hugolars

-

Posts

86 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by hugolars

-

-

1 minute ago, DrJack54 said:

When does current permission of stay end. After march 26 do nothing.

My stamp is until 18 april.

-

Hi,

I have same situation. Under normal circumstances I would have extended the 60 days with another 30 days for 1900 bath.

What to do now? Extend at immigration or does amnesty cover?-

1

1

-

-

Very little talk about what happens when Thais cannot pay mortgages.

The interest rate is very high i Thailand. Is it not 8%?

BOT is making very good money. Should the rate not be lowered ALOT and how will it affect the mighty Bath? -

31 minutes ago, The Koenig said:

I am supporting the family of my ex- girlfriend.

Both parents of a 1 year old child, lost their jobs and didn't see 1 baht of government help!

Yes...I am a dirty farang, not wearing a mask for the longest time, so I guess, I was responsible for their lot in the first place!

I'm very curious on why you are doing this. Thais in general are excepting farangs giving them stuff without any appreciation.

I say save you money.

-

1

1

-

-

There is no such thing.

You have to leave the country to activate another 60 days on ME. -

Thought Thailand didn't need tourism at all.

-

1

1

-

-

6 hours ago, pantsonfire said:

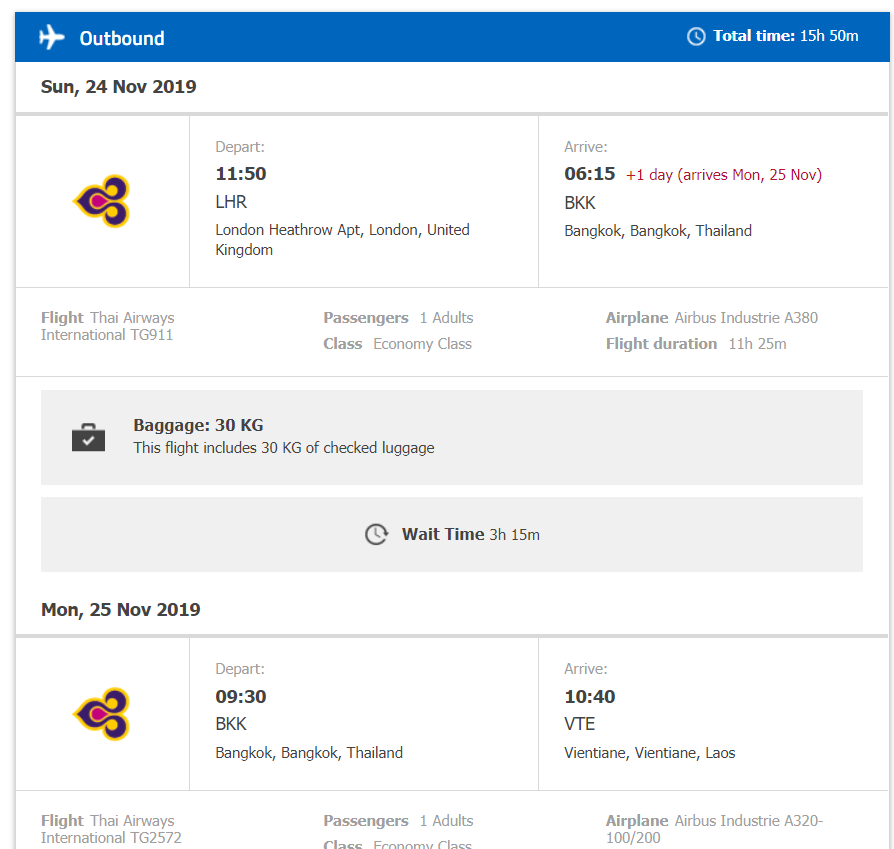

I wonder what would happen if you try pass immigration at BKK and get rejected and just continue to VTE?

You have a boarding pass to fly on. What would be their excuse to hold you? If you are not let in to VTE the same airline will be responsible to fly you back to LHR from VTE.

-

On 10/24/2019 at 7:47 AM, FritsSikkink said:

As long as you have the proper visa, you don't have any problems. The people with problems are the ones who think they can still live here on tourist visas.

Well every Thai embassy around the say that you can live in Thailand long term with tourist visa,.

Have anyone heard of somebody being denied a tourist visa in his home country with a passport full of visas and stamps?

