suzannegoh

-

Posts

1,591 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by suzannegoh

-

-

Improved to 5 Mbps? Did you write that in 2009 and just post it now?

-

2

2

-

-

If Medicare pays for longterm care in nursing homes in the US that's a new development. Do you have a source for that info? AFAIK only Medicaid would pay for it, and only then if you have no savings to pay for it yourself.not quite right. medicare would pay if she is living in the us. Same in many countries. Out of the country is out of the medical insurance. And no payment more for the medical insurance .-

1

1

-

-

1 minute ago, Thaidream said:

Every American who works has Medicare tax deducted from their salary.

What Medicare for all will do is for the first 5 years lower the age gradually to obtain actual care from 65 to 55 and then it will cover everyone from birth to death. Medical Insurance companies would be eliminated.

Many questions about the actual nuts and bolts. How much will it cost and will it truly be universal- coverage extending overseas.

What it will do is eliminate insurance; get the lawyers out of medicine and force Big Pharma to lower drug costs as well as get rid of For Profit Medicine.

If this passes- it will eventually affect medical care in Thailand as Thailand will see the obvious savings that can be had by adopting a similar system.

But only Medicaid, and not Medicare, covers long-term care of Alzheimer patients in convalescence homes. So expanding Medicare to include everyone would do nothing to help Alzheimer patients.

-

7 minutes ago, connda said:

What? Medicare for all? ????

If "Medicare for All" is just an expansion of the program to include younger people then it would not solve the problem. Most Alzheimer's patients in the US are older than 65 years old and hence already have Medicare.

-

- Popular Post

15 hours ago, Kasane said:The patient needs to be on Medicaid. She paid all her life for Medicare, now that she is ill US don't want to care for its citizen who is now terminally ill. Reminds me of unscrupulous insurance companies who drop coverage when the patient really needs them.

One problem in the States is that longterm healthcare in a "home" for Alzheimers patients is only covered by Medicaid and not by Medicare, and to qualify for Medicaid you need to be certifiably poor. So basically you need to completely drain your savings on mefical care or hide it away in a trust before the government would pay for it.

-

5

5

-

5

5

-

13 minutes ago, Old Man River said:

Jaidee, is Kodi legal in Thailand and can I access US programs and US sports?

Sent from my iPad using Thaivisa ConnectKodi is legal but some of the third-party addons might not be. Kodi without addons is just another media player.

-

7 hours ago, utalkin2me said:

If there is one thing I have learned in life, it is that working an honest 9 to 5 job is some of the lowest wages per hour possible.

I think we are all going to realize this one day, but people do not put 2 and 2 together. After you commute daily, waste your time on your unpaid lunch hour (which should not even be legal to not pay people at lunch), and take care if all the little things you need to have done to show up to work like gas in the car, car maintenance, clothes, shaving, taxes.... how much are you really making per hour?

The real kicker is you can't do anything, and you do not get compensated for that! Wanna go on a trip to Italy? Well, screw you. You get two days off a week. Ask for more and you are a bum. Your life is not your any ore when you are 9 to 5, and you do not get compensated for the fact that you cannot do anything with your life.

True, if by “honest work” you mean a job where you punch a clock. What people earn is more closely related to how much revenue they have an influence over rather than to how hard they work.

-

43 minutes ago, JimGant said:

Nope. We're not talking about the "nobodies." We're talking about the skilled, educated, productive "somebodies." You don't need hefty premiums for nobodies -- but you do for the somebodies. Bodes well for Thailand. Thank you Somkid. Hope you remain in whatever the new government looks like.

This days there seem to be more corporate people interested in international assignments, but often the people that a company really wants to fill those posts with will have a life in the US that they'd need to uproot in order to take the job. Kids need to be taken out of school, you might need to sell your house, etc. And then there's the issue of whether it's really a good job to take - taking the wrong international assignment can really derail your career. So yeah, to get the right people you're going to have to make it lucrative.

-

1

1

-

-

The article is not about retirees, it's about corporate expats.Interesting article. False but an interesting take on the World's financial health among those of retirement age. My question is did they actually take into account the 'normal' population? Or just those in Singapore or from within those that have that 'golden retirement package' that comes with the six figure monthly payout; you know the 1%?

