suzannegoh

-

Posts

1,591 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by suzannegoh

-

-

Most likely he mistakenly thinks that his wifi router's 5 GHz band is "5G".So is that 5G INTERNET connection really a 100 times faster? -

4 minutes ago, mfd101 said:

I use a handmedown from my b/f ( a Samsung about 4-years old with internet switched off).

Will I be able to use it still in 15 years time when 5G arrives in Prasat? and will I still be able to order books from Amazon?

15 years is an eon in the tech world but most likely there will be backwards compatibility for years to come.

-

52 minutes ago, CGW said:

I wonder why all the kids that are protesting against climate change are not protesting about the pollution that wifi produces? 5g will only add to the "pollution" levels as well as fry our brains, after it has killed off most of the wildlife.

Maybe because they are not scientifically illiterate.

-

1

1

-

-

13 minutes ago, ujayujay said:

So , do you think, without details you can do a legal Testament? ????????????

Yes, you can stipulate in the will that your beneficiary gets all of your assets in Thailand without itemizing those assets. But you should consult a lawyer about that.

-

1

1

-

-

17 hours ago, Stocky said:

Interesting, no need to detail your bank accounts and assets?

No, but it's a good idea to give your executor as many details as possible about what assets you have otherwise he might fail to find all of your accounts after you die.

-

2

2

-

-

17 hours ago, bearpolar said:

definitely not overkill unless you're a tech illiterate person using farang iptv packages.

Could you elaborate on that? What types of things should those people be doing online instead of watching IPTV that require Gbps speeds?

-

- Popular Post

2 hours ago, Zikomat said:Spend around 120 k a month for 5 years in TH. Still getting squeezed out by the visa requirements. Get those cheap asses out and leave me alone! Do they have wives or are they on retirement visa? Who cares - just kick them out of the country and let the smart ones like me stay here without stupid annoyances.

You spend 120K baht per month and you're calling other people cheap? That's barely enough money to maintain a wardrobe.

-

4

4

-

28 minutes ago, Jingthing said:

Yeah even though a million ain't what it used to be I think most retirees in Thailand are not up to that wealth level. With that amount there are many more options. Yes Thailand has been one of the easier visa countries but that is changing.

Sent from my Lenovo A7020a48 using Thailand Forum - Thaivisa mobile app

It would have been a more informative survey if it had asked some questions about Net Worth rather than just about monthly expenditures. You never know who might be a millionaire, but definitely in Chiang Mai it’s a lot more common to hear farangs brag about their frugality than about their wealth.

-

1

1

-

-

15 minutes ago, mommysboy said:

Perhaps it is, but it's a salary that can only be dreamed of for tens of millions of Thais.

And many farangs would settle for it, as it pays the way.

You sound like a very young man; I hope that is the case.

Getting a job that "pays the way" in a low cost country is a trap. If your salary is going to be proportional to your living expenses and is greater than your living expenses, then you will be able to save more money if you work somewhere where the cost of living is higher. That's what digital Nomads generally seem to get backwards - the time to concentrate on reducing expenses is during retirement not during your prime earning years.

-

1

1

-

-

- Popular Post

2 hours ago, BoBoTheClown said:Way too many people claim to make a lot of money, but can't prove it with bank statements and tax returns. Thats all the officially matters.

That's were you're wrong. Most people here provided Thaivisa moderators with a fully audited list of their assets when they signed up for this forum.

-

1

1

-

3

3

-

1 hour ago, Sticky Wicket said:

Utter garbage

When my family visit they tend to leave the AC on 24/7

That's 4 powerful ACs in the bedrooms + the living room full blast in the evening

Add pool pump etc , the most my bill has been is 12k

You must be getting ripped off or have the oldest AC units ever!

Maybe he has a 1000 sqm house.