If you have more information than the I suggest you informing them (Thai embassies) rather than giving out wrong information here in TVF.-

1

1

-

-

- Popular Post

- Popular Post

11 minutes ago, saengd said:A visa gives you permission to travel to country, not to enter it. The job of the IO is to determine whether you may enter, using a series of rules about which he has considerable latitude, including his personal judgement and this is true of any IO anywhere. Imagine if you showed up at Heathrow with a visa and the IO asked you a few questions and you told him to <deleted> of you fascist scum. You may well have all the other bits and pieces necessary to enter successfully but the IO didn't think you ought to enter because of your attitude, in which case you would be denied using some vague blanket rule, not in the public interest, or similar.

The IO in Thailand is not as proficient as you in English but he goes through a similar process, he asks questions but doesn't believe/comprehend fully your answers, IN AN ENVIRONMENT OF HEIGHTENED SCRUTINY WHERE A HIGH PROPORTION OF VISA HOLDERS ARE HANDING HIM FAIRY STORIES, and pow, you just got excluded. If you were expecting that what follows might be the same as the UK, several levels of review by increasingly senior officers, you would be mistaken. If you were expecting that an excuse of, well it worked OK last year, might be OK, you would also be mistaken.

Well any country has the right to make a buck on issuing useless Visas, which is pretty unique behavior in the world but hey, this is "amazing Thailand", but to take the freedom away from the visitor by locking him up for days and charging him for the "visit" is beyond comprehension. You don't want me entering your country even though I have a valid "ticket" that is your loss so let me instantly travel anywhere I want! Can you imagine being locked up for days like a rabid dog in a cage because you are not a "tourist" even though the Thai ambassador told you otherwise? They don't even lock up dogs in this country but you think it's OK to lock in people on suspicion on not being tourists???? Should this not cause the Thai ambassador a "face loss" because the visa he sell is useless?

I don't get it, is not a violation of human right to lock in a person like this??? Should this not make every civilized country issue warning to it's citizens that visiting Thailand is discouraged? shouldn't the embassy of the persons country instantly demand the release of it's citizen by the crazed Thais?-

3

3

-

1

1

-

1

1

-

4 hours ago, Max69xl said:

Some of the posters here at TVF will never understand what a "normal tourist is". On top of that they seem to think that everyone in the world can visit a western country without a proper visa. To be honest, I'm real tired of border hoppers and people with phony ED visas and their endless complaints.

Many poster here will never understand why Thai embassies sell Visas to people who in reality cannot enter the country. Can you comprehend that this is more logical than your opinion? Imagine buying an cinema ticket but cannot enter the cinema because you have been there to many times? You are not interested in movies but other devious intents to enter? Same same, but different.

-

1

1

-

-

- Popular Post

- Popular Post

4 hours ago, Chivas said:Ludicrous utterly ludicrous by this ever increasing Banana Republic

If the geezer is granted a tourist visa in the first place from a 1st Word Country than quite simply he should be let in (no dont come back with it doesn't guarantee entry)

Lunacy utter lunacy. When the Indians and Chinese disappear off to pastures new (and they will) this banana republic will be desperate to accept all the Europeans as possible

Please stop insulting the Banana Republics by thinking they behave the same as Thais. Banana Republics value visitors and respects their own Visas.

-

1

1

-

3

3

-

Any tip on how buying tickets is appriciated.

Check below about refundable tickets and train ticket

http://www.thaivisa.com/forum/topic/754481-boarding-to-thailand-without-return-ticket/

Thanks Paz.

-

Exactly! Dont understansd why they have those rules at certain embassys.

Any clue how can I buy bus or train tickets online or something?

Phone - ask - report here.

Called once and told the that i dont know when i will be coming back and will book return ticket later, they said NO. But also said that bus/train/taxi ticket exiting the country will do.

The even have it on their Swedish website.

Any tip on how buying tickets is appriciated.

-

At the Thai Embassy in Sweden I know people have showed tickets out/in with bus and train for double and triple tourist visas. But I would guess the rules can change a bit depending on what embassy in Europe that you use.

Exactly! Dont understansd why they have those rules at certain embassys.

Any clue how can I buy bus or train tickets online or something?

-

Want to apply for two entry Visa in Europe but the embassy require travel tickets for all entrys.

In my case I need three tickets (out, in and out from Thailand).

Anybody knows if i can buy international bus ticket online to present to the embassy?

You need to ask the embassy. We don't even know which one are you talking about.

It's for tourist visa they require entry and exit tickets.

-

Off topic. Forgive me.

