-

Posts

6,514 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by beautifulthailand99

-

-

- Popular Post

Markets crashing again. This is looking like a start of a catastrophe. He pulled back, but his off-ramp plan aint working and he and his friends insider traded. Nobody has confidence in US and it's crashing! This orange clown caused it - there is only one question how do we get rid of him before he destroys us all. But it may already be too late - we are cursed to live in interesting times.

-

1

1

-

2

2

-

- Popular Post

Both sides’ tariffs are causing deep economic harm; they may also raise the risk of a military showdown. A more promising route for America was to marshal its allies into a free-trade bloc large enough to force China to change its trade practices as the price of admission. This was the strategy behind the Trans-Pacific Partnership, a trade deal that Mr Trump binned in his first term. Scott Bessent, the treasury secretary, talks of doing a trade deal with allies and approaching China “as a group”. But now that it has bullied its allies and reneged on its past deals, America will find they are less willing to co-operate.

Such is the short-sightedness of Mr Trump’s reckless agenda. In a mere ten days the president has ended the old certainties that underpinned the world economy, replacing them with extraordinary levels of volatility and confusion. Some of the chaos may have abated for now. But it will take a very long time to rebuild what has been lost.-

2

2

-

1

1

-

Markets in turmoil again - the world and his dog knows that The Trump Organisation America is not to be trusted. Smart money will try and get as far away from the dumpster fire as they can.

But when prices on imported goods, particularly from China, rise many times above inflation, this will lead to higher interest rates and all the negative consequences for a nation already relying too heavily on credit rather than savings.

The next impacts are as predictable as they are depressing: a sluggish economy results in less job security and lower jobs growth as employers cut their cloth.

Then, as the competition for jobs increases, wage levels fall and people fall further into debt, generating an inter-generational rise in poverty that future administrations will have to tackle or, more likely, ignore.

-

1

1

-

-

11 minutes ago, stupidfarang said:

Then you do not understand the Chinese economy. Yes China debt is very high but the debt is differant fron the USA. China debt is mostly domestic, banks, local goverments property market and based on the Yuan(china mostly borrows in Yuan) and can be controlled by the goverment decisions are fast unlike usa who have trouble passing budgets.

USA debt is dollar based and part of the global system, if yields spike, debt service costs go up, treasury demand drops the dollar slides. Need to look at what the debt is funding as well for both countries. USA debt is war, tax cuts for the rich, stock buybacks and social debt. China is infrastructure, industrial, R&D and property market

Indeed with the ability to shake down or even arrest and execute rogue billionaires if they are getting too rich and/or corrupt. Now I like that a bigly lot. A billion is more than enough for anyone - the rest is stealing the worker's labour.

-

1

1

-

1

1

-

1

1

-

-

-

1 hour ago, Eric Loh said:

All that plus China has a nuclear option.

Robin Brooks, senior fellow Brookings.

If China embarked on a mass sale of its US treasuries, the value of the debt would plunge and yields would soar. This would drive up US government borrowing costs and hammer the public finances in a highly destabilising move.

They’ve quietly been selling them off since the peak in 2013, fully aware that in the event of a war, they could lose everything. The rest will likely be offloaded quietly in due course. America is the world’s biggest debtor nation — it needs borrowed cash just to keep going and if they print because bond auctions fail then they debauch the dollar. It's looking like the bill is coming in from a decades old binge at the global buffet.

-

2

2

-

-

- Popular Post

American consumers are about to get a harsh wake-up call: much of the cheap, readily available stuff they’ve come to rely on is about to get significantly more expensive. And globally, there's a growing consensus — the world is learning that Trump's version of America is unpredictable and, frankly, not to be trusted. It has the distinct flavour of end-of-empire decline.

Meanwhile, outside the U.S., the rest of us may actually benefit. As trade relationships shift, many countries can look forward to improved ties with China and a potential influx of affordable goods — the very products that once would have been destined for American shelves. Markets may become more competitive, and prices could drop.