So, if Thailand really thinks that it doing so well... why is it that it cannot pick a government, come to grips with China and its moving in plans (There are Chinese 'themed' communities (complete with their own schools, shops, hospitals, etc already being planned and built within my own Province and elsewhere by all accounts. These also include.... where geographically possible... casinos). Or find itself losing trade, and tourist numbers, Thai Airlines failing, as well as environmental issues that have helped to diminish those aforementioned numbers.

The Thai Baht might be the healthy at the moment, but is it really. I mean compared to what. As for retirement salaries going up by 11% or whatever... and I mean whatever... as it all seems to be at best based upon want-to-be guesswork. For I do not see any of those numbers on the folks that have daily interactions with. Seems to me that most are faced with an uphill struggle not just with the new immigration financial policies, the future health insurance fiasco for A/O visa holders, but with the changes going on in this country.

I love this country and its people. But like we are all our worst enemy. However, this country is losing its view on what is really important. Or is that the only thing anyone here prays for at the shrines, the Spirit Houses and the statuary in their homes is for ... money. I like to think that it is not the only thing. But these days I simply do not see it is the same for those running the 'show'. -

2 hours ago, Duck J Butters said:

Better just to become a digital nomad and work for US tech companies that pay mid-six figures (10-year contracts at 12% annual increase ) + equity + bonuses and live beachfront in Thailand. The remote packages US tech companies are offering for you "not to live in the US" are far superior to what is posted above. You also don't have to bother with the Thai taxes since you're not working for a Thai company, don't need a work permit, and the work you are doing is for a different country. US tax is also minimal due to Foreign Earned Income Exclusion ( FEIE ). Your first $105k of salary earned while living abroad is federal-tax-free. At max, you're looking at 15% self-employment tax but even that can be avoided if you set up an offshore company in Singapore for example.

The real question is, with the way tech companies are going these days, why on Earth would anyone live in a Western country where the cost of living is absurd and you're getting reamed with 30% - 40% tax on your salary? Verus you can go live in Thailand, get paid exactly what you would get paid while living in the US ( makes no difference to tech companies, just need a computer ), pay 40,000 baht a month to live oceanfront in Phuket ... all while raking in 1 million baht a month at 12% to 15% tax to the US. Seems like a no brainer to me.

Github, Amazon, Facebook, Google, Netflix are all working towards distributed and fully remote teams by 2024. I'm age 30 and work for one of the companies listed above, fully remote, from Phuket and have a 15-year contract locked in. Impossible to break the contract.

Remote is the future and companies do not care where you live anymore. No one in their right mind would live in the US if they didn't have to. It's a huge disadvantage to live in the US or Europe these days. I can't speak for Europe but I can say with certainty that the US doesn't really have anything that Thailand doesn't have in 2019. Nothing really. Even Whole Foods is not a US perk anymore. Bangkok has Gourmet Market which is better. Phuket has Villa Market which is good enough. I would even argue that healthcare in Thailand is on par with the US. I had some serious work done on my teeth last month in Phuket and was blown away by my Thai dentist. Extremely good work done and at 1/6th of what said work would have cost me in California. I mean who needs health insurance in Thailand at these prices?

Of course, you need to get a Thai wife so you can stay here forever on a marriage visa and avoid being put into the system via work permit. But that's easy enough to find.

And no, Thailand has no interest in giving digital nomads the boot or taxing us. We bring massive amounts of money into the country, spend big wads of stupid cash, and employ lots of Thais. I've hired over 20 Thai programmers since I've been living in Thailand. Thailand needs more digital nomads if anything and should be doing everything they can to attract our attention.

https://remoteok.io/ Change your life and work from home, from anywhere you freaking want...dude. California Dreaming but in Thailand.

Yes, the base salary (neglecting fringe benefits) for those jobs sounds a little low, but do you think that your salary as a Digital Nomad is typical? If the Digital Nomads in Chiang Mai are averaging in excess of US$100K per year they sure are hiding it well.

-

1

1

-

-

23 minutes ago, baansgr said:

How much of the package is for schooling, if the Expat has three kids all going to an international school, thats 60-70k US$ alone.

That's probably true, and that's a $60-70K expense that you probably wouldn't have if you were living in your home country instead of expatting. Some of the other fringes are like that too.

-

What are you talking about?