Want to apply for two entry Visa in Europe but the embassy require travel tickets for all entrys.

In my case I need three tickets (out, in and out from Thailand).

Anybody knows if i can buy international bus ticket online to present to the embassy?

Thx,

-

You said that you did not have cash.

Would they have let you in if you could present cash?

-

You dont need a work permit or pay taxes in Thailand if you are not making money from Thai economy.

You are simply not a Thai citizen. Don't listen to anybody telling you otherwise.

Forget about starting a thai company etc. You need a Thai company only if you are conducting business in Thailand.

Dont complicate it. Everything is legal and illegal in Thailand. The system is setup to screw the farangs.

Visa is a complete different issue.

-

1

1

-

-

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

Hello Forum!

My first post so go easy on me. I am a digital nomad for over 10 years now and have worked many times from Thailand in cafes etc. I pay my taxes in the UK as my income is derived from the UK.

I don't really understand why anyone would have a problem with the concept of working remotely when it has no negative impact whatsoever on the host country.

As many have said the only consequence is an extra foreign body spending their foreign earnings in Thailand on accommodation, coffee, food, travel etc.

How can this be an issue?

You use the streets in Thailand. You drink the water in Thailand. You are protected by the police and military in Thailand. You use Thailand's roads and mass transit. You are protected from having a building fall on you by Thai building inspectors. Thai health department money protects you from Ebola and scads of other threats, whether you know it or not. Thai money kills the mosquitoes so you don't get dengue. The list goes on and on.

All that costs money, and yours is going to the UK where it doesn't do the Thai people much benefit.

You pay 7% VAT on the stuff you buy here. That doesn't come close to covering your share of the wear and tear on the infrastructure.

You pump some money into the economy. Thai's that earn the same money to pump into the economy also pump a lot more into the tax coffers.

You're getting a free ride in Thailand, and that's the issue. I love visitors to my home. So do the Thai's. But if my guests plan to stay for 10 years, they probably ought to chip in some rent and put some food into the fridge occasionally.

If you disagree with that, I dare you to go to the Revenue Department back home and claim you pump so much money into the economy that you shouldn't be required to pay taxes on top of your VAT, GST or sales tax.

So shut down all tourism because they also do not pay tax for those "services". So what if i "pay tax" as you want mo to do and i get hit by a car. Does the service include medical expenses? Hell no!

Man get real. A farang working here online pays more tax in form of VAT than majority of Thais do in total in a lifetime.

Maaaaaan. What are you, like 12 dude?

Get a grip. You pay VAT. Bully for you.

You are just missing the bit where the same revenue code which contains VAT also contains a little thing about how your income you earn is taxable if repatriated into Thailand once you spend more that 182 days per year in Thailand.

So duuude, I know your poo doesn't stink and all, but you are dodging the tax man otherwise. If you want tax free living, I hear Somalia is good this time of year.So in your professional opinion, I mean you have actually written over 13.000 posts which make you believe that you are a pro in these issues, your you telling me that if I stay here over 183 days I have to tax my income twice because i walk on Thai streets. The cash the nomads put in the Thai economy is worth twice since its generated outside Thai economy. VAT is more than enough and the Thais should be happy about this.

Oh did you miss this? "A non-resident is, however, subject to tax only on income from sources in Thailand"

The "nomads" do not make their cash from sources in Thailand even if they stay here full time. Even a 12 year old can comprehend this.

-

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

You are just missing the bit where the same revenue code which contains VAT also contains a little thing about how your income you earn is taxable if repatriated into Thailand once you spend more that 182 days per year in Thailand.According to KPMG and PwC, only the portion remitted to Thailand in the year it is earned. Probably due to this part of the code http://www.rd.go.th/publish/6045.0.html

'A resident of Thailand is liable to pay tax on income from sources in Thailand as well as on the portion of income from foreign sources that is brought into Thailand.'

Key phrase being brought into ThailandThis in conjunction with 'Personal Income Tax (PIT) is a direct tax levied on income of a person. A person means an individual, an ordinary partnership, a non-juristic body of person and an undivided estate. In general, a person liable to PIT has to compute his tax liability, file tax return and pay tax, if any, accordingly on a calendar year basis.' means that if somebody keeps foreign sourced income offshore until the subsequent tax year, it is not taxable - since it is not earned in the relevant calendar year for tax calculation, it is not a factor in calculating the relevant years PIT.

No dodging about it, it is simply following the rules. AKA good tax planning.

