JB300

Advanced Member-

Posts

1,624 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by JB300

-

UK Defined Benefits pension, early retirement

JB300 replied to JB300's topic in UK & Europe Topics and Events

Thanks, I can understand how interest rates can affect the transfer out value of the pension as the money they would need to give you to purchase annuities to give you an equivalent pension is less (my Xfer out value dropped by about 30% when annuity/interest rates shot up), but I can’t understand why the early retirement/taking the pension numbers would do anything but go up. Will do December’s quote middle of next week & then I’ll have 3 months of data to go back to WTW with (though I won’t be holding my breath waiting for a sensible answer from them). -

UK Defined Benefits pension, early retirement

JB300 replied to JB300's topic in UK & Europe Topics and Events

Very useful, thank you for your contribution… 👍🏻 -

UK Defined Benefits pension, early retirement

JB300 replied to JB300's topic in UK & Europe Topics and Events

Yes the plan includes a Cost of Living increase each year (Trustees discretion max 5%) but even if this changed I can’t see how they would decrease the pension. I do the quotes to hit the same date (2nd of the month) to match my Birthday & for the past > 18 months it’s gone up by more or less the same amount each month, but in October (5 months before it’s due to mature) it (& the PCLS) went down for no reason I can think of. -

UK Defined Benefits pension, early retirement

JB300 replied to JB300's topic in UK & Europe Topics and Events

I haven’t asked them yet, I was giving it 3 months worth of quotes so I could see if I could see some kind of pattern that I might be able to make sense of. Will be able to do December’s quote mid next week & if that’s still below September’s quote I’ll ask them but my reason for asking on here is that I’m really scratching my head to understand how that could be. -

UK Defined Benefits pension, early retirement

JB300 replied to JB300's topic in UK & Europe Topics and Events

As I said, “Investment Performance” shouldn’t affect what I get as it’s solely based on the salary I was on when I left the company. The pension matures when I’m 60 (Feb 2026), so I’m quite close to being able to get a final quote but if the December’s numbers are still less than September’s then I’m just going to take the money early. -

Scratching my head at this one… Each month I get a quote for how much I will get from my UK Defined Benefits pension if I were to retire in 6 months (max I can get a quote for) & every month the number has been going up by more or less the same amount until I got to October’s quote where it went down. I thought this might be an anomaly so did November’s quote at the start of this month & it’s up on October but still less than September’s. This makes no sense to me as if I took my pension in September not only would I get an extra 2 month’s pension but I’d also get more money & a higher PCLS! Im going to do a quote for December next week & if it’s still down then will contact my pension provider to find out why but can anybody think of any reason why this would happen? NB This is a defined benefit pension so is solely based on my final salary, any changes in “Investment Performance” would not impact how much I get, good or bad.

-

I’ve seen grown men p1ssing on the side of the road & taking a <deleted> on Juhu beach so it’s a real thing in India. Seems they’ve exported it to Thailand as well https://timesofindia.indiatimes.com/life-style/travel/news/indian-tourists-urinating-on-pattaya-beach-this-is-what-actually-happened/articleshow/117454745.cms

-

What's the dullest place in Thailand?

JB300 replied to Tuco Ramirez's topic in ASEAN NOW Community Pub

Krabi when it’s rainy season, drive 5 hours from Satun so we could do a tour to Similan Islands & trip was cancelled because of the weather, spent 4 days in the hotel just waiting for the flight back (I’d have bailed but she won’t leave an already paid for hotel). Great if you want to eat Indian food for breakfast, lunch & dinner, not so great if you like Thai food & especially Pork (much more Muslim oriented than when I visited 17 years ago). Won’t be back. -

Was in Ao Nang 10 days ago & I’ve never seen so many Indian restaurants in 1 place (except when I spent 18 months working in Mumbai), really struggled to find somewhere to eat as although I really like Indian food, it’s not something I’d eat regularly + the GF is (quite rightly) wary about getting Thai food from a non-Thai restaurant. As an aside we’d been to visit her family in Hat Yai & Satun before that & I honestly though I was back in Malaysia when I went into Satun central, >90% of the females were wearing headscarves.