-

15 minutes ago, mania said:

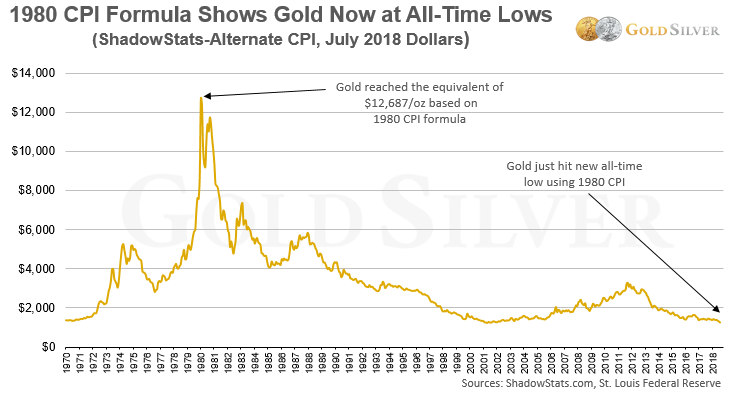

I do not know what folks mean "exactly" But I know many consider gold a hedge against inflation

You know that old saying an ounce can always buy a fine suit?

The problem with using gold as a hedge against inflation is that the old saw that “an ounce of gold bought a fine toga in Roman times and will buy a fine suit today” is only true it you carefully pick the dates on which you buy you gold and then sell it to buy that suit. The inflation adjusted price of gold has been quite volatile over our lifetime.

-

People keep saying that Gold is insurance without saying exactly what they are insuring against. If the idea is to insure against a rapid devaluation of the dollar, the question then is how likely is that to happen, how likely is it that gold will move inversely of the dollar when that happens, and how much is that insurance worth. And if it’s insurance against volatility in the stock market, then the question would be whether having x% of your portfolio in gold reduces a portfolio’s volatility better than having x% in bonds, and whether the volatility matters if you are a long term investor.

-

1

1

-

-

-

Did you cost them an amount of money that would be enough for them to spit on your burger but not enough for them to have five guys beat you up?

-

Faber lives in Chiang Mai and occasionally gives talks here. What he says at the start of that video is a pretty good point - that you can't make your financial plan assuming that WWIII will start tommorrow.I´m not an investor, so I don´t know.. maybe Marc Faber can tell us what to do?

https://marcfabersblog.blogspot.com/2018/03/marc-faber-gold-wont-collapse-unless.html

If Trump does indeed dismantle the FED and go back to a Gold Standard, as many US Patriots hope, then gold is the shiny new thing to have!

-

28 minutes ago, wilailuk said:

Trump wants to be re-elected, that´s why he want´s to postpone the crash/reset, by having FED doing more QE.

Maybe those "crumbling countries" actually could need a straightjacket on their spendings? Oh, but that´s so very boring and old fashioned!

It would take a lot of political will to push through a new gold standard. The first thing that would happen upon the idea being floated is that the New York Times, Washington Post, and CNN would have a tantrum. Then they’d come up with reasons that it’s racist and only benefits the rich.

-

1

1

-

-

3 minutes ago, RocketDog said:

As I and others have stated: metals should never be considered an investment. It is primarily a hedge against fiat currency and is considered a tangible asset, along with some other asset classes. It's all about preservation and growth is just a happy coincidence if it happens.

It is simply another asset class like collectibles, real estate, stocks, bonds, etc.

I believe in asset class as well as geographic asset diversification.

In my personal case I'm content with what I have and care less about growing it and more about preserving it.

Everybody's case is different to some degree or another. There is never only one way to grow or preserve wealth.

DISCLAIMER:

I'm not a broker, financial planner, tycoon, rocket surgeon, or even a particularly good investor.

All I did was work hard, accumulate assets, retire at 67, and now try to enjoy life.

Sent from my SM-G930V using Thailand Forum - Thaivisa mobile app

I have no disagreement with that. Where I find myself in disagreement is that often in this forum buying gold seems to be part of a Radical Libertarian philosophy rather than part of a portfolio management plan.

-

1

1

-

-

6 minutes ago, Brunolem said:

I won't pretend to be a specialist... the latter generally recommend around 10%...

I would say that it also depends on how one's money is invested/parked... whether one is in low risk assets or high risk assets influences how much insurance one requires...