If you live and work in Thailand. You pay Thai income taxes. Not US taxes.

Even if you did have an obligation to file US income tax assessement at the same time, you wouldn't pay anything because the Thai income tax rates are higher than US income tax rates (using foreign tax credits from Thai withholding tax on your salary) and as a non-resident for US taxes you would also qualify for Foreign income exemption on the first $110k of your Thai salary.

Someone at your company is fooling you.

If you are a US citizen then the US taxes all of your income over about $100K worldwide. And if the you are on a temporary assignment in a foreign country (for instance you are sent from your company's heaquarters in the US to work two years in Bangkok, after which you will go back to work at the heaquarters in the US again) you may also need to pay taxes to a US State and to the Social Security & Medicare funds. There could be cases where foreign tax credits would make the US tax bill go to zero, but if the company wasn't stepping in to pay those foreign taxes you would end up paying on the fringe benefits in addition to your direct salary.

You might not like it or might not beleive me, but what the MNC that I worked for would do is have you (or rather their accountants) fill out a hypothetical US tax return to calculate how much tax you need to would be paying if the job was in the US and you weren't getting any fringe benefits, a real US income tax return that includes the cash value of any portion of the fringe benefits that are taxable, and a tax return for your host country. Then the company would pay the real amount of taxes owed to the US and to your host country less the amount that you would have been paying in taxes if you hadn't gone abroad. Possibly the company could turn a "profit" on that if you are working in a low-tax country such as Singapore, except that they wind up absorbing taxes on the fringe benefits.

-

1 hour ago, toenail said:

The article doesn’t mention the high tax base the expats have to pay (depending on income bracket) with nothing in return.

Often part of the package will be making you whole in regard to taxes. What the MNC that I worked for would do is have you fill out a mock US income tax return to figure out how much tax you would have been paying if you were still in the US. Then they (the company) would pay the Thai income tax and you would pay the company the an amount of money equal the amount that you would have paid if you were working in the US. This was generally a good deal even if the local tax rates weren't higher than in the US because often the non-cash fringe benefits (such as car housing, education for kids) will be considered to be taxable income by either your home country or your host country.

-

21 minutes ago, Oxx said:

Not really. They're more likely to split when the cost of a single share becomes a barrier to purchase. Splitting simply increases liquidity (albeit at a cost for implementation), which may in turn slightly increase the share price for shareholders.

Yes, really. As you say, stocks generally split when the price become a barrier to purchase. But the reason that the price becomes a barrier to be purchased would either because it became too expensive or too cheap. In the former case a split would be a common remedy and in the latter case a reverse split might be considered.

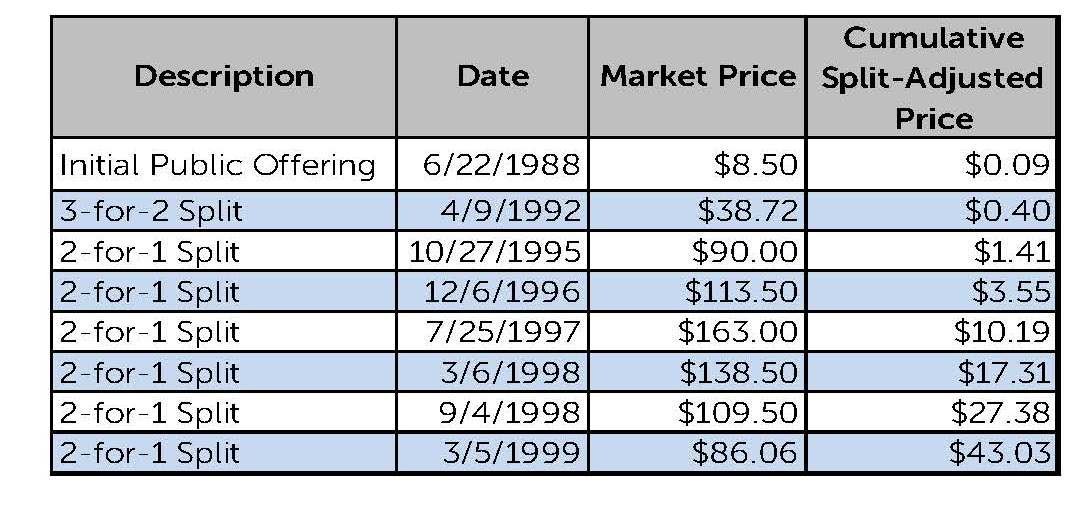

In this particular case, that other poster was talking about having held Dell while it split multiple time. You can see in the table below the price that Dell was at each time that it split. Each time it went up a lot, split, went up more, and then split again. -

2 hours ago, Oxx said:

Uh, stock splits don't affect the value of your investment. It just means, for example, rather than holding 10 shares, each worth $10 (total value $100), you end up with 100 shares, each worth $1.