-

Using Agent at Immigration - good idea?

JB300 replied to TerraplaneGuy's topic in Thai Visas, Residency, and Work Permits

Absolutely & my bank accounts would stand up to an audit to show I followed the rules, but I was just highlighting the only example I could think of where a stamp from an Agent assisted extension could look different to a DIY one. Simple answer if somebody was worried about this is to go see your agent within the 45/30 days permitted by your IO office & the stamps would look identical. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

JB300 replied to snoop1130's topic in Thailand News

I live on passive income (Rent, Dividends & Capital Gains), my accountant files my return & I have no tax pay by UK rules… 1. (net) Rental income, below the £12,570 personal allowance, no tax to pay. 2. Dividends, reported as “Disregarded” Income so no additional tax to pay over the tax already withheld. 3. Capital Gains, I’ve been an expat for 17 years so any (Non Property)) capital gains are not taxable. Not evading anything, just following the rules… Have filed returns since I was 19 (this year will be my 40th return) before becoming an Expat, as a higher rate tax payer, there there was always some extra tax to be paid on dividends & benefits in kind (Conpany car, Private Health insurance etc)… but apart from property sales, the Uk is very generous to Non-UK Tax residents. -

Using Agent at Immigration - good idea?

JB300 replied to TerraplaneGuy's topic in Thai Visas, Residency, and Work Permits

The UK passport you’re renewing already has the Biometric data (Introduced in 2006 & I believe this is photo only as I don’t ever recall being fingerprinted when applying for a passport) so as long as your new photo isn’t massively dissimilar than your old photo then you’re ok. -

Report Foreign Earnings Taxed Under New Thai Rules - But With Exceptions

JB300 replied to snoop1130's topic in Thailand News

Even if they went “Full USA” Thailand couldn’t tax non-Tax residents on anything unless they were Thai Citizens (maybe argue a case for PR holders) so the approach of spending <180 days in-country would still work. -

Using Agent at Immigration - good idea?

JB300 replied to TerraplaneGuy's topic in Thai Visas, Residency, and Work Permits

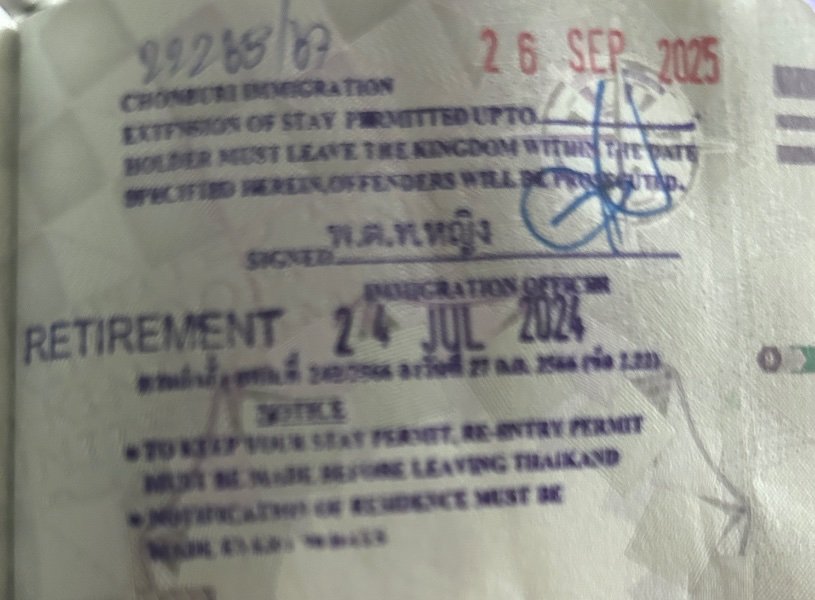

The only thing I can think of where the stamp might look different is an agent can get your extension done up to 90 days before it’s due whereas doing it yourself it would be 30/45 days before it’s due. E.g Because of travel plans I did my extension > 60 days early this year so a sharp eyed IO officer could work out it was done via an agent… -

Using Agent at Immigration - good idea?