So, in an ironic twist, while the U.S. doubles down on isolationist rhetoric and erratic leadership, the rest of the world might just walk away with the better deal.

Thanks for that, Donald.

https://unherd.com/2025/04/china-is-ready-for-battle/

Meanwhile, China has a lot of what can be called economic strategic depth. The basic tension in the US/China trade relationship is that the US has been living beyond its means, whereas China has been living well beneath them, repressing wages to keep export prices competitive. Faced with the loss of external markets, the Chinese leadership is now re-orienting the economy towards domestic consumption to pick up the slack, which will lessen the impact of the trade war on ordinary citizens. It thereby has a lot of capacity to absorb lost American sales.

-

1

1

-

2

2

-

I wonder if the reason Trump is prepared to take such a huge gamble on this working out is because he can't run for office again and even if its a disaster it won't personally effect him and his family, they'll still be able to swan about golf courses and mar-a-lago whilst their country crumbles around them. If there is some 4D chess vision behind this madness - like some reset of the entire international economic order with the US as the unrivalled hegemon - and it works out, Trump gets to bask in the glory of it. In other words, for the Trump dynasty, they perceive no downside. If there truly is a conspiratorial deep state like he likes to opine about then he truly is a dead man walking.

-

1

1

-

-

He was even wrong about the sharks / electrocution dilemna. AI says take your chance with the sharks rather than going down with the boat.

-

1

1

-

-

https://www.dailymail.co.uk/news/article-14587659/China-revenge-tariffs-US-goods-Trump.html

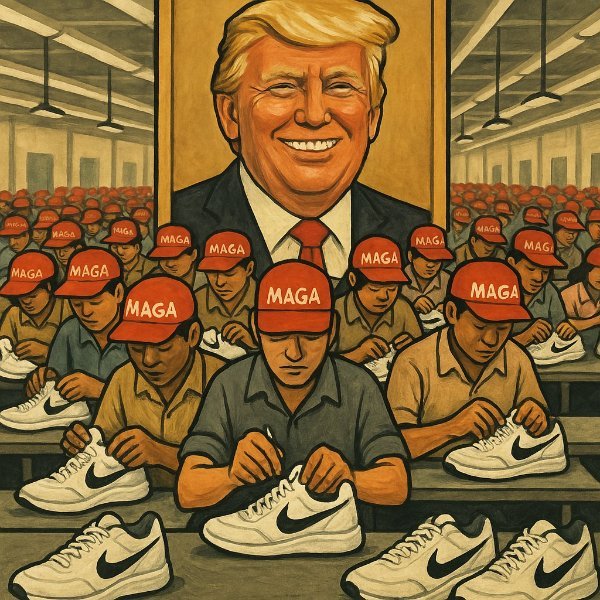

A lot of buyer's regret in MAGA world now and when rednecks see prices in Walmart surging or not available the real pain party begins. Either Trump goes or America falls and along with it a lot of financially indebted western world.

-

1

1

-

-

- Popular Post

- Popular Post

JFK Jr. in charge of Health, Tulsi Gabbard over "Intelligence," Hegseth at Defense — everything is broken or breaking. This is truly American carnage.

The electorate and the GOP played stupid games — and have now won stupid prizes.

The only question now is: how do they get rid of him?

Treasuries are in turmoil, and lurking in the financial ecosystem are toxic synthetic products that could detonate the system and accelerate the velocity of the collapse.

I now fact check myself.

Your statement regarding the current financial situation is largely accurate, reflecting recent developments in global markets.

Treasuries in Turmoil:

U.S. Treasury bonds have experienced significant volatility following the implementation of President Trump's 104% tariffs on China. This has led to a sharp selloff, with the 10-year Treasury yield surging to 4.46% and the 30-year yield exceeding 5%, marking the steepest increase since 1981. These movements indicate a declining appetite for longer-term government debt, traditionally considered a safe-haven asset.