"A non-resident is, however, subject to tax only on income from sources in Thailand."

So staying in Thailand 12 months a year does not make liable to pay tax income made abroad.

-

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

Hello Forum!

My first post so go easy on me. I am a digital nomad for over 10 years now and have worked many times from Thailand in cafes etc. I pay my taxes in the UK as my income is derived from the UK.

I don't really understand why anyone would have a problem with the concept of working remotely when it has no negative impact whatsoever on the host country.

As many have said the only consequence is an extra foreign body spending their foreign earnings in Thailand on accommodation, coffee, food, travel etc.

How can this be an issue?

You use the streets in Thailand. You drink the water in Thailand. You are protected by the police and military in Thailand. You use Thailand's roads and mass transit. You are protected from having a building fall on you by Thai building inspectors. Thai health department money protects you from Ebola and scads of other threats, whether you know it or not. Thai money kills the mosquitoes so you don't get dengue. The list goes on and on.

All that costs money, and yours is going to the UK where it doesn't do the Thai people much benefit.

You pay 7% VAT on the stuff you buy here. That doesn't come close to covering your share of the wear and tear on the infrastructure.

You pump some money into the economy. Thai's that earn the same money to pump into the economy also pump a lot more into the tax coffers.

You're getting a free ride in Thailand, and that's the issue. I love visitors to my home. So do the Thai's. But if my guests plan to stay for 10 years, they probably ought to chip in some rent and put some food into the fridge occasionally.

If you disagree with that, I dare you to go to the Revenue Department back home and claim you pump so much money into the economy that you shouldn't be required to pay taxes on top of your VAT, GST or sales tax.

So shut down all tourism because they also do not pay tax for those "services". So what if i "pay tax" as you want mo to do and i get hit by a car. Does the service include medical expenses? Hell no!

Man get real. A farang working here online pays more tax in form of VAT than majority of Thais do in total in a lifetime.

-

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

On line business can be very successful.

If you're good at what you do, why not setting up a company in Thailand, under BOI scheme for example and, therefore, being fully legal?

Just my 2 cents...Because setting up a company abroad and run earnings and expenses trough it would be considered tax evasion in my home country. We are talking about a serous crime with heavy penalties and jail. And there is no bribing your way out of that like in Thailand.

Hence not an option at all.

Your country doesnt allow the offsetting of taxes baid in another jurisdiction against home country taxes ??

Secondly it doesnt allow corporate expenses as a deduction against taxes ??

Which country is this ??

I'm from the most socialistic country on this planet

It's in Europe, try guess.

It's in Europe, try guess.The ground rule is that money made there has to be taxed there. If suspected of tax evasion you are guilty if you cannot prove the opposite.

It's easier to get away with murder.

-

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

u dont need work permit

http://chiangmaicitynews.com/news.php?id=4366

Quote

The event was organised by the Chamber of Commerce, Upper Northern Thailand Provincial Cluster 1, and was attended by members of the local consular corps and some foreign business owners.

Pol. Col. Rutphong Sanwanangkun, Superintendent of Chiang Mai Immigration, addressed those present along with two of his colleagues. The immigration officers answered questions, including some that CityNews asked readers to submit.

What if I want to work in Thailand?

If you are working for a Thai company, you will need a non-immigrant (type visa and then a work permit in order to work legally.

If you are a 'digital nomad' running your own business on the internet, the immigration office says you can do this on a tourist visa.

If you are a 'digital nomad' running your own business on the internet, the immigration office says you can do this on a tourist visa.

chiangmaicitynews link does not connect

What other evidence is there for your assertion ?

The link works for me. This is great!

It would be good if it was also written in Thai to be presented to the immigration officer.

-

<script type='text/javascript'>window.mod_pagespeed_start = Number(new Date());</script>

On line business can be very successful.

If you're good at what you do, why not setting up a company in Thailand, under BOI scheme for example and, therefore, being fully legal?

Just my 2 cents...Because setting up a company abroad and run earnings and expenses trough it would be considered tax evasion in my home country. We are talking about a serous crime with heavy penalties and jail. And there is no bribing your way out of that like in Thailand.

Hence not an option at all.

Mortgage

in Real Estate, Housing, House and Land Ownership

Posted

Hello,

What happens if a Thai got a loan to buy a Condo and is unable to pay the mortgage and interest?

You just give the bank the keys to the condo or is it there other repercussions?

Thanks,