JB300 replied to TerraplaneGuy's topic in Thai Visas, Residency, and Work Permits

In Pattaya I use Maneerat on Soi 13/2 (Soi Post Office) When I lived in Bangkok (5 years ago) I used Asia Visa Consulting IIRC, Extensions were 7,900, multi re-entry permits were an additional 4,000 & 90 day reporting was 375. -

Using Agent at Immigration - good idea?

JB300 replied to TerraplaneGuy's topic in Thai Visas, Residency, and Work Permits

Sorry I’m one of those people who believes that time is worth more than money so I use an agent to make my life easier at any opportunity I can (just like in the UK, I use an accountant to file tax returns & a gardener to take care of my gardens). 1. Annual Extension 8K (have the 800K in the bank) + 4K for a multi reentry permit. 2. TM30 (when I moved condo) 500b. 3. 90 day report (1st one after getting back from an overseas trip) 100b (because I do my annual extension with them, 200b if not) … rest of them I do online. 4. Residency Certificate (opening bank account, driving licence etc…) 500b 5. UK Passport renewal 12K (+ 1K for them to arrange the transfer of the visa/permission to stay to the new passport). All 100% legit, I’m paying for a “Concierge” service not for somebody to “Bend the Rules”. One thing I would say to the OP is in all of the above Immigration interactions your agent needs to have your passport & in the case of annual extension of stay you have to go to Immigration to have your photo taken (my experience in Bangkok & Pattaya, your local IO office might have different rules) so you need to be in-country even if using an agent. -

Agree on that, when I lived in On Nut (Bangkok) the Lotus’s across the road had great pork at about 1/2 of what I pay nowadays, the Lotus’s in Pattaya I won’t buy any meat from but the GF loves their Chicken Feet! As an aside for anybody who lives in the Pattaya areas, I’ve recently been given a tip on a good place to buy quality pork… https://maps.app.goo.gl/ypaFDpsD4oesVhAd9?g_st=com.google.maps.preview.copy I haven’t had chance to check it out yet but might be worth a look for any fellow Pork lovers 😊

-

Have never seen meat in Makro that I would eat (Nb I don’t eat chicken, Thai beef or fatty Pork), but they do save me about 2-3,000 THB pm on the Korean/Japanese sauces that I use when cooking my Foodland bought Pork (330B per kilo). But Thailand is very cheap for anything that involves labour… E.g. Extractor hob on the cooker failed, Condo maintenance guy comes round to have a look, 75B for a new capacitor & 100B standard condo service fee. Better still, came back from 12 days away down south & the condo walls/ceilings were showing signs of moisture, 24K (I rent so landlord is paying) & the whole unit (2 bed, 2 bath 79 sqm) gets a repaint… Only downside is I need to book a 5 day holiday somewhere (having just got back from Hat Yai, Satun & Krabi I figure we’ll hide out in Jomtien, 1600 THB gets me the 1st 2 nights in a beach front hotel… Cheap as chips😊).

-

Yes, I’m on the outskirts of Pattaya (Wongamat)

-

That was the photo that condo maintenance sent to me. I did take off the outer covers of the extractor unit but didn’t see any electronic components, hesitant to start dismantling it unless I have to.

-

My cooker extractor hood has stopped working & Condo maintenance tell me I need one of these… … But they can’t buy them anymore. To my simple mind this looks like a pretty standard capacitor so as long as the numbers match it shouldn’t matter what the brand is (in this case it’s a for a Mafele overhead hood). Can anybody advise where I can find one of these or suggest an alternative I could buy in Thailand. Many Thanks JB