti-gold play, unless you belong to one of the dogmatic gold bug religious groups, where being long USD and Gold at the same time is akin to the religious equivalent of being a right wing Christian/Creationist and also a devout follower of Islamic Sharia law

. Gold good very well still go up with the USD. The interesting thing about the above linked charts to the PDF by Ross Clark is how the USD bottoms, you can see a subset of charts where it shows how each major USD bottom formed on a daily timeframe. Once again it seems to be following the pattern to the letter. Of course it does not have to play out like that this time, but until it doesn't then it is still in play. Seasonally we are moving towards a negative bias for risk assets, the stock market is over valued by any historical measure, the USD short positions have eased, the retail traders are slowly turning net short the USD (contrarian signal), and a mammoth 77% of retail positionings on Silver are long. The extreme positive sentiment towards Silver in the retail crowd is still high.

. Gold good very well still go up with the USD. The interesting thing about the above linked charts to the PDF by Ross Clark is how the USD bottoms, you can see a subset of charts where it shows how each major USD bottom formed on a daily timeframe. Once again it seems to be following the pattern to the letter. Of course it does not have to play out like that this time, but until it doesn't then it is still in play. Seasonally we are moving towards a negative bias for risk assets, the stock market is over valued by any historical measure, the USD short positions have eased, the retail traders are slowly turning net short the USD (contrarian signal), and a mammoth 77% of retail positionings on Silver are long. The extreme positive sentiment towards Silver in the retail crowd is still high.Another move up to 90 on the USD Index is not out of the question with an outside chance of a move towards 100...something almost unthinkable. I do not think a move towards 100 is likely due to the interventionist nature of the government and central banks but needs some consideration if some true black swan appears. However, it is worth noting that the FED did not want the USD to move from 71 to 90 in 2008, but it happened so fast, that they really had no choice in it. So if it gains momentum I don't think the FED will be able to over ride the rally in the short term.

The USD Index is against a basket of currencies and has no gold component after all. The USD against other fiat currencies I believe is in the process of a major rally. It is a case of the finding the least ugly sister in a fiat world. The USD despite all the focus on it is more attractive at this juncture than the AUD, CAD, EUR and GBP, and even the CHF. Although some powerful trends are in place I think they seem to be turning. This is based on technicals for some, and fundamentals also. The AUD I think has a terrible fundamental outlook for the next number of months.

So all in all, the next few months should see a stronger USD against other fiat currencies. Gold may or may not move higher. The chart attached is the one I posted the Sunday before last, and here is the same chart obviously with the price now higher than then, and following the trajectory so far. The green rectangle area marked is an area where I see value as in I only see value there as that is where other market players are seeing value...as the highest volume has occurred at those price levels, and gold has moved higher from here once the equilibrium between buyers and sellers becomes dis-equilibrium in favour of bulls. This is where I could see gold drift to by the middle to the end of the summer, and the ending of a seasonally weak period. Whether we get a failure to make a new high on this little rally underway right now, or we get a spike up to $1650 area first before a move down who knows.

In summary, Gold to stay firm, before settling into a low between $1420-1490. Silver to under perform, price targets lower end of band would be $26 and higher end $30-33$. USD to be stronger against most currencies, risk assets down, US T-Bonds up/yields down

-

I am confused --- on May 17th the OP was married to a Thai!?!?

Well picked up. Could have been a typo, as in I m not married, but then thinking about it, seems a little strange that you would ever qualify that anyway...very strange. God thats going to put off any prospective drinking mates...Reminds of a story for another forum related to Thailand where someone was always on the forum, they had a few thousand posts, but got caught out one night saying they were in a club in Bangkok and had just got back to his condo and the club had shut at 2am (despite other posters being there after that time), but in actual fact it turned out they were in America and not even living in Thailand, despite the charade that he was. Why would anyone even do that?

-

Hello,

Sorry if in wrong forum or if all i can say this on here but does anybody know what (go hock) means in Thai not to sure correct spelling just write as i here it.