Toxic Synthetic Products in the Financial Ecosystem:

The financial ecosystem is also grappling with complex financial instruments that pose systemic risks. Notably, the "basis trade," a strategy involving leveraged positions in Treasury cash and futures markets, has come under pressure. Hedge funds are being forced to unwind these trades due to tighter lending conditions and margin calls, exacerbating market instability.

While these developments are concerning, it's important to note that the full extent of their impact on the financial system is still unfolding. Market conditions are dynamic, and ongoing monitoring is essential to assess potential risks and responses.

-

2

2

-

1

1

-

1

1

-

1 minute ago, Harrisfan said:

Ww3 and depression

The funny thing is that anyone believed this 6 time bankrupt convicted felon was the answer to anything. He's not the real thing what follows him is what you should be really scared about. This is just the entree.

-

1

1

-

1

1

-

-

1 hour ago, Harrisfan said:

What's the point in whingeing non stop about Trump?

He's destroying the world economy and the US ecomomy and many people's wealth with his insane policies and probably will usher in a Global Depression that will probably lead to World War 3 - that point. The joke has long ceased to be funny.

-

1

1

-

-

-

If I said what I really feel I would probably be banned from this board forever.

-

1 minute ago, placeholder said:

So, for argument's sake let's say your characterization of Biden is true. Therefore even if it wasn't his fault, he still is responsible for inflation because of his intellectual failings?

It was really executively Obama 3.0 with the country running on autopilot. Meanwhile the greatest pilot in the world(TM) who was sitting in 1st Class barged into the cockpit and is now pulling levers and pressing switches. Prepare for crash landing.

-

20 minutes ago, thaibeachlovers said:

While I'm no longer a supporter, I think he's doing a great job domestically. Unfortunately everything he does in the middle east is appalling and dangerous for all of us. He should stay in the US and keep his sticky beak out of the M E.

The thing is Trump is only in it for himself any bonus that accrues to the American working MAGA man will be by accident rather than design. The good news is that he is destroying the American finances and their standing in the world and I can't see that not impacting the dollar , and the more impoversihed the US is the les able it will be able to finance endless wars and Israel - indeed he just stuck 17% on Israel much to their consternation. So I for one am cheering on the destruction. Keep up the good work Donnie - it's like a toddler walking into a bar on the dark side with a loaded gun.

-

1

1

-

1

1

-

-

-

-

That scared look you see on many of the faces of the newsreaders is the knot in their stomachs as they see their acquired wealth torched by the insane orange clown. The free MAGA ride troll is over and the crazy cost of voting this idiot into power is becoming starkly clear.

-

1

1

-

-

If andy MAGIdiots here have pension funds , stocks or an interest in the strength of the dollar I applaud your sacrifices on the altar of Trumpism so that maybe , just maybe the US economy may turn around in 5 years or more. But I'm afraid it will be neither - he will destroy your wealth along with your country.

-

what would be historic fair value for the dow jones without QE as a % of it's current value

ChatGPT said:That’s a super interesting (and big!) question — trying to strip out the effects of Quantitative Easing (QE) from the Dow Jones to estimate a kind of "organic" or "historic fair value" is tricky, but we can reason through it.

TL;DR:Estimates vary widely, but some analysts argue the Dow could be 30–50% lower without QE, putting a rough "historic fair value" at 50–70% of its current level. So if the Dow is around 39,000 (as of early 2025), its QE-free fair value might be in the range of 19,500 to 27,300.

I'll buy in at half price - went very long physical gold at the start of the Ukraine war on the basis that peer proxy wars by nuclear superpowers are very bad news indeed and let's take Trump's Main Street not Wall Street at face value then he will let stocks slide and what goes bust goes bust rather than a liquidity QE stick save.

-

Jim Cramer has said don't panic - you all know what that means.

-

30 minutes ago, Yagoda said:

If my stock dude wasn't so conservative, it would tell me to buy.

MAGA bill incoming !!

Poll -- Who will cave first in the momentous China-USA trade war?

in Political Soapbox

Posted