Yes, though stocks are more likely to split when their prices are rising.

-

To get deported and have someone else pay for your plane ticket home you may need to confess to an unsolved murder or kidnapping in your home country.

-

2

2

-

-

I had two pet weevils but one of them died. He was the lesser of two weevils.

-

4 minutes ago, NotYourBusiness said:

Singapore has no minimum wage.

Correct, though imposing one has recently been the subject of political debate there.

-

2 hours ago, Pattayabeerbacon said:

Yep recieving 2 dollars a day whilst recovering from alcohol addiction in a third world country is spoiled.

Maybe not as spoiled as Aussies who have enough money to buy an iPhone and a plane ticket to Thailand and then complain that if they don't go back to Oz after a certain amount of time they'll get cut off the dole. But it's close.

-

1

1

-

-

- Popular Post

- Popular Post

It's quite possible that someone who had an identical life as mine but was born 10 years earlier would have been significantly better off financially than I am now. However that does not make me feel like a victim, and I surely don't blame my parents for it.You missed out ............ and private pensions have almost disappeared for everyone except government employees.-

3

3

-

There is 9 jobs in perth today, in a city of over 2 million.

How do i get money when there is no job to goto MR?

What line of work are you in? -

- Popular Post

- Popular Post

This thread explains a lot about farangs in Thailand - lots of people with Mommy and Daddy issues.

-

3

3

-

1

1

-

2

2

-

- Popular Post

- Popular Post

12 hours ago, mommysboy said:Very difficult for the old uns to understand this, but it is the way it is imo for millions of people who formerly had options but don't now. Times have indeed changed.

It’s hard for anyone to judge how economic conditions are for other people, that’s why it’s hard for the “old uns” to know. When your neighbor loses his job you think it’s a recession, when you lose your job you think it’s a depression, but either way your impression of the economy mostly reflects the very small slice of the economy that you participate in.

I don’t have kids myself but my brother and sister bother have sons who are now in their early 20’s and you’d get the exact opposite impression of how good of opportunities have by looking at either set of kids. My sister’s kids were a bit nerdy but big for their age so they didn’t get bullied. The studied a lot and when then goofed off it was by doing nerdy things like writing code or tinkering with old electronics equipment. And after high school they went to university and majored in engineering. In contrast, my bother’s kids were among the cool kids in school, were popular, but never developed any intellectual curiosity nor any demonstrable skills other than doing a bong hit. And after high school they jobs hanging sheetrock. So now, with them no longer being “kids”, I could look at my sisters kids I might conclude that the future is limitless for kids. Or I could look at my brother’s kids living in a slum and conclude that kids today don’t stand a chance.-

4

4

-

2

2

-

11 hours ago, CNX GUY said:

this is a very good topic to have raised, I think it is a fascinating question. fathers are fascinating because, to a pretty great extent, they make the world what it is.

and that is why I hate my father.

was he a bad man? certainly not! did he abuse me, no!

however, with a combination of shall we say a high score on the narcissist scale, and a very low score on the accomplishment scale, he represents everything that is wrong with the world and makes it a pretty terrible place.

there's nothing wrong with being a nothing, but there is something very wrong with being a nothing while insisting you are a something.

that's why we humans never make any progress and that's why I "hate" my father.

The way that you have it figured, are you a better man than your father? It sounds like he was a man if his time and circumstances and you are a man of yours.

-

2

2

-

Video: Brit loses his holiday money to ladyboy in Pattaya

in Pattaya News

Posted

I've noticed that whenever someone gets robbed in Thailand it almost always will be said to be for an unusually large amount of cash and/or jewelry. Everyone, it seems, walks around with hundreds of dollars in their pocket and has ten times that stashed back in their hotel room.