I already think something not good but would like to know 100%

Cheers

Paul

It means you need to learn some basic Thai

-

Why is it irrational to think that people might want to withdraw money and their life savings from an insolvent bank?

not irrational at all but

1. until this very moment there are no insolvent greek banks (no matter how often you repeat it).

2. i keep daily close contact with three greek colleagues in a financial forum (two live in Athens, one lives in Saloniki) who would have definitely mentioned any obvious bank run that happened last week. take a wild guess what the most discussed topic in this forum is. i'll give you some hints: it's not the prevailing bride price a headhunter has to pay to his future father-in-law in Papua New Guinea and it's not the possible outcome of a soccer game between Manchester United and Dynamo Vladivostok.

I tend to disagree, Greek banks are insolvent, the extend and pretend game is in play. If those Greek bonds that the ECB has bought up were dumped onto the market, rather than artificially propped up by the ECB then they would be gone. On paper they are insolvent, technically. But if one lies, and uses accounting chicanery, that can be postponed, but it does not change the fact they the Greek banks liabilities far outweigh their assets. If Greek banks do not take the loss, then it will be the ECB who will take it,,,or print it away, either way it is default.

-

another one who is in dire need of reading glasses

I was writing as you posted it...but I have already responded,haha....do you want to borrow those reading glasses?

-

edit: I see Red just wrote the above.

That ll be me

It just shows their are too many bureaucrats which is causing me to get mixed up between them all.

It just shows their are too many bureaucrats which is causing me to get mixed up between them all.

-

here's the complete interview "Stark / Welt am Sonntag" published yesterday.

Thanks for this...I used google translate for this part...and it came out like this

Each process requires a first step. Prime Minister Giorgos Papandreou announced the program only in the March of this yearly. First of all an independent privatisation agency must be created, this process accompanied by the government. But one can make oneself the experiences of other states too own, including the trust establishment in Germany. The Greek government holds portions of quoted enterprises, it possesses real estate. Experts estimate the sales potential on up to 300 billion euros. A part of these values must be mobilized, in order to lower the debt level. In addition privatisations cause more efficiency in the entire national economy.So it seems he was happy to concur with the experts and reiterated their opinion? If he did not agree with the experts I m sure he would not have quoted them. So one way or another he indirectly said Greece could sell 300 billion of assets?

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Thailand Steps Up Fight Against Inflation

in Jobs, Economy, Banking, Business, Investments

Posted

I think that is what is important. Basically, I see forums as an open place to put your point across, exchange views etc etc. I m neither asking anyone to accept anything I say, and I m sure no one else is asking me to accept their view also. I m just put it out there and if people agree or disagree it does not matter, as everyone has their own paths.

And apart from stimulating an intellectual debate on these issues, there is no need to try and win any intellectual arguments. Think on it like this...The very existence of prices and markets, and pricing signals is only possible through disagreement. If there was no disagreement there would be no markets. Prices, markets, assets are undergoing a constant flow of momentary dances between agreement and disagreement, buying and selling.

In the end it is good to have a debate on a forum, I find it enjoyable from time to time, I m at my computer alot at the minute so it fills time while writing helps to cement your own ideas. However, the real intellectual battle is against the the actual market, not a few people on a forum. If you can make some money or make a living from what you do, or enough that makes you happy, then you are proof that you are winning the intellectual battle with the market, not a few individuals. Thats the way I see it...it does matter one iota who agrees or likes what you say on a forum, unless they are going to pay you .....Trust your arguments, and intellectual reasonings by dipping them into the market(s)of choice that way you will find out if your arguments are right, with actual numbers...not with actual peoples views...

I don't know if anyone has read the Market Wizards series. Excellent interviews with successful traders...what struck me was that they were all very successful in their own right but all very different ways. One great investor saying charting is like astrology, while another has made millions from charts...there is more than one way to skin a cat...

P.S Alert we have an illiquid market. Naam and Red are in agreement,