That lays ground for a much more even-keeled discussion. Even famous gold guys like Peter Schiff give similar advice. When you hear him talk he usually presents a very bullish story on gold and one might get the impression that he's saying to jump into gold with both feet, but he's not generally telling his clients to go all-in.

-

44 minutes ago, Brunolem said:

And the same can be said for stock markets, where laypeople are lured when they reach the top, only to lose everything when comes the crash... as happened in 2000, then 2008, and is going to happen again...

There are many people who have made their fortunes with the stock market, yet keep on buying gold because they understand that trees don't grow to the sky, and that after the party comes the hangover...

I think that you used the analogy gold being an insurance policy. That being the case, what percent of your portfolio would you put in that insurance policy?

-

1 hour ago, RocketDog said:

The gov won't do that again, at least in America; too few Americans own enough gold to make it worth the home-to-home searches and violence necessary to retrieve it.

Watch out for simple bans on precious metals trading or outright windfall profits taxes that nullify the original point of owning metals: hedges against colored paper.

Bottom line: own some metals and spread them across the globe in stable jurisdictions. Sorry, I meant 'more' stable jurisdictions than a big country run by a moronic sociopath with a king complex.

OK, but the reason that this came up was that it was demonstrated that if someone put money in gold in 1913 that they would have beat inflation by about 1% per year for the last 106 years. And I asked how that would compare to keeping the money in a savings account. The bank could have gone bust, and there was a 40 year period in there were it was illegal to hold gold in the US, so it's sort of a hypothetical question. So let me rephrase is - does gold having an annualized real rate of return of 1% over that period of time make it a good investment compared to the alternatives?

-

6 minutes ago, Brunolem said:

... and ZIRP, or even NIRP is an even bigger factor ... just look at how stock markets react on the hope of lower interest rates...

Now, on the other side, what exactly is the purpose of a paper gold market (that is a market that trades gold that doesn't physically exist, yet influence the price of physical gold)?

The very existence of this paper market is a manipulation in itself!

Why isn't there a paper cotton, or a paper copper, market?

What's so special with gold (and other precious metals) that it needs to be treated differently than other commodities?

It might be ripe for manipulation but it serves another purpose too. The existence of exchange traded funds like GLD makes it easy for anyone with a 401k or IRA to invest in gold.

-

1

1

-

-

22 minutes ago, Naam said:

these old and naïve conspiracy theories always make me smile. yes... i agree that QE is indeed a major factor influencing the appreciation of stocks. but this appreciation is a normal reaction (interest lower = stocks higher and vice versa) and neither a manipulation nor fraud.

And it takes a lot to make a Klingon smile.

People here are talking as if they buy gold and hold it forever. Good for them if they do. But unfortunately these discussions encourage people who don;t know that they are doing to go out and buy gold a speculative investment. Alex Jones and all the awake people scare them into thinking that the dollar is going to zero so they buy gold as it's price is rising, and then they panic and dump the gold when the market goes south. I know a couple of retirees in Chaing Mai that did that - went all in on gold and gold miners shares in 2010 or 2011 and wound up taking a bath.

-

Maybe I'm wrong about that, maybe upward manipulation has only happened in the silver market. Remember the Hunt Brothers? Still it seems a bit dillusional the way goldbugs assume that whenever gold goes down it's because of manipulation and that when it goes up it can only be because of natural market forces. At a minimum there must be people on Wall Street unethical enough to do a pump & dump.The market forces pushed the price to 1,900...not manipulation...Find me one example of fraud/manipulation where the fraudsters were caught pushing the price of gold up.

There are many many cases, the latest being quoted above, but they tend to all work in the same direction... and this is not up... go figure...

Why so much negativity?

in ASEAN NOW Community Pub

Posted

That about sums up the reason for the negativity – an inability to accept Thai culture as being a legitimate alternative to Western Liberalism. If someone feels that way that’s fine by me, after all it is in many ways at odds with the values Westerner are indoctrinated in. Individualism & self-sufficiency are not a prized commodities here, and neither is there an underlying belief that "all me are created equal". But if you can’t accept that, or it has worn you down, then it’s time to move on rather than to rail against it on